The thought of an interview can be nerve-wracking, but the right preparation can make all the difference. Explore this comprehensive guide to Knowledge of the real estate market and industry trends interview questions and gain the confidence you need to showcase your abilities and secure the role.

Questions Asked in Knowledge of the real estate market and industry trends Interview

Q 1. What are the current prevailing interest rates for mortgages?

Mortgage interest rates are dynamic and fluctuate based on various economic factors. There isn’t a single prevailing rate; it varies significantly depending on the type of mortgage (e.g., fixed-rate, adjustable-rate), the borrower’s credit score, the down payment amount, and the loan term. Currently, we’re seeing a range for 30-year fixed-rate mortgages between approximately 6.5% and 8%, but it’s crucial to check with multiple lenders for the most up-to-date information specific to your financial profile. Remember, these rates are subject to change daily, sometimes hourly. It’s essential to shop around and compare offers from different mortgage providers before committing to a loan.

Q 2. Explain the difference between a 1031 exchange and a traditional sale.

A 1031 exchange and a traditional sale are both methods of selling real estate, but they differ significantly in their tax implications. A traditional sale involves selling a property and paying capital gains taxes on any profit. This is a straightforward transaction where you receive the full proceeds from the sale after paying closing costs and any outstanding debts. Think of it like selling your car – you get the money, and you pay taxes on the profit.

In contrast, a 1031 exchange (named after Section 1031 of the Internal Revenue Code) allows you to defer capital gains taxes by reinvesting the proceeds from the sale of a property into a similar property. This means you sell your investment property, but instead of getting the money directly, you designate a Qualified Intermediary (QI) who will handle the funds. The funds are then used to purchase a like-kind replacement property within a specific timeframe. Crucially, you are not paying capital gains taxes at this point. The tax liability is deferred until you ultimately sell the replacement property. This strategy is frequently employed by real estate investors to grow their portfolios without immediate tax consequences. The key difference lies in the timing of tax obligations: immediate with a traditional sale, deferred with a 1031 exchange.

Q 3. Describe the current state of the local housing market (mention specific location).

Let’s focus on the current state of the housing market in Denver, Colorado. Denver, like many other markets, has seen a significant slowdown compared to the frenetic pace of the past few years. While still a strong market overall, we’re observing a decrease in buyer demand, primarily driven by those rising interest rates discussed earlier. Inventory is slowly increasing, offering buyers slightly more options than they had a year ago. This means less intense bidding wars, and in some segments, even some price reductions on homes that have been on the market for a while. However, it’s important to note that this slowdown is not uniform across all price points or property types. Luxury homes still command strong prices, but the mid-range market is experiencing more adjustment. The overall trend suggests a movement toward a more balanced market, shifting from a seller’s market to a more neutral or even slightly buyer-favored market.

Q 4. How do rising interest rates impact real estate prices?

Rising interest rates have a substantial impact on real estate prices. Higher rates increase the cost of borrowing money, making mortgages more expensive. This leads to reduced buyer purchasing power. With higher monthly payments, potential buyers can afford less expensive properties or may be priced out of the market entirely. This decrease in demand naturally puts downward pressure on real estate prices. Think of it like this: if fewer people can afford to buy, sellers have to adjust their asking prices to attract buyers. The extent of the impact depends on several factors including the magnitude and speed of interest rate increases, the overall economic climate, and the specific local market dynamics. While prices may not necessarily crash, a rise in interest rates generally results in a cooling, or even a contraction, of the market, leading to slower price appreciation or even price declines.

Q 5. What are the key indicators you monitor to assess market trends?

To effectively assess market trends, I monitor several key indicators. These include:

- Mortgage interest rates: As explained previously, these directly impact buyer affordability.

- Housing inventory: The number of available homes on the market is a crucial indicator of supply and demand.

- Days on market (DOM): The average number of days a property spends on the market provides insight into how quickly homes are selling.

- Median sale price: This gives a clear picture of the average price homes are selling for in a given area.

- Sales volume: The total number of homes sold during a specific period indicates market activity.

- Pending sales: This metric shows the number of homes under contract, offering insight into future sales activity.

- Consumer confidence index: This measures consumer sentiment, which has a direct correlation with willingness to buy.

- Local economic data: Employment rates, job growth, and population changes are all important contextual factors.

Q 6. Explain the concept of property appreciation and depreciation.

Property appreciation refers to an increase in the value of a property over time. This can be due to various factors, including increased demand, economic growth, improvements to the property, or simply the general appreciation of assets in a desirable location. For example, a home in a rapidly developing neighborhood might appreciate significantly as new businesses and amenities attract more residents. Conversely, property depreciation represents a decrease in the property’s value. This can result from several factors like poor maintenance, obsolescence, changes in zoning regulations, market downturns, or even damage from natural disasters. A home in a neighborhood experiencing economic decline or a major infrastructure issue might depreciate in value. It’s crucial to remember that while appreciation is generally desired, depreciation is a potential risk, highlighting the importance of due diligence and market research before purchasing any property.

Q 7. What are some common real estate investment strategies?

Several common real estate investment strategies exist, each with its own risk and reward profile:

- Buy and hold: This is a long-term strategy focused on generating rental income and capital appreciation. It involves purchasing a property, renting it out, and holding onto it for an extended period.

- Fix and flip: This involves buying undervalued properties, renovating them, and quickly reselling them for a profit. It’s a more active strategy requiring significant expertise in construction and project management.

- Wholesaling: This strategy centers on finding discounted properties and assigning the contract to another buyer for a fee. It requires skillful negotiation and market knowledge.

- Land flipping: This involves buying vacant land, holding it for a short period, and then reselling for a profit, often capitalizing on zoning changes or developments. High risk, but high reward potential.

- Real Estate Investment Trusts (REITs): This provides exposure to the real estate market without directly owning properties. Investors purchase shares of publicly traded companies that invest in commercial real estate.

Q 8. Discuss the impact of inflation on real estate values.

Inflation significantly impacts real estate values. When inflation rises, the cost of building materials, labor, and land increases, driving up construction costs and ultimately property prices. This is because the purchasing power of money decreases – you need more money to buy the same thing. Conversely, high inflation can also increase interest rates, making mortgages more expensive, potentially slowing down demand and dampening price growth. However, real estate is often seen as an inflation hedge; it’s a tangible asset that tends to hold its value or appreciate during inflationary periods, as people seek to protect their wealth from eroding purchasing power. For example, if inflation is at 5%, a property valued at $500,000 might see its value increase to $525,000 simply due to inflation, reflecting the increased cost of replacement.

The relationship isn’t always straightforward. Factors like market supply and demand, economic conditions, and investor sentiment also play crucial roles. A period of high inflation might lead to increased demand if investors see real estate as a safe haven, pushing prices upward. However, if economic uncertainty is high, demand might fall, mitigating the inflationary effect on prices.

Q 9. How do you analyze a property’s potential ROI?

Analyzing a property’s potential Return on Investment (ROI) requires a thorough assessment of both income and expenses. It’s not just about the purchase price; it’s about understanding the total cost of ownership and potential future cash flow.

- Calculate Net Operating Income (NOI): This is the annual rental income minus all operating expenses (property taxes, insurance, maintenance, management fees, etc.).

- Determine the Capitalization Rate (Cap Rate): This shows the potential rate of return based on the property’s NOI and its purchase price. Cap Rate = (NOI / Purchase Price) * 100. A higher cap rate suggests a potentially better investment.

- Consider Appreciation: The property’s value may increase over time. This appreciation adds to your overall ROI, but it’s crucial to remember that this is an estimate, not a guarantee.

- Factor in Financing Costs: If you’re using a mortgage, calculate the interest paid and include it in your total expenses.

- Account for Potential Vacancies and Repairs: Rental properties are subject to vacancies and unexpected repairs. Build in a buffer for these costs.

For example, if a property costs $200,000, has an annual NOI of $20,000, and you sell it after 5 years for $250,000, your ROI will account for the $20,000 annual income over five years ($100,000), plus the $50,000 appreciation, less your initial investment and any financing costs. This calculation offers a holistic picture of the investment’s profitability.

Q 10. What are the main factors influencing rental rates in your area?

Rental rates are influenced by a complex interplay of factors. In my area [replace with specific area], some key drivers include:

- Demand and Supply: A high demand for rentals and a low supply of available units will typically drive up rental rates.

- Location and Amenities: Properties in desirable neighborhoods with convenient access to schools, transportation, and other amenities command higher rents.

- Property Size and Features: Larger units with updated kitchens, bathrooms, and modern features typically fetch higher rents.

- Market Conditions: Overall economic conditions, interest rates, and population growth all influence rental rates.

- Competition: The number of similar rental properties in the area impacts pricing strategies.

For example, an apartment complex near a major university or employment center will likely experience higher rental rates than one in a more remote location, due to significantly higher demand. Likewise, a renovated apartment with modern appliances will rent for more than a comparable unit requiring updates.

Q 11. Describe different types of real estate financing options.

Real estate financing options vary greatly, each with its own advantages and disadvantages. Here are some common types:

- Conventional Loans: These are offered by banks and other private lenders, typically requiring a down payment of 20% or more, but usually offering lower interest rates than other loan types.

- FHA Loans: Backed by the Federal Housing Administration, these loans require a lower down payment (often as low as 3.5%) but involve mortgage insurance premiums.

- VA Loans: Guaranteed by the Department of Veterans Affairs, these loans are available to eligible veterans and often require no down payment.

- USDA Loans: The United States Department of Agriculture backs these loans, designed for rural properties. These loans often come with lower interest rates and limited down payments or no down payment requirements.

- Hard Money Loans: These short-term loans are typically secured by the property itself and often have higher interest rates, but are quicker to obtain and can be used for fast transactions.

- Private Money Loans: These loans are offered by individual investors or private lending companies, often used for bridging financing or transactions with less stringent lending criteria.

The best financing option depends on your individual circumstances, creditworthiness, and the specific property being purchased.

Q 12. What are the current trends in commercial real estate development?

The commercial real estate (CRE) development landscape is constantly evolving. Current trends include:

- Focus on Sustainability: Developers are increasingly prioritizing environmentally friendly designs and construction practices, driven by tenant demand and regulatory changes. LEED certification is becoming more common.

- Adaptive Reuse of Existing Structures: Converting older buildings into modern office spaces, apartments, or mixed-use developments is gaining popularity, offering cost-effective alternatives to new construction.

- Rise of Multifamily Housing: Demand for rental units continues to drive significant development in the multifamily sector, especially in urban areas.

- Technology Integration: Smart building technology, including automation and energy-efficient systems, is becoming integral to new developments.

- Demand for Flexible Workspaces: The increase in remote and hybrid work models is driving demand for flexible and collaborative workspaces.

- Growth of the Industrial Sector: E-commerce growth fuels the need for more warehouse and distribution centers.

For instance, we see many developers converting old factories into trendy loft apartments or co-working spaces, catering to the rising demand for urban living and flexible work environments.

Q 13. What are the risks associated with investing in real estate?

Investing in real estate carries inherent risks. These include:

- Market Volatility: Real estate values can fluctuate significantly depending on economic conditions and market trends.

- Interest Rate Changes: Rising interest rates can make financing more expensive, impacting profitability and affordability.

- Vacancy Risk: Rental properties may experience periods of vacancy, resulting in lost income.

- Property Damage and Maintenance Costs: Unexpected repairs and maintenance expenses can significantly impact profitability.

- Illiquidity: Real estate is not as easily converted to cash as other investments, making it difficult to access funds quickly.

- Tax Implications: Real estate investments involve various tax considerations that need careful planning.

- Local Market Conditions: Local factors such as economic downturns or oversupply can negatively impact property values.

- Environmental Concerns: Environmental hazards or regulations can affect property value and usability.

It’s crucial to conduct thorough due diligence, have a clear understanding of market conditions, and carefully manage risk through diversification and appropriate insurance.

Q 14. How do you identify undervalued properties?

Identifying undervalued properties requires a keen eye for detail and a deep understanding of the local market. My approach involves:

- Comparative Market Analysis (CMA): Carefully compare the subject property to similar recently sold properties in the area to identify potential price discrepancies.

- Analyzing Property Condition and Potential: Look for properties needing repairs or updates, where renovations could significantly increase value. Consider properties with unique features or potential for future development.

- Considering Market Sentiment: Understand the overall market sentiment. A downturn in the market might offer opportunities to buy below market value.

- Assessing Rental Potential: If considering a rental property, analyze the potential rental income and compare it to similar properties in the area. A higher-than-average rental yield indicates potential undervaluation.

- Due Diligence: Thoroughly inspect the property for any hidden problems and check its legal and financial status.

- Negotiation Skills: Be prepared to negotiate effectively to secure a favorable price.

For example, I might find a property that’s priced lower than comparable properties due to minor cosmetic issues, but with significant potential for appreciation after renovations. Careful analysis and effective negotiation could then secure an undervalued asset.

Q 15. Explain the process of due diligence when purchasing real estate.

Due diligence in real estate is the investigative process buyers undertake to verify all aspects of a property before committing to a purchase. It’s like a thorough background check for a house, ensuring you’re not buying into any hidden problems. This crucial step protects you from costly surprises down the line.

Property Inspection: A professional inspector examines the property’s physical condition, identifying potential structural, mechanical, or safety issues. Think leaky roofs, faulty wiring, or pest infestations – things you might not notice yourself.

Title Search: This verifies the seller’s legal ownership and identifies any liens, encumbrances (like easements or mortgages), or other claims against the property. Imagine discovering someone else unexpectedly has a claim on your dream home!

Survey: A land survey confirms the property’s boundaries and ensures it matches the legal description. This prevents boundary disputes with neighbors after you move in.

Environmental Review: This checks for environmental hazards, such as asbestos, lead paint, or radon gas, especially important in older properties. These hazards can be extremely costly to remediate.

Review of Disclosures: Carefully examine all seller disclosures for any known issues with the property, neighborhood, or surrounding area.

Financial Review: Verify the seller’s financial standing, especially if they are financing the sale. Ensure the mortgage is valid and properly recorded.

Failing to perform thorough due diligence can lead to significant financial losses and legal battles, making it a non-negotiable step in any real estate transaction.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. What are the legal implications of real estate transactions?

Real estate transactions are heavily regulated and involve complex legal implications. Understanding these is vital to avoid costly mistakes. Key legal aspects include:

Contract Law: Real estate purchases are governed by detailed contracts. Understanding offer and acceptance, contingencies, deadlines, and breach of contract is crucial. A poorly drafted contract can lead to disputes and litigation.

Property Law: This covers ownership rights, zoning regulations, easements, and other legal interests in the land. Violating zoning laws, for instance, can render a property unusable or unsellable.

Title and Escrow: A clear title is essential, ensuring the seller has the right to sell the property. Escrow agents protect funds and documents during the transaction, safeguarding both buyer and seller.

Real Estate Licensing Laws: Agents must be licensed and abide by specific regulations to protect consumers. Improper conduct can lead to disciplinary action.

Tax Implications: Real estate transactions have significant tax consequences, including property taxes, capital gains taxes, and potential tax deductions. Seeking professional tax advice is essential.

Environmental Laws: Regulations regarding environmental hazards like asbestos and lead paint can impact transactions. Non-compliance can result in hefty fines and legal liabilities.

Navigating these complexities requires working with experienced real estate attorneys and licensed professionals to ensure compliance with all applicable laws and regulations.

Q 17. What are some common real estate appraisal methods?

Real estate appraisal methods aim to estimate a property’s market value. Several common approaches exist:

Sales Comparison Approach: This involves comparing the subject property to recently sold comparable properties (comps) in the same area. Adjustments are made for differences in features, size, location, etc. It’s like comparing similar cars to determine the price of a specific model.

Cost Approach: This method estimates the cost of replacing or constructing the property, less depreciation. It’s particularly useful for newer buildings or unique properties where comparable sales data is scarce. Imagine estimating the cost to build a new house with similar features.

Income Approach: This approach is used for income-generating properties (e.g., rental buildings). It estimates value based on the property’s potential rental income and capitalization rate. It’s like valuing a business based on its projected profits.

Appraisers often use a combination of these methods, weighing each based on the specific property and market conditions. The final appraisal report provides a detailed explanation of the methodology and the resulting value estimate.

Q 18. How do you manage tenant relations effectively?

Effective tenant relations are crucial for successful property management. It’s all about building positive relationships and fostering a sense of community.

Clear Communication: Establish clear communication channels (email, phone, online portal) and promptly respond to tenant inquiries and concerns. Think of it as customer service for your renters.

Fair and Consistent Enforcement of Rules: Clearly define rules and regulations, and enforce them consistently and fairly among all tenants. This ensures a harmonious living environment.

Regular Property Maintenance: Perform regular inspections and promptly address maintenance requests. Proactive maintenance prevents minor issues from escalating into major problems.

Respectful Interactions: Treat tenants with respect and courtesy. Remember, they are your customers and maintaining a positive relationship is beneficial for both parties.

Conflict Resolution: Develop strategies for resolving conflicts peacefully and effectively. Mediation or arbitration may be necessary in some cases.

Investing in building positive tenant relationships reduces tenant turnover, improves property value, and protects your investment.

Q 19. Discuss the importance of market research in real estate decisions.

Market research is the cornerstone of sound real estate decisions. It provides the data-driven insights needed to make informed choices about buying, selling, or developing property.

Understanding Market Trends: Analyzing data on property values, rental rates, and market absorption rates helps identify emerging trends and anticipate future market movements. Knowing if the market is cooling or heating up is crucial.

Identifying Investment Opportunities: Market research helps uncover undervalued properties or areas poised for appreciation. It’s about finding the diamonds in the rough.

Pricing Strategies: Determining the optimal listing price for a property requires thorough market analysis to ensure it’s competitive yet maximizes profit. Underpricing or overpricing can severely impact sales results.

Risk Assessment: Understanding market fluctuations and potential risks (e.g., economic downturns, oversupply) is crucial for managing investment risk.

Competitive Analysis: Assessing the competitive landscape, including other properties on the market and competing developers, is essential for strategic decision-making.

Ignoring market research can lead to poor investment choices, missed opportunities, and financial losses. It’s the foundation of successful real estate investing.

Q 20. How would you handle a difficult negotiation with a buyer or seller?

Difficult negotiations require patience, strategy, and a focus on finding mutually beneficial solutions. It’s about understanding the other party’s needs and interests.

Active Listening: Pay close attention to what the other party is saying, both verbally and nonverbally. Understanding their motivations and concerns is crucial.

Empathy and Understanding: Try to see the situation from their perspective. What are their needs and priorities?

Clear and Concise Communication: Clearly articulate your position and expectations. Avoid emotional language and stick to the facts.

Strategic Concessions: Be prepared to make concessions, but only strategically. Avoid making concessions too early or giving away too much.

Finding Common Ground: Look for areas of common ground where you can reach an agreement. Focus on collaborative problem-solving.

Know When to Walk Away: Recognize when a negotiation is not likely to result in a favorable outcome and be prepared to walk away.

Remember, a successful negotiation is not about winning or losing, but about finding a solution that satisfies both parties. It’s about building relationships, not just closing deals.

Q 21. What is the current vacancy rate for residential properties in (mention a city)?

I cannot provide the exact current vacancy rate for residential properties in a specific city without real-time access to constantly updating market data. Vacancy rates are highly dynamic and change frequently based on various economic and seasonal factors. To find this information, I recommend checking with:

Local Real Estate Boards or Associations: These organizations often publish market reports with up-to-date statistics.

Government Agencies: Your city or regional government’s housing or economic development department might provide such data.

Real Estate Market Research Firms: Many private companies specialize in collecting and analyzing real estate market data, often offering subscription-based access.

Local News Outlets: Newspapers and websites may periodically publish articles containing local real estate market statistics.

Remember to specify the city and the type of residential property (e.g., apartments, single-family homes) when conducting your research, as rates can vary significantly.

Q 22. What are some key challenges facing the real estate industry today?

The real estate industry is currently navigating a complex landscape of challenges. One major hurdle is the increasing interest rates which significantly impact affordability and buyer demand. This is further compounded by inflation, which drives up construction and material costs, affecting both new builds and renovations. Supply chain disruptions also play a crucial role, leading to delays and increased expenses. Finally, changing demographics and evolving buyer preferences require adaptability and a deeper understanding of market segmentation.

- Interest Rates: Higher interest rates directly translate to higher mortgage payments, making homeownership less accessible for many potential buyers.

- Inflation and Costs: Increased costs of building materials and labor directly impact the profitability of new construction projects and renovation costs.

- Supply Chain Issues: Delays in obtaining necessary materials can stall projects and inflate budgets, making projects less attractive.

- Changing Demographics: The shifting preferences of younger generations, like a greater emphasis on sustainable practices or proximity to urban amenities, necessitates a responsive market adaptation.

Q 23. How do you stay updated on the latest real estate market trends?

Staying abreast of real estate market trends requires a multi-faceted approach. I regularly consult reputable sources like the National Association of Realtors (NAR) reports, as well as local and regional market analyses from established brokerage firms. I also utilize economic indicators, such as consumer confidence indices and employment data, to predict shifts in the market. In addition, attending industry conferences and webinars allows me to network with other professionals and learn about emerging trends firsthand. Furthermore, I actively use social media and online platforms, such as industry-specific blogs and publications, to gather the latest information and insights.

Think of it like being a detective, constantly gathering clues from various sources to build a complete picture of the market’s direction.

Q 24. What software or tools do you utilize for real estate analysis?

My toolkit for real estate analysis includes a variety of software and tools. For market research, I use platforms like Realtor.com and Zillow to gather comparative market data. For detailed financial analysis, I utilize spreadsheet software like Microsoft Excel or Google Sheets to build detailed pro forma models for investment properties. I also employ specialized real estate software such as ARGUS Enterprise for complex valuation and investment analysis, especially for larger commercial properties. This allows me to model different scenarios and make data-driven decisions.

Q 25. Describe your experience with property valuation.

My experience in property valuation spans over [Number] years, encompassing residential, commercial, and industrial properties. I’m proficient in various valuation methods, including the sales comparison approach, income capitalization approach, and cost approach. The sales comparison approach involves analyzing recent sales of comparable properties to estimate the value of the subject property. The income capitalization approach focuses on the potential income generated by a property to determine its value. The cost approach estimates the value by considering the cost of constructing a new building with similar characteristics. Each method has strengths and weaknesses, and the most appropriate approach depends heavily on the type of property and the availability of data. I always prioritize using multiple approaches and triangulating the results to obtain the most reliable valuation.

For example, when valuing a multi-family apartment building, I would heavily rely on the income approach by analyzing rental income, vacancy rates, and operating expenses, while simultaneously utilizing the sales comparison approach to account for market fluctuations and comparable property features.

Q 26. How would you respond to an unexpected market downturn?

Responding to an unexpected market downturn requires a proactive and adaptable strategy. First, I would carefully analyze the market conditions to understand the depth and scope of the downturn, paying close attention to factors such as interest rate changes, unemployment levels, and consumer confidence. Then, I would reassess my portfolio and adjust my strategies accordingly. This might involve temporarily scaling back on new acquisitions, focusing on preserving capital, and prioritizing properties with strong cash flow. Negotiating more favorable terms with lenders and strategically adjusting pricing to maintain competitiveness are also critical. Finally, maintaining open communication with clients and investors, demonstrating transparency and a proactive approach to navigating the challenges, is paramount.

Think of it like adjusting the sails on a ship during a storm – you need to adapt to the changing winds to maintain stability and navigate safely.

Q 27. What is your understanding of zoning regulations and building codes?

Zoning regulations and building codes are critical components of the real estate development process. Zoning regulations dictate how land can be used, including permitted building types, density, and setbacks. Building codes establish minimum standards for construction quality, safety, and accessibility. Understanding these regulations is crucial to avoid costly delays and legal issues. I regularly consult local government websites and relevant building departments to stay updated on current regulations and ensure compliance with all applicable laws. Non-compliance can result in significant fines or even project termination.

For instance, a developer needs to be well versed in the specific zoning regulations of a city to determine if their proposed project, such as constructing a high-rise apartment building, complies with the zoning ordinances regarding height restrictions, parking requirements, and lot coverage.

Q 28. Describe a successful real estate deal you were involved in.

One particularly successful deal involved the redevelopment of a previously underutilized commercial property. The property was a dated shopping center in a rapidly gentrifying neighborhood. By conducting thorough market research and identifying the growing demand for mixed-use developments, we developed a plan to transform the property into a vibrant complex encompassing retail spaces, residential units, and a community park. The key to success lay in securing favorable financing terms, securing necessary permits efficiently, and managing the construction process effectively. The result was a significant increase in property value, exceeding initial projections. More importantly, it transformed a neglected area into a thriving community hub.

Key Topics to Learn for Knowledge of the Real Estate Market and Industry Trends Interview

- Market Analysis: Understanding fundamental market indicators like supply and demand, interest rates, and economic factors influencing property values. Practical application: Analyzing local market data to predict future trends and price fluctuations.

- Property Valuation Techniques: Mastering different appraisal methods (e.g., comparable sales, income approach, cost approach) and their application in various property types. Practical application: Justifying a property’s asking price based on sound valuation principles.

- Investment Strategies: Familiarizing yourself with various investment strategies (e.g., buy-and-hold, flipping, REITs) and their associated risks and rewards. Practical application: Evaluating the viability of different investment opportunities.

- Legal and Regulatory Landscape: Understanding relevant laws, regulations, and ethical considerations within the real estate industry (e.g., fair housing laws, zoning regulations). Practical application: Ensuring compliance with all legal requirements in real estate transactions.

- Current Market Trends: Staying updated on emerging trends such as sustainable building practices, technological advancements (proptech), and shifts in consumer preferences. Practical application: Identifying and capitalizing on emerging opportunities in the market.

- Financial Analysis: Understanding key financial metrics relevant to real estate (e.g., capitalization rate, net operating income, debt service coverage ratio). Practical application: Evaluating the financial performance of real estate investments.

- Negotiation and Communication Skills: Developing strong negotiation and communication skills to effectively interact with clients, colleagues, and other stakeholders. Practical application: Successfully navigating complex real estate transactions.

Next Steps

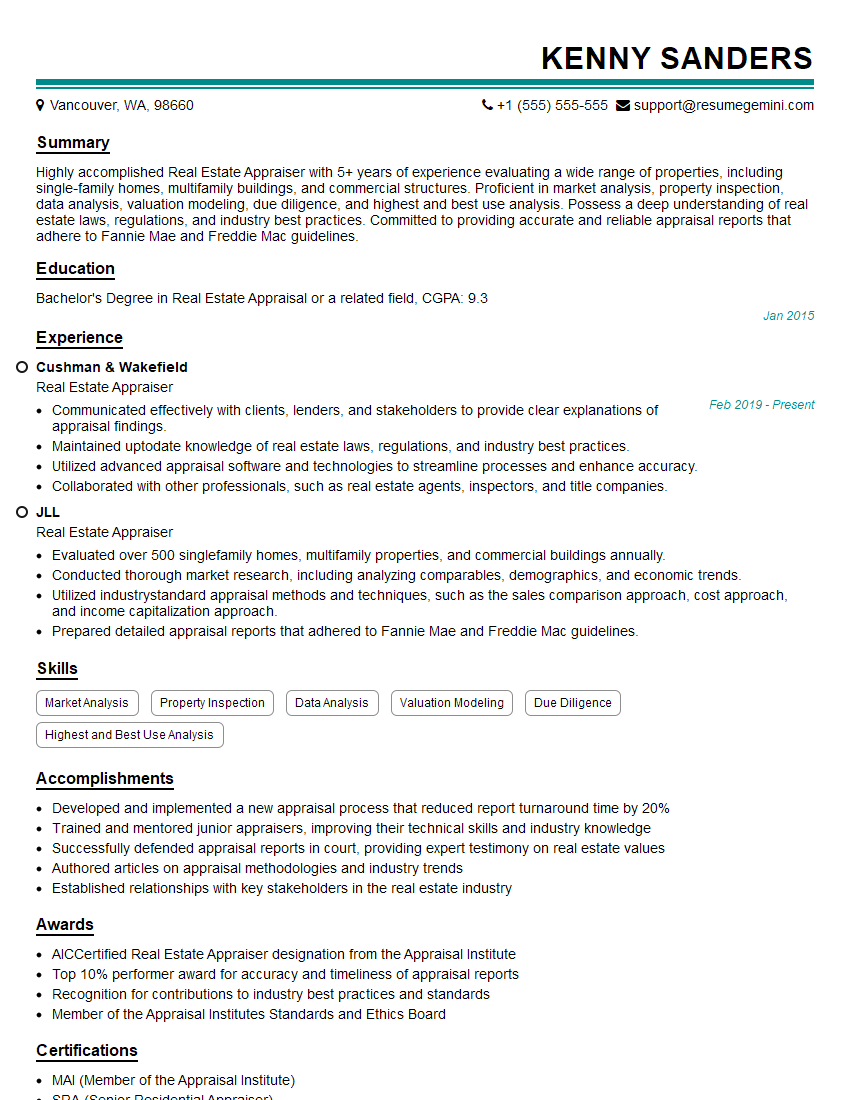

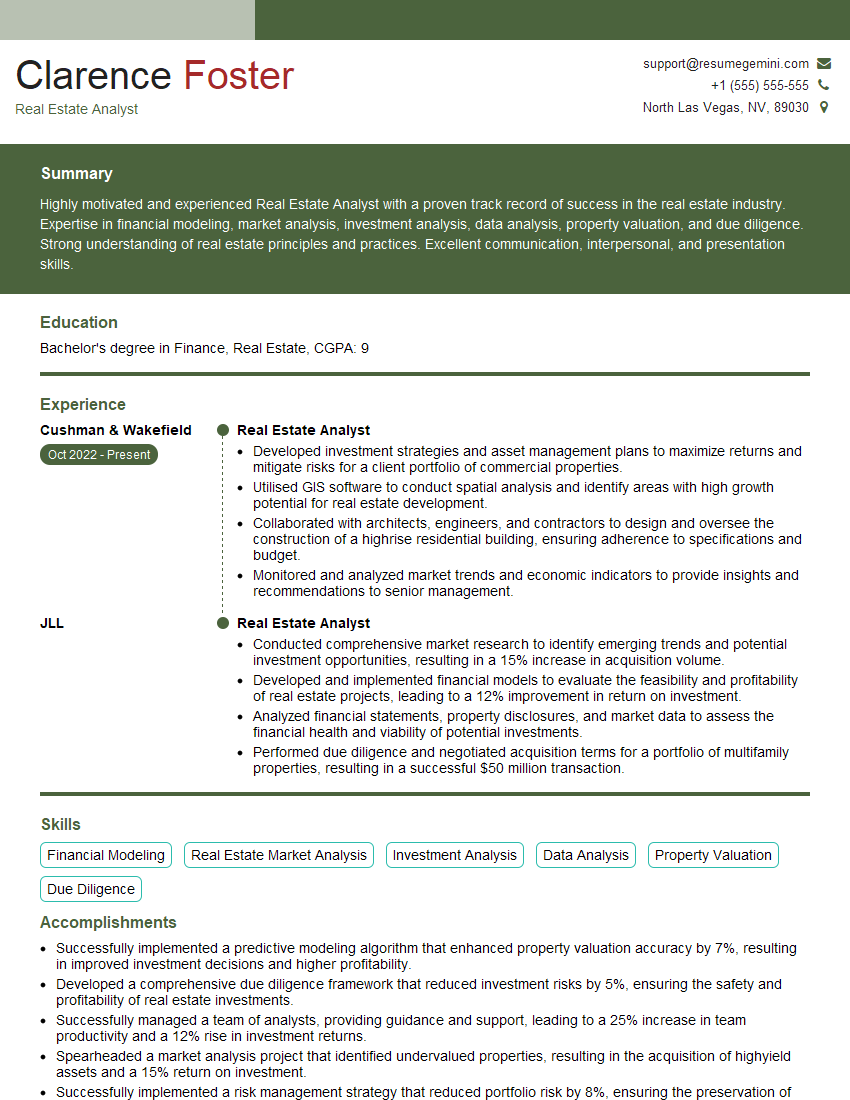

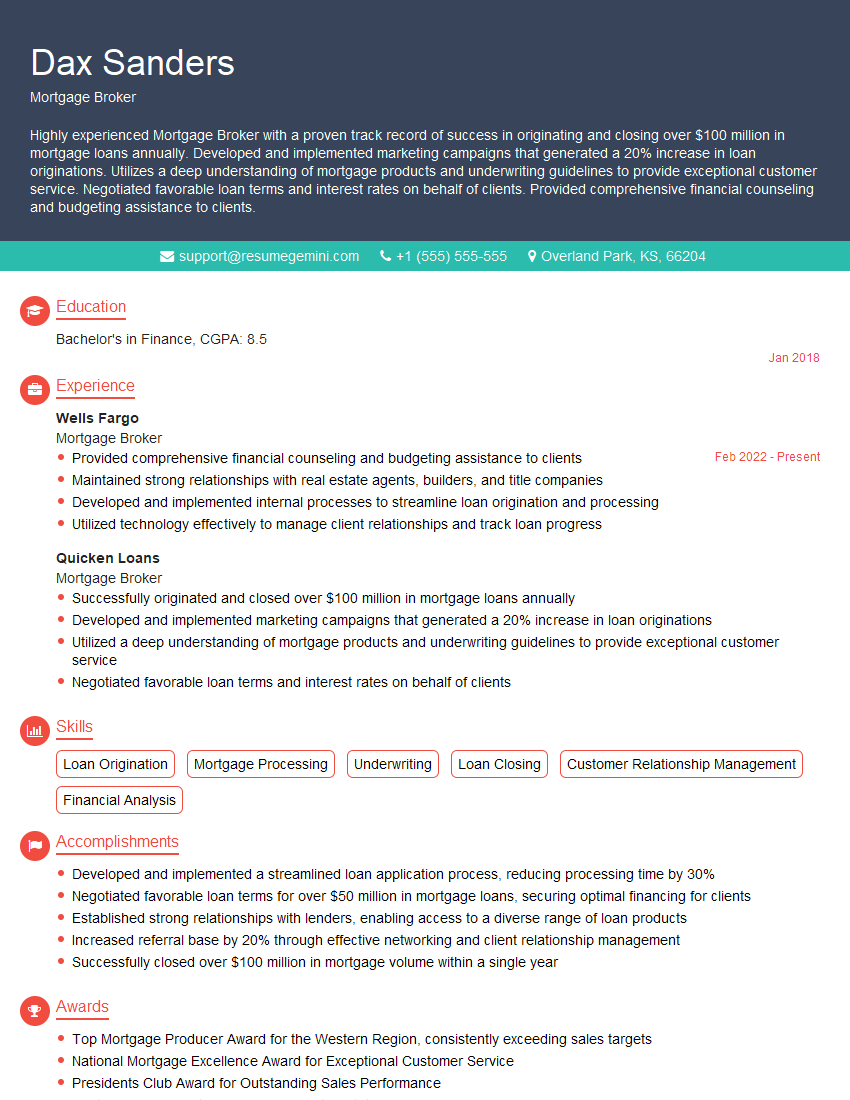

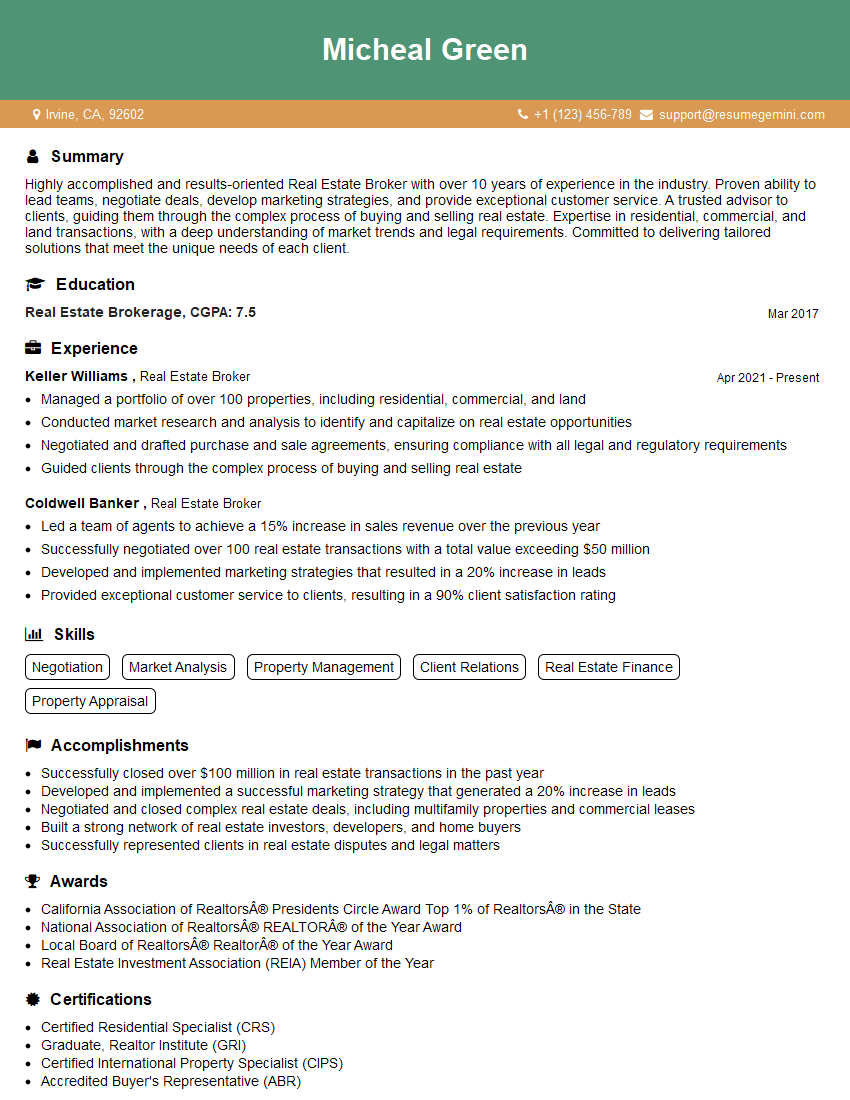

Mastering knowledge of the real estate market and industry trends is crucial for career advancement in this dynamic field. A strong understanding of these topics demonstrates expertise and positions you as a valuable asset to any real estate organization. To maximize your job prospects, it’s vital to create an ATS-friendly resume that effectively highlights your skills and experience. ResumeGemini is a trusted resource that can help you build a professional and impactful resume. Examples of resumes tailored to showcasing expertise in real estate market knowledge and industry trends are available, helping you present yourself in the best possible light. Invest the time in crafting a compelling resume – it’s your first impression and a critical step in securing your dream real estate role.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

I Redesigned Spongebob Squarepants and his main characters of my artwork.

https://www.deviantart.com/reimaginesponge/art/Redesigned-Spongebob-characters-1223583608

IT gave me an insight and words to use and be able to think of examples

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO