The thought of an interview can be nerve-wracking, but the right preparation can make all the difference. Explore this comprehensive guide to Insurance Contracts interview questions and gain the confidence you need to showcase your abilities and secure the role.

Questions Asked in Insurance Contracts Interview

Q 1. Explain the concept of ‘indemnity’ in insurance contracts.

Indemnity, at its core, means to make someone whole again after a loss. In insurance, it’s the principle that an insured individual should not profit from a loss but should be restored to their financial position before the loss occurred. It prevents individuals from overcompensating for their damages. For example, if your car worth $10,000 is totaled, your insurance company will pay you $10,000, not $15,000. The goal is to put you back where you were before the accident, not to give you a windfall.

This principle is particularly important in property and casualty insurance, limiting payouts to the actual cash value (ACV) of the damaged property or the cost of repair, minus depreciation. However, there might be exceptions like replacement cost coverage in some policies, which could cover the cost of a new item even if depreciation exists.

Q 2. What is the difference between a ‘first-party’ and a ‘third-party’ claim?

The difference between first-party and third-party claims lies in who is making the claim and who is responsible for the loss.

- First-party claims involve a direct loss suffered by the policyholder. For example, if your house burns down, you file a first-party claim with your homeowner’s insurance company because you are directly impacted.

- Third-party claims involve a loss caused to another person by the policyholder. For instance, if you cause a car accident and injure another driver, that injured driver would file a third-party claim against your liability insurance. They are not directly insured under your policy but are making a claim against you due to your negligence.

Think of it this way: first-party claims are ‘me against my insurer,’ and third-party claims are ‘the other person against my insurer (because of me).’

Q 3. Describe the elements of a legally binding insurance contract.

A legally binding insurance contract, like any contract, requires several key elements:

- Offer and Acceptance: The insured offers to pay premiums, and the insurer accepts by issuing a policy.

- Consideration: This is the exchange of value – the insured pays premiums (consideration), and the insurer provides coverage (consideration).

- Legal Capacity: Both parties must be legally competent to enter into a contract (of legal age and sound mind).

- Legal Purpose: The contract’s purpose must be lawful. An insurance contract to cover illegal activities would be void.

- Utmost Good Faith (Uberrimae Fidei): Both parties are obligated to disclose all material facts relevant to the risk being insured. This is discussed further in another question.

If any of these elements are missing, the contract may be void or voidable.

Q 4. What are the common exclusions found in liability insurance policies?

Liability insurance policies often exclude coverage for several types of losses. These exclusions protect the insurer from potentially unlimited liability. Common exclusions include:

- Intentional acts: Damages caused intentionally are usually not covered.

- Nuclear hazards: Damage caused by nuclear reactions or radiation is typically excluded.

- Pollution: Environmental damage caused by pollution is often a significant exclusion.

- Professional services: Errors or omissions in professional services (e.g., doctor’s malpractice) generally require separate professional liability insurance.

- Criminal acts: Damages arising from illegal activity by the insured are excluded.

- War and terrorism: Coverage for losses due to acts of war or terrorism is usually limited or excluded.

It’s crucial to carefully review the policy wording to understand the specific exclusions that apply.

Q 5. Explain the concept of ‘proximate cause’ in relation to insurance claims.

Proximate cause is the direct, unbroken chain of events leading to a loss. It determines the cause of the loss that the insurer is responsible for covering. To be covered, the loss must be a reasonably foreseeable consequence of the initial event.

Example: If a fire starts in your kitchen (initial event), and the fire spreads to damage your neighbor’s house, the fire is the proximate cause of the damage to both your house and your neighbor’s. If the fire was caused by a faulty appliance, then the faulty appliance is the proximate cause of the entire event.

However, if a hurricane destroys your home, and subsequently a thief steals items from the debris, while the hurricane was the proximate cause of the home’s destruction, the theft isn’t directly caused by the hurricane and therefore likely wouldn’t be covered.

Q 6. What is the significance of ‘utmost good faith’ in insurance contracts?

Utmost good faith, or uberrimae fidei, is a cornerstone of insurance contracts. It means both the insured and the insurer must act honestly and openly in all dealings. The insured has a duty to accurately disclose all material facts relevant to the risk being insured, even if not specifically asked. Material facts are those that could influence the insurer’s decision to offer coverage or determine the premium.

Failure to disclose material facts can invalidate the policy or allow the insurer to deny a claim, making this a critical part of the policy process. For example, failing to disclose a prior accident history when applying for car insurance is a breach of utmost good faith.

Q 7. How do you interpret policy wording, particularly ambiguous clauses?

Interpreting policy wording, especially ambiguous clauses, requires careful attention to detail and a methodical approach.

- Literal Interpretation: Start by reading the clause literally. However, court precedent shows strict literal interpretations should be avoided where they lead to absurd outcomes.

- Contextual Analysis: Consider the entire policy, not just the isolated clause. The context provided by other sections of the policy can help clarify the meaning.

- Dictionary Definitions: Use standard dictionary definitions for any ambiguous terms.

- Industry Standards: Refer to established industry standards and practices for guidance.

- Legal Precedent: Consider any relevant court cases that have interpreted similar clauses.

If ambiguity persists, it is best to consult with an insurance professional or seek legal advice. In most jurisdictions, courts will interpret ambiguous clauses in favor of the insured (contra proferentem). This means any uncertainty in policy language will be resolved in favor of the party that did not draft the contract (the insured).

Q 8. Explain the difference between ‘actual cash value’ and ‘replacement cost’ in property insurance.

In property insurance, both ‘actual cash value’ (ACV) and ‘replacement cost’ (RC) determine how much you’ll receive after a covered loss. The key difference lies in how they calculate the payout.

Actual Cash Value (ACV) considers the item’s current market value, factoring in depreciation due to age and wear and tear. Think of it like the price you could realistically sell a used item for. For example, if your 5-year-old sofa cost $1000 new and depreciated by 50%, the ACV would be $500.

Replacement Cost (RC), on the other hand, covers the cost of replacing the damaged item with a new one of similar kind and quality. It doesn’t consider depreciation. Using the same sofa example, the RC would be the current cost of a new, comparable sofa, say $1200 (prices may have increased).

Many policies offer RC coverage with a deductible, but some might offer ACV as a cost-saving option. It’s crucial to understand which your policy provides.

Q 9. What is subrogation, and how does it apply to insurance claims?

Subrogation is a crucial concept in insurance. It’s the right of your insurance company, after it has compensated you for a loss, to step into your shoes and pursue recovery from the party responsible for that loss. Think of it as your insurer ‘taking over’ the legal right to sue the at-fault party.

Example: Your car is damaged in an accident caused by another driver. Your insurance pays for the repairs. Your insurer then uses subrogation to sue the other driver’s insurance company to recover the money they paid out for your repairs. This helps keep premiums lower for everyone.

This process ensures that the at-fault party, not the insurance company or the policyholder, ultimately bears the financial burden of the loss.

Q 10. Describe the process of handling a denied insurance claim.

Handling a denied insurance claim involves several steps. First, understand the reason for denial—it’s often detailed in the denial letter. Carefully review the policy to ensure the claim is covered and that all requirements have been met.

- Review the Policy: Check if your claim falls under the policy’s coverage parameters and if any exclusions apply.

- Gather Evidence: Compile all necessary documentation, including photos, repair estimates, police reports, etc., to support your claim.

- Appeal the Decision: Most insurers have an appeals process. You can formally appeal the denial, providing additional evidence or explaining why you disagree with the decision.

- Consider Mediation or Arbitration: If the appeal fails, consider mediation or arbitration—neutral third-party processes to resolve disputes.

- Legal Action: As a last resort, you may need to pursue legal action against the insurer.

It’s always best to meticulously document your communications with the insurance company throughout the entire process.

Q 11. What are the key differences between different types of insurance policies (e.g., property, liability, life)?

Different types of insurance policies offer distinct coverage:

- Property Insurance: Protects your physical assets (house, car, belongings) against damage or loss due to events like fire, theft, or natural disasters. It typically covers both the structure and its contents.

- Liability Insurance: Protects you financially against claims for bodily injury or property damage you cause to others. Auto insurance and homeowner’s insurance often include liability coverage.

- Life Insurance: Provides a death benefit to your beneficiaries upon your passing. This helps provide financial security for loved ones after your death. There are various types like term life and whole life, each with different payout structures and features.

Other types include health insurance, disability insurance, and business insurance, each designed to address specific risks.

Q 12. Explain the concept of ‘insurable interest’.

Insurable interest means you must have a legitimate financial stake in the insured item or person. This ensures that you would suffer a direct financial loss if the insured item is damaged or the insured person dies.

Example: You have an insurable interest in your house because you own it; you’ll lose value if it burns down. You also have an insurable interest in your car if you own it and it’s damaged, or in your spouse’s life because their death would impact your financial situation.

Without insurable interest, insurance becomes a form of gambling, and insurance companies won’t provide coverage.

Q 13. What is a deductible, and how does it affect the claim process?

A deductible is the amount of money you agree to pay out-of-pocket before your insurance coverage kicks in. It’s a fixed amount, specified in your policy. Think of it as your ‘share’ of the loss.

Example: You have a $500 deductible on your auto insurance. If you’re in an accident resulting in $2000 in damages, you pay $500, and your insurance pays the remaining $1500.

Higher deductibles usually lead to lower premiums, while lower deductibles mean higher premiums. The choice depends on your risk tolerance and financial situation.

Q 14. How do you handle conflicting clauses within an insurance policy?

Conflicting clauses in an insurance policy are rare but can be challenging. In such cases, courts typically apply rules of contract interpretation to resolve the conflict.

- Plain Meaning Rule: Courts often begin by looking at the plain, ordinary meaning of the words used in the policy.

- Specific over General: If a specific clause contradicts a more general clause, the specific clause usually takes precedence.

- Ambiguity: If clauses are genuinely ambiguous (unclear), courts generally interpret them in favor of the insured, as insurance policies are considered contracts of adhesion (the insured has limited ability to negotiate terms).

- Policy as a Whole: Courts consider the entire policy document and attempt to reconcile conflicting clauses in a manner that is consistent with the overall policy intent.

If you encounter such issues, seeking professional legal advice is crucial.

Q 15. Describe the process of reviewing and analyzing insurance contracts for compliance.

Reviewing insurance contracts for compliance is a meticulous process ensuring the contract adheres to all applicable laws, regulations, and internal company policies. It involves a thorough examination of every clause to identify potential issues and ensure the contract is fair, transparent, and protects both the insurer and the insured.

- Legal Compliance: We verify that the contract complies with state and federal regulations regarding insurance practices, including provisions on consumer protection, anti-discrimination, and specific policy requirements (e.g., minimum coverage limits for auto insurance).

- Policy Clarity and Accuracy: We analyze the wording for ambiguities, ensuring the language is unambiguous and easily understood by the average person. We check for errors in calculations, coverage details, and exclusions.

- Internal Policy Adherence: We ensure the contract aligns with our company’s underwriting guidelines, risk assessment models, and internal compliance procedures. This ensures consistent application of our risk management strategy across all policies.

- Data Integrity: We verify the accuracy of all personal and policy data entered into the contract, ensuring it matches the application and supporting documentation.

- Disclosure Requirements: We check for full disclosure of all relevant information, including exclusions, limitations, and any potential risks. This ensures transparency and protects the insured from surprises.

For example, a life insurance policy might require a review for proper disclosure of pre-existing conditions, while a commercial liability policy needs to ensure compliance with specific industry regulations.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. What are the common types of endorsements used in insurance policies?

Endorsements, also known as riders or amendments, modify the original insurance policy. They add, delete, or change specific provisions. Common types include:

- Increased Coverage Endorsements: These increase the policy’s coverage limits for specific perils or add coverage for previously excluded events. For example, adding flood coverage to a homeowner’s insurance policy.

- Exclusion Endorsements: These remove coverage for specific perils or circumstances. For example, excluding coverage for water damage from a specific area of the property.

- Changes in Insured/Coverage Endorsements: These alter the named insured or the covered property, vehicles, or individuals. For example, adding a new driver to an auto insurance policy or changing the address on a homeowner’s policy.

- Deductible Endorsements: These modify the insured’s out-of-pocket expense before coverage begins. A policyholder might opt for a higher deductible to lower premiums.

- Liability Endorsements: These address specific liability concerns, such as umbrella liability insurance that extends coverage beyond the limits of primary policies.

It’s important to note that endorsements must be legally sound and adhere to the same regulatory standards as the original policy.

Q 17. How do you identify and assess potential risks within an insurance contract?

Identifying and assessing risks within an insurance contract is crucial to determine the potential for claims and appropriately price the policy. We use several methods:

- Risk Classification: We analyze the insured’s profile, location, and the nature of the insured item (e.g., property, vehicle, health) to assess inherent risks. This might involve checking credit scores for insurance applicants or using geographical data for flood risk assessment.

- Policy Analysis: We thoroughly examine the policy wording to pinpoint potential loopholes, ambiguous clauses, or exclusions that could lead to disputes or unexpected claims.

- Historical Data Analysis: We leverage historical claim data and industry statistics to predict future claim frequency and severity. For instance, accident rates in a specific area influence auto insurance pricing.

- External Factors: We consider external factors like climate change, economic conditions, and evolving legal environments, which can significantly impact the risk landscape. For example, increasing instances of wildfires can increase the risk for homeowners’ insurance.

- Modeling and Simulation: Sophisticated models and simulations are used to quantify and analyze the probability of various events and their associated financial impacts.

A thorough risk assessment ensures appropriate pricing and prevents the insurer from accepting policies that expose them to excessive or unmanageable risk.

Q 18. Explain the concept of ‘risk transfer’ in insurance.

Risk transfer is a core principle in insurance. It involves shifting the financial burden of potential losses from an individual or entity (the insured) to an insurance company (the insurer). Instead of bearing the full cost of a potential loss themselves, the insured pays premiums in exchange for the insurer’s promise to cover specified losses.

Think of it like this: You own a house (risk of fire damage). Instead of directly facing the financial devastation of a fire, you transfer that risk to an insurance company by paying premiums. If a fire occurs, the insurer assumes the financial burden of rebuilding your house, up to the policy’s limits.

This transfer of risk allows individuals and businesses to operate with greater certainty, knowing that they are protected against catastrophic losses, and frees up their financial resources for other activities. The insurer, in turn, pools together risks from many individuals and businesses, using actuarial methods to predict and manage overall losses.

Q 19. What is the role of an insurance adjuster in settling a claim?

An insurance adjuster plays a vital role in settling claims. Their responsibilities include investigating the claim, assessing the damage, determining the amount of the loss, and negotiating a settlement with the insured. This involves:

- Investigation: Gathering all relevant information, including police reports, medical records, and witness statements, to verify the claim’s validity.

- Damage Assessment: Determining the extent of the damage or loss, often requiring expertise in areas such as property valuation, vehicle repairs, or medical evaluations.

- Loss Calculation: Calculating the amount of the loss based on the policy’s terms and conditions, including applicable deductibles and coverage limits.

- Negotiation: Negotiating a settlement with the insured, aiming to reach a fair and reasonable agreement that respects both parties’ interests. This might involve several back-and-forth discussions.

- Documentation: Meticulously documenting every step of the claims process, including correspondence, assessments, and the final settlement agreement.

Adjusters act as impartial mediators, balancing the insurer’s financial obligations with the insured’s needs.

Q 20. How do you handle disputes related to insurance contract interpretation?

Disputes over insurance contract interpretation are handled through a variety of methods, depending on the contract’s terms and the jurisdiction. Common approaches include:

- Negotiation and Mediation: The first step usually involves attempts to resolve the dispute through informal negotiations between the insurer and the insured, often with the help of a mediator.

- Arbitration: If negotiation fails, the dispute may be submitted to arbitration, a process where a neutral third party hears both sides and makes a binding decision.

- Litigation: As a last resort, the dispute can be taken to court, where a judge or jury will decide the matter. This is usually a lengthy and expensive process.

- Review of the Contract: Before any dispute resolution, a detailed review of the contract language is undertaken to look for clarity in the definition of terms and relevant clauses that apply to the specific issue.

- Prior Case Law: Similar cases are reviewed to understand how courts have previously interpreted analogous clauses in related contracts.

The specific process depends on the policy language, state regulations, and the willingness of both parties to reach an agreement. Clear and unambiguous contract language can significantly reduce the likelihood of disputes.

Q 21. What are the legal implications of breaching an insurance contract?

Breaching an insurance contract can have significant legal implications for both the insurer and the insured. Consequences vary based on the nature and severity of the breach.

- For the Insured: Failure to pay premiums, making fraudulent claims, or failing to fulfill other contractual obligations (such as providing accurate information) can lead to policy cancellation, denial of claims, and even legal action for damages suffered by the insurer.

- For the Insurer: Breaching a contract by denying valid claims or engaging in unfair business practices can result in fines, legal penalties, reputational damage, and regulatory action by state insurance departments. Consumers can file complaints, and insurers may face lawsuits for breach of contract.

The legal ramifications are serious, and both parties are expected to act in good faith and comply with the terms of the agreement. Clarity in the contract’s language is vital to minimizing the chance of misinterpretations and disputes.

Q 22. Explain the different types of insurance policy limits.

Insurance policy limits define the maximum amount an insurer will pay for covered losses under a specific policy. These limits can vary significantly depending on the type of insurance and the specific coverage. Understanding these limits is crucial for both policyholders and insurers.

- Per Occurrence Limit: This is the maximum amount the insurer will pay for all losses arising from a single event. For example, a liability policy might have a $1 million per occurrence limit, meaning the insurer will pay no more than $1 million for all claims resulting from a single accident.

- Aggregate Limit: This limit represents the maximum amount the insurer will pay for all covered losses during the policy period, regardless of the number of occurrences. If the same policy had a $2 million aggregate limit, it would mean that even if multiple incidents occurred, the total payout wouldn’t exceed this amount.

- Per Person Limit: Often seen in liability policies, this specifies the maximum payment for injuries or damages to a single person, regardless of the number of claims arising from the same incident. If someone is seriously injured in a car accident, this limit comes into play.

- Combined Single Limit (CSL): This limit combines bodily injury and property damage limits into one single amount. This is common in auto insurance. For instance, a CSL of $1 million means that the insurer’s maximum payment for both bodily injury and property damage from a single accident is capped at $1 million.

Think of it like a credit card – you have a spending limit. Similarly, policy limits act as a cap on the insurer’s financial responsibility for covered claims.

Q 23. What is the significance of the ‘notice’ provision in an insurance contract?

The ‘notice’ provision in an insurance contract is absolutely critical. It outlines the policyholder’s obligation to promptly notify the insurer of any potential claim or loss. This prompt notification is essential for the insurer to effectively investigate the claim, assess the damages, and initiate the claims process. The specifics of the notice provision, such as the timeframe for notification and the required information, vary depending on the policy and jurisdiction.

Failing to provide timely notice can severely impact a claim. For instance, if a business experiences a theft and delays notifying its insurer, the insurer might argue that the delay prejudiced its ability to investigate, potentially leading to denial of the claim or a reduction in the payout. The insurer’s ability to promptly investigate is critical for minimizing financial loss and ensuring fair claims handling.

The notice provision is typically written as a condition precedent, meaning that the insurer’s obligation to pay benefits is conditional upon proper and timely notice from the insured. If the condition isn’t met, the insurer may have grounds to deny coverage.

Q 24. How do you identify and manage potential fraud in insurance claims?

Identifying and managing insurance fraud requires a multi-faceted approach combining sophisticated data analytics, robust investigation techniques, and a strong understanding of fraud patterns. Here’s a breakdown of the process:

- Data Analytics: We use sophisticated algorithms and software to analyze claims data, identifying anomalies and patterns indicative of fraud. This might include analyzing claim frequency, claim amounts, or the geographic location of claims.

- Special Investigation Units (SIUs): Insurance companies employ specialized investigators trained to conduct thorough investigations of suspected fraudulent claims. This might involve interviewing witnesses, reviewing documents, and conducting surveillance.

- Collaboration: We work closely with law enforcement agencies and other insurers to share information and coordinate investigations, particularly in cases involving organized fraud rings. This includes participation in fraud detection networks and the exchange of data amongst different insurance providers.

- Claim Auditing: Thoroughly reviewing submitted documents, medical records, and other evidence is essential to identify inconsistencies or discrepancies that suggest fraud.

- Red Flags: We are trained to recognize common red flags indicative of fraud, such as unusually high claim amounts, inconsistent statements from claimants, or a lack of supporting documentation. For example, a claim submitted right before a policy expires might be flagged for further investigation.

Effective fraud management protects both the insurer and honest policyholders by preventing unnecessary payouts and maintaining the integrity of the insurance system.

Q 25. What are the key regulatory requirements for insurance contracts?

Insurance contracts are heavily regulated at both the state and federal levels. The specific requirements vary significantly by jurisdiction, but some key regulatory aspects include:

- Licensing and Solvency: Insurers must obtain licenses to operate in each state and maintain adequate financial reserves to ensure their solvency. This ensures that companies can meet their obligations to pay claims.

- Policy Forms and Content: Policy forms must comply with state regulations regarding required disclosures, definitions, and exclusions. This ensures that consumers are provided with clear and understandable policy documents.

- Rate Regulation: In many states, insurance rates are subject to regulation to prevent excessive pricing and ensure affordability. The regulator needs to approve rate increases or changes in the rating criteria.

- Consumer Protection Laws: Numerous laws are designed to protect consumers from unfair or deceptive insurance practices, such as those pertaining to misrepresentation or discrimination.

- Claims Handling Regulations: Laws often dictate the procedures insurers must follow in handling claims, including timeframes for responding to claims and the required documentation.

Non-compliance with these regulations can result in significant penalties for insurance companies, including fines, license revocation, or even criminal prosecution.

Q 26. Explain the difference between an ‘occurrence’ and a ‘claims-made’ policy.

The key difference between ‘occurrence’ and ‘claims-made’ policies lies in when the insurance coverage applies. Understanding this distinction is crucial for choosing the appropriate policy type.

- Occurrence Policy: This type of policy covers claims arising from incidents that occur during the policy period, regardless of when the claim is made. For example, if an accident happens in 2024, and the claim is made in 2025, an occurrence policy would still cover the claim if the underlying policy was in place in 2024.

- Claims-Made Policy: This policy only covers claims made during the policy period, regardless of when the incident occurred. If an incident occurs in 2024 but the claim is made in 2025 when the policy has expired, it would not be covered under a claims-made policy. However, many claims-made policies include a ‘tail coverage’ option – an extension that covers claims made after the policy expires, for an additional premium.

Consider this analogy: An occurrence policy is like a snapshot of coverage for a specific period. A claims-made policy is more like a window of time during which claims must be reported.

Q 27. Discuss your experience in negotiating insurance contract terms.

My experience in negotiating insurance contract terms spans numerous projects and a variety of insurance types, including property, casualty, and professional liability. I have a proven track record of successfully negotiating favorable terms for my clients.

My approach emphasizes a collaborative, yet firm, stance. I begin by thoroughly understanding my client’s needs and risk profile, and then carefully analyze the proposed policy terms. This analysis includes a detailed review of coverage limits, exclusions, definitions, and conditions.

During negotiations, I prioritize open communication and seek creative solutions to address any concerns or disagreements. I’m adept at identifying areas where the proposed terms might be overly restrictive or advantageous to the insurer and work to achieve a more balanced agreement. For example, I’ve successfully negotiated broader coverage definitions, higher policy limits, and more favorable claims handling procedures. I also leverage my knowledge of insurance regulations and market trends to justify my proposed changes.

Ultimately, my goal is to secure an insurance contract that adequately protects my client’s interests while remaining cost-effective. This often requires a delicate balance of risk assessment, negotiation skills, and a deep understanding of the insurance market.

Key Topics to Learn for Insurance Contracts Interview

- Contract Formation: Understand offer, acceptance, consideration, and the legal capacity of parties involved. Practical application: Analyze a sample contract to identify these key elements and assess its validity.

- Types of Insurance Contracts: Explore the differences between life insurance, health insurance, property insurance, and liability insurance, focusing on their unique clauses and obligations. Practical application: Compare and contrast the key features of two different policy types.

- Insurable Interest: Grasp the concept of insurable interest and its implications for contract enforceability. Practical application: Evaluate scenarios to determine if insurable interest exists.

- Interpretation of Policy Language: Master the ability to decipher complex policy wording, including exclusions, limitations, and definitions. Practical application: Analyze ambiguous clauses and interpret their meaning within the context of the contract.

- Risk Assessment and Underwriting: Understand the role of risk assessment in pricing and underwriting insurance contracts. Practical application: Discuss how different risk factors influence premium calculations.

- Claims Handling and Dispute Resolution: Familiarize yourself with the process of handling insurance claims and resolving disputes, including arbitration and litigation. Practical application: Outline the steps involved in a typical claims process.

- Regulatory Compliance: Understand relevant insurance regulations and legal frameworks governing insurance contracts. Practical application: Discuss the impact of a specific regulation on contract terms.

- Reinsurance: Explore the concept of reinsurance and its role in risk management within the insurance industry. Practical application: Explain how reinsurance affects the financial stability of an insurance company.

Next Steps

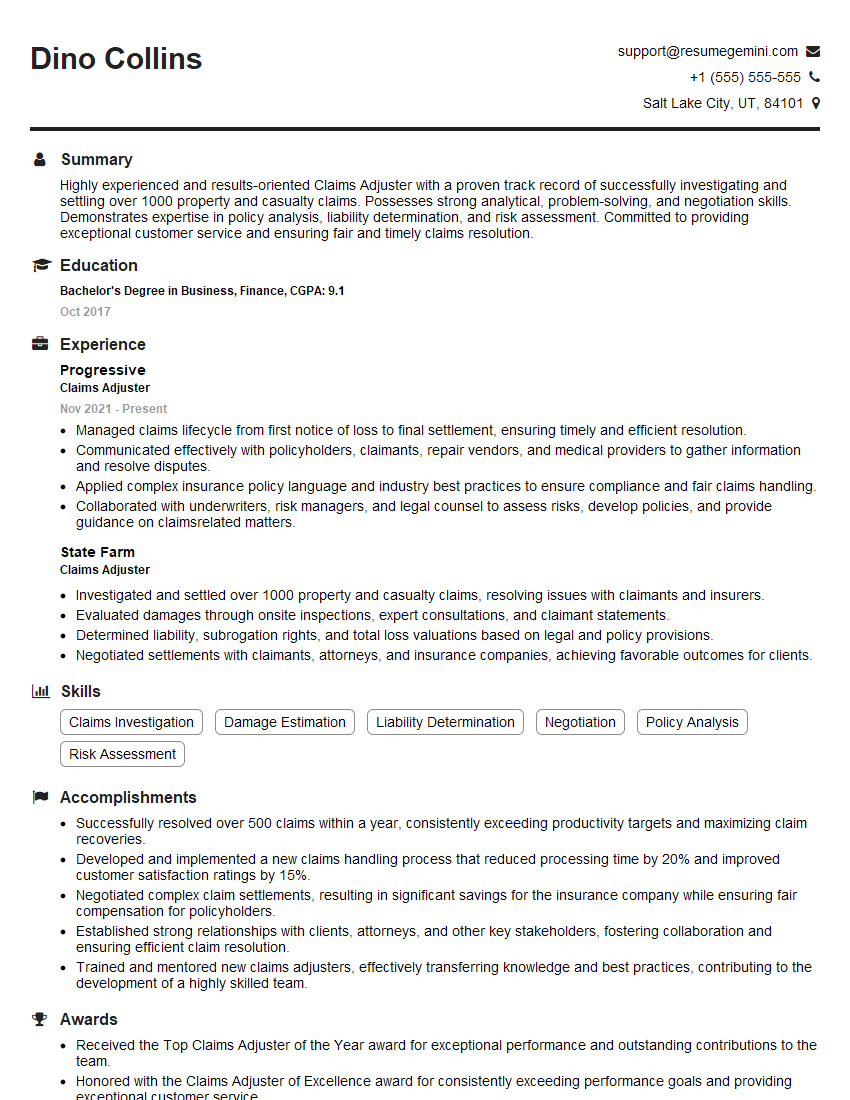

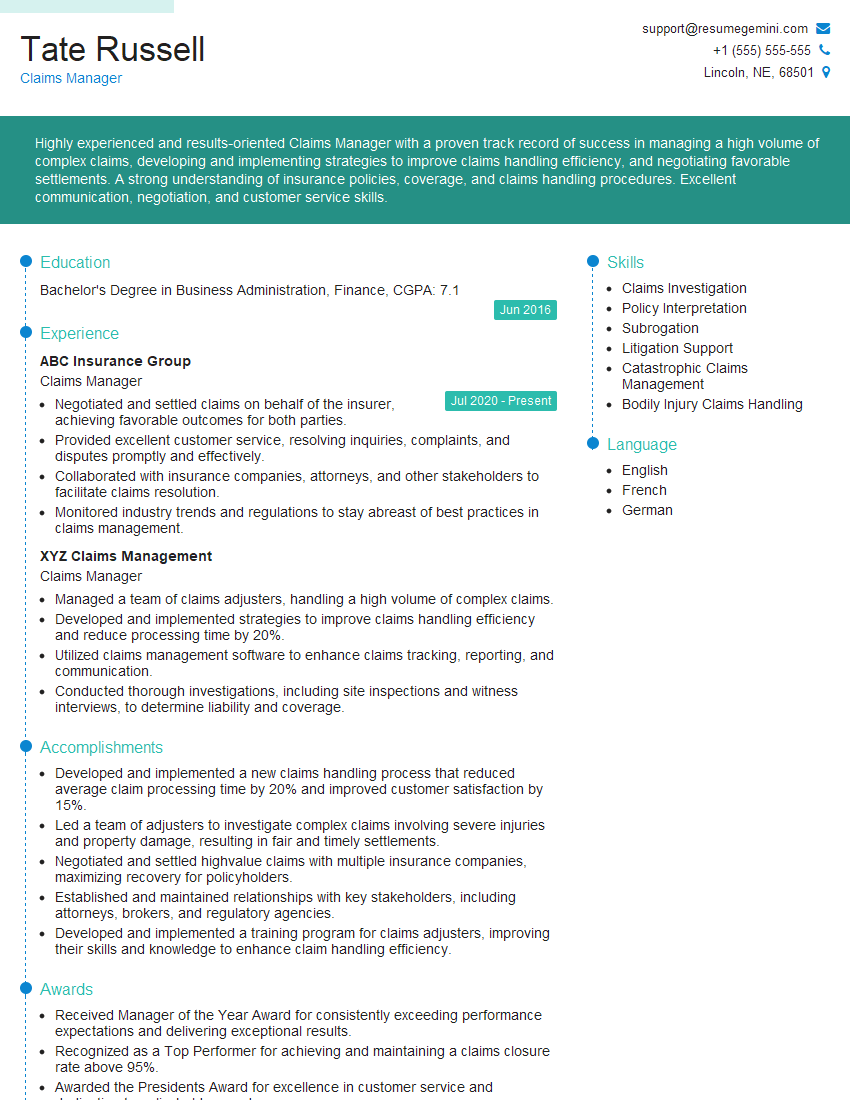

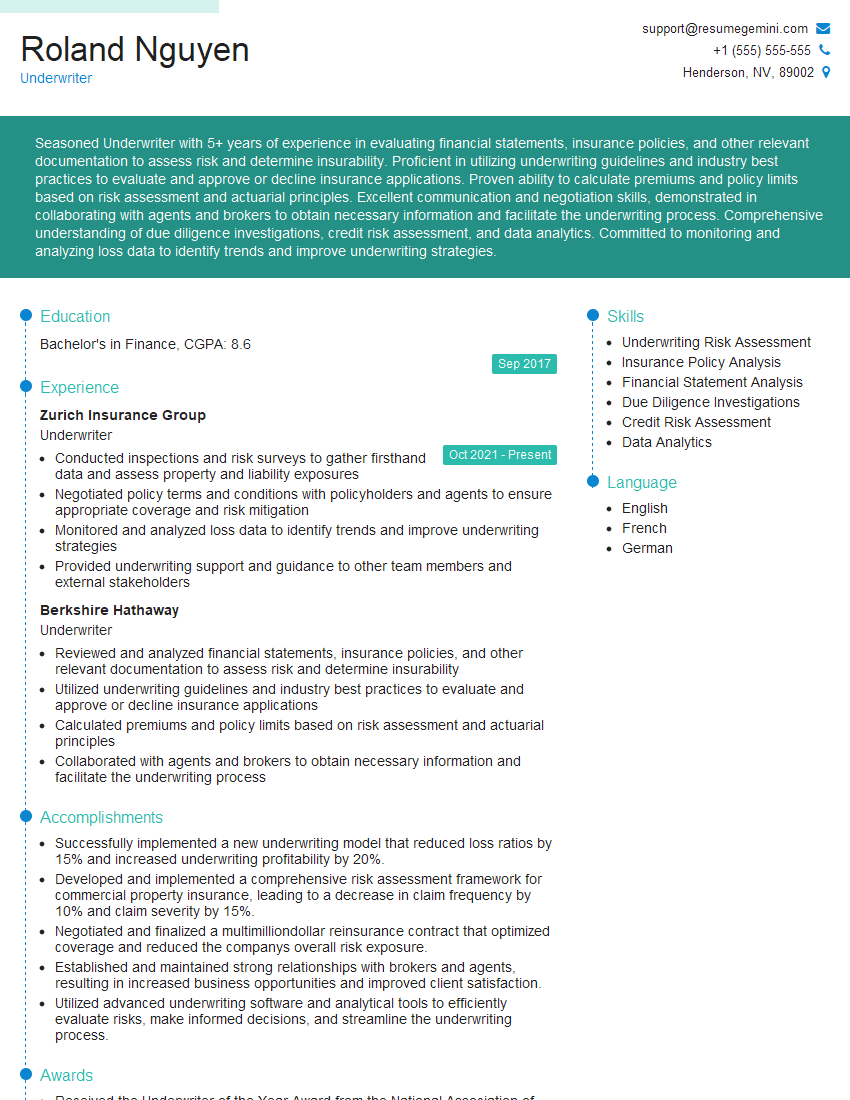

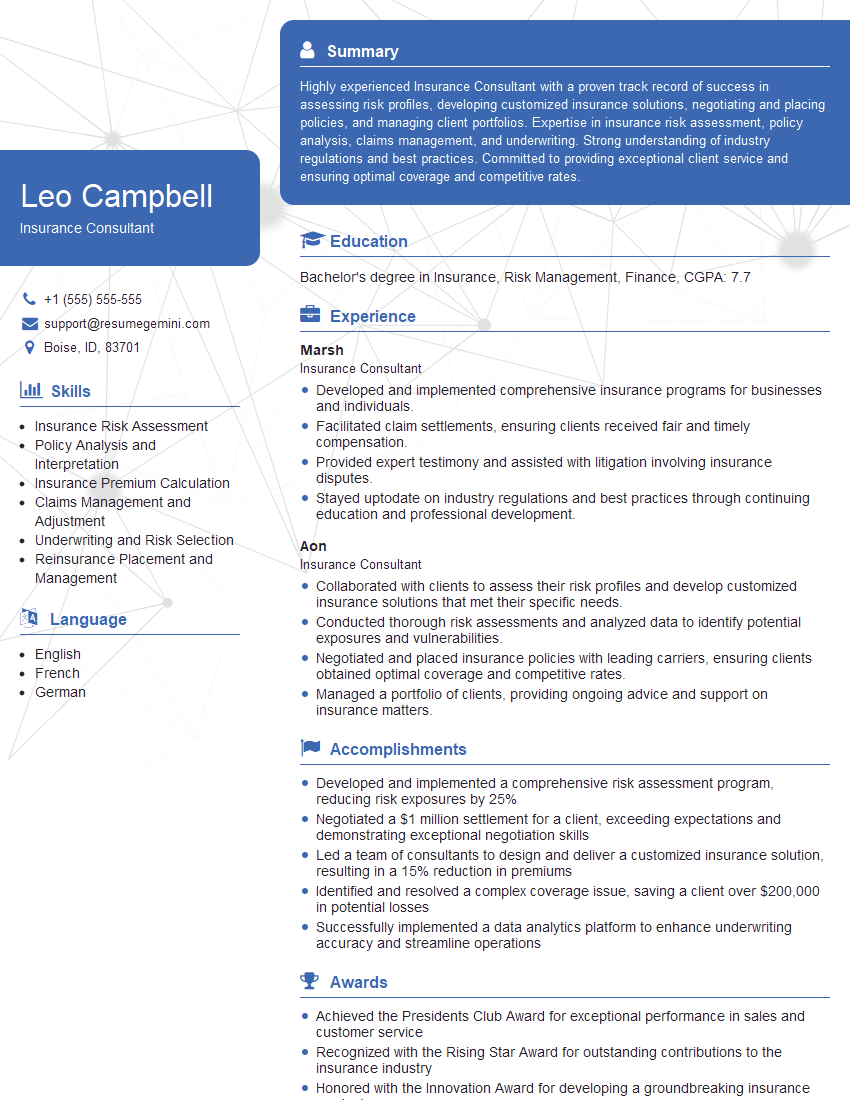

Mastering insurance contracts is crucial for advancement in the insurance industry, opening doors to specialized roles and higher earning potential. An ATS-friendly resume is your key to unlocking these opportunities. To make your application stand out, leverage the power of ResumeGemini to create a professional and impactful resume that highlights your expertise in insurance contracts. ResumeGemini provides examples of resumes tailored to the Insurance Contracts field, helping you craft a document that showcases your skills and experience effectively.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO