The thought of an interview can be nerve-wracking, but the right preparation can make all the difference. Explore this comprehensive guide to Insurance Industry Trends and Best Practices interview questions and gain the confidence you need to showcase your abilities and secure the role.

Questions Asked in Insurance Industry Trends and Best Practices Interview

Q 1. Explain the impact of Insurtech on the insurance industry.

Insurtech, a portmanteau of “insurance” and “technology,” is revolutionizing the insurance industry by leveraging technological advancements to improve efficiency, customer experience, and product offerings. Think of it as a digital transformation of a traditionally analog sector.

Improved Efficiency: Insurtech solutions automate many previously manual processes, such as claims processing and underwriting. This leads to faster turnaround times, reduced operational costs, and fewer errors. For example, AI-powered chatbots can handle simple customer inquiries 24/7, freeing up human agents to focus on more complex issues.

Enhanced Customer Experience: Insurtech companies often prioritize user-friendly interfaces and personalized experiences. Mobile apps allow customers to manage their policies, file claims, and access information easily. Telematics, for instance, uses data from connected devices in vehicles to assess driving behavior and offer personalized premiums.

New Product Innovation: Insurtech is fostering the development of innovative insurance products, such as on-demand insurance and micro-insurance, catering to evolving customer needs. On-demand insurance, for example, provides coverage only when needed, like renting a bike for a few hours.

Increased Competition: The entry of numerous Insurtech startups is increasing competition, pushing traditional insurers to innovate and improve their services.

In short, Insurtech is not merely disrupting the industry; it’s reshaping it, driving efficiency, improving customer service and creating new opportunities.

Q 2. Describe the current trends in risk management within the insurance sector.

Current trends in risk management within the insurance sector are heavily influenced by technological advancements and evolving global risks. The focus is shifting from reactive to proactive measures.

Data Analytics and Predictive Modeling: Insurers are increasingly using big data and advanced analytics to identify, assess, and mitigate risks more accurately. Predictive models help anticipate potential claims and adjust pricing accordingly.

Cybersecurity: With the increasing reliance on digital systems, cybersecurity is paramount. Insurers are investing heavily in robust security measures to protect sensitive customer and company data from breaches and cyberattacks.

Climate Change and Environmental Risks: The growing awareness of climate change has led to a greater focus on assessing and managing environmental risks, such as extreme weather events and rising sea levels. This includes incorporating climate data into underwriting and pricing models.

Operational Resilience: Insurers are strengthening their operational resilience to withstand various disruptions, including pandemics, natural disasters, and geopolitical instability. This involves developing robust business continuity plans and diversifying operations.

Regulatory Compliance: Staying compliant with evolving regulations, such as GDPR and CCPA, is crucial for managing reputational and legal risks.

Essentially, modern risk management in insurance is a data-driven, proactive approach that leverages technology and anticipates future challenges.

Q 3. How have recent regulatory changes affected the insurance landscape?

Recent regulatory changes have significantly impacted the insurance landscape, often aimed at enhancing consumer protection, increasing market transparency, and promoting financial stability. These changes vary by region but share some common themes.

Increased Scrutiny of Data Privacy: Regulations like GDPR and CCPA mandate stringent data protection measures, requiring insurers to obtain explicit consent for data collection and ensure data security. This necessitates significant investment in data governance and compliance infrastructure.

Strengthened Consumer Protection: Regulations are often introduced to protect consumers from unfair practices, such as discriminatory pricing or misleading advertising. This involves stricter oversight of insurer conduct and increased penalties for non-compliance.

Emphasis on Solvency and Capital Adequacy: Regulators are increasingly focused on ensuring the financial stability of insurance companies, often implementing stricter capital requirements to withstand economic shocks and unexpected losses. This requires insurers to carefully manage their risk profiles and maintain adequate capital reserves.

Open Banking and Data Sharing: Some jurisdictions are promoting open banking initiatives, allowing insurers access to more customer data, potentially leading to more accurate risk assessments and personalized products. However, this also brings challenges related to data privacy and security.

In essence, recent regulatory shifts are reshaping the insurance industry by demanding greater transparency, accountability, and resilience, benefiting both consumers and the overall financial system.

Q 4. What are the key challenges in implementing data analytics in insurance claims processing?

Implementing data analytics in insurance claims processing presents several key challenges:

Data Quality and Consistency: Claims data can be fragmented, inconsistent, and incomplete across various sources. Cleaning and standardizing this data is a crucial yet time-consuming step. Imagine trying to analyze claims data with inconsistent formats for dates or claim numbers – it’s nearly impossible.

Data Security and Privacy: Claims data contains highly sensitive personal and financial information. Ensuring data security and compliance with privacy regulations (like GDPR and CCPA) is paramount. A data breach could have devastating consequences.

Integration with Existing Systems: Integrating data analytics tools with legacy claims processing systems can be complex and costly. Many insurers have older systems that are not easily compatible with modern analytics platforms.

Lack of Skilled Personnel: Successfully implementing data analytics requires skilled professionals with expertise in data science, statistics, and insurance domain knowledge. Finding and retaining such talent can be difficult.

Interpretation and Actionability: Generating insights from data is only the first step. Translating those insights into actionable strategies for improving claims processing efficiency and reducing costs requires careful analysis and strategic planning.

Overcoming these challenges requires a strategic approach involving investment in data infrastructure, talent acquisition, and robust data governance processes.

Q 5. Discuss the role of artificial intelligence in underwriting.

Artificial intelligence (AI) is transforming underwriting by automating tasks, improving accuracy, and enhancing decision-making. Think of it as a powerful assistant to underwriters.

Automated Risk Assessment: AI algorithms can analyze vast amounts of data – from applicant information to external data sources – to assess risk more accurately and efficiently than humans alone. This can include evaluating credit scores, social media activity, and even satellite imagery.

Fraud Detection: AI can identify patterns and anomalies that suggest fraudulent claims or applications, helping insurers prevent financial losses and protect their reputation.

Personalized Pricing: AI can help develop more granular and accurate risk profiles, leading to more personalized pricing models that are fairer and more competitive.

Improved Efficiency: Automating routine tasks, such as data entry and document processing, frees up underwriters to focus on more complex cases and strategic decision-making.

However, it’s important to note that AI in underwriting should be used to augment, not replace, human judgment. Human oversight is crucial to ensure fairness, transparency, and compliance with regulations.

Q 6. How can insurance companies leverage predictive modeling to improve profitability?

Insurance companies can leverage predictive modeling to significantly improve profitability by accurately forecasting future events and optimizing various aspects of their operations.

Accurate Loss Prediction: Predictive models can analyze historical claims data, incorporating external factors like weather patterns and economic indicators, to forecast future losses more precisely. This allows for more accurate reserving and pricing.

Optimized Pricing Strategies: By identifying factors that correlate with higher risk, insurers can develop more accurate pricing models that reflect the true risk associated with each policy. This helps avoid both underpricing (leading to losses) and overpricing (driving away customers).

Improved Customer Segmentation: Predictive models can help identify and segment customers based on their risk profiles, allowing insurers to tailor products and services to specific groups. This enables targeted marketing and risk management strategies.

Enhanced Fraud Detection: Predictive models can identify patterns and anomalies indicative of fraudulent claims, helping insurers reduce losses and improve operational efficiency.

Better Resource Allocation: By anticipating future demand for claims processing or other resources, insurers can optimize their staffing and operational processes, improving efficiency and reducing costs.

The key to success is using high-quality data, robust modeling techniques, and continuous monitoring and refinement of the models to ensure their accuracy and effectiveness.

Q 7. Explain the concept of dynamic pricing in insurance.

Dynamic pricing in insurance uses real-time data and algorithms to adjust insurance premiums based on current risk factors. It’s like a continuously adjusting scale that reflects the ever-changing landscape of risk.

Real-time Risk Assessment: Unlike traditional static pricing, dynamic pricing considers a wider range of real-time factors, such as weather conditions, traffic data (for auto insurance), or even social media sentiment (for certain types of risk).

Personalized Pricing: It allows insurers to offer more personalized premiums based on individual risk profiles, leading to fairer pricing for low-risk individuals.

Improved Profitability: By accurately reflecting current risk levels, dynamic pricing can help insurers optimize profitability by avoiding underpricing and overpricing.

Increased Customer Engagement: Transparent communication about how dynamic pricing works can increase customer understanding and trust, fostering a stronger relationship.

However, ethical considerations are crucial. Dynamic pricing should be implemented transparently and fairly to avoid discrimination or unfair practices. Customers need to understand how their premiums are determined.

Q 8. What are some best practices for managing cyber risk in the insurance industry?

Cyber risk management in insurance is paramount given the industry’s reliance on sensitive data. Best practices involve a multi-layered approach encompassing prevention, detection, response, and recovery.

- Robust Cybersecurity Infrastructure: This includes firewalls, intrusion detection systems (IDS), and intrusion prevention systems (IPS) to protect against external threats. Regular security audits and penetration testing are crucial to identify vulnerabilities before attackers can exploit them. Imagine a bank vault – you wouldn’t just rely on one lock; you’d have multiple layers of security.

- Data Encryption: Protecting sensitive customer and company data through encryption is non-negotiable. This safeguards information even if a breach occurs, limiting the damage. Think of it like scrambling a message – even if intercepted, it’s unintelligible without the key.

- Employee Training and Awareness: Phishing attacks are common. Employees need regular training to recognize and report suspicious emails or websites. A well-informed workforce is the first line of defense.

- Incident Response Plan: A detailed plan outlining steps to take in case of a cyberattack is vital. This includes identifying key personnel, communication protocols, and data recovery procedures. This is like having a fire drill – knowing exactly what to do in an emergency minimizes damage and disruption.

- Cyber Insurance: Insurers themselves can mitigate their cyber risk by purchasing cyber insurance policies to cover losses and liabilities resulting from cyber incidents. This is risk transfer at its finest – shifting some of the financial burden to another party.

- Third-Party Risk Management: Insurance companies often rely on third-party vendors. Thorough vetting and ongoing monitoring of these vendors’ security practices are critical to preventing vulnerabilities in the extended ecosystem.

Q 9. Describe the different types of insurance fraud and methods for detection.

Insurance fraud encompasses a wide range of deceptive activities aimed at illegally obtaining insurance payouts. Types include:

- Hard Fraud: Intentional staging of events to claim insurance benefits, such as deliberately causing a car accident or faking an injury. This is the most serious type.

- Soft Fraud: Exaggerating claims or providing false information to inflate payouts. This might involve claiming more damage than actually occurred.

Detection methods utilize a combination of approaches:

- Data Analytics: Analyzing claim data to identify patterns and anomalies indicative of fraud. Algorithms can spot inconsistencies in claim details or unusual claim frequencies from specific individuals or geographic areas. For example, a sudden spike in claims for a particular type of injury in a small town might raise a red flag.

- Special Investigation Units (SIUs): Teams of investigators who conduct in-depth investigations of suspected fraudulent claims. This might involve interviews, surveillance, and forensic analysis.

- Fraud Detection Software: Specialized software designed to identify fraudulent patterns and red flags within claims data. These programs utilize complex algorithms and machine learning techniques.

- Collaboration with Law Enforcement: Insurance companies often collaborate with law enforcement agencies to investigate and prosecute major fraud cases.

Q 10. How do insurance companies manage catastrophic risks?

Catastrophic risks, like hurricanes, earthquakes, or pandemics, pose significant challenges to insurers. Management involves a combination of strategies:

- Diversification: Spreading risk across different geographic locations and lines of business. This reduces the impact of a single catastrophic event.

- Reinsurance: Purchasing insurance from other insurance companies to transfer a portion of the risk. Reinsurers essentially act as insurers for insurers, absorbing a portion of the risk in exchange for a premium. This is like sharing the burden of a heavy load.

- Catastrophe Modeling: Using sophisticated computer models to predict the potential impact of catastrophic events. These models help insurers assess their exposure to risk and price their policies accordingly.

- Risk Mitigation: Implementing measures to reduce the impact of catastrophic events. This might involve building codes, land-use planning, or public awareness campaigns.

- Financial Reserves: Maintaining substantial financial reserves to cover potential losses from catastrophic events. These reserves act as a safety net to weather the storm.

Q 11. What are the ethical considerations in using customer data in insurance?

Ethical considerations regarding customer data are paramount. Transparency, data minimization, and purpose limitation are key principles. Insurers must:

- Obtain Informed Consent: Customers should clearly understand how their data will be used and have the option to opt-out.

- Protect Data Privacy: Implement robust security measures to protect customer data from unauthorized access, use, or disclosure. Compliance with regulations like GDPR and CCPA is crucial.

- Use Data Responsibly: Data should only be used for legitimate business purposes, such as underwriting, claims processing, and customer service improvements. Using data for discriminatory purposes is unethical and potentially illegal.

- Maintain Data Accuracy: Insurers have a responsibility to maintain accurate and up-to-date customer data. Errors can lead to incorrect risk assessments and unfair treatment.

- Ensure Data Security: Protecting customer data from breaches and cyberattacks is a critical ethical responsibility.

- Be Transparent about Data Usage: Clearly communicating with customers about how their data is used builds trust and fosters transparency.

Q 12. Explain the importance of compliance in the insurance industry.

Compliance in the insurance industry is vital for maintaining public trust, protecting consumers, and avoiding significant penalties. Insurers are subject to numerous regulations at the state and federal levels, covering areas such as:

- Solvency: Maintaining sufficient capital to meet obligations. Regulatory bodies like the NAIC (National Association of Insurance Commissioners) monitor this closely.

- Consumer Protection: Fair and transparent practices in underwriting, claims handling, and customer service are essential. This includes avoiding discriminatory practices and providing clear policy information.

- Data Privacy: Safeguarding sensitive customer information in compliance with regulations like GDPR and CCPA.

- Anti-Money Laundering (AML) and Know Your Customer (KYC): Preventing the use of insurance products for illicit activities.

- Fraud Prevention: Implementing measures to detect and prevent insurance fraud.

Failure to comply can lead to significant fines, reputational damage, and even business closure.

Q 13. How do you assess the financial stability of an insurance company?

Assessing an insurer’s financial stability involves a multifaceted approach:

- Financial Statements: Analyzing the insurer’s balance sheet, income statement, and cash flow statement to understand their financial position, profitability, and liquidity.

- Regulatory Filings: Reviewing regulatory filings with state insurance departments, which provide insights into the insurer’s financial condition, reserve adequacy, and compliance with regulations. These filings are publically available.

- Rating Agencies: Considering ratings from independent rating agencies like A.M. Best, Moody’s, Standard & Poor’s, and Fitch. These agencies provide an assessment of the insurer’s creditworthiness and financial strength.

- Loss Ratios: Analyzing the insurer’s loss ratio (incurred losses/earned premiums) to understand their ability to manage claims costs effectively.

- Capital Adequacy: Assessing the insurer’s capital levels in relation to their risk exposure to determine if they possess enough capital to absorb potential losses. This often involves using various solvency ratios.

- Management Quality: Evaluating the insurer’s management team’s experience, expertise, and track record.

Q 14. What are the key performance indicators (KPIs) used in insurance underwriting?

Key Performance Indicators (KPIs) in insurance underwriting provide insights into the effectiveness and profitability of the underwriting process. Examples include:

- Loss Ratio: The ratio of incurred losses to earned premiums; a lower loss ratio indicates better underwriting performance.

- Combined Ratio: The sum of the loss ratio and the expense ratio; a combined ratio below 100% indicates profitability.

- Retention Ratio: The percentage of policies renewed from the previous period, reflecting customer satisfaction and the effectiveness of retention efforts.

- Underwriting Profit Margin: The profitability of the underwriting operations after considering both losses and expenses.

- New Business Written Premium: The total premium generated from new policies written during a specific period, representing growth.

- Average Policy Size: The average premium amount for policies in the portfolio, reflecting the risk profile.

- Claim Frequency: The number of claims filed per policy or per unit of exposure, revealing patterns of risk.

- Claim Severity: The average cost of individual claims, reflecting the magnitude of losses.

Monitoring these KPIs allows underwriters to fine-tune their strategies, identify areas for improvement, and ensure sustainable profitability.

Q 15. Describe the process of developing a new insurance product.

Developing a new insurance product is a multifaceted process requiring meticulous planning and execution. It begins with identifying an unmet market need or a gap in existing coverage. This involves extensive market research, analyzing competitor offerings, and understanding customer preferences.

- Market Research & Needs Assessment: Thorough research to identify potential customer segments and their specific needs. For instance, analyzing the demand for pet insurance in a specific demographic.

- Product Design & Development: Defining the product’s features, benefits, and pricing structure. This includes determining coverage limits, exclusions, and the overall value proposition. Example: deciding whether to offer liability coverage for dog bites in a pet insurance product.

- Actuarial Analysis & Pricing: Calculating the appropriate premiums based on anticipated claims costs and considering factors like mortality rates, morbidity rates, and inflation. This ensures the product is financially sustainable.

- Legal & Regulatory Compliance: Ensuring the product complies with all relevant laws and regulations in the target market. This may involve obtaining necessary licenses and approvals.

- Product Launch & Marketing: Developing a marketing strategy to reach the target audience and build brand awareness. This could include digital marketing campaigns, partnerships, and public relations initiatives.

- Post-Launch Monitoring & Evaluation: Continuously monitoring the product’s performance, collecting customer feedback, and making adjustments as needed. This ensures the product remains competitive and meets customer expectations. For example, analyzing claims data to identify potential areas for improvement in the policy design.

The entire process is iterative, with continuous feedback loops ensuring the final product effectively addresses the identified market need.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Explain the role of reinsurance in risk mitigation.

Reinsurance is a crucial risk mitigation strategy in the insurance industry. It involves an insurance company (the ceding company) transferring a portion of its risk to another insurance company (the reinsurer). This reduces the potential financial impact of catastrophic events or large claims.

Think of it like this: an insurance company is like a homeowner, and the risks they underwrite are like potential house fires. They can buy insurance (reinsurance) to protect themselves against a massive fire (a huge claims payout).

- Proportional Reinsurance: The reinsurer shares a percentage of each risk undertaken by the ceding company (e.g., 50%).

- Non-Proportional Reinsurance: The reinsurer covers losses exceeding a certain threshold (e.g., only losses above $1 million). This helps the primary insurer protect against extreme events.

By utilizing reinsurance, insurance companies can:

- Increase underwriting capacity: Take on more risks without increasing their own financial vulnerability.

- Stabilize financial results: Protect against the impact of unexpected large claims.

- Manage capital requirements: Reduce the amount of capital needed to meet regulatory requirements.

- Access expertise: Leverage the reinsurer’s knowledge and experience in risk assessment and management.

Q 17. Discuss the impact of climate change on insurance risk.

Climate change significantly exacerbates insurance risks across multiple lines of business. Increased frequency and severity of extreme weather events – hurricanes, floods, wildfires – directly translate to higher claim payouts for insurers.

- Increased Frequency and Severity of Catastrophic Events: More frequent and intense hurricanes, wildfires, and floods lead to substantially higher claims costs for property, casualty, and crop insurers.

- Sea Level Rise and Coastal Erosion: This leads to increased flood risk for coastal properties, impacting both residential and commercial insurance.

- Shifting Weather Patterns: Changes in temperature and precipitation patterns affect agricultural yields, impacting crop insurance and potentially even causing increased damage to property and infrastructure.

- Increased Wildfire Risk: Longer, drier seasons increase the risk and intensity of wildfires, causing significant damage to property and infrastructure.

Insurance companies are responding by:

- Adjusting premiums: Increasing premiums in high-risk areas to reflect the increased likelihood and cost of claims.

- Refining risk models: Developing more sophisticated models that incorporate climate change data to improve risk assessment.

- Developing new products: Offering new products that address climate-related risks, such as parametric insurance, which pays out based on the occurrence of a specified event regardless of the specific damage.

- Investing in mitigation strategies: Supporting initiatives aimed at reducing greenhouse gas emissions and adapting to climate change.

Q 18. How do you evaluate the effectiveness of a risk management strategy?

Evaluating the effectiveness of a risk management strategy requires a multi-faceted approach involving quantitative and qualitative assessments.

- Key Risk Indicators (KRIs): Track metrics such as the frequency and severity of losses, the number of claims, and the cost of claims. Analyze trends over time to see if the strategy is having the intended impact. For example, if the number of large claims related to a specific risk has decreased, that’s a positive indicator.

- Loss Ratio Analysis: Calculate the loss ratio (incurred losses / earned premiums) to measure the profitability of the insurance operations. A lower loss ratio indicates better risk management.

- Compliance Audits: Regularly review compliance with relevant regulations and internal policies to ensure that the risk management strategy is effective. Are we adhering to best practices and minimizing potential regulatory fines?

- Scenario Analysis & Stress Testing: Perform stress tests to simulate the impact of various events (e.g., a large-scale disaster) to assess the robustness of the strategy. This helps identify weaknesses and areas for improvement.

- Regular Reviews & Improvements: Conduct periodic reviews of the risk management strategy, taking into account changes in the business environment, emerging risks, and feedback from stakeholders. The risk landscape is constantly shifting, so strategies must be dynamic.

Effective risk management isn’t just about preventing all losses, but it’s about mitigating the impact of unavoidable ones. This involves a balance between cost-effective prevention and adequate contingency planning.

Q 19. What are the key elements of a successful claims management system?

A successful claims management system is crucial for maintaining customer satisfaction and operational efficiency. Key elements include:

- Prompt Acknowledgment & Investigation: Quickly acknowledge claims and conduct thorough investigations to determine liability and the extent of damages. Speedy and transparent communication with the claimant is vital.

- Fair and Equitable Settlement: Resolve claims fairly and efficiently, offering settlements that are appropriate and consistent with policy terms. Avoiding drawn-out disputes is crucial for maintaining trust.

- Effective Communication: Maintain clear and consistent communication with claimants throughout the claims process, keeping them informed of progress and addressing their concerns. This helps build customer loyalty.

- Robust Technology: Utilize technology such as claims management software to streamline the claims process, track claims status, and improve efficiency. Automation is key to minimizing processing time.

- Fraud Detection & Prevention: Implement measures to detect and prevent fraudulent claims, reducing losses and protecting the insurer’s financial interests. This might involve data analytics and specialized teams.

- Performance Monitoring & Improvement: Track key metrics such as claim cycle times, customer satisfaction scores, and claims costs to identify areas for improvement in the claims handling process. Regular reviews will help in optimizing efficiency and minimizing issues.

Think of it as a well-oiled machine: every part needs to work seamlessly for a smooth and efficient claims process. The goal is to resolve claims fairly and quickly, creating positive customer experiences.

Q 20. Explain the principles of reserving in insurance.

Reserving in insurance involves setting aside funds to cover future claims liabilities. It’s a crucial aspect of financial reporting and solvency. Insurers use actuarial techniques to estimate the amount needed to cover claims that have occurred but haven’t been settled yet (incurred but not reported), and claims that will occur in the future (IBNR).

Think of it as saving for future expenses, but for uncertain events. The level of accuracy is crucial; underestimating reserves can lead to financial instability, whereas overestimating them limits profitability.

- Estimating Claims Liabilities: Actuaries use various methods to estimate the amount needed to cover future claims. This involves analyzing historical claims data, considering inflation, and making assumptions about future claim frequencies and severities.

- Developing Reserve Models: Sophisticated models are used to quantify uncertainty and incorporate various factors influencing claims costs. These models use statistical methods to project future claims.

- Regulatory Compliance: Reserves must meet regulatory requirements, and insurers are subject to audits to ensure adequacy. Solvency is a key concern for regulators.

- Monitoring and Adjustments: Reserves are reviewed regularly and adjusted as new information becomes available or as claims patterns change. Regular updates are essential for financial stability.

Accurate reserving is essential for the financial health of an insurance company. It allows for the consistent and responsible payout of claims while ensuring the company’s long-term viability.

Q 21. How do you handle a situation where conflicting regulatory requirements exist?

Conflicting regulatory requirements across jurisdictions present significant challenges for multinational insurance companies. The approach to resolving these conflicts involves a multi-pronged strategy.

- Identify and Analyze Conflicts: Carefully identify all applicable regulations and pinpoint the specific areas of conflict. Understanding the nature of the conflict is the first step.

- Prioritize and Assess: Prioritize the regulations based on their impact on the business and the potential penalties for non-compliance. Weighing the potential consequences is crucial.

- Seek Legal Counsel: Consult with legal experts specializing in insurance regulation to get informed advice. Legal expertise can help navigate complex regulations.

- Engage with Regulators: Open communication with the relevant regulatory bodies to explain the situation and seek clarification. This demonstrates proactive compliance.

- Develop Compliance Strategies: Develop strategies to comply with the most stringent regulations or find ways to reconcile conflicting requirements where possible. Finding suitable solutions is key.

- Document Everything: Thoroughly document all steps taken to address the conflicts. This record-keeping is essential for audit trails and potential dispute resolution.

Navigating conflicting regulations requires a proactive, well-documented approach that balances compliance with operational efficiency. The overarching goal is to minimize risk and ensure compliance with the law while operating effectively in different jurisdictions.

Q 22. Describe your experience with different insurance policy types.

My experience encompasses a wide range of insurance policy types, from personal lines like auto, home, and life insurance to commercial lines including property, casualty, and professional liability. I’ve worked extensively with various policy structures, including:

- Term Life Insurance: Provides coverage for a specific period, offering a cost-effective solution for temporary needs.

- Whole Life Insurance: Offers lifelong coverage and a cash value component that grows over time, acting as a savings vehicle.

- Auto Insurance: Covers liability, collision, and comprehensive damages related to vehicle accidents. I’m familiar with different coverage levels and deductibles.

- Homeowners Insurance: Protects against property damage, liability claims, and additional living expenses in case of unforeseen events. Understanding the intricacies of coverage limits is crucial.

- Commercial General Liability (CGL): Protects businesses from third-party claims related to bodily injury or property damage caused by their operations.

- Workers’ Compensation Insurance: Mandated in most jurisdictions, this covers medical expenses and lost wages for employees injured on the job. Accurate risk assessment is paramount.

This diverse experience allows me to understand the unique needs and risks associated with each policy type and tailor solutions effectively.

Q 23. What strategies do you employ to stay updated on insurance industry trends?

Staying ahead in the dynamic insurance landscape requires a multi-faceted approach. I consistently leverage several strategies:

- Industry Publications and Journals: I regularly read publications like the Insurance Journal, Best’s Review, and industry-specific newsletters to stay informed about emerging trends and regulatory changes.

- Conferences and Webinars: Attending industry conferences and webinars allows me to network with peers, learn from experts, and discover best practices. This is especially valuable for understanding technological advancements.

- Online Resources and Databases: I use online databases and research platforms to access market reports, analysis, and case studies. This data-driven approach helps me identify emerging risks and opportunities.

- Professional Organizations: Membership in professional organizations like the Society of Actuaries (SOA) or the Casualty Actuarial Society (CAS) provides access to educational resources, networking opportunities, and industry insights.

- Regulatory Updates: Monitoring regulatory changes at both the state and federal levels is critical to ensuring compliance and adapting to evolving legal frameworks.

By combining these methods, I maintain a current understanding of market shifts, technological innovations, and regulatory developments that shape the insurance industry.

Q 24. Explain your understanding of different actuarial models.

Actuarial models are the cornerstone of insurance pricing and risk management. They employ statistical methods to estimate future losses and determine appropriate premiums. My understanding encompasses various models, including:

- Generalized Linear Models (GLMs): These are frequently used for modeling frequency and severity of claims, considering various risk factors like age, location, and driving history. For example, a GLM can predict the likelihood and cost of auto accidents based on these factors.

- Credibility Theory: This model blends prior experience with newly available data to improve the accuracy of estimates, especially when limited data exists for a specific risk segment.

- Survival Analysis Models: Used extensively in life insurance and other areas with time-dependent events, these models estimate the probability of an event occurring within a specific timeframe, such as the likelihood of a policyholder surviving to a certain age.

- Stochastic Models: Incorporating elements of randomness, these models allow for simulating various scenarios to assess the potential impact of different risks and uncertainties on financial results.

Selecting the appropriate actuarial model depends on the specific insurance product, the available data, and the desired level of accuracy. A thorough understanding of each model’s strengths and limitations is vital for effective risk assessment and pricing.

Q 25. How do you prioritize tasks in a fast-paced insurance environment?

Prioritizing tasks in a fast-paced insurance environment necessitates a structured approach. I utilize a combination of techniques:

- Prioritization Matrix (Eisenhower Matrix): I categorize tasks based on urgency and importance. Urgent and important tasks are tackled immediately, while less urgent tasks are scheduled or delegated. This ensures that critical matters are addressed promptly.

- Time Blocking: Allocating specific time blocks for focused work on particular tasks enhances efficiency and reduces distractions. I might allocate a morning block for analyzing data and an afternoon block for client interaction.

- Project Management Software: Utilizing project management tools like Asana or Trello allows for efficient task management, tracking progress, and collaborating with colleagues on shared projects. This improves visibility and ensures timely completion of tasks.

- Regular Review and Adjustment: I regularly review my task list and adjust priorities based on evolving circumstances. Flexibility is key in a dynamic environment.

This multi-pronged strategy ensures that I consistently meet deadlines, manage my workload effectively, and maintain a focus on the most critical tasks.

Q 26. Discuss the importance of customer relationship management in insurance.

Customer Relationship Management (CRM) is paramount in the insurance industry. It’s not merely about selling policies; it’s about building long-term relationships and providing exceptional service. Effective CRM leads to:

- Improved Customer Retention: Personalized communication and proactive service demonstrate value, increasing customer loyalty and reducing churn.

- Enhanced Customer Satisfaction: Efficient claim processing and readily available support create positive customer experiences.

- Increased Cross-Selling and Upselling Opportunities: Understanding customer needs allows for offering relevant products and services, boosting revenue.

- Improved Risk Management: Collecting and analyzing customer data helps in identifying potential risks and tailoring policies accordingly.

- Data-Driven Decision Making: CRM systems provide valuable insights into customer behavior, enabling better strategic planning and resource allocation.

For example, a CRM system could track policy renewals, automate communication regarding upcoming premiums, and provide agents with insights into customer preferences to offer tailored solutions. A strong CRM strategy is crucial for sustainable growth and competitive advantage in the insurance market.

Q 27. What are your thoughts on the future of insurance technology?

The future of insurance technology is brimming with innovation. Key trends include:

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML will play a crucial role in automating processes like claims processing, fraud detection, and risk assessment, leading to improved efficiency and accuracy. AI-powered chatbots can provide 24/7 customer service.

- Blockchain Technology: Blockchain offers the potential to streamline transactions, improve data security, and reduce fraud by creating a transparent and immutable record of insurance policies and claims.

- Internet of Things (IoT): IoT devices collect real-time data, providing valuable insights into risk profiles. For example, telematics devices in vehicles can monitor driving behavior for auto insurance.

- Big Data Analytics: Analyzing vast amounts of data enables insurers to develop more accurate risk models, personalize products, and improve customer service.

- Insurtech Startups: The emergence of insurtech startups is driving innovation and challenging traditional insurance models, leading to more efficient and customer-centric solutions.

Insurers that embrace these technological advancements will be better positioned to meet the evolving needs of customers and maintain a competitive edge.

Q 28. How do you approach problem-solving in complex insurance scenarios?

Approaching complex insurance scenarios requires a structured and analytical approach:

- Define the Problem Clearly: Thoroughly understand the issue at hand, gathering all relevant information and identifying the key challenges.

- Gather and Analyze Data: Collect data from various sources, including policy documents, claims data, and external market information. Analyze this data to identify patterns and trends.

- Develop Potential Solutions: Brainstorm multiple solutions, considering their feasibility, cost-effectiveness, and potential impact.

- Evaluate Solutions: Assess the pros and cons of each solution, considering factors like regulatory compliance, customer impact, and financial implications.

- Implement the Best Solution: Select the optimal solution and implement it, ensuring proper communication and coordination with stakeholders.

- Monitor and Evaluate Results: Track the impact of the implemented solution and make adjustments as needed based on observed outcomes.

For example, when facing a surge in claims related to a specific event, a structured approach would involve analyzing the causes, adjusting pricing models, and implementing risk mitigation strategies. This systematic approach ensures effective problem-solving in even the most complex situations.

Key Topics to Learn for Insurance Industry Trends and Best Practices Interview

- Digital Transformation: Understanding the impact of Insurtech, AI, and big data analytics on insurance operations, customer experience, and risk management. Consider how these technologies are changing underwriting, claims processing, and fraud detection.

- Customer Experience & Personalization: Explore strategies for enhancing customer satisfaction through personalized products, seamless digital interactions, and proactive customer service. Think about how to leverage data to understand customer needs and preferences.

- Risk Management & Mitigation: Discuss evolving risk landscapes, including climate change, cybersecurity threats, and emerging technologies. Consider the application of predictive modeling and advanced analytics for proactive risk management.

- Regulatory Compliance & Governance: Familiarize yourself with key regulations (e.g., GDPR, CCPA) and their impact on insurance practices. Understand the importance of ethical considerations and data privacy in the insurance industry.

- Data Analytics & Predictive Modeling: Explore the use of data analytics for pricing, underwriting, claims management, and fraud detection. Understand the practical application of predictive models and their limitations.

- Innovation & Emerging Trends: Stay abreast of emerging trends like embedded insurance, blockchain technology, and the Internet of Things (IoT) and how they are reshaping the industry. Discuss potential opportunities and challenges presented by these innovations.

- Financial Analysis & Performance Measurement: Understand key financial metrics relevant to the insurance industry (e.g., loss ratios, expense ratios) and be able to interpret and analyze financial statements.

Next Steps

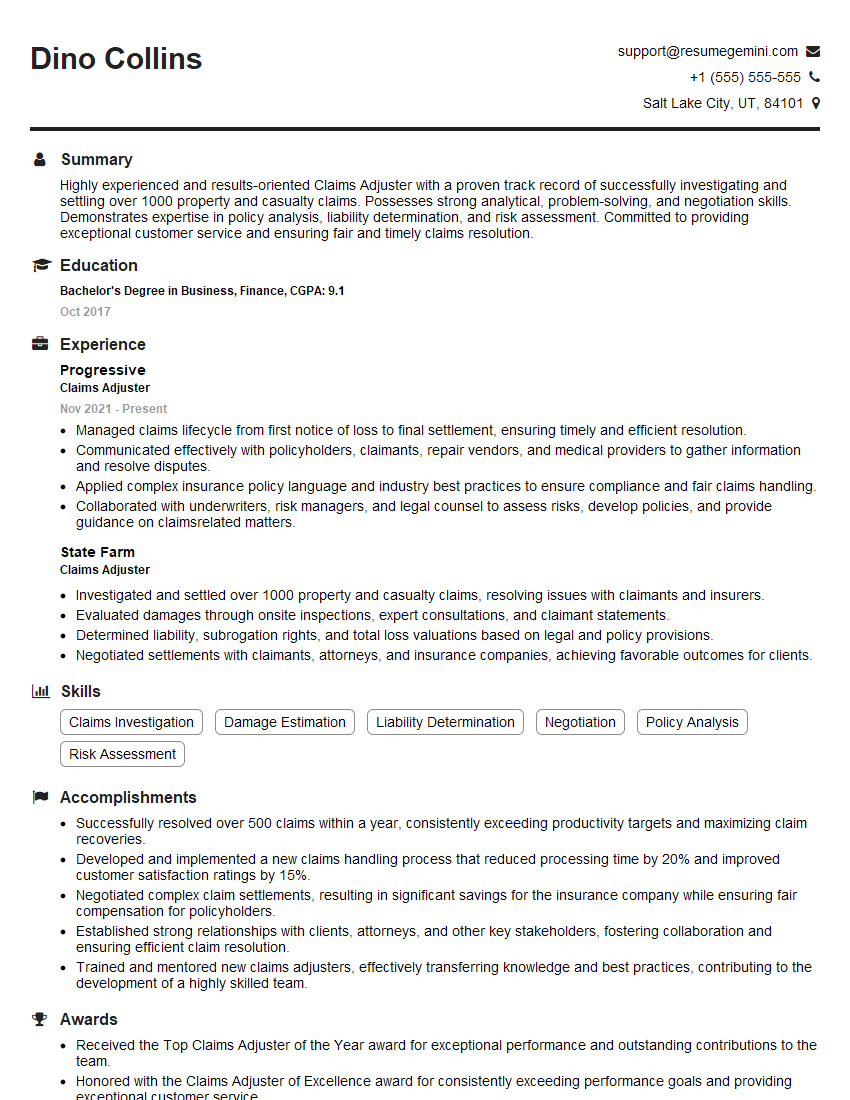

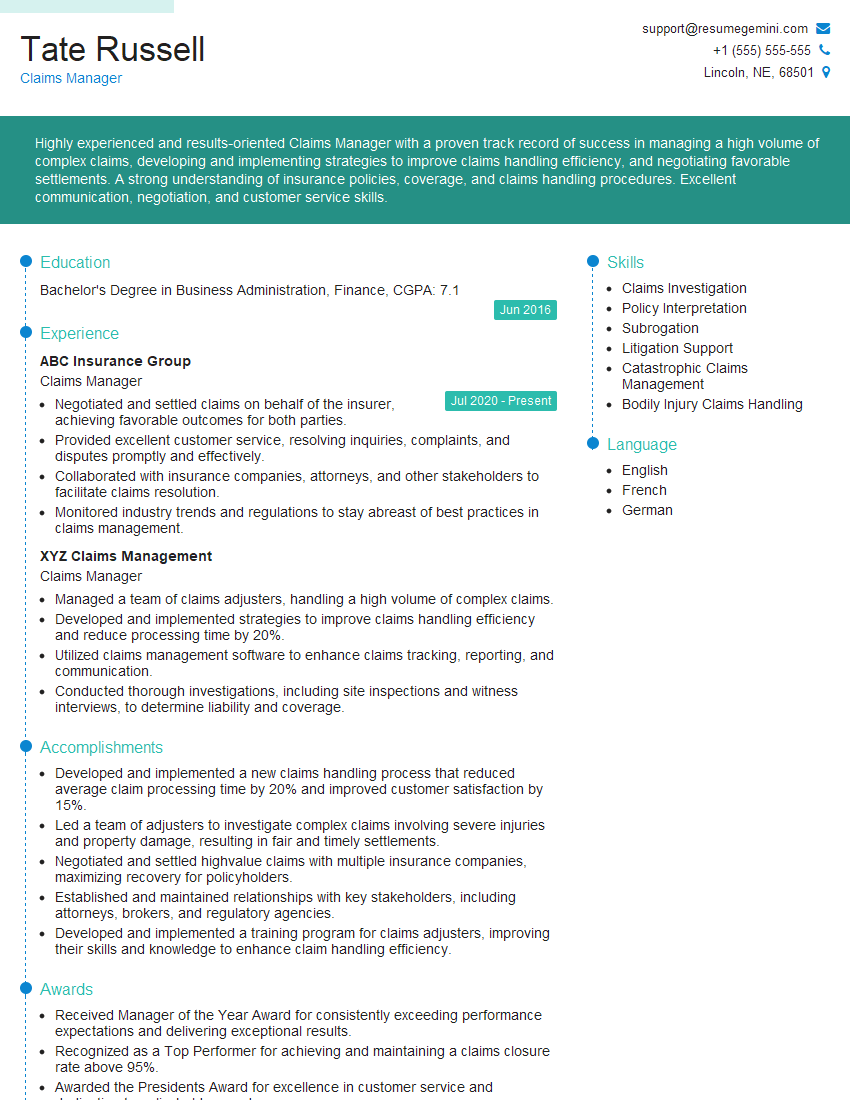

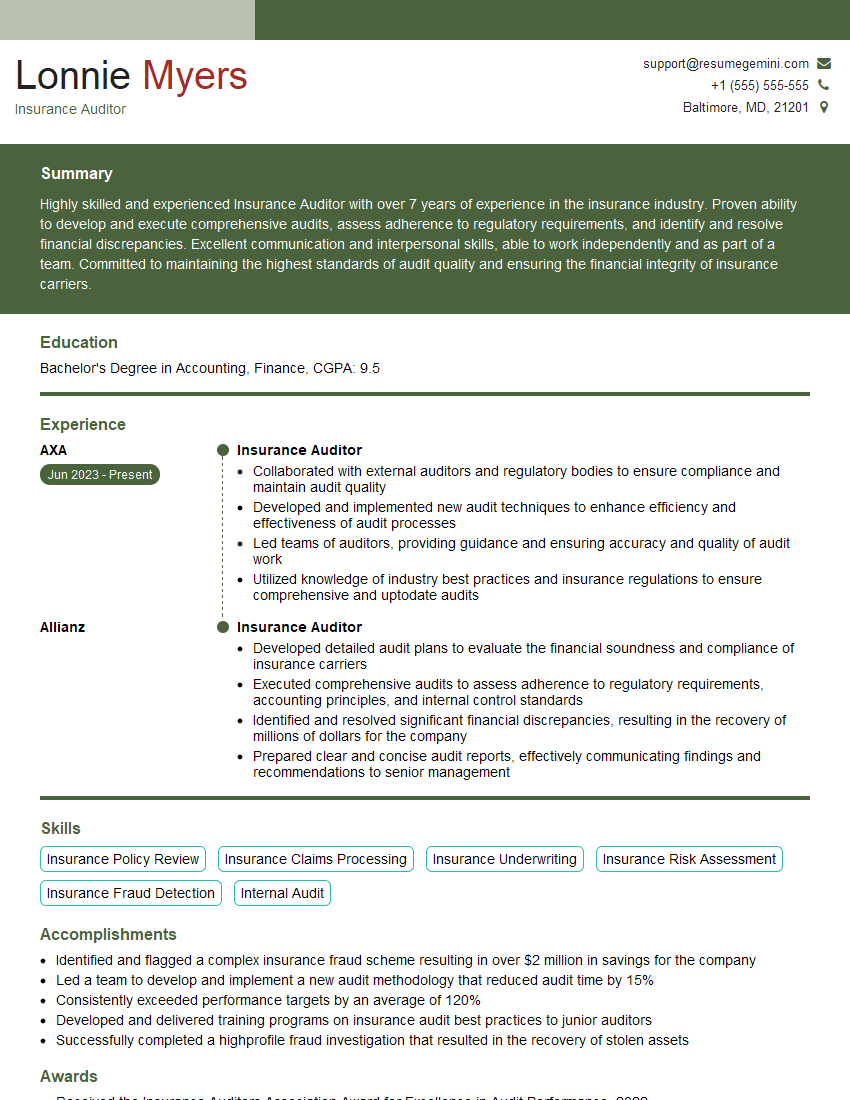

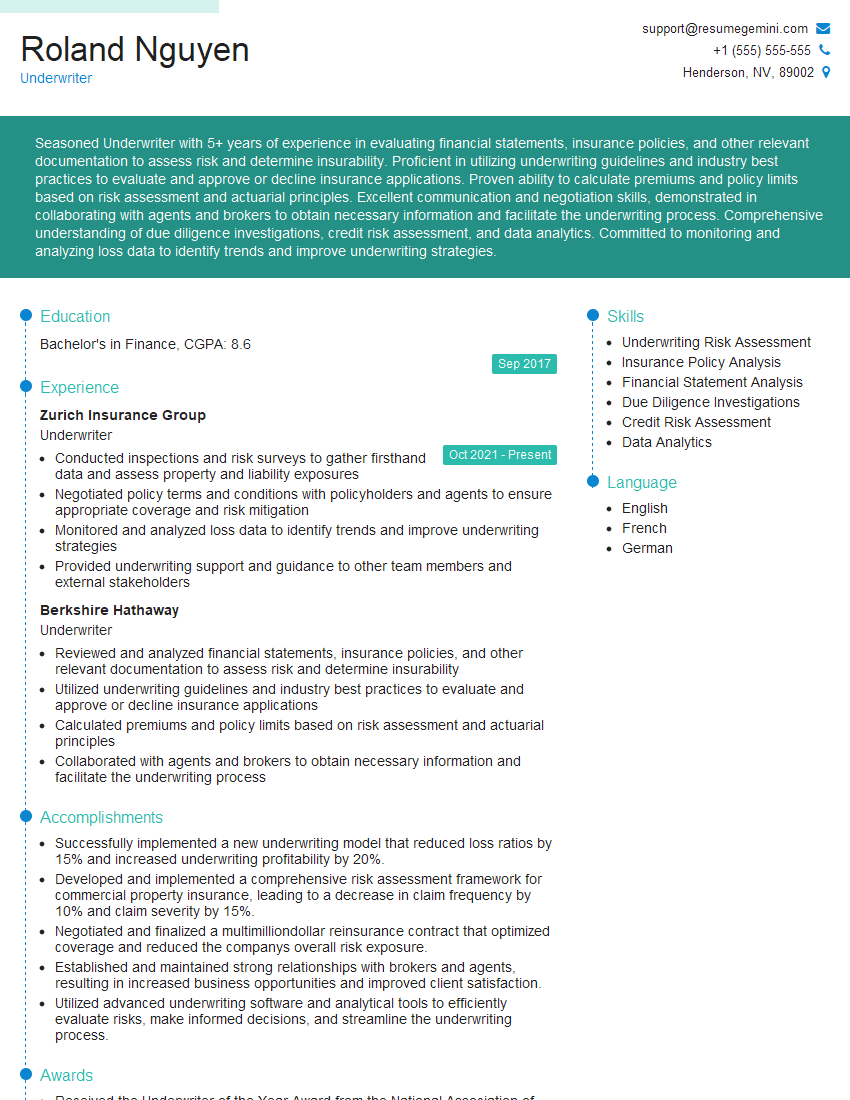

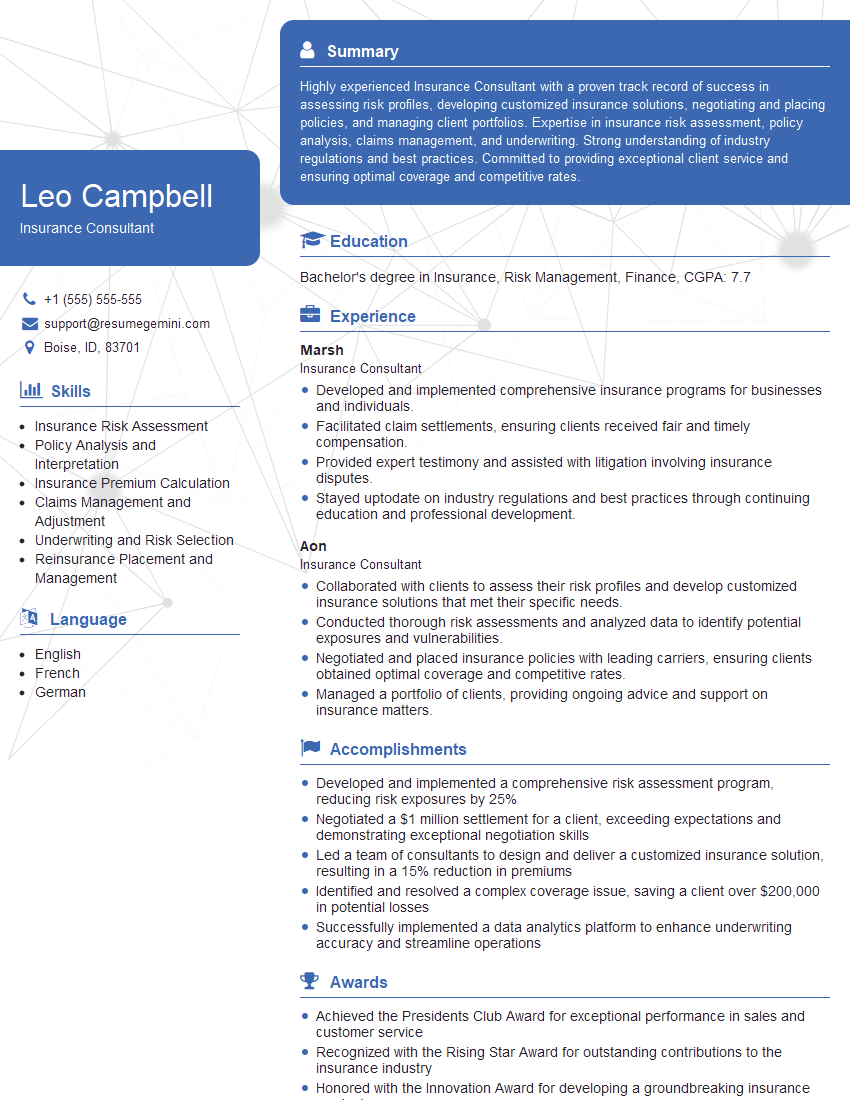

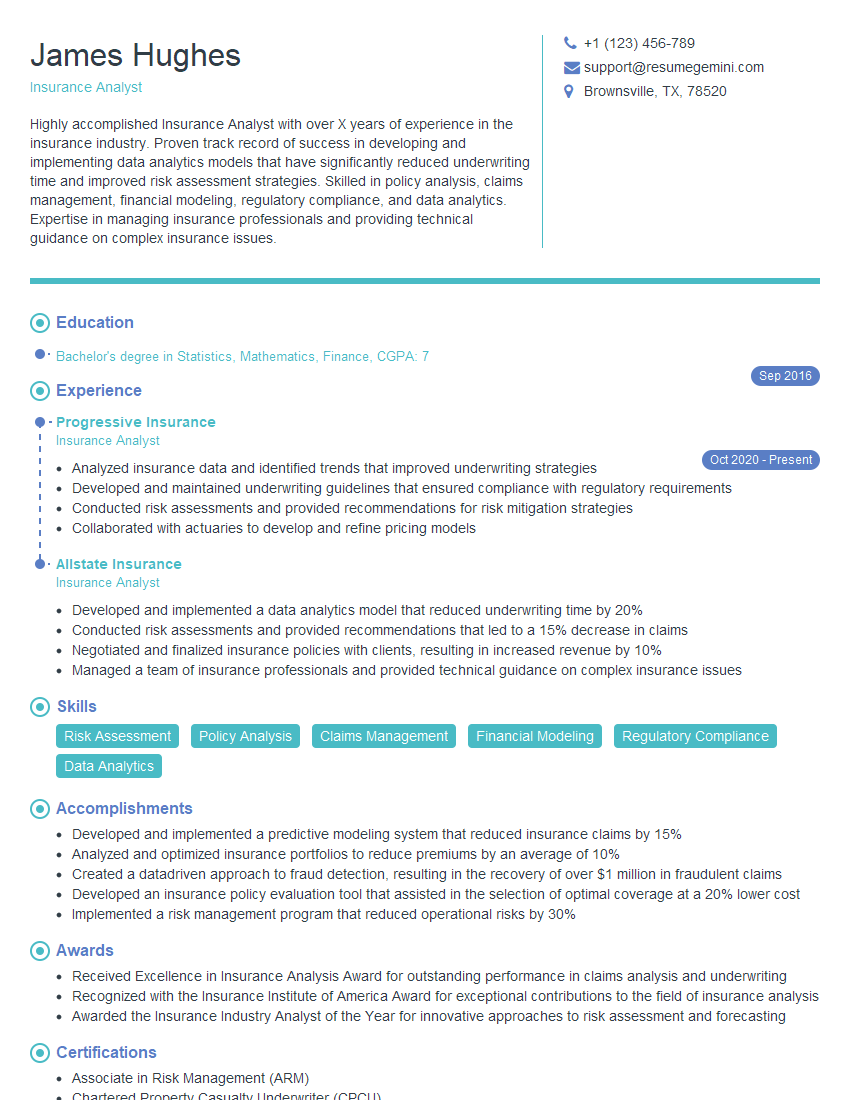

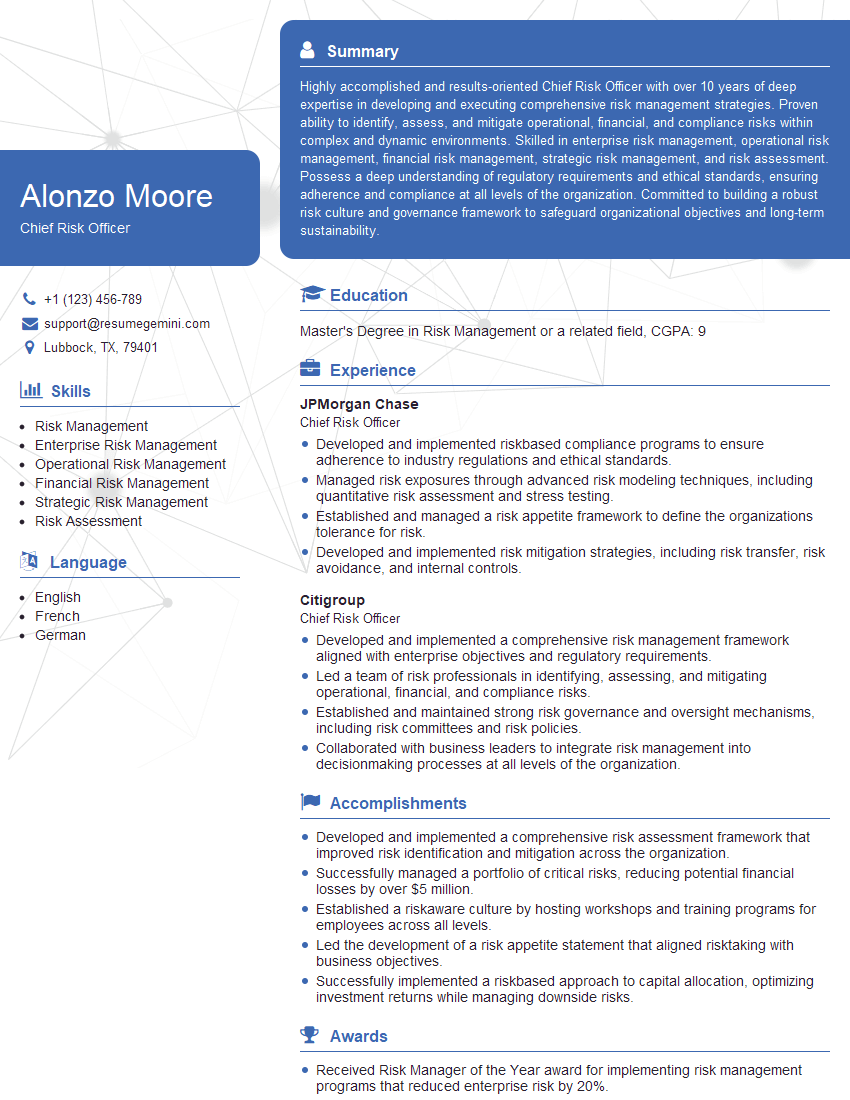

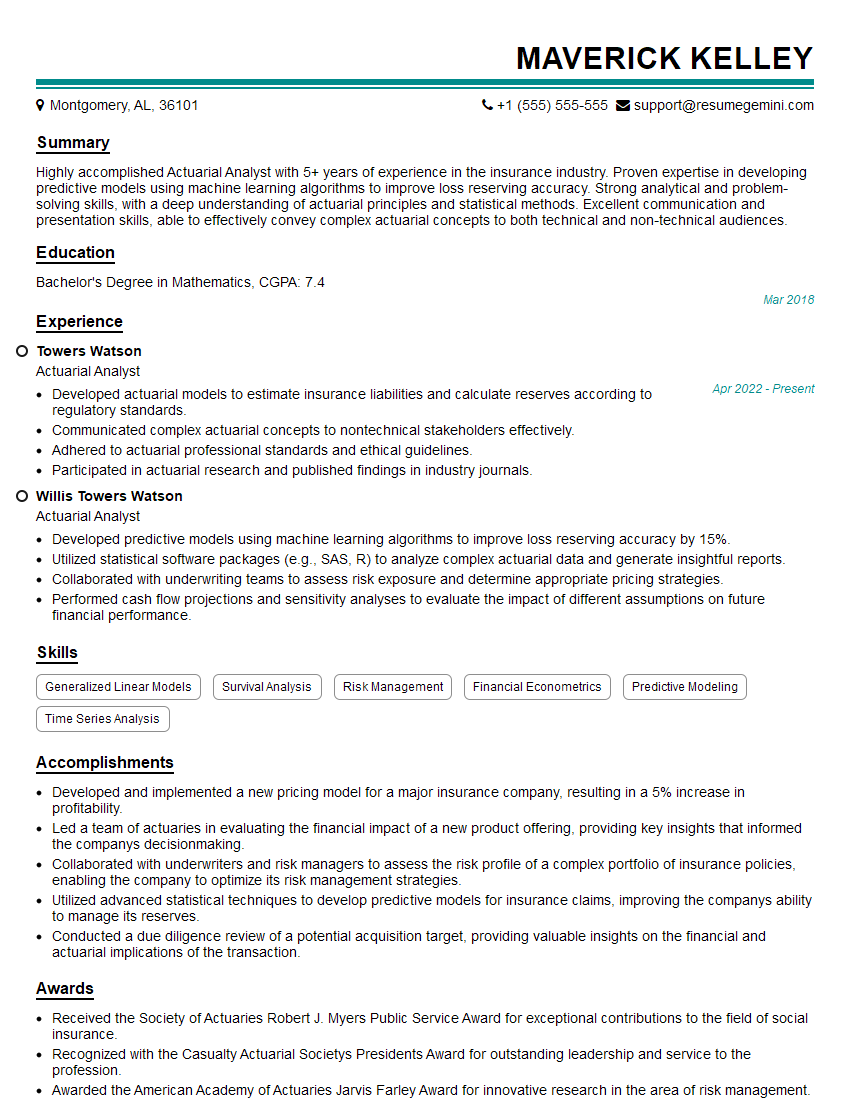

Mastering Insurance Industry Trends and Best Practices is crucial for accelerating your career in this dynamic field. Demonstrating a strong understanding of these concepts will significantly improve your interview performance and job prospects. To enhance your chances, focus on creating an ATS-friendly resume that effectively showcases your skills and experience. We highly recommend using ResumeGemini to build a professional and impactful resume. ResumeGemini provides valuable tools and resources to help you craft a compelling narrative, and you’ll find examples of resumes tailored to Insurance Industry Trends and Best Practices available to guide you. Take the next step toward your ideal career today!

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

I Redesigned Spongebob Squarepants and his main characters of my artwork.

https://www.deviantart.com/reimaginesponge/art/Redesigned-Spongebob-characters-1223583608

IT gave me an insight and words to use and be able to think of examples

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO