Are you ready to stand out in your next interview? Understanding and preparing for Insurance Policies and Procedures interview questions is a game-changer. In this blog, we’ve compiled key questions and expert advice to help you showcase your skills with confidence and precision. Let’s get started on your journey to acing the interview.

Questions Asked in Insurance Policies and Procedures Interview

Q 1. Explain the difference between an indemnity policy and a valued policy.

The core difference between an indemnity policy and a valued policy lies in how the amount of compensation is determined after a loss.

An indemnity policy, the most common type, aims to put the policyholder back in the same financial position they were in before the loss occurred. It doesn’t compensate for the full replacement cost, but rather the actual financial loss suffered. Think of it like this: if your car is totaled, an indemnity policy will compensate you for its market value before the accident, not a brand-new replacement. This helps prevent profiting from a loss.

A valued policy, on the other hand, specifies a predetermined amount of compensation in the policy itself. This is typically used for items that are difficult to value after a loss, such as antiques or art. The insured and insurer agree on the value upfront. If the item is destroyed, the policy pays the agreed-upon value regardless of the actual market price at the time of loss.

Example: Imagine you have a painting valued at $10,000. An indemnity policy might only pay you the current market value if it’s damaged, which could be lower than $10,000. A valued policy, however, would guarantee you $10,000 in compensation.

Q 2. Describe the process of handling a first-party claim.

Handling a first-party claim (a claim made by the policyholder against their own insurance company) involves a systematic process:

- Notification: The policyholder reports the claim to the insurer, usually by phone or online.

- Acknowledgement and Assignment: The insurer acknowledges the claim and assigns it to a claims adjuster.

- Investigation: The adjuster investigates the claim, gathering information such as police reports, photos of damages, and witness statements. For example, in a car accident claim, the adjuster will examine the damage to the vehicle, assess its pre-accident value, and determine the extent of the loss.

- Evaluation: The adjuster evaluates the claim, determining the amount of loss and the insurer’s liability based on the policy coverage and the facts of the case.

- Negotiation and Settlement: The adjuster might negotiate with the policyholder to reach a settlement. This could involve repair costs, replacement costs, or other compensation outlined in the policy.

- Payment: Once the settlement is agreed upon, the insurer issues payment to the policyholder.

Throughout the process, the insurer maintains detailed records and documentation. Transparency and clear communication with the policyholder are crucial.

Q 3. What is subrogation, and how does it apply in insurance claims?

Subrogation is the right of an insurer, after paying a claim to its insured, to recover the amount paid from a third party who is legally liable for the loss. It’s like stepping into the shoes of the insured to pursue recovery. It’s a crucial aspect of keeping insurance premiums reasonable.

How it applies: Let’s say you’re in a car accident caused by another driver. Your insurance company pays for the repairs to your car. Through subrogation, they would then pursue the at-fault driver’s insurance company to recover the money they paid out. This prevents the policyholder from having to pursue legal action themselves.

Subrogation helps to prevent fraud and ensures that the responsible party bears the cost of the loss, rather than spreading it across all policyholders through higher premiums.

Q 4. Explain the concept of insurable interest.

Insurable interest means having a financial stake in the subject matter of an insurance policy. In simpler terms, you must stand to suffer a financial loss if the insured item is damaged or destroyed. This principle prevents people from insuring things they don’t care about. Without insurable interest, insurance becomes a form of gambling.

Examples:

- You have an insurable interest in your own home because its damage would cause you financial loss.

- A bank has an insurable interest in the property that secures a mortgage; its value impacts the bank’s security.

- A business owner has an insurable interest in their business property because damage would affect their income.

Lack of insurable interest can invalidate a policy. For instance, you can’t insure your neighbor’s house unless you have a legally recognized financial interest in it.

Q 5. What are the common exclusions found in liability insurance policies?

Liability insurance policies, which cover the insured’s legal responsibility for causing injury or damage to others, typically include several exclusions. These exclusions limit coverage in specific situations.

Common exclusions include:

- Intentional acts: Coverage usually doesn’t extend to injuries or damages caused intentionally by the insured.

- Nuclear hazards: Damage resulting from nuclear reactions or radiation is often excluded.

- Pollution: Environmental damage caused by pollution can be excluded, though this varies by policy and state.

- War or terrorism: Losses caused by acts of war or terrorism are often excluded.

- Specific types of vehicles or equipment: Certain vehicles (e.g., race cars) or equipment (e.g., aircraft) might have limited or no coverage.

It’s crucial to carefully review the policy’s exclusions to understand what situations are not covered.

Q 6. How do you determine the appropriate reserve for a claim?

Determining the appropriate reserve for a claim is a critical aspect of claims handling. The reserve is the amount of money the insurer sets aside to cover the anticipated cost of the claim. It requires careful assessment and experience.

Factors considered in determining the reserve include:

- Nature of the claim: A simple claim will require a smaller reserve than a complex one.

- Extent of damage: The severity of the loss greatly impacts the reserve amount.

- Potential legal costs: If litigation is anticipated, a higher reserve is needed.

- Policy limits: The reserve cannot exceed the policy’s coverage limits.

- Past experience: Insurers use historical data and industry benchmarks to guide their reserve estimates.

Adjusters use various techniques, including statistical modeling, to project claim costs. The reserve is reviewed and adjusted as more information becomes available throughout the claim process.

Q 7. Describe the different types of insurance coverage (e.g., property, liability, casualty).

Insurance coverage comes in various forms, each designed to protect against different types of risks:

- Property Insurance: Protects against damage to physical property, such as homes, buildings, and personal belongings. This includes dwelling coverage, personal property coverage, and liability coverage related to the property.

- Liability Insurance: Covers legal liability for causing injury or damage to others. This includes auto liability insurance, general liability insurance for businesses, and professional liability insurance (errors and omissions).

- Casualty Insurance: This is a broader term that often overlaps with liability insurance but may also include other types of coverage, such as workers’ compensation, which covers employee injuries, and surety bonds.

- Health Insurance: Covers medical expenses resulting from illness or injury.

- Life Insurance: Provides a financial benefit to beneficiaries upon the death of the insured.

- Auto Insurance: A common type of insurance that combines several coverages, including property damage liability, bodily injury liability, collision, and comprehensive coverage.

The specific types of coverage needed depend on an individual’s or business’s circumstances and risk profile.

Q 8. Explain the concept of risk assessment in underwriting.

Risk assessment in underwriting is the crucial process of evaluating the likelihood and potential severity of a loss associated with insuring a particular applicant or asset. Underwriters analyze various factors to determine the risk profile, ultimately deciding whether to insure the applicant and at what premium.

For example, consider car insurance. The underwriter would assess factors like the applicant’s driving history (accidents, tickets), age, vehicle type, location (urban vs. rural), and annual mileage. A young driver with multiple speeding tickets in a high-theft area driving a sports car presents a higher risk than an older driver with a clean record in a safe neighborhood driving a sedan. This analysis leads to different premium levels reflecting the assessed risk.

- Data Collection: Gathering information from applications, credit reports, driving records, and other relevant sources.

- Risk Categorization: Classifying risks based on predefined criteria and historical data.

- Probability Assessment: Estimating the likelihood of specific events (e.g., accidents, claims).

- Severity Estimation: Determining the potential financial impact of different events.

- Premium Determination: Setting premiums that reflect the assessed risk level.

Q 9. What is the role of an actuary in an insurance company?

Actuaries are vital to insurance companies; they are the financial architects. Their primary role is to manage and analyze financial risk. They use statistical models and mathematical techniques to predict future claims costs and set appropriate premiums. This ensures the insurer maintains profitability while offering competitive products.

Imagine actuaries as financial detectives, piecing together complex data to solve financial puzzles. They use past claims data to predict future claims and help design insurance products that are both financially viable and attractive to customers. They also contribute significantly to reinsurance strategies, investment management, and capital allocation within the company.

- Pricing and Product Development: Designing insurance products with accurate premiums and benefit structures.

- Reserving: Estimating the amount of money an insurer needs to set aside to cover future claims.

- Financial Reporting: Ensuring that financial statements accurately reflect the company’s financial position.

- Capital Modeling: Assessing the amount of capital a company needs to withstand unexpected losses.

Q 10. How do you handle a disputed claim?

Handling a disputed claim requires a systematic and fair approach. The process begins with a thorough investigation of the claim, gathering all relevant documentation and evidence from both the claimant and the insurer’s records.

For example, imagine a homeowner claims damage due to a flood, but the policy has an exclusion for flood damage. We need to verify the cause of damage. If the claim is denied, a clear and well-documented explanation must be given to the policyholder. If the policyholder disagrees, a formal dispute resolution process will be followed, which might include internal appeals procedures, mediation, or arbitration depending on the policy and local regulations. Transparency and maintaining a professional, empathetic approach are paramount throughout this process.

- Investigation: Gather evidence and statements from all parties involved.

- Review: Examine the policy terms and conditions, applicable laws, and the evidence gathered.

- Decision: Determine the validity of the claim based on the evidence and policy language.

- Communication: Clearly communicate the decision to the policyholder, providing a detailed explanation.

- Dispute Resolution: If the decision is disputed, implement a formal dispute resolution process.

Q 11. What are the key elements of a valid insurance contract?

A valid insurance contract must contain several key elements to be legally binding. These elements ensure both the insurer and the insured understand their obligations and responsibilities.

- Offer and Acceptance: A clear offer from the insured to purchase insurance and acceptance of that offer by the insurer.

- Consideration: The exchange of value; the insured pays premiums, and the insurer promises to pay benefits in case of a covered loss.

- Legal Capacity: Both parties must be legally competent to enter into a contract (e.g., of legal age and sound mind).

- Legal Purpose: The contract’s purpose must be legal and not against public policy.

- Insurable Interest: The insured must have a financial stake in the subject matter of the insurance policy (e.g., owning a car or a house).

The absence of even one of these elements can invalidate the contract.

Q 12. Explain the principle of utmost good faith in insurance.

The principle of utmost good faith, also known as uberrimae fidei, is a cornerstone of insurance contracts. It means both parties must act honestly and disclose all material facts relevant to the risk being insured. This goes beyond simple honesty; it requires a proactive approach to full disclosure.

For example, if an applicant for health insurance has a pre-existing condition, they must disclose it even if not explicitly asked. Failure to disclose material facts can lead to the policy being voided if the undisclosed information significantly impacts the insurer’s risk assessment. It’s a mutual obligation, ensuring transparency and fairness in the insurance relationship.

Q 13. Describe the process of policy issuance and renewal.

The policy issuance process begins with the application. Once the application is approved after underwriting, the policy is issued, outlining the terms, conditions, coverage, and premiums. This usually involves generating a policy document, which might be electronic or paper-based.

Policy renewal is the process of continuing coverage after the initial policy term expires. Insurers typically send renewal notices, which may include updated premiums based on risk reassessments. The insured can either renew the policy by paying the premium or choose to let it lapse. In some cases, the insurer may choose not to renew the policy based on factors such as increased risk or non-payment of premiums.

Q 14. What are some common causes of insurance fraud?

Insurance fraud is a serious crime involving deliberate deception to obtain insurance benefits unfairly. It’s a costly problem for insurers and society. Some common causes include:

- Staged Accidents: Deliberately causing accidents to file fraudulent claims.

- Inflated Claims: Exaggerating the extent or value of losses to receive higher payouts.

- False Claims: Filing claims for losses that never occurred.

- Ghost Workers’ Compensation: Filing false claims for injuries or illnesses that never happened.

- Arson: Deliberately setting fire to property to collect insurance money.

Combating insurance fraud requires strong investigative capabilities, data analytics, and effective fraud detection systems. It is important to note that Insurance companies employ sophisticated anti-fraud measures to detect and prevent these activities.

Q 15. How do you investigate potential insurance fraud?

Investigating potential insurance fraud requires a systematic and thorough approach. It begins with identifying red flags in a claim, such as inconsistencies in the claimant’s statements, unusually high claim amounts compared to the policy coverage, or a pattern of suspicious claims from the same individual or group.

Our investigation process typically involves:

- Initial Assessment: Reviewing the claim documents for inconsistencies and anomalies.

- Data Analysis: Using databases and analytical tools to compare the claim with historical data and identify patterns of fraud.

- Interviews: Conducting interviews with the claimant, witnesses, and other relevant parties to gather information and verify the details of the claim.

- Verification: Verifying the information provided by the claimant, including medical records, repair estimates, and police reports.

- Surveillance: In certain cases, using surveillance techniques to gather evidence of fraudulent activity. This is always done within legal and ethical boundaries.

- Expert Consultation: Consulting with specialists, such as accident reconstructionists or medical professionals, to provide expert opinions.

For example, a claim for a car accident might be flagged for fraud if the claimant’s description of the accident differs significantly from witness statements or police reports, or if the damage to the vehicle seems disproportionate to the reported impact. We’d then delve into the specifics, potentially using surveillance footage to verify the account of events.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. What are the key regulatory requirements for insurance companies?

Insurance companies face stringent regulatory requirements designed to protect policyholders and maintain market stability. These regulations vary by jurisdiction but generally include:

- Licensing and Solvency: Insurance companies must obtain licenses to operate and maintain adequate financial reserves to meet their obligations. Solvency standards are regularly audited by regulatory bodies.

- Rate Regulation: Many jurisdictions regulate the rates that insurers can charge for their policies, ensuring fair pricing and preventing excessive profits.

- Policy Forms and Content: Regulations govern the content and clarity of insurance policies, requiring insurers to use plain language and disclose all relevant terms and conditions.

- Claims Handling: Insurers are subject to regulations regarding prompt and fair claims handling procedures, including timeframes for processing claims and methods for dispute resolution.

- Consumer Protection: Regulations safeguard consumers from unfair or deceptive practices by insurers, including provisions for consumer complaints and appeals processes.

- Data Privacy and Security: Strict regulations govern the collection, use, and protection of policyholder data, complying with laws like GDPR (in Europe) or CCPA (in California).

Non-compliance can lead to significant penalties, including fines, license revocation, and legal action.

Q 17. Explain the difference between a deductible and a premium.

The premium and deductible are two crucial components of an insurance policy, but they represent opposite aspects of the financial responsibility.

Premium: This is the regular payment you make to the insurance company to maintain your coverage. Think of it as your monthly fee for the protection they provide. The premium amount depends on various factors, such as your risk profile (age, driving history, health status), the type of coverage, and the amount of coverage you choose.

Deductible: This is the amount you are responsible for paying out-of-pocket before your insurance coverage kicks in. For example, if you have a car accident with a $500 deductible and $10,000 in damages, you’ll pay the first $500, and your insurance company will pay the remaining $9,500. A higher deductible usually means a lower premium, while a lower deductible means a higher premium.

In short: The premium is what you pay to have insurance, and the deductible is what you pay before your insurance pays.

Q 18. What are the different types of insurance policies available?

There’s a wide range of insurance policies available, categorized broadly into:

- Health Insurance: Covers medical expenses, hospitalization, and other healthcare costs.

- Auto Insurance: Protects against financial losses from car accidents, including property damage and bodily injury.

- Homeowners/Renters Insurance: Covers damage or loss to your property and liability for accidents on your property.

- Life Insurance: Provides a financial benefit to beneficiaries upon the death of the insured.

- Disability Insurance: Replaces a portion of your income if you become disabled and unable to work.

- Business Insurance: A wide category encompassing various types of coverage tailored to businesses, such as commercial property, general liability, professional liability (errors and omissions), and workers’ compensation.

- Travel Insurance: Covers trip cancellations, medical emergencies, and lost luggage while traveling.

Each policy type has its variations and options, allowing for customized coverage based on individual needs and risk assessments.

Q 19. Explain the concept of coinsurance.

Coinsurance is a provision in many insurance policies requiring the insured to share a portion of the cost of covered losses with the insurer, after the deductible has been met. It’s expressed as a percentage.

For example, if you have an insurance policy with an 80/20 coinsurance clause, and a covered loss of $10,000 occurs, after you’ve met your deductible, you’d pay 20% ($2,000) and the insurer would pay 80% ($8,000).

Coinsurance is designed to encourage insured individuals to carry adequate coverage and to share the risk with the insurer. It helps to control costs and prevent over-insurance, where individuals are insured for far more than the potential value of their assets.

Q 20. How do you handle a claim involving bodily injury?

Handling a claim involving bodily injury is a complex process that often involves multiple steps and stakeholders. The process typically involves:

- First Report of Injury: Upon receiving notification of a bodily injury claim, we begin with a thorough review of the initial report, gathering all pertinent information.

- Investigation: This can involve witness statements, police reports, medical records review, and possibly site investigations to determine the circumstances of the injury.

- Liability Determination: We must determine the liability for the incident. Was it a result of negligence on the part of the insured? This can be a complex process, sometimes requiring legal consultation.

- Medical Evaluation: We may require independent medical examinations (IMEs) to assess the extent and nature of the injuries and their relation to the incident.

- Negotiation and Settlement: Once liability and damages are established, we work towards a fair settlement with the injured party or their legal representative. This often involves negotiations and potentially mediation.

- Legal Action: If a settlement cannot be reached, legal action may be necessary.

Each case is unique, and our approach will be tailored to the specific facts and circumstances.

Q 21. What is the difference between liability and property insurance?

Liability insurance and property insurance are distinct types of coverage that protect against different kinds of losses:

Liability Insurance: This protects you against financial responsibility for injuries or damages you cause to others. It covers the costs associated with legal defense, settlements, and judgments resulting from claims of negligence or wrongdoing. Examples include general liability insurance (for businesses), auto liability insurance (covering injuries or property damage caused by an accident), and professional liability insurance (covering claims of professional negligence).

Property Insurance: This protects your own property (real or personal) from damage or loss. It covers the cost of repairing or replacing your property due to events such as fire, theft, vandalism, or natural disasters. Homeowners insurance and renters insurance are examples of property insurance.

Think of it this way: Liability insurance protects you from your actions causing harm to others, while property insurance protects your things from harm.

Q 22. Describe your experience with policy interpretation and application.

Policy interpretation and application are crucial aspects of my work. It involves thoroughly reviewing policy documents to understand the coverage, exclusions, and conditions. This goes beyond simply reading the words; it requires a deep understanding of legal language, industry standards, and the context of the specific policy. I then apply this understanding to real-world situations, determining whether a claim falls within the policy’s scope and how the policy’s terms affect the claim’s outcome.

For example, I recently handled a case involving a homeowner’s insurance policy. The policyholder’s claim stemmed from water damage after a heavy rain. While the policy covered water damage, it specifically excluded damage caused by flooding. Through careful analysis of the policy wording, weather reports, and site inspection photos, I determined the damage was indeed from heavy rain and not a flood, resulting in a successful claim payout. Another example involved a complex liability claim where I had to analyze multiple policy endorsements to determine the applicable coverage limits and deductibles.

My approach involves a systematic review of the policy, considering any endorsements or amendments, and a thorough investigation of the facts surrounding the claim to ensure a fair and accurate application of the policy’s provisions.

Q 23. Explain your understanding of insurance regulations and compliance.

Insurance regulations and compliance are paramount in my field. I possess a strong understanding of federal and state regulations, including those related to consumer protection, underwriting, claims handling, and data privacy (like HIPAA and GDPR where applicable). Staying up-to-date on these regulations is ongoing, requiring continuous professional development and monitoring of legislative changes.

Compliance involves more than just avoiding penalties; it’s about building trust with clients and maintaining the integrity of the insurance industry. I routinely review our company’s processes to ensure we are meeting all regulatory requirements. For instance, I’m familiar with the requirements for maintaining accurate records, handling sensitive customer data, and conducting fair and unbiased claims investigations. I am also well-versed in the implications of non-compliance, which can range from fines to license revocation and reputational damage.

I actively participate in continuing education programs to stay current on evolving regulatory landscapes and best practices, ensuring the company remains compliant and maintains its strong reputation.

Q 24. How do you prioritize multiple competing claims or tasks?

Prioritizing competing claims or tasks requires a strategic approach. I use a combination of urgency, impact, and complexity to determine the order. I utilize a system that considers several factors:

- Urgency: Claims needing immediate attention, such as those involving serious injuries or significant property damage, take precedence.

- Impact: Claims with larger potential payouts or those that could have significant legal ramifications require prompt action.

- Complexity: Complex claims requiring extensive investigation or multiple stakeholder involvement are prioritized based on their overall impact and the resources required to resolve them.

I often use project management tools and techniques, including task lists, deadlines, and assigning priorities using methods like the Eisenhower Matrix (urgent/important). Regularly reviewing and adjusting this prioritization is vital, particularly when unforeseen circumstances arise. Open communication with stakeholders is key to managing expectations and ensuring transparency throughout the process.

Q 25. Describe your experience with different claims adjusting methodologies.

My experience encompasses various claims adjusting methodologies, including first-party and third-party claims adjusting.

First-party claims involve handling claims filed by a policyholder against their own insurance company. This often includes property damage claims (e.g., homeowners, auto) where I’d assess the extent of the damage, determine the cause, and apply the policy’s terms to determine the indemnity.

Third-party claims involve handling claims filed against the policyholder by a third party (e.g., someone injured in an auto accident covered by the policyholder’s liability insurance). Here, a thorough investigation into the cause of the accident and liability is paramount.

I utilize a variety of methodologies depending on the specific type of claim. These include:

- Reserve setting: estimating the potential cost of a claim based on available information.

- Negotiation: resolving claims through negotiation with claimants and their legal representatives.

- Independent medical examinations: evaluating the extent of injuries for liability claims.

- Independent appraisals: assessing the value of damaged property for property claims.

My experience ensures I’m adept at selecting and applying the appropriate methodology to ensure fair and accurate claim resolution.

Q 26. What is your experience with insurance software and systems?

I have extensive experience with various insurance software and systems, including claims management systems (CMS), policy administration systems (PAS), and actuarial modeling software.

My proficiency in CMS allows for efficient claim processing, from initial intake to final settlement. This includes using the software to track claim status, document uploads, communication logs, and financial transactions. I am also familiar with PAS for accessing policy information, verifying coverage, and ensuring the accuracy of policy data. I have worked with systems like Guidewire, Duck Creek, and other industry-leading platforms. My expertise extends to data analysis using actuarial software to support underwriting decisions, identify trends, and improve claims forecasting.

I understand the importance of data security and maintain compliance with all relevant regulations concerning the handling of sensitive client information within these systems.

Q 27. Describe a time you had to resolve a complex insurance issue.

I once handled a complex liability claim involving a multi-vehicle accident with several injured parties. The initial investigation was complicated by conflicting witness statements and unclear liability. Furthermore, the involved vehicles had different insurance policies with varying coverage levels and deductibles.

My approach involved:

- Thorough Investigation: I meticulously reviewed police reports, medical records, witness statements, and photos of the accident scene to reconstruct the events.

- Liability Determination: I used a comparative negligence approach to assess the degree of fault of each driver involved, referring to state traffic laws and accident reconstruction principles.

- Negotiation and Settlement: I engaged in negotiations with all parties’ legal representatives, balancing the legal implications with the need for a fair and cost-effective resolution. This involved coordinating with adjusters from other insurance companies and working towards a settlement that took into account the severity of the injuries and the extent of the damages.

- Documentation and Reporting: Throughout the process, I maintained meticulous documentation, including all communication, investigation findings, and settlement agreements.

This complex case required patience, strong analytical skills, excellent communication, and a deep understanding of liability laws. The successful resolution of this claim demonstrated my ability to handle challenging situations efficiently and fairly.

Q 28. How would you explain a complex insurance concept to a non-expert?

Explaining complex insurance concepts to a non-expert requires clear, concise language and relatable analogies. For example, explaining deductibles, I’d say: “Imagine your insurance policy is like a shield protecting you from financial loss. The deductible is the amount you agree to pay out-of-pocket before the shield takes full effect. If you have a $1,000 deductible and your claim is $5,000, you pay $1,000, and your insurance pays the remaining $4,000.”

Similarly, when explaining liability coverage, I might use this analogy: “Think of liability coverage as a safety net for someone you accidentally harm. If you cause an accident and injure someone, your liability coverage will help pay for their medical bills and other related costs.”

Visual aids such as charts and diagrams are also beneficial tools to enhance understanding. The key is to break down complex terms into digestible parts and connect them to everyday experiences, ensuring the client feels comfortable and informed.

Key Topics to Learn for Insurance Policies and Procedures Interview

- Policy Lifecycle Management: Understanding the entire process from policy inception to renewal and termination, including underwriting, claims handling, and policy administration.

- Types of Insurance Policies: Familiarize yourself with various policy types (e.g., life, health, auto, homeowners) and their key features, differences, and coverage limitations. Be prepared to discuss specific examples.

- Claims Processing and Procedures: Learn the steps involved in handling insurance claims, from initial notification to investigation, assessment, and settlement. Understand different claim types and potential challenges.

- Compliance and Regulations: Gain knowledge of relevant industry regulations and compliance requirements, including data privacy and security protocols. Be ready to discuss how these impact daily operations.

- Risk Assessment and Management: Understand how insurance companies assess and mitigate risks associated with different policy types and clients. This includes understanding risk factors and their impact on premiums.

- Policy Interpretation and Application: Develop strong analytical skills to interpret policy language accurately and apply it to real-world scenarios. Practice identifying ambiguities and potential conflicts.

- Technology in Insurance: Familiarize yourself with the role of technology in insurance, including claims processing systems, policy management software, and data analytics.

- Customer Service and Communication: Prepare to discuss effective communication strategies when dealing with clients, agents, and other stakeholders. Emphasize professionalism and problem-solving skills.

Next Steps

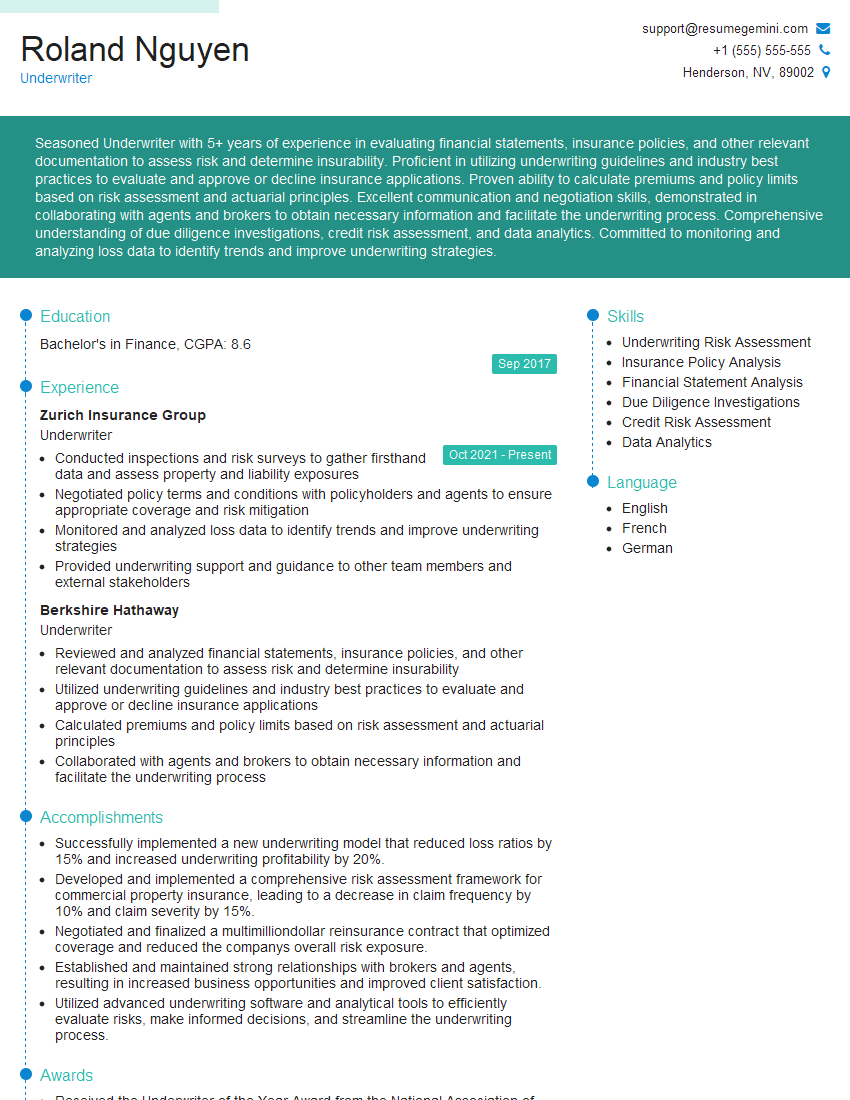

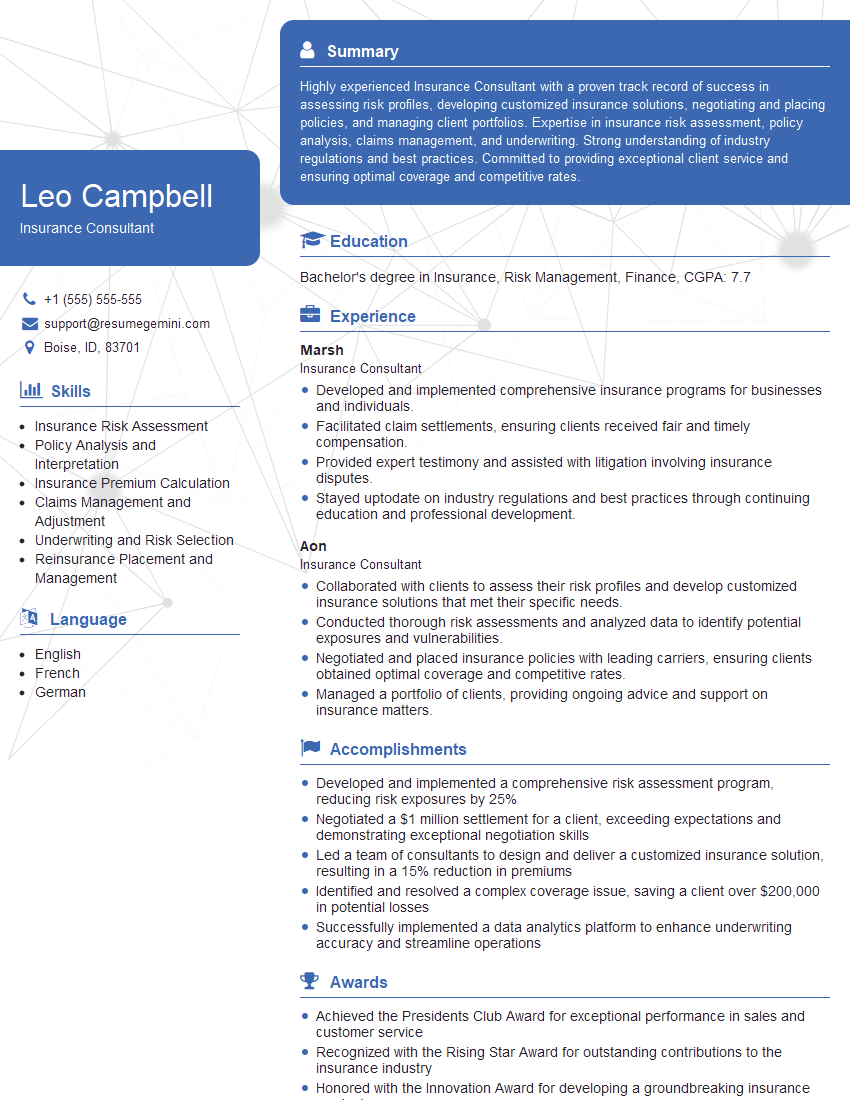

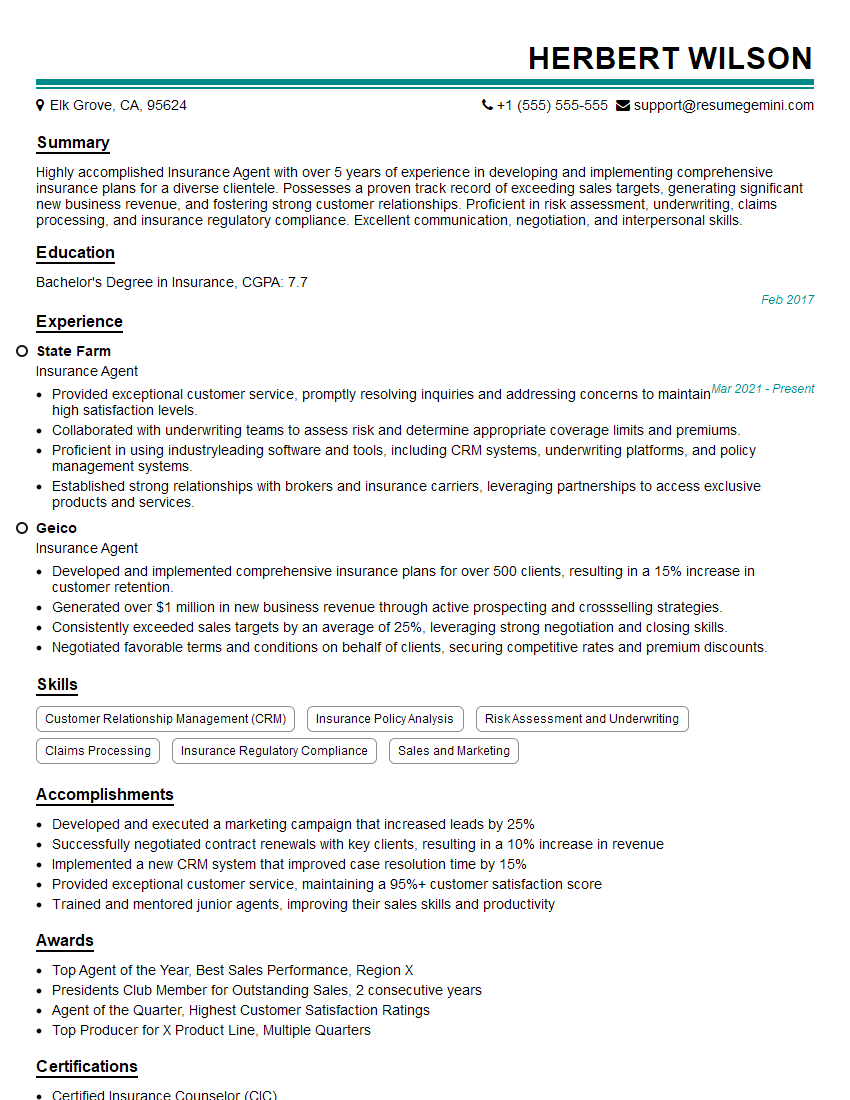

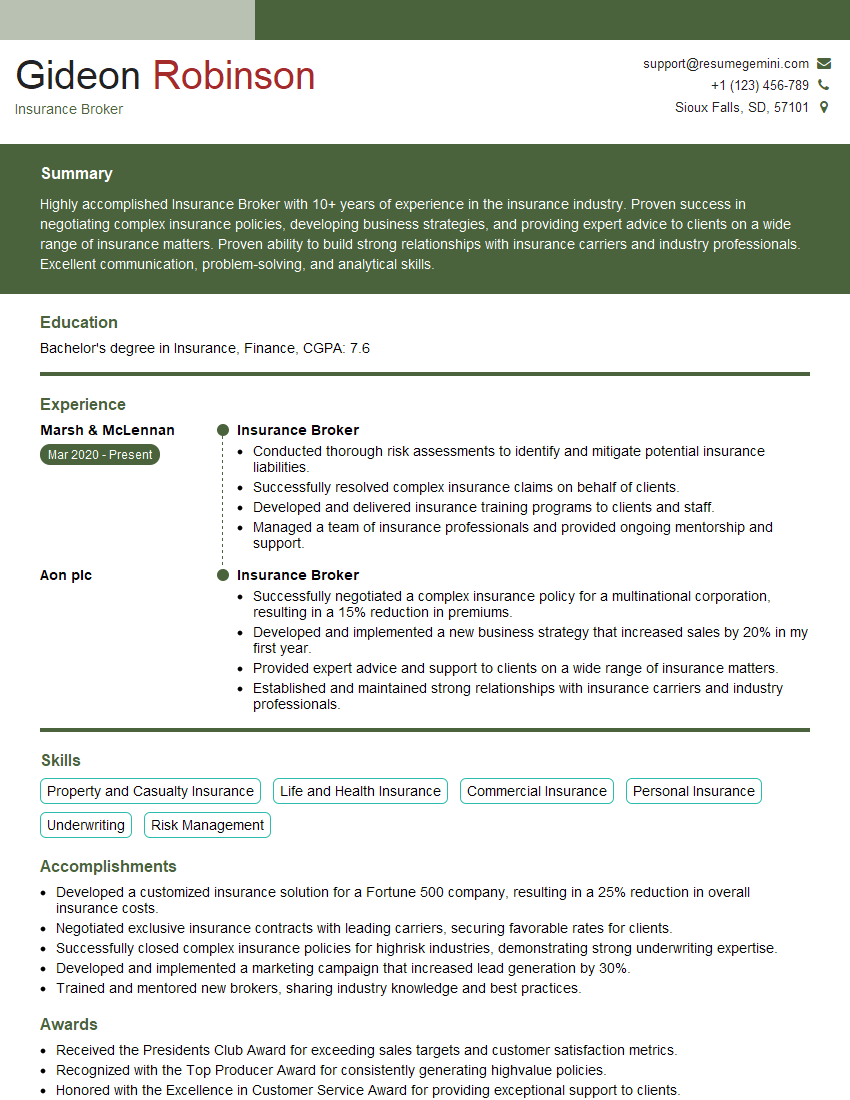

Mastering Insurance Policies and Procedures is crucial for career advancement in this dynamic field. A strong understanding of these concepts demonstrates competence and allows you to contribute effectively from day one. To maximize your job prospects, create an ATS-friendly resume that highlights your relevant skills and experience. ResumeGemini is a trusted resource to help you build a professional and impactful resume. We offer examples of resumes tailored to Insurance Policies and Procedures to guide you in crafting your own compelling application. Use these resources to showcase your abilities and land your dream role.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO