The thought of an interview can be nerve-wracking, but the right preparation can make all the difference. Explore this comprehensive guide to Insurance Regulations and Laws interview questions and gain the confidence you need to showcase your abilities and secure the role.

Questions Asked in Insurance Regulations and Laws Interview

Q 1. Explain the difference between state and federal insurance regulations.

Insurance regulation in the United States is a dual system, with both federal and state governments playing significant roles. Think of it like a layered cake: the states form the base, handling the majority of insurance regulation, while the federal government provides an overarching framework and addresses specific national issues.

State Regulation: Each state has its own insurance department responsible for licensing insurers, approving policy forms, setting reserve requirements, and overseeing the solvency of insurance companies operating within its borders. This means regulations can vary significantly from state to state, leading to a complex and sometimes fragmented regulatory landscape. For example, the requirements for auto insurance coverage can differ greatly between states.

Federal Regulation: The federal government’s role is more limited but crucial. Federal laws primarily focus on areas impacting interstate commerce or national interests. Examples include the McCarran-Ferguson Act, which grants states primary regulatory authority over insurance, the Fair Credit Reporting Act (FCRA), which protects consumer credit information, and the Gramm-Leach-Bliley Act (GLBA), which addresses financial privacy. The federal government also plays a role in regulating specific types of insurance, like health insurance under the Affordable Care Act.

Q 2. Describe your experience with the McCarran-Ferguson Act.

The McCarran-Ferguson Act of 1945 is a cornerstone of US insurance regulation. It essentially grants states the primary authority to regulate the business of insurance. Prior to this Act, there was a debate about whether the federal government should have more control over the industry. McCarran-Ferguson essentially declared that insurance was best regulated at the state level, unless federal laws specifically preempt state regulations. This act fosters a degree of regulatory consistency and allows states to tailor their regulations to the specific needs of their citizens and the insurance market within their borders. However, this system can lead to inconsistencies across states, which is something that is routinely debated.

In my experience, understanding the McCarran-Ferguson Act is crucial when advising insurance companies on compliance matters. It’s essential to determine whether a specific federal law preempts state law in a particular instance. For example, while a state might have specific rules about advertising practices, a federal law related to consumer protection might override them in certain situations. I’ve been involved in several instances where we had to analyze federal and state laws to determine the most legally compliant course of action for a client.

Q 3. What are the key components of the Fair Credit Reporting Act (FCRA) as it pertains to insurance?

The Fair Credit Reporting Act (FCRA) significantly impacts the insurance industry by protecting consumer credit information used in underwriting. Insurers often use credit information to assess risk, but the FCRA ensures this is done fairly and accurately. Key components include:

- Notice and Disclosure: Insurers must clearly inform consumers that they are using credit information in the underwriting process and provide details about where this information is obtained.

- Accuracy and Dispute Resolution: Consumers have the right to dispute inaccurate information in their credit reports. Insurers must follow established procedures to investigate and resolve these disputes before making underwriting decisions.

- Adverse Action Notice: If an insurer denies coverage or offers less favorable terms based on credit information, the consumer must be notified of this adverse action and provided with information about how to obtain their credit report.

- Permissible Purpose: Credit information can only be used for legitimate insurance-related purposes, such as assessing risk, setting premiums, and making underwriting decisions.

For example, if an insurer denies an application based on a credit score, they must inform the applicant and provide them with the contact information for the credit reporting agency to begin the dispute process. Non-compliance with FCRA can result in significant fines and legal action against the insurance company.

Q 4. How familiar are you with the Gramm-Leach-Bliley Act (GLBA) and its impact on insurance data security?

The Gramm-Leach-Bliley Act (GLBA), also known as the Financial Services Modernization Act of 1999, significantly impacts insurance data security. It requires financial institutions, including insurers, to protect the personal information of their customers. Key provisions include:

- Privacy Rule: Insurers must provide consumers with a clear privacy notice explaining how their nonpublic personal information is collected, used, and shared. Consumers have the right to opt out of the sharing of their information with non-affiliated third parties.

- Safeguards Rule: Insurers must implement reasonable administrative, technical, and physical safeguards to protect customer information from unauthorized access, use, or disclosure. This includes things like data encryption, access controls, and employee training.

My experience with GLBA compliance involves working with insurers to develop comprehensive data security programs. This includes assessing vulnerabilities, implementing security controls, conducting regular security audits, and training employees on data protection best practices. Failure to comply with GLBA can lead to significant penalties, including fines and legal action, as well as reputational damage.

Q 5. What is your understanding of the regulatory landscape surrounding insurance privacy?

The regulatory landscape surrounding insurance privacy is complex and multifaceted, involving both federal and state laws. Key considerations include:

- GLBA: As mentioned, this is a cornerstone of federal insurance privacy regulation.

- State Privacy Laws: Many states have their own laws governing the collection, use, and disclosure of insurance information, often going beyond the minimum requirements of GLBA. These state laws vary greatly, creating challenges for insurers operating in multiple states.

- HIPAA: The Health Insurance Portability and Accountability Act (HIPAA) applies to health insurers and protects the privacy and security of protected health information (PHI).

- CCPA/CPRA: The California Consumer Privacy Act (CCPA) and the California Privacy Rights Act (CPRA) significantly impact insurance data privacy, particularly for insurers operating in California, by granting consumers more control over their data.

Navigating this intricate legal framework requires a thorough understanding of both federal and state laws, along with staying updated on the constantly evolving regulatory changes. I’ve dealt with various situations, from advising clients on compliance with state-specific privacy regulations to helping them develop comprehensive data privacy programs that meet both federal and state requirements.

Q 6. Explain the process of obtaining an insurance license in your state.

The process of obtaining an insurance license varies by state, but generally involves these steps:

- Meet eligibility requirements: This typically includes age, education, and experience requirements. Specific requirements vary by state and the type of insurance license sought.

- Complete pre-licensing education: Most states mandate completing a pre-licensing course before applying for a license.

- Pass a licensing examination: State-administered exams test knowledge of insurance laws, regulations, and principles.

- Submit a license application: The application requires providing personal information, background details, and other relevant information. Fingerprinting might be required for background checks.

- Pay applicable fees: State licensing fees vary considerably.

- Meet continuing education requirements: After obtaining a license, insurers must maintain it by completing ongoing continuing education courses.

It’s important to remember each state’s Department of Insurance website has all specific details. I’ve personally guided numerous individuals and companies through this process in [State Name], assisting with application completion, exam preparation, and compliance with continuing education rules. The process can be quite involved, and navigating the specific state regulations is key to success.

Q 7. Describe your experience with insurance claim audits and compliance procedures.

Insurance claim audits and compliance procedures are crucial for ensuring accuracy, fairness, and regulatory compliance. My experience involves several key aspects:

- Reviewing claim files: This entails a thorough examination of individual claim files to ensure proper documentation, adherence to company policies and procedures, and compliance with applicable state and federal regulations.

- Identifying trends and patterns: Auditing processes often uncover trends or patterns that may indicate systemic issues with claims handling, such as potential fraud or improper payment practices.

- Evaluating claim processing times: Audits can assess the efficiency and timeliness of the claims process, identifying areas for improvement and ensuring claims are settled within reasonable timeframes.

- Implementing corrective actions: Following the identification of issues, appropriate corrective actions must be put in place to fix problems and prevent future occurrences.

- Developing and maintaining compliance programs: I work with companies to design and implement robust compliance programs, including ongoing monitoring and auditing to ensure compliance with all relevant regulations. This includes regular training for claims staff and consistent documentation of all processes.

One specific example involved an audit that revealed a pattern of delays in processing certain types of claims. By identifying the root causes of these delays – inadequate staffing and poorly defined procedures – we were able to implement targeted solutions that improved efficiency and reduced processing times. This improved both customer satisfaction and regulatory compliance.

Q 8. How do you stay updated on changes in insurance regulations?

Staying current with insurance regulations requires a multi-faceted approach. It’s not a one-time task, but an ongoing commitment. I leverage several key strategies:

- Subscription to Regulatory News Services: I subscribe to reputable services that provide real-time updates, analysis, and commentary on changes in insurance laws and regulations at both the state and federal levels. This ensures I’m aware of proposed legislation, newly enacted rules, and important court decisions.

- Professional Organizations and Associations: Active participation in professional organizations like the American Academy of Actuaries or similar bodies offers access to webinars, conferences, and publications focused on regulatory developments. Networking with colleagues provides valuable insights and perspectives on practical implications.

- Government Websites and Regulatory Agencies: Regularly reviewing websites of relevant government agencies (e.g., state insurance departments, the NAIC) is crucial for accessing official documents, rule changes, and announcements. I set up alerts to receive notifications of updates.

- Legal and Compliance Professionals: Maintaining strong relationships with legal counsel specializing in insurance regulation is vital. They provide expert analysis and guidance on complex regulatory issues.

- Continuous Learning: I actively participate in continuing education courses and workshops that focus on regulatory compliance and updates. This ensures my knowledge remains sharp and relevant.

This comprehensive approach guarantees I’m always informed about the latest changes and their potential impact on the insurance industry.

Q 9. What are the potential consequences of non-compliance with insurance regulations?

Non-compliance with insurance regulations can lead to a wide range of severe consequences, impacting both the company and its stakeholders. These consequences can be financial, reputational, and even legal.

- Financial Penalties: Significant fines and penalties can be imposed by regulatory authorities for violations. The amount varies based on the severity and nature of the non-compliance.

- Legal Action: Companies can face lawsuits from policyholders, investors, or other parties harmed by non-compliance. This can result in substantial legal fees and settlements.

- License Revocation or Suspension: Regulatory agencies have the power to revoke or suspend an insurer’s operating license, effectively shutting down the business.

- Reputational Damage: Non-compliance can severely damage a company’s reputation, eroding public trust and impacting its ability to attract and retain customers and investors.

- Criminal Charges: In some cases, particularly involving fraudulent activities, criminal charges may be filed against the company and its executives.

- Increased Scrutiny: Even minor infractions can lead to increased regulatory oversight and scrutiny, requiring additional resources and effort for compliance.

For example, failure to maintain adequate reserves could lead to insolvency, while misrepresenting policy terms might result in significant lawsuits and reputational damage. The consequences can be devastating, underscoring the critical importance of robust compliance programs.

Q 10. Describe your experience with regulatory reporting requirements.

My experience with regulatory reporting requirements is extensive. I’ve been involved in the preparation and submission of numerous reports to various regulatory bodies, including state insurance departments and the NAIC. This includes:

- Annual Statements: Preparing and filing comprehensive annual statements disclosing financial information, reserves, and operational data in accordance with statutory accounting principles (SAP).

- Regulatory Filings for New Products: Working with actuaries and legal counsel to prepare and submit filings for new insurance products, ensuring compliance with all applicable regulations and ensuring accurate and transparent disclosure.

- Market Conduct Examinations: Collaborating with auditors and internal teams during market conduct examinations to ensure compliance with consumer protection regulations and providing necessary documentation.

- Solvency Reporting: Monitoring key solvency metrics and preparing reports demonstrating the company’s financial stability and ability to meet its obligations.

- Data Reporting: Compiling and submitting various data reports, as required by different regulatory bodies, ensuring data accuracy and timeliness.

I’m proficient in using various reporting software and systems to manage and track regulatory filings. My experience allows me to anticipate potential reporting issues and proactively address them, preventing delays and potential penalties.

Q 11. How would you handle a situation where a regulatory change impacts your company’s operations?

Handling regulatory changes that impact company operations requires a structured and proactive approach. My process involves these steps:

- Immediate Assessment: Upon learning of a regulatory change, I conduct a thorough assessment of its impact on the company’s products, services, and operations. This involves identifying specific areas affected and the extent of the changes required.

- Internal Communication: I ensure clear and timely communication of the regulatory change to all relevant departments and stakeholders. This includes explaining the implications and the required actions.

- Gap Analysis: I conduct a gap analysis to identify discrepancies between current practices and the new regulatory requirements. This helps pinpoint areas needing immediate attention.

- Development and Implementation of Action Plan: Based on the gap analysis, I develop a detailed action plan outlining the necessary steps to achieve compliance. This plan includes timelines, responsibilities, and resource allocation.

- Training and Education: I ensure appropriate training is provided to employees to familiarize them with the new regulations and ensure consistent adherence.

- Monitoring and Review: I establish a robust monitoring system to track the implementation of the action plan and ensure ongoing compliance. Regular reviews are conducted to assess effectiveness and address any emerging issues.

- Documentation: Meticulous documentation of the entire process, including assessments, action plans, and training records, is essential for demonstrating compliance to regulatory authorities.

For example, if a new data privacy regulation is introduced, my response would involve updating our data security protocols, training employees on the new requirements, and modifying our customer communications to reflect the changes. This systematic approach ensures a smooth transition and continued compliance.

Q 12. What are the common types of insurance fraud and how are they detected?

Insurance fraud takes many forms, costing the industry billions annually. Common types include:

- Hard Fraud: This involves intentionally staging or fabricating a loss, such as deliberately causing a car accident to collect insurance money. It’s a deliberate act of deception.

- Soft Fraud: This involves exaggerating a legitimate claim to receive a larger payout. For example, inflating the value of stolen goods or the extent of damage to a property.

- Application Fraud: Misrepresenting information on an insurance application to obtain coverage at a lower premium or to get coverage for a higher risk. This might involve concealing pre-existing medical conditions or inaccurate information about a property.

- Agent Fraud: Insurance agents might engage in fraudulent activities, such as forging signatures, submitting false claims, or recommending unsuitable policies for personal gain.

- Organized Fraud Rings: These are sophisticated criminal enterprises that engage in large-scale insurance fraud schemes involving multiple individuals and claims.

Detection relies on a combination of methods:

- Data Analysis: Sophisticated algorithms can identify patterns and anomalies in claims data that suggest fraud. This includes comparing claim frequency, amounts, and patterns across different locations or demographics.

- Special Investigation Units (SIUs): Insurance companies employ SIUs to investigate suspicious claims, employing techniques like surveillance, interviews, and background checks.

- Fraudulent Claim Detection Software: Specialized software analyzes claims data to identify potential red flags and automatically score claims based on the likelihood of fraud.

- Collaboration with Law Enforcement: Insurance companies often collaborate with law enforcement agencies to investigate and prosecute insurance fraudsters.

A combination of preventative measures, proactive detection techniques, and robust investigation capabilities are essential in combating insurance fraud.

Q 13. Explain your understanding of anti-money laundering (AML) regulations in the insurance industry.

Anti-money laundering (AML) regulations in the insurance industry aim to prevent the use of insurance products to launder illicit funds. These regulations require insurers to implement robust AML compliance programs, including:

- Customer Due Diligence (CDD): Insurers must identify and verify the identity of their customers to prevent the use of false identities to conceal illicit activities. This includes obtaining and verifying identification documents and conducting background checks where appropriate.

- Suspicious Activity Monitoring (SAM): Insurers must establish systems to monitor transactions and identify suspicious activity that might indicate money laundering. This might involve large, unusual, or complex transactions that deviate from normal patterns.

- Record Keeping: Insurers must maintain detailed records of all transactions and customer interactions for a specified period, allowing for effective auditing and investigation.

- Training and Education: Employees involved in handling transactions must receive appropriate training on AML regulations and procedures to ensure awareness and compliance.

- Compliance Officer: Many insurance companies designate a compliance officer responsible for overseeing the AML compliance program.

- Reporting: Suspected money laundering activities must be reported to the relevant authorities, such as FinCEN (Financial Crimes Enforcement Network).

Failure to comply with AML regulations can result in significant financial penalties, reputational damage, and even criminal charges. The insurance industry’s role in AML compliance is critical in maintaining the integrity of the financial system and preventing the use of insurance products for illegal purposes.

Q 14. What is your experience with conducting due diligence on insurance products?

Conducting due diligence on insurance products is crucial to ensure their compliance with regulations, their suitability for the target market, and their financial soundness. My experience includes:

- Regulatory Compliance Review: Assessing the product’s compliance with all applicable state and federal regulations, including those related to policy language, pricing, and marketing practices.

- Financial Analysis: Evaluating the financial soundness of the product, including its pricing adequacy, reserve requirements, and potential impact on the insurer’s financial stability.

- Product Suitability Assessment: Determining whether the product is appropriate for the intended target market and assessing its potential risks and benefits for policyholders.

- Market Research and Analysis: Analyzing market conditions, competitive landscape, and consumer demand to ensure the product is viable and meets market needs.

- Risk Assessment: Identifying and assessing potential risks associated with the product, including underwriting risks, operational risks, and legal and regulatory risks.

- Documentation Review: Reviewing all product-related documentation, including policy forms, brochures, marketing materials, and internal memos, to ensure accuracy, consistency, and compliance.

I often collaborate with actuaries, underwriters, legal counsel, and marketing teams to ensure a comprehensive and thorough due diligence process. This collaborative approach guarantees that all aspects of the product are carefully considered and potential problems are identified and addressed before launch.

Q 15. What are the key differences between state and federal insurance regulatory agencies?

The insurance industry is primarily regulated at the state level, with the federal government playing a supporting role. This creates a complex, decentralized system. The key difference lies in the scope and authority of each level.

State Regulators: Each state has its own insurance department or agency responsible for licensing insurers, overseeing rates and policy forms, conducting market conduct examinations, and handling consumer complaints within its borders. They have primary authority over the daily operations of insurance companies operating within their state. For example, a company wanting to sell auto insurance in California must meet specific licensing requirements set by the California Department of Insurance.

Federal Regulators: While the federal government doesn’t directly regulate most insurance products, several federal agencies play significant roles. The McCarran-Ferguson Act of 1945 generally exempts the insurance industry from federal antitrust laws, leaving primary regulatory authority to the states. However, agencies like the Federal Trade Commission (FTC) can investigate unfair or deceptive insurance practices. Additionally, federal laws, such as those related to consumer protection (e.g., the Fair Credit Reporting Act), apply to the insurance industry. Federal agencies also regulate specific types of insurance, like those offered by federal credit unions or certain employee benefit plans.

In essence, state regulators are responsible for the daily oversight of the insurance market in their states, while federal regulators address broader national issues, consumer protection, and specific types of insurance or practices that cross state lines.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Explain the role of an insurance commissioner.

The Insurance Commissioner, often appointed by the Governor of a state, is the head of the state’s insurance department. They are responsible for the effective regulation of the insurance industry within their jurisdiction. Think of them as the CEO of that state’s insurance oversight body.

Licensing and Market Conduct: Commissioners oversee the licensing of insurers and agents, ensuring they meet specific qualifications and financial stability requirements. They conduct market conduct examinations to ensure companies engage in fair and ethical business practices.

Rate Regulation: Commissioners review and approve (or disapprove) insurance rate filings to protect consumers from excessive pricing. They balance the needs of consumers with the financial stability of insurers.

Consumer Protection: Commissioners are responsible for investigating and resolving consumer complaints related to insurance. This involves mediating disputes and imposing penalties on insurers for violations of consumer protection laws.

Financial Solvency: A critical function is ensuring the financial solvency of insurers to safeguard policyholders’ benefits. This involves monitoring insurers’ financial strength and taking action if necessary, potentially preventing insolvencies.

Essentially, the Insurance Commissioner’s role is to balance the need to protect consumers with the necessity of a healthy and competitive insurance market. They’re the gatekeeper, ensuring that insurance companies operate fairly and remain financially stable.

Q 17. How familiar are you with insurance rate regulation and filing requirements?

I’m very familiar with insurance rate regulation and filing requirements. These vary significantly by state, but several common principles apply. The goal of rate regulation is to ensure rates are adequate, not excessive, and not unfairly discriminatory.

Rate Filings: Insurers typically must file their proposed rates with the state insurance department before implementing them. The filings generally include detailed actuarial justifications showing how the rates are calculated, including factors like loss experience, expenses, and anticipated profit margins.

Approval Process: State insurance departments review these filings to determine whether the proposed rates comply with state regulations. This review might involve detailed analysis by actuaries employed by the department. The department might approve the rates as filed, request modifications, or reject them altogether.

Rate Regulation Models: Different states use different approaches to rate regulation. Some states have a “prior approval” system, where rates cannot be used until approved by the state. Others employ “file and use” or “modified prior approval” systems, offering more flexibility to insurers but still subject to oversight.

Fairness Considerations: Rate regulations consider whether rates are fairly discriminatory. This means insurers cannot charge significantly different rates to similar groups of policyholders without a justifiable reason based on risk differences. For instance, charging higher rates for a specific demographic without a statistically valid basis is prohibited.

My experience includes reviewing numerous rate filings, analyzing actuarial methodologies, and advising insurers on compliance with state-specific requirements. I understand the nuances of different regulatory approaches and the complexities of demonstrating rate adequacy and non-discrimination.

Q 18. Describe your experience with insurance policy drafting and review.

My experience encompasses the entire lifecycle of insurance policy drafting and review. This includes drafting new policies, reviewing existing policies for compliance and clarity, and analyzing policies for potential risks.

Drafting: This involves working closely with underwriters, actuaries, and legal counsel to ensure policies are legally sound, clearly written, and accurately reflect the intended coverage. It requires a keen understanding of insurance terminology and concepts to ensure policies are unambiguous and avoid potential loopholes.

Review and Analysis: This often involves identifying potential ambiguities, gaps in coverage, or inconsistencies that could lead to disputes or litigation. I perform thorough reviews to ensure compliance with state regulations and company guidelines.

Compliance: My review process includes verifying compliance with specific state-mandated policy provisions, such as those relating to consumer protection, anti-discrimination, and other statutory requirements.

Risk Assessment: I assess policies for potential liabilities and risks to the insurer. This includes identifying areas where the policy wording could lead to unforeseen claims or costly litigation.

I’ve worked on a wide range of insurance policies, from personal lines (auto, home) to commercial lines (general liability, professional liability), and have a strong understanding of the specific language and provisions used in each type.

Q 19. How do you ensure compliance with consumer protection regulations in the insurance industry?

Ensuring compliance with consumer protection regulations is paramount in the insurance industry. My approach is multifaceted and proactive.

Know the Regulations: I maintain a thorough understanding of federal and state consumer protection laws, including regulations concerning unfair trade practices, deceptive advertising, and data privacy. I stay updated on changes to the legal landscape.

Policy Review and Training: I review insurance policies, marketing materials, and sales practices to ensure they are compliant with consumer protection laws. This includes providing training to agents and staff on proper sales practices and consumer rights.

Complaint Handling: I establish and oversee effective complaint handling procedures to investigate and resolve consumer complaints promptly and fairly. This often involves mediating disputes between consumers and insurers.

Data Privacy: With the increasing importance of data privacy, I ensure that insurers comply with relevant regulations (e.g., GDPR, CCPA) by implementing appropriate data security measures and managing consumer data responsibly.

Proactive Monitoring: I proactively monitor the regulatory landscape and implement changes to ensure ongoing compliance. This involves staying updated on relevant case law and regulatory interpretations.

By combining these measures, I aim to create a culture of compliance within the organization, minimizing the risk of regulatory action and ensuring fair treatment of consumers.

Q 20. What are your thoughts on the use of technology to enhance insurance regulatory compliance?

Technology plays a vital role in enhancing insurance regulatory compliance. It offers several advantages:

Automated Compliance Checks: Software tools can automate the review of insurance policies and rate filings, identifying potential compliance issues early in the process. This saves time and resources.

Data Analytics: Data analytics can be used to identify trends and patterns that might indicate compliance risks. For example, a sudden spike in consumer complaints might suggest a problem with a specific product or practice.

Improved Record-Keeping: Technology can improve the efficiency and accuracy of record-keeping, making it easier for insurers to respond to regulatory inquiries and demonstrate compliance.

Secure Data Management: Technology enhances secure data management, protecting sensitive consumer information and ensuring compliance with data privacy regulations.

Regulatory Reporting: Technology can simplify regulatory reporting, making it easier for insurers to meet filing deadlines and submit accurate information.

However, it’s important to remember that technology is a tool; it’s the people who use it that ultimately ensure compliance. A robust compliance program requires a combination of technology, strong internal controls, and a culture of compliance.

Q 21. Describe your experience with handling regulatory inquiries and investigations.

I have extensive experience handling regulatory inquiries and investigations. This includes responding to requests for information from state insurance departments, cooperating with market conduct examinations, and addressing allegations of regulatory violations.

Information Requests: I’ve effectively managed numerous requests for information, gathering and providing relevant documentation within the required timelines. This requires careful organization of records and a thorough understanding of the information sought by the regulators.

Market Conduct Examinations: I have participated in several market conduct examinations, cooperating fully with examiners and providing access to necessary information. This involves working collaboratively with the examining team to address their questions and concerns.

Allegations of Violations: I’ve addressed allegations of regulatory violations by conducting thorough internal investigations, cooperating with regulatory authorities, and taking corrective actions where necessary. This includes identifying the root cause of any issues and implementing measures to prevent similar violations in the future.

Negotiation and Resolution: I have experience negotiating with regulatory authorities to reach mutually acceptable resolutions to compliance issues. This often involves working towards agreements that minimize the impact on the business while addressing the regulators’ concerns.

Throughout this process, my focus has always been on transparency, cooperation, and achieving a fair and equitable resolution. Effective communication and a proactive approach are essential in managing regulatory inquiries and investigations successfully.

Q 22. How do you assess and mitigate regulatory risk?

Assessing and mitigating regulatory risk in insurance involves a proactive, multi-step process. It begins with a thorough understanding of the applicable laws and regulations, which vary significantly by jurisdiction and insurance product. This includes federal and state laws in the US, for example, as well as international regulations if operating globally.

My approach involves:

- Identifying potential risks: This starts with a comprehensive regulatory mapping exercise, identifying all applicable laws and regulations relevant to our operations. We use a risk matrix to categorize risks by likelihood and impact. For instance, a failure to comply with data privacy regulations (like GDPR or CCPA) would be high-impact and high-likelihood, demanding immediate attention.

- Monitoring regulatory changes: The insurance regulatory landscape is constantly evolving. I actively monitor changes through subscriptions to regulatory updates, attending industry conferences, and engaging with regulatory bodies. This allows us to proactively adjust our practices before violations occur. For example, we recently adapted our marketing materials to align with updated advertising standards for life insurance products.

- Implementing controls: Once risks are identified, I develop and implement controls to mitigate them. These controls might include internal policies and procedures, technology solutions (like compliance monitoring software), and regular audits. A good example would be implementing a robust process for verifying customer information to meet KYC/AML requirements.

- Regular reporting and review: I establish a system for regular reporting on regulatory compliance. This includes internal audits, management reporting, and the creation of Key Risk Indicators (KRIs). The KRI data is used to constantly evaluate the effectiveness of our risk mitigation strategies and to identify areas needing improvement.

Essentially, it’s a continuous cycle of identification, assessment, mitigation, monitoring, and improvement. Failure to properly manage regulatory risk can result in significant penalties, reputational damage, and even business failure.

Q 23. Explain your experience with developing and implementing compliance training programs.

I have extensive experience designing and implementing compliance training programs across various insurance lines. My approach focuses on creating engaging and effective learning experiences that empower employees to understand and adhere to regulations.

My process typically includes:

- Needs assessment: I begin by identifying specific compliance needs based on the roles and responsibilities of employees, as well as current regulatory challenges. This might involve conducting surveys, interviewing employees, and reviewing past audit findings.

- Curriculum development: I develop a targeted curriculum that uses various methods, including interactive modules, case studies, quizzes, and role-playing scenarios. For example, I developed a training module on anti-money laundering (AML) regulations using realistic scenarios to help employees understand the nuances of suspicious activity reporting.

- Delivery and tracking: Training can be delivered in various formats: online modules, in-person workshops, or a blended approach. I utilize a Learning Management System (LMS) to track employee participation, progress, and assessment results. This helps ensure that everyone receives the necessary training and that knowledge is retained.

- Evaluation and updates: I regularly evaluate the effectiveness of the training programs. This might involve reviewing compliance audit results and gathering employee feedback. The curriculum is updated to reflect changes in regulations or to address identified weaknesses.

The goal is not just to meet regulatory requirements, but to foster a culture of compliance where employees actively participate in upholding ethical and legal standards.

Q 24. What are the ethical considerations in insurance regulatory compliance?

Ethical considerations are paramount in insurance regulatory compliance. Compliance isn’t just about avoiding penalties; it’s about acting with integrity and fairness towards customers and stakeholders.

Key ethical considerations include:

- Transparency and disclosure: Providing clear and accurate information to customers about insurance products and their coverage. Avoiding misleading or deceptive marketing practices.

- Fairness and non-discrimination: Ensuring equitable access to insurance products and avoiding discriminatory practices in underwriting, pricing, or claims handling. For example, it is unethical to deny coverage based on factors unrelated to risk.

- Data privacy and security: Protecting the confidentiality and security of customer data in accordance with applicable laws and regulations (like GDPR, CCPA). This also includes being transparent about data collection and use practices.

- Conflict of interest management: Identifying and effectively managing potential conflicts of interest to avoid compromising the interests of customers or the company.

- Whistleblower protection: Creating a safe environment for employees to report potential violations without fear of retaliation.

Ethical lapses in insurance can severely damage an insurer’s reputation and erode public trust. Maintaining high ethical standards is a critical component of successful regulatory compliance.

Q 25. How familiar are you with international insurance regulations?

I possess a strong understanding of international insurance regulations. My experience includes working with insurers operating in multiple jurisdictions, requiring familiarity with a diverse range of regulatory frameworks.

Key areas of my international regulatory knowledge include:

- Solvency II (EU): The EU’s comprehensive regulatory framework for insurance companies, including capital requirements, risk management, and reporting.

- Insurance laws in various jurisdictions: This includes understanding the differences in regulations related to product approvals, licensing, distribution, and claims handling in key markets such as Canada, the UK, Singapore, and Australia.

- International accounting standards (IFRS): Familiarity with these standards is crucial for accurate financial reporting under various international regulatory regimes.

- Cross-border insurance operations: Understanding the specific rules and challenges related to offering insurance products across national borders.

Navigating international insurance regulations requires a nuanced understanding of jurisdictional differences and the ability to adapt strategies accordingly. I’m adept at interpreting and applying these diverse regulations to ensure compliance and facilitate international business operations.

Q 26. Describe your experience with insurance contract law.

My experience with insurance contract law is extensive, encompassing drafting, review, negotiation, and interpretation of various insurance contracts. I understand the complexities involved, including policy construction, exclusions, and the principles of indemnity, insurable interest, and utmost good faith.

Key areas of my expertise include:

- Policy interpretation: Analyzing contract language to determine coverage, exclusions, and the parties’ rights and obligations. I am proficient in resolving ambiguities and interpreting the intent behind the contract language.

- Contract drafting and negotiation: Drafting and negotiating insurance contracts to ensure they accurately reflect the intentions of the parties while adhering to applicable regulations.

- Claims handling and dispute resolution: Understanding the legal aspects of claims handling, including the insurer’s duty to investigate and indemnify, and the grounds for denying a claim.

- Contract voidability and enforceability: Identifying situations where an insurance contract may be voidable (e.g., due to misrepresentation or material non-disclosure) or unenforceable.

A strong understanding of insurance contract law is essential for mitigating legal risks, protecting the insurer’s interests, and ensuring fair treatment of policyholders. I have successfully negotiated and litigated complex insurance contract disputes.

Q 27. Explain your understanding of the legal aspects of reinsurance.

My understanding of the legal aspects of reinsurance encompasses the contractual relationships between the ceding insurer, reinsurer, and the underlying insured. Reinsurance is a crucial risk management tool for insurers, and its legal framework is intricate.

My expertise covers:

- Reinsurance contracts: Analyzing and interpreting various reinsurance agreements, including treaty and facultative reinsurance contracts. This includes understanding different reinsurance structures like quota share, excess of loss, and surplus lines.

- Claims handling in reinsurance: Understanding the legal aspects of reinsurance claims, including the reinsurer’s duty to follow the fortunes of the ceding insurer and the handling of disputes between reinsurers and ceding insurers.

- Reinsurance regulation: Staying abreast of regulations related to reinsurance, including capital requirements, solvency standards, and regulatory reporting requirements.

- Arbitration and litigation in reinsurance: I am familiar with the various dispute resolution mechanisms used in reinsurance, including arbitration, mediation, and litigation.

A sound grasp of reinsurance law is vital for effective risk transfer and managing the legal complexities inherent in reinsurance transactions. I’ve advised on numerous reinsurance transactions and assisted in resolving reinsurance disputes.

Q 28. What is your experience with insurance dispute resolution?

I have extensive experience in insurance dispute resolution, utilizing a range of methods to resolve disagreements between insurers and policyholders. My approach is to find the most efficient and cost-effective solution while upholding legal and ethical principles.

My experience includes:

- Negotiation and settlement: I have successfully negotiated numerous settlements between insurers and policyholders, resolving disputes before they escalate to litigation.

- Mediation and arbitration: I have participated in and facilitated mediations and arbitrations, helping parties reach mutually acceptable resolutions.

- Litigation: I have experience representing insurers in litigation involving coverage disputes, bad faith claims, and other insurance-related matters.

- Regulatory dispute resolution: I have worked with regulatory bodies to resolve disputes concerning insurance practices and compliance issues.

Dispute resolution is a crucial aspect of insurance operations. My goal is always to find a fair and equitable solution, considering the interests of all parties involved. I prioritize early intervention to prevent disputes from escalating and becoming costly and time-consuming.

Key Topics to Learn for Insurance Regulations and Laws Interview

- Contract Law Fundamentals: Understanding offer, acceptance, consideration, and the elements of a legally binding insurance contract. Practical application: Analyzing policy wording to identify potential coverage disputes.

- Insurance Policy Interpretation: Deciphering complex policy language, including exclusions, endorsements, and definitions. Practical application: Determining coverage based on specific claim scenarios.

- Regulatory Compliance: Familiarity with key regulatory bodies and their impact on insurance practices (e.g., state insurance departments, federal regulations). Practical application: Assessing the compliance of insurance products and operations.

- Claims Handling and Adjustments: Understanding the claims process, including investigation, evaluation, and settlement. Practical application: Identifying and mitigating potential legal risks in claims handling.

- Types of Insurance and their Regulations: Knowledge of different insurance lines (e.g., property, casualty, life, health) and their unique regulatory frameworks. Practical application: Advising on the appropriate insurance product for specific risks.

- Consumer Protection Laws: Understanding regulations designed to protect policyholders from unfair or deceptive practices. Practical application: Evaluating the ethical implications of insurance sales and marketing.

- Reinsurance: Understanding the role and regulations surrounding reinsurance contracts and their impact on risk management. Practical application: Assessing the financial stability of reinsurers and their capacity to meet obligations.

- Risk Management and Mitigation: Applying regulatory knowledge to design and implement effective risk management strategies. Practical application: Developing and implementing compliance programs within an insurance organization.

Next Steps

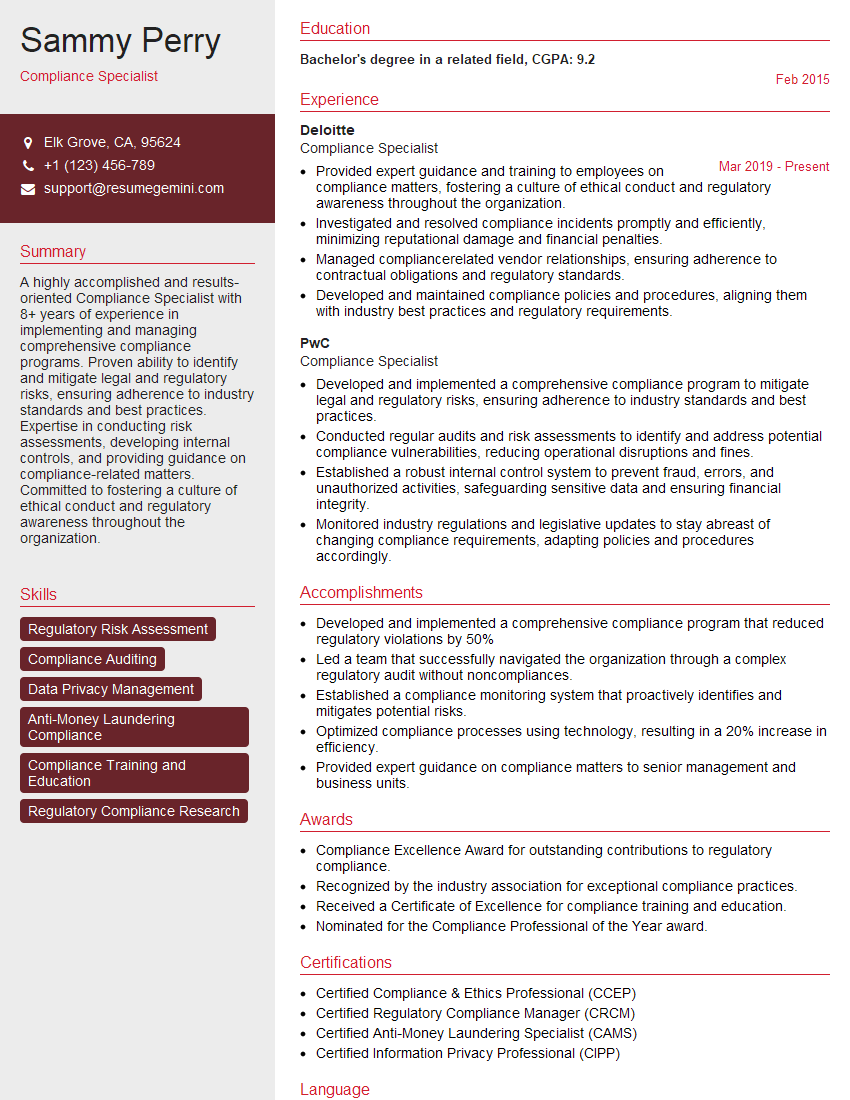

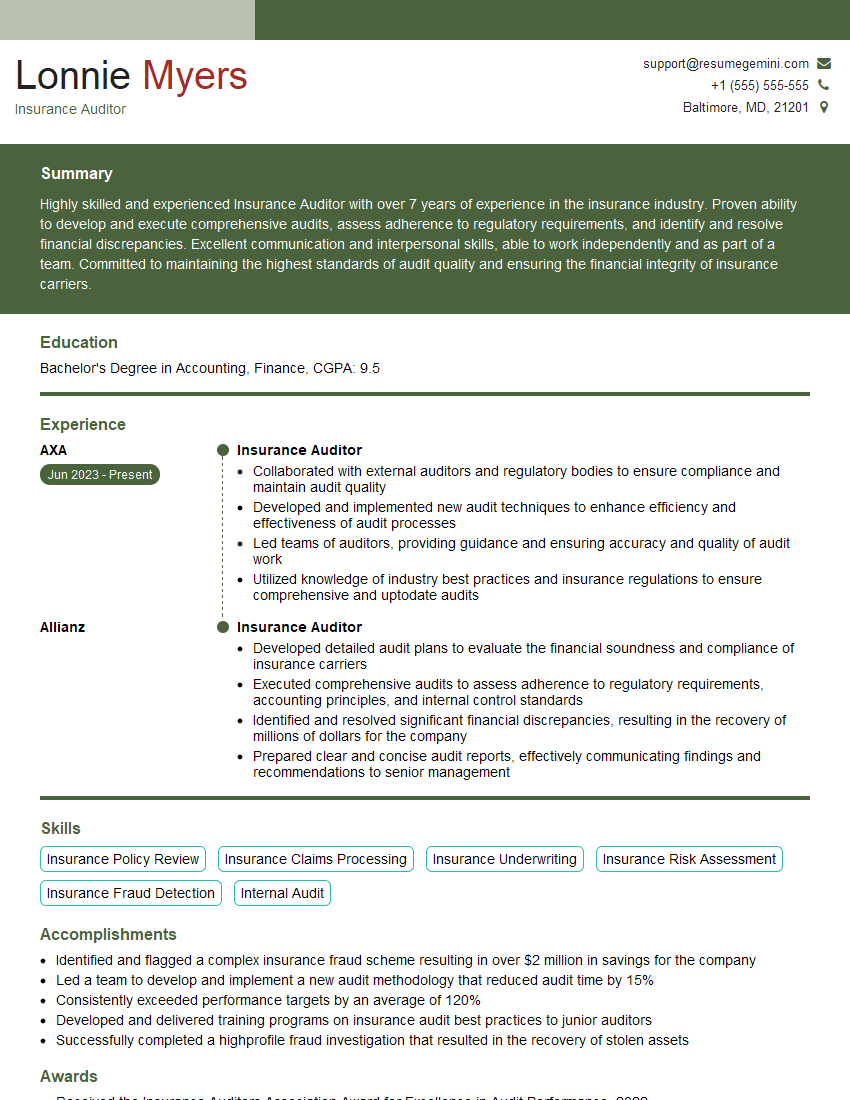

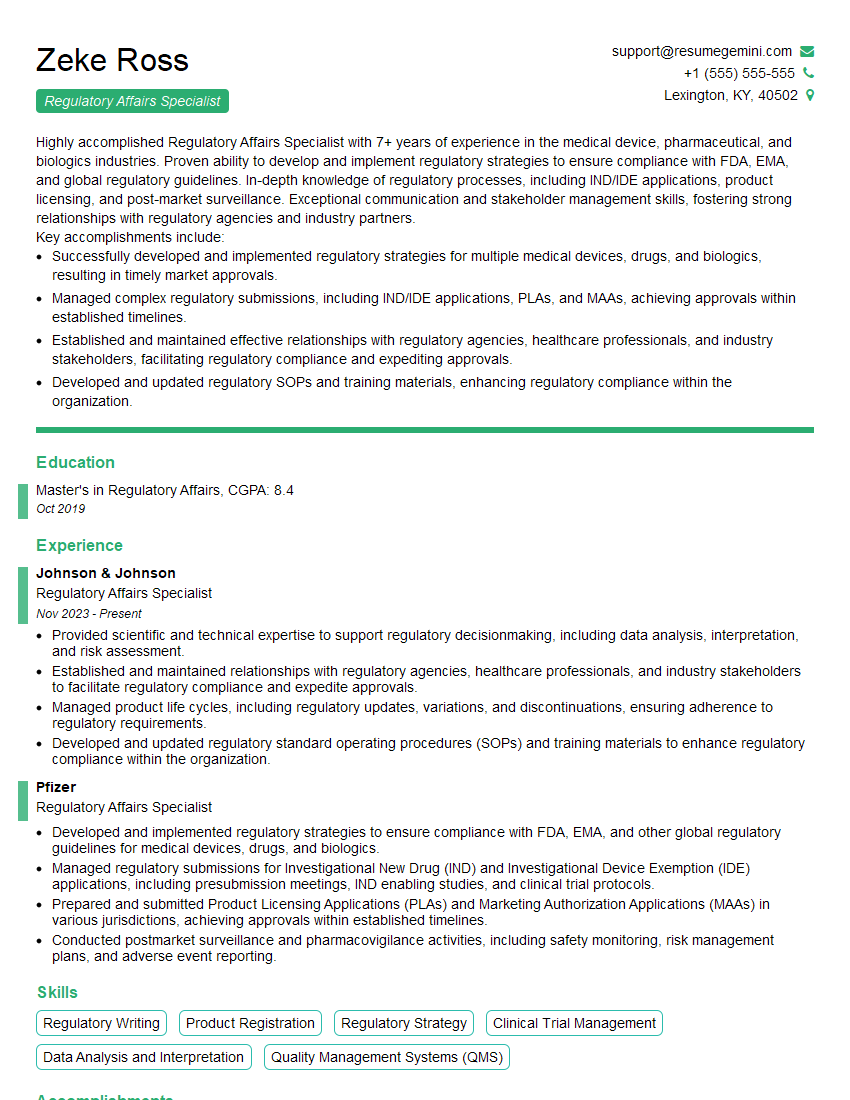

Mastering Insurance Regulations and Laws is crucial for career advancement in the insurance industry. A strong understanding of these concepts opens doors to senior roles, increased responsibilities, and higher earning potential. To maximize your job prospects, crafting an ATS-friendly resume is essential. ResumeGemini is a trusted resource to help you build a professional and impactful resume that showcases your expertise. We offer examples of resumes tailored to Insurance Regulations and Laws to guide you in creating a compelling application. Invest time in crafting a strong resume; it’s your first impression with potential employers.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO