Interviews are opportunities to demonstrate your expertise, and this guide is here to help you shine. Explore the essential Job Costing and Estimating interview questions that employers frequently ask, paired with strategies for crafting responses that set you apart from the competition.

Questions Asked in Job Costing and Estimating Interview

Q 1. Explain the difference between job costing and process costing.

Job costing and process costing are two different methods of assigning costs to products or services. The key difference lies in the nature of the product or service being produced.

Job costing is used when producing unique or customized products or services, like building a house, creating a website for a specific client, or undertaking a complex legal case. Each job is treated as a separate cost object, and costs are tracked individually for that job. Think of it like baking a custom cake – each cake is unique, requiring specific ingredients and time, and its cost is tracked separately.

Process costing, on the other hand, is used when producing homogenous products or services in large quantities, like manufacturing plastic bottles, refining oil, or producing canned goods. Costs are tracked across the entire production process and then averaged across the total units produced. It’s like baking hundreds of identical cookies – you track the total cost of ingredients and labor and divide it by the number of cookies produced.

In short: Job costing focuses on individual projects, while process costing focuses on mass production.

Q 2. Describe the steps involved in developing a job cost estimate.

Developing a job cost estimate is a crucial step in project management. It’s like creating a detailed blueprint for your budget before starting construction. The process generally involves these steps:

- Identify the Scope of Work: Clearly define all aspects of the job, including materials, labor, and equipment needed. For example, if we are building a house, this includes foundation, walls, roofing, plumbing, and electrical work.

- Quantify Resources: Determine the quantities of materials, labor hours, and equipment usage needed. This requires a detailed understanding of the project’s specifications. For the house, we need to specify the amount of lumber, bricks, cement etc.

- Estimate Costs: Assign costs to each resource based on current market prices, historical data, and vendor quotes. For the house, this includes obtaining quotes from lumber suppliers, electricians, and plumbers.

- Account for Indirect Costs: Include overhead costs like rent, utilities, and administrative expenses that are not directly tied to the job, but are necessary for its completion. We need to allocate a portion of the office rent and administrative salaries to this house construction project.

- Add Markup: Include a profit margin to ensure profitability. This markup accounts for risks, uncertainties, and desired profit levels. A typical construction company might add a 15-20% markup.

- Review and Refine: Thoroughly review the estimate for accuracy and completeness before presenting it to the client. It’s important to cross-check quantities and prices.

Q 3. How do you handle unexpected costs during a project?

Unexpected costs are inevitable in project management. Handling them effectively requires a proactive approach.

- Change Orders: For significant changes, formal change orders should be issued, documenting the reason for the change, its impact on the schedule and budget, and obtaining client approval. For instance, if unforeseen soil conditions require additional foundation work, a change order outlining the extra costs and timeline impact should be generated.

- Contingency Reserves: Include a contingency reserve in the original estimate to cover minor unforeseen expenses. This is like having a small emergency fund for your project. This could be 5-10% of the overall estimated cost.

- Value Engineering: If significant cost overruns occur, explore value engineering to identify areas where costs can be reduced without compromising quality. This involves finding alternative materials or methods that achieve the same outcome at a lower cost.

- Open Communication: Maintain open communication with the client throughout the project. Transparency about unexpected costs and potential solutions can help avoid conflicts and maintain a positive relationship.

- Project Management Software: Utilize project management software to track actual costs against the budget in real-time. This enables early detection of variances and facilitates proactive cost control measures.

Q 4. What are the key performance indicators (KPIs) you use to monitor job costs?

Monitoring job costs requires using relevant KPIs to track performance and identify areas for improvement. Some key KPIs include:

- Cost Variance: The difference between actual costs and budgeted costs (Actual Cost – Budgeted Cost). A positive variance indicates cost overrun, and a negative variance indicates cost underrun.

- Schedule Variance: The difference between the actual completion time and the planned completion time. This can indirectly impact costs.

- Budget at Completion (BAC): The total budget planned for the project from its initiation to completion.

- Earned Value (EV): The value of work completed to date, based on the planned budget.

- Cost Performance Index (CPI): The ratio of earned value to actual cost (EV/AC). A CPI less than 1 indicates cost overrun.

- Schedule Performance Index (SPI): The ratio of earned value to planned value (EV/PV). An SPI less than 1 indicates schedule delay.

By tracking these KPIs, we can get a comprehensive picture of the project’s financial health and identify any areas needing attention.

Q 5. Explain variance analysis in the context of job costing.

Variance analysis in job costing is the process of comparing actual costs to budgeted costs to identify and analyze differences. This helps us understand why costs are higher or lower than planned and take corrective actions.

For example, let’s say the budgeted cost for labor on a construction project is $100,000, but the actual cost is $110,000. The variance is $10,000 (unfavorable). Variance analysis would then delve into the reasons for this overrun. Were there unforeseen delays? Did labor rates increase? Was there inefficient labor utilization? By investigating these possibilities, we can prevent similar overruns in future projects.

The analysis involves identifying the cause of the variance (material price increases, labor inefficiencies, etc.), quantifying the impact of the variance on profitability, and developing corrective actions to mitigate future occurrences.

Q 6. How do you allocate indirect costs to jobs?

Allocating indirect costs to jobs is crucial for accurate cost accounting. Indirect costs, unlike direct costs (materials and labor directly used on a job), are not easily traceable to specific jobs. Examples include rent, utilities, and administrative salaries.

Common methods for allocating indirect costs include:

- Direct Labor Hours: Allocate indirect costs based on the number of labor hours spent on each job. A job consuming more labor hours receives a larger share of indirect costs.

- Machine Hours: If machinery is a significant part of the production process, allocate indirect costs based on machine hours used by each job.

- Direct Costs: Allocate indirect costs as a percentage of the total direct costs incurred for each job.

- Activity-Based Costing (ABC): A more sophisticated method that assigns indirect costs based on the activities that consume those costs. This is more accurate but requires more detailed tracking of activities.

The choice of allocation method depends on the specific industry and the nature of the indirect costs. The goal is to use a method that is both fair and reasonable and provides a clear cost picture for each job.

Q 7. What methods do you use for cost estimation (e.g., parametric, bottom-up)?

Several methods are available for cost estimation, each with its strengths and weaknesses:

- Bottom-Up Estimating: This involves breaking down the project into its individual components, estimating the cost of each component, and summing them up to get a total project cost. It’s detailed and accurate but can be time-consuming.

- Top-Down Estimating: This uses historical data or similar projects to estimate the total project cost, then uses factors like size or complexity to adjust the estimate. It’s quicker but less precise.

- Parametric Estimating: This uses statistical models and historical data to predict costs based on project characteristics (e.g., square footage for a building). It’s efficient for large-scale projects but requires reliable historical data.

- Analogous Estimating: This compares the current project to similar past projects to estimate the cost. It’s simple and fast but relies on the availability of comparable projects.

The best method depends on the project’s complexity, available data, and time constraints. Often, a combination of methods is used to get a more reliable estimate.

Q 8. How do you deal with cost overruns?

Cost overruns are a common challenge in project management. My approach is proactive and multi-faceted, focusing on prevention and mitigation. It begins with rigorous initial estimating, leveraging historical data, detailed task breakdowns, and risk assessments. I use techniques like three-point estimating to account for uncertainty. If an overrun occurs, my first step is to thoroughly investigate the root cause – was it due to inaccurate estimating, unforeseen circumstances, scope creep, or inefficient resource allocation? Once identified, corrective actions are implemented, which might involve renegotiating contracts, optimizing resource utilization, or adjusting project scope. Regular monitoring using Earned Value Management (EVM) helps detect potential overruns early, allowing for timely intervention. Finally, lessons learned are documented and integrated into future projects to prevent similar issues.

For example, in a recent construction project, an unexpected geological condition led to a material cost overrun. By carefully analyzing the issue and adjusting the project plan (slightly altering the foundation design), we mitigated the impact, keeping the overall project cost within an acceptable range. Transparent communication with stakeholders throughout the process is crucial for navigating cost overruns effectively.

Q 9. What software or tools are you proficient in for job costing and estimating?

I’m proficient in several software and tools for job costing and estimating. My expertise includes Microsoft Excel for detailed cost tracking and analysis, which I use to create custom spreadsheets for managing budgets, tracking expenses, and generating reports. I’m also experienced with dedicated project management software like Primavera P6 and Microsoft Project, using their features to schedule tasks, assign resources, and monitor progress against budget. Furthermore, I’ve worked with enterprise resource planning (ERP) systems such as SAP and Oracle, which integrate job costing seamlessly with other business functions. For estimating, I utilize specialized software like Timberline (now part of Sage) to produce detailed cost estimates and manage the bid process. My proficiency extends to using data visualization tools like Power BI to create dashboards and reports that present job costing data in a clear, actionable format for management.

Q 10. Describe your experience with different costing systems (e.g., standard costing, actual costing).

I have extensive experience with both standard costing and actual costing systems. Standard costing relies on predetermined costs for materials, labor, and overhead, established before the job begins. This provides a benchmark for performance evaluation and allows for quicker cost estimations. However, it can be less accurate if actual costs deviate significantly from the standards. Actual costing, on the other hand, reflects the actual costs incurred during the project. It’s more accurate, offering a true representation of project profitability but requires more time and effort for data collection and analysis. The choice between the two depends on the project’s nature and the level of accuracy required. For high-volume, standardized jobs, standard costing is often preferred, while custom projects or those with high uncertainty benefit from actual costing. In practice, I often use a hybrid approach, incorporating elements of both methods for optimal results.

For instance, in manufacturing, we might use standard costing for routine production runs while employing actual costing for specialized custom orders.

Q 11. How do you ensure accuracy in job costing data?

Accuracy in job costing is paramount. My approach focuses on several key strategies. Firstly, establishing clear and detailed procedures for data collection and recording is crucial. This includes using standardized forms, barcodes for materials tracking, and time-tracking software for labor. Regular audits and reconciliations are essential to identify and correct any discrepancies. I emphasize the importance of training staff on proper data entry and cost allocation procedures. Implementing strong internal controls helps prevent errors and fraud. Finally, technology plays a significant role; using integrated systems minimizes manual data entry and reduces the risk of human error. For example, linking time tracking directly to the job costing system avoids manual data transfer and ensures consistency.

Q 12. Explain the importance of a well-defined cost accounting system.

A well-defined cost accounting system is the backbone of profitable project management. It provides crucial information for pricing, bidding, performance monitoring, and decision-making. It allows businesses to understand the cost structure of each job, identifying areas of inefficiency and opportunities for improvement. Accurate cost data enables informed pricing decisions, ensuring competitiveness and profitability. Real-time monitoring of costs enables timely interventions if overruns occur. Finally, a robust system improves internal controls, reducing the risk of errors and fraud, building trust with stakeholders, and enhancing the organization’s overall financial health. Think of it as a navigational system for a ship – without it, you are blindly sailing towards an uncertain destination.

Q 13. How do you track labor costs in a job costing environment?

Tracking labor costs in a job costing environment involves a multi-step process. Firstly, we use time-tracking systems, either manual or automated, to record the time spent by each employee on specific jobs. This often involves employees using timesheets or clocking in and out on job-specific tasks. The system should capture not only hours worked but also the employee’s pay rate, allowing for accurate calculation of labor costs. Next, we allocate labor costs to individual jobs based on the time recorded. Overhead costs associated with labor, such as employee benefits and training expenses, are also allocated to jobs using appropriate allocation methods, such as direct allocation or allocation based on labor hours. Regular reconciliation of labor costs against budgeted amounts is essential for early identification of variances and potential issues.

Q 14. How do you handle material costs and inventory in job costing?

Managing material costs and inventory in job costing requires a combination of careful tracking and efficient inventory management. The process begins with accurate material requisitioning for each job, ensuring that only necessary materials are used. This often involves creating material requisitions linked directly to the job, enabling precise tracking. We utilize inventory management systems to track the quantity and cost of materials used, allowing for real-time monitoring of inventory levels and preventing shortages. The cost of materials used is then allocated to specific jobs, ensuring accurate costing. This involves methods such as first-in, first-out (FIFO) or weighted-average cost methods to value materials used. Regular physical inventory counts and reconciliations against system records are critical for maintaining accuracy and identifying any discrepancies. Furthermore, minimizing waste and spoilage through efficient inventory management practices contributes to reducing material costs. This might include implementing strategies like just-in-time inventory management or improved storage practices.

Q 15. What are the challenges of implementing a new job costing system?

Implementing a new job costing system presents several challenges. One significant hurdle is the initial setup and data migration. This involves meticulously mapping existing cost data into the new system, which can be time-consuming and prone to errors if not properly planned. For example, transitioning from a manual system to a sophisticated software solution requires careful consideration of data integrity and ensuring all relevant cost elements are accurately captured. Another major challenge is user adoption and training. Employees accustomed to old methods may resist change, so a comprehensive training program is crucial for success. Resistance can stem from a lack of understanding of the new system’s benefits or fear of increased workload. Finally, the integration with other systems, such as inventory management or accounting software, is critical. A poorly integrated system can lead to inconsistencies and inefficiencies, negating the benefits of the new job costing system. A phased rollout, focusing on comprehensive training and clear communication, can mitigate these challenges. For instance, starting with a pilot program in a small department can help identify and resolve issues before full-scale implementation.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you ensure timely and accurate reporting of job costs?

Ensuring timely and accurate job cost reporting requires a multi-pronged approach. First, a robust data capture system is essential. This involves using technology to track direct and indirect costs associated with each job. Automated data entry reduces manual errors and accelerates the reporting process. Think of it like a well-oiled machine, each part working smoothly to deliver accurate information. Second, regular reconciliation of data is vital. This involves comparing actual costs against the budget regularly, identifying discrepancies, and investigating the root causes. A monthly reconciliation, for instance, allows for timely corrective actions. Finally, clear and standardized reporting procedures are critical. Reports should be designed to provide relevant information to different stakeholders in a user-friendly format. This includes providing summary reports as well as detailed breakdowns to accommodate various management levels. Using dashboards and visualization tools can aid in quicker comprehension and identification of potential problems. For example, a dashboard showing variance between actual and budgeted costs for each project can immediately highlight areas needing attention.

Q 17. Explain the concept of cost pools and cost drivers.

Cost pools and cost drivers are fundamental concepts in job costing. A cost pool is a grouping of costs that share a common characteristic. Think of it as a container holding various costs related to a specific activity. For example, a manufacturing company might have a cost pool for machine maintenance, encompassing all costs associated with maintaining and repairing its machinery. A cost driver is the factor that causes the cost pool’s costs to change. In the machine maintenance example, the number of machine hours operated could be the cost driver. The more machine hours, the higher the maintenance costs. Understanding cost pools and cost drivers is crucial for accurate cost allocation. A company might have various cost pools like direct labor, direct materials, factory overhead, and administrative overhead, each having a corresponding cost driver like labor hours, material quantities, machine hours, and number of projects respectively. Accurate allocation requires carefully selecting the appropriate cost driver for each cost pool to reflect the true cost of each job.

Q 18. How do you use cost information to make management decisions?

Cost information is a powerful tool for making informed management decisions. It can be used for various purposes, including pricing decisions, resource allocation, and performance evaluation. For instance, by analyzing the cost of goods sold per unit, a company can determine the optimal selling price to ensure profitability. Similarly, by comparing the costs of different production methods, management can choose the most efficient approach. Cost data also provides insights into the efficiency of resource utilization. Identifying jobs with high variances between actual and budgeted costs allows management to pinpoint areas for improvement, leading to cost savings. Furthermore, accurate cost information is essential for evaluating the performance of individual projects and departments. For example, tracking the actual costs of a construction project against the budget can indicate potential delays or cost overruns, allowing management to take timely corrective actions.

Q 19. What are some common errors in job costing, and how can they be avoided?

Several common errors can occur in job costing. One frequent mistake is the inaccurate allocation of indirect costs. If overhead costs aren’t properly allocated, it can distort the true cost of individual jobs, leading to incorrect pricing decisions or inefficient resource allocation. For example, using a single overhead rate for all projects when different projects utilize resources differently can lead to inaccuracies. Another frequent issue is incomplete cost capture. Failing to account for all costs associated with a job, such as indirect materials or labor, leads to underestimation of the actual project cost. This can result in unexpected losses or financial difficulties. Finally, inadequate tracking of time and materials is a significant problem. Poor timekeeping or inaccurate material tracking generates unreliable cost data, making it challenging to make accurate decisions. These errors can be avoided through improved data capture systems, robust cost allocation methods, and regular reconciliation processes. Implementing a well-defined cost accounting system with proper training for employees ensures accuracy and prevents these errors.

Q 20. How do you reconcile actual costs with budgeted costs?

Reconciling actual costs with budgeted costs is a crucial step in job costing. This process involves comparing the actual costs incurred on a job against the planned costs and analyzing any variances. The first step is to gather the actual cost data from various sources, including time sheets, material requisitions, and overhead records. The second step is comparing this data to the original budget for that job. The difference between actual and budgeted costs constitutes the variance. This variance should then be analyzed to determine its causes. Were there unforeseen expenses? Were there inefficiencies? Were there pricing errors in the budget? Once the cause is identified, corrective actions can be implemented to prevent similar discrepancies in the future. Regular reconciliation through variance reports facilitates proactive problem-solving, allowing for course correction and improvement in future budgeting and cost control.

Q 21. Describe your experience with cost-benefit analysis.

Cost-benefit analysis (CBA) is a critical tool in my professional experience. It involves systematically assessing the costs and benefits associated with a project or decision. I have utilized CBA extensively in project selection and evaluation. For example, when deciding between two different software solutions for job costing, I performed a CBA to compare the costs of implementation, training, and maintenance against the expected benefits in terms of efficiency gains and improved accuracy. The CBA helped justify the investment in the chosen software. The process typically involves identifying all relevant costs and benefits, assigning monetary values to them where possible, and calculating the net present value (NPV) or internal rate of return (IRR) to evaluate the financial viability of a project. A positive NPV or IRR generally indicates that the benefits outweigh the costs, making the project worthwhile. Furthermore, I often include qualitative factors, such as improved employee satisfaction or enhanced product quality, in a CBA to provide a more holistic assessment. Documenting the assumptions and limitations of the CBA is essential for transparency and robust decision-making.

Q 22. How do you handle changes in project scope and their impact on costs?

Managing scope changes in projects is crucial for accurate cost control. It involves a systematic approach to assess the impact of any alterations on the initial project plan and budget. The first step is to clearly define the change, documenting its nature, extent, and justification. Then, we meticulously analyze its effect on the existing cost estimate. This might include extra labor, materials, or time. We use a change order process, formally documenting the changes, revised cost estimate, and approval from stakeholders. For example, if a client requests a design alteration in a construction project, we analyze the implications – will it involve additional materials, labor, and potentially adjustments to the project timeline? We then create a detailed breakdown of the associated costs, presented in a change order to the client for review and approval. This ensures transparency and prevents cost overruns. We also consider potential knock-on effects. Does this change necessitate other modifications down the line? Proactive communication is key – keeping stakeholders informed throughout the entire process minimises misunderstandings and ensures a smooth workflow.

Q 23. How do you communicate cost information to non-financial stakeholders?

Communicating cost information effectively to non-financial stakeholders requires translating complex financial data into easily understood terms. Instead of using jargon, I focus on visual aids like charts, graphs, and dashboards that highlight key aspects such as projected costs, actual spending, and potential cost overruns. I use analogies and real-world examples to explain technical concepts. For example, comparing project costs to the budget of a household renovation project makes it easier for a non-financial client to grasp the scale and significance of various cost elements. I also highlight the return on investment (ROI) or value proposition of the project, emphasizing the long-term benefits that justify the expenses. Regular briefings and progress reports, presented in a straightforward manner, maintain transparency and build trust.

Q 24. What are the ethical considerations in job costing and estimating?

Ethical considerations in job costing and estimating are paramount. Accuracy and transparency are at the core of ethical practices. Padding estimates or manipulating cost data to benefit personally or the company is unethical and can have serious legal and professional repercussions. I believe in honest cost estimations, based on realistic assessment of resources, time, and potential risks. It’s crucial to disclose all potential hidden costs and risks upfront to stakeholders. Confidentiality also plays a vital role. Protecting sensitive financial information of clients and the company is essential. Maintaining professional objectivity is also crucial. Personal biases or relationships should not influence the objectivity of the cost estimations. Conflicts of interest must be disclosed and addressed transparently.

Q 25. How do you stay updated on the latest trends in job costing and estimating?

Staying updated in this field requires a multi-pronged approach. I regularly attend industry conferences and webinars to learn about the latest software, methodologies, and best practices in job costing and estimating. I actively participate in professional organizations and networking events to engage with peers and industry leaders. Subscribing to relevant journals and publications keeps me abreast of the newest research and innovations. I also leverage online resources such as industry blogs, podcasts, and professional platforms to access insights and case studies. This continuous learning process allows me to adapt to the evolving demands of the industry and apply the most efficient and accurate techniques in my work.

Q 26. How would you handle a disagreement with a project manager about cost estimates?

Disagreements with project managers on cost estimates are handled professionally and collaboratively. The first step is to thoroughly review the data and assumptions underpinning both estimates. I identify the points of divergence and seek to understand the rationale behind the differing estimations. Open communication is crucial; I discuss the different perspectives with the project manager to find common ground and pinpoint any areas of misunderstanding. We explore alternative approaches and compromise, aiming to reach a mutually agreeable estimate that reflects the project’s reality and potential risks. If the disagreement persists, involving a senior manager or an independent estimator can offer an objective assessment and resolution.

Q 27. Describe a situation where you had to make a difficult cost-related decision.

In a previous project, we faced a significant cost overrun due to unforeseen soil conditions during a construction project. The initial estimates were based on standard soil profiles, but during excavation, we encountered unexpectedly dense and rocky soil. This necessitated a complete revision of the excavation plan and the use of specialized machinery, significantly increasing the labor and equipment costs. Making the difficult decision to inform the client about the cost implications promptly, despite the potential for project cancellation, was critical. We presented a transparent report detailing the unexpected situation, the reasons for the cost increase, and alternative solutions. Ultimately, open communication and collaboration with the client led to a revised budget and the successful completion of the project, although with a revised timeline.

Key Topics to Learn for Job Costing and Estimating Interview

- Direct Costs vs. Indirect Costs: Understanding the difference and accurately allocating each to projects. Practical application includes analyzing project budgets and identifying cost overruns.

- Cost Estimation Techniques: Mastering various methods like top-down, bottom-up, parametric, and analogous estimating. Practical application involves selecting the most appropriate technique for a given project and justifying your choice.

- Activity-Based Costing (ABC): Understanding how ABC assigns costs based on activities and its application in improving cost control and profitability. Practical application includes analyzing project efficiency and identifying areas for improvement.

- Budget Variance Analysis: Interpreting and explaining variances between budgeted and actual costs. Practical application includes identifying the root causes of variances and recommending corrective actions.

- Job Costing Systems: Familiarity with different job costing systems (manual, automated) and their implementation. Practical application includes designing and implementing an effective job costing system for a specific scenario.

- Profitability Analysis: Analyzing project profitability using job costing data. Practical application includes identifying profitable and unprofitable projects and making informed decisions.

- Software Applications: Demonstrating familiarity with relevant software used in job costing and estimating (e.g., project management software). This shows practical experience and technological proficiency.

Next Steps

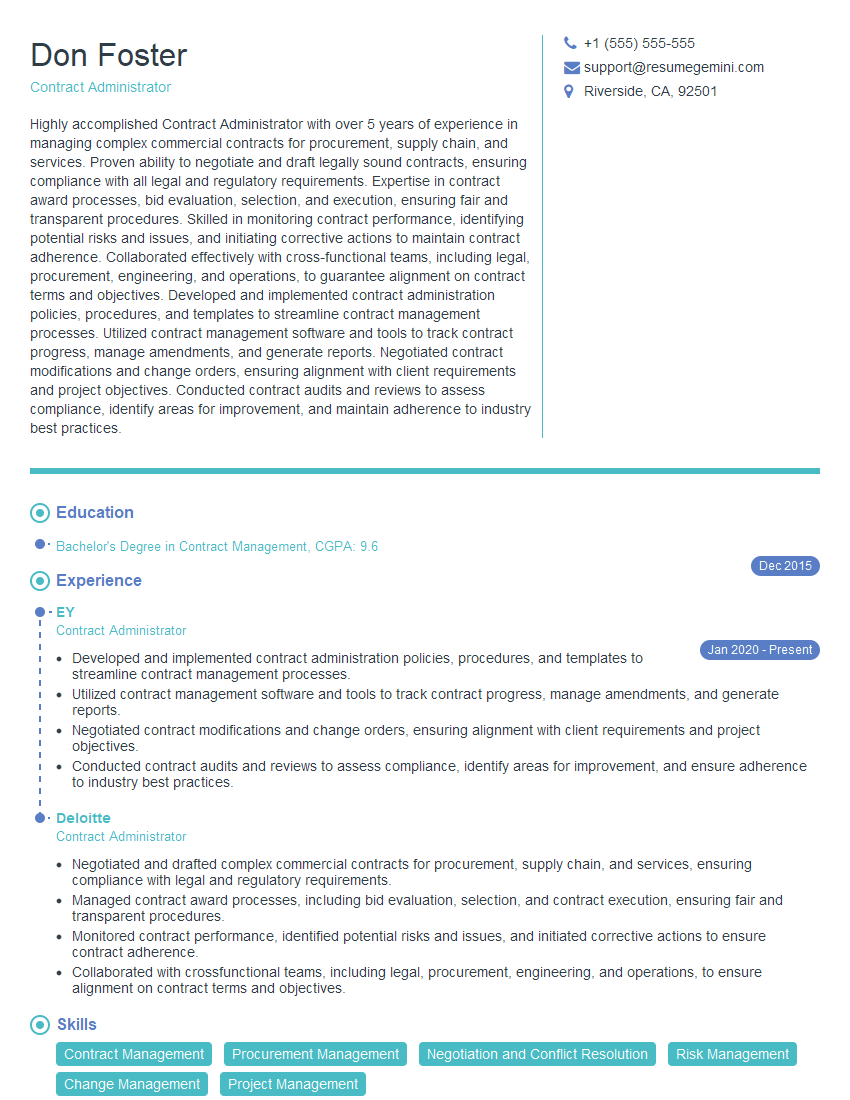

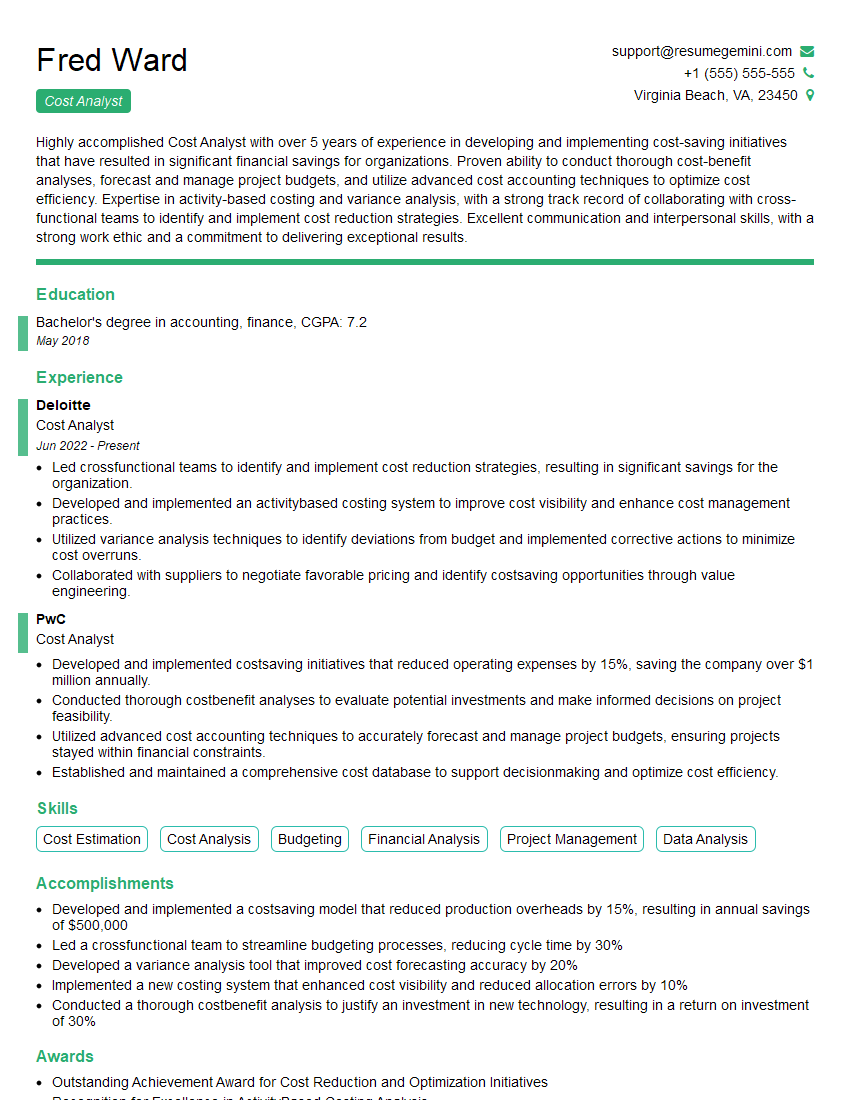

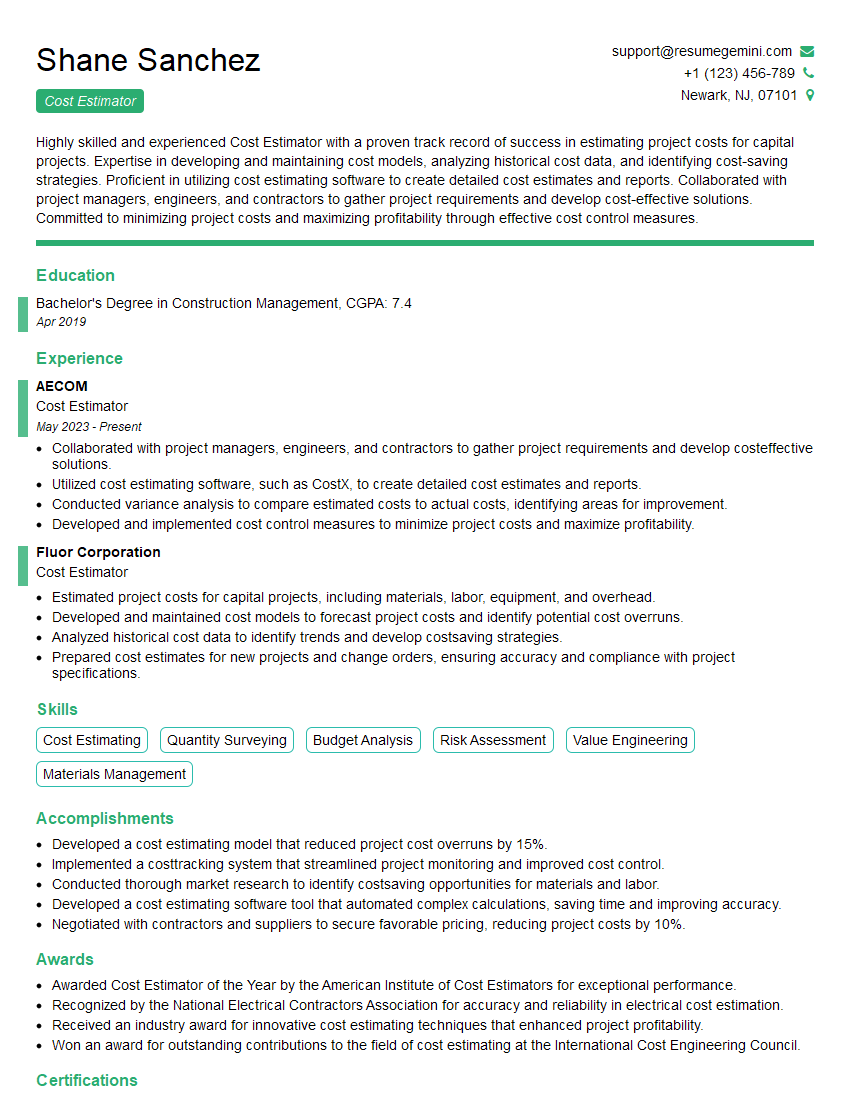

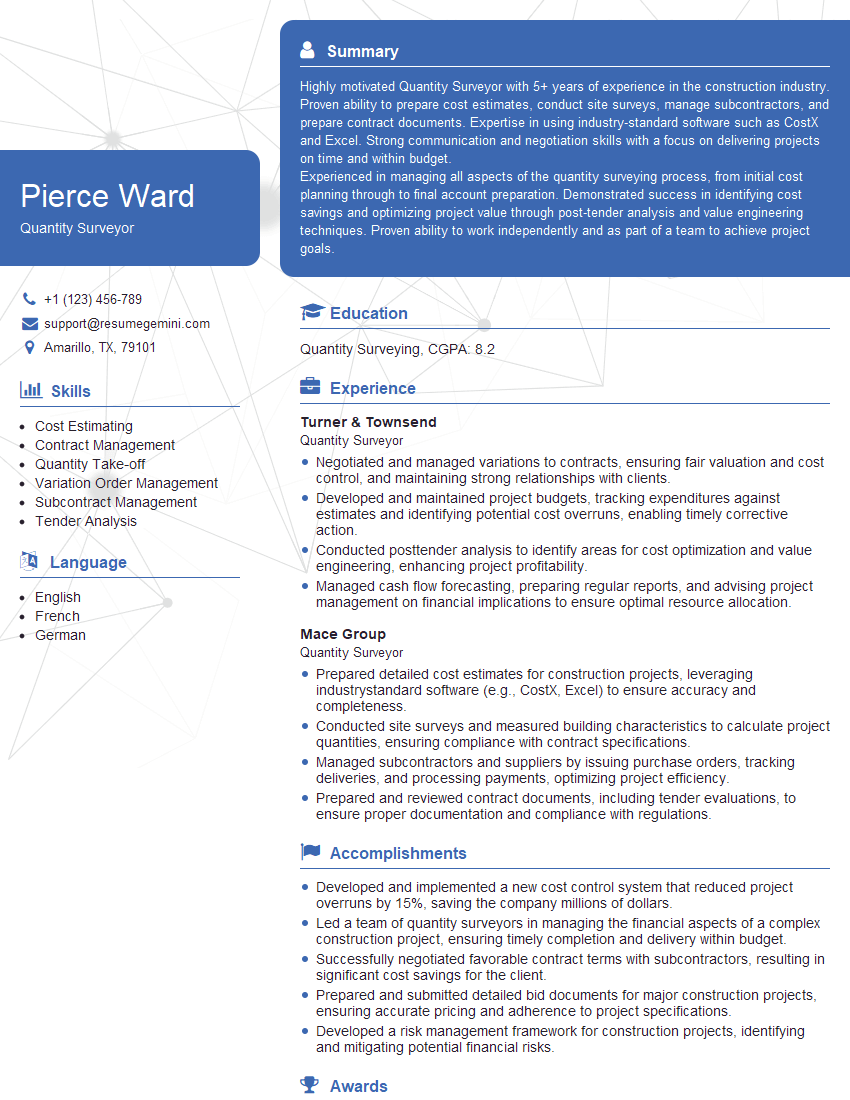

Mastering Job Costing and Estimating is crucial for career advancement in many fields, opening doors to higher-paying roles and increased responsibility. A strong understanding of these concepts showcases your analytical skills and your ability to contribute significantly to a company’s bottom line. To maximize your job prospects, create an ATS-friendly resume that highlights your skills and experience effectively. ResumeGemini is a trusted resource to help you build a professional and impactful resume. We provide examples of resumes tailored to Job Costing and Estimating to help you get started. Let us help you present your qualifications in the best possible light!

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

I Redesigned Spongebob Squarepants and his main characters of my artwork.

https://www.deviantart.com/reimaginesponge/art/Redesigned-Spongebob-characters-1223583608

IT gave me an insight and words to use and be able to think of examples

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO