Interviews are more than just a Q&A session—they’re a chance to prove your worth. This blog dives into essential Market Feasibility Analysis interview questions and expert tips to help you align your answers with what hiring managers are looking for. Start preparing to shine!

Questions Asked in Market Feasibility Analysis Interview

Q 1. Explain the process of conducting a market feasibility analysis.

Conducting a market feasibility analysis is a systematic process designed to determine the viability of a new product, service, or business venture within a specific market. It involves a thorough investigation to assess whether the market presents a sufficient opportunity to justify the investment of time, resources, and capital. Think of it like testing the waters before diving into a new ocean.

- Define the Opportunity: Clearly articulate the product or service and its target market. What problem are you solving, and for whom?

- Preliminary Market Research: Conduct initial research to gain a basic understanding of the market size, potential demand, and existing competition. This might involve desk research, looking at publicly available data.

- Develop a Detailed Market Analysis: This is the core of the study, encompassing a deeper dive into market size, segmentation, trends, and competitive landscape.

- Assess Market Demand and Potential: This involves forecasting future demand based on various factors (discussed further in the following questions).

- Competitive Analysis: Evaluate the strengths and weaknesses of competitors, identify any barriers to entry, and determine your potential market share.

- Financial Projections: Develop financial models to project revenue, expenses, and profitability. This helps determine the financial viability of the venture.

- Sensitivity Analysis: Assess the impact of changes in key variables (e.g., pricing, demand) on the financial projections.

- Risk Assessment: Identify and assess potential risks associated with the venture, such as market fluctuations, competition, and regulatory changes.

- Feasibility Report: Compile the findings into a comprehensive report, clearly stating the conclusions and recommendations.

For example, imagine a company considering launching a new eco-friendly cleaning product. The feasibility analysis would involve researching the market for eco-friendly cleaning products, understanding consumer preferences and needs, identifying competitors, and projecting sales based on different marketing strategies.

Q 2. Describe the key elements of a comprehensive market feasibility study.

A comprehensive market feasibility study includes several key elements that work together to paint a holistic picture of the market’s potential. Think of it as building a strong foundation for a successful business.

- Executive Summary: A concise overview of the entire study, highlighting key findings and recommendations.

- Industry Analysis: An overview of the industry’s characteristics, trends, and growth prospects. This includes growth rates, technological advancements, and regulatory influences.

- Market Analysis: A detailed examination of the target market, including market size, segmentation, geographic distribution, and customer demographics.

- Competitive Analysis: A thorough evaluation of competitors, including their market share, strengths, weaknesses, strategies, and competitive advantages.

- Marketing and Sales Strategy: A plan outlining the marketing and sales strategies that will be used to reach the target market, highlighting pricing, distribution, and promotion.

- Financial Projections: Projected financial statements, including income statements, balance sheets, and cash flow statements, that showcase the financial viability of the venture.

- Management Team: A description of the management team and their relevant experience. Investors want to see a capable team.

- Risk Assessment: An identification and assessment of potential risks and mitigation strategies. This might include economic downturns, competitor responses, or regulatory changes.

- Appendices: Supporting data and documentation used in the study, adding credibility and detail.

Q 3. How do you identify and assess market size and potential?

Identifying and assessing market size and potential requires a multi-pronged approach. It’s like trying to measure the size of a very large, irregularly shaped lake. You need multiple methods to get a good estimate.

- Top-down Approach: Start with the total market size and then estimate the percentage your product or service will capture. For example, if the total market for pet food is $100 billion and you estimate capturing 1%, your potential market size is $1 billion.

- Bottom-up Approach: Start with estimating the potential number of customers in your target market and multiplying by the average revenue per customer. If you estimate 1 million customers willing to pay $100 per year, your market size is $100 million.

- Market Research Data: Utilize industry reports, market research databases (like Statista or IBISWorld), and government statistics to gather data on market size and trends. These reports often give detailed segmentation and market projections.

- Surveys and Focus Groups: Conduct surveys and focus groups to gather information directly from potential customers about their purchasing intentions and preferences. This gives you qualitative data to back up quantitative estimations.

- Competitive Analysis: Analyze competitor market shares and extrapolate to estimate your potential market share.

Let’s say we’re analyzing the market for electric scooters. We might use a top-down approach, starting with the overall market for personal transportation and estimating the share electric scooters represent. Then, using a bottom-up approach, we’d research the number of potential users in specific cities and project market share based on demographics and adoption rates.

Q 4. What are the different methods used to forecast market demand?

Forecasting market demand is crucial for making informed business decisions, a bit like predicting the weather for the next harvest season. Accurate forecasting can significantly reduce risk and improve decision-making.

- Trend Analysis: Analyze historical data to identify trends and extrapolate them into the future. This is a simple, but potentially unreliable, method if trends are volatile.

- Regression Analysis: Use statistical techniques to model the relationship between market demand and other variables (e.g., price, income, population). This provides more robust forecasting, especially with good data.

- Qualitative Forecasting: Gather expert opinions from industry professionals, customers, and other stakeholders. This method is valuable when dealing with new products or uncertain markets, supplementing quantitative data with expert insights.

- Delphi Method: A structured approach involving a panel of experts who provide anonymous forecasts, which are then aggregated and shared with the panel for further refinement. This helps reach a more consensus-based prediction.

- Causal Forecasting: Uses cause-and-effect relationships to forecast future demand. This is useful when market shifts are driven by external factors such as technological advancements or regulatory changes.

For instance, when forecasting demand for solar panels, one might use regression analysis to model the relationship between panel price, government subsidies, and overall demand. Combining this with qualitative insights from industry experts could provide a more accurate forecast.

Q 5. How do you analyze the competitive landscape in a market feasibility study?

Analyzing the competitive landscape is like studying the terrain before planning a hiking expedition. Understanding the competition is essential for success.

- Identify Competitors: Identify both direct and indirect competitors. Direct competitors offer similar products or services, while indirect competitors offer alternatives that address the same customer need.

- Market Share Analysis: Determine the market share of each competitor to understand the existing power dynamics.

- Competitive Strategies: Analyze the competitive strategies of each competitor (e.g., pricing, product differentiation, marketing). This helps you understand their strengths and weaknesses.

- SWOT Analysis: Conduct a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) for each major competitor. This framework helps you understand their competitive position.

- Competitive Advantage: Determine your potential competitive advantage. What makes your product or service different or better than what’s already on the market? This could be pricing, quality, features, or brand image.

- Competitive Barriers: Identify any barriers to entry or competitive advantages enjoyed by existing players. This might include patents, brand recognition, or established distribution networks.

Imagine launching a new coffee shop. You’d analyze existing coffee shops in the area (direct competitors), but also consider other cafes, bakeries, and even fast-food restaurants offering coffee (indirect competitors). You’d compare pricing, menu offerings, and marketing strategies to pinpoint opportunities.

Q 6. What are the key factors to consider when evaluating market entry barriers?

Market entry barriers are obstacles that make it difficult for new businesses to enter a market. They’re like obstacles on a race track that hinder new racers.

- Economies of Scale: Existing companies may have lower production costs due to their size and volume of production. This makes it difficult for smaller entrants to compete on price.

- Brand Loyalty: Strong brand loyalty can make it challenging to attract customers to a new product or service. Consumers often prefer established brands.

- Capital Requirements: High initial investment costs (e.g., in equipment, marketing, or research and development) can discourage new entrants.

- Government Regulations: Permits, licenses, and other regulatory requirements can create significant hurdles for new businesses.

- Distribution Channels: Access to distribution channels (e.g., retail stores, online marketplaces) may be controlled by existing players, making it difficult for new entrants to reach their customers.

- Technology: Proprietary technology or intellectual property can create a significant barrier to entry, making it hard to duplicate a successful product or service.

- Switching Costs: The costs incurred by customers switching from one product or service to another can create a barrier, particularly for businesses with loyal customer bases.

For instance, the automotive industry has high capital requirements for research, development, and manufacturing, acting as a significant barrier to entry for new manufacturers.

Q 7. Explain how you would assess the regulatory environment for a new product or service.

Assessing the regulatory environment is crucial; it’s like checking the rules of a game before playing. Failing to comply can lead to severe consequences.

- Identify Relevant Regulations: Determine which laws, regulations, and standards are applicable to your product or service. This might involve researching at the federal, state, and local levels, depending on your jurisdiction.

- Compliance Requirements: Understand the specific compliance requirements for your product or service, such as labeling, safety standards, and environmental regulations.

- Licensing and Permits: Identify any licenses or permits required to operate legally. This may involve applications and fees.

- Industry-Specific Regulations: Research any industry-specific regulations that might affect your business. Certain industries are heavily regulated (e.g., pharmaceuticals, food and beverage).

- Future Regulatory Changes: Consider potential future regulatory changes that could impact your business, and plan for adaptation.

- Consult Legal Counsel: Engage legal professionals with expertise in relevant regulations to provide guidance and ensure compliance. This is especially important for complex regulatory environments.

For example, a company developing a new pharmaceutical drug would need to navigate stringent regulations related to clinical trials, safety testing, and labeling before it can be brought to market. Ignoring these rules could lead to delays, fines, or even the product being banned.

Q 8. How do you identify and evaluate potential risks and opportunities in a market?

Identifying and evaluating risks and opportunities in a market is crucial for a successful feasibility analysis. It involves a systematic approach, combining qualitative and quantitative methods. Think of it like a detective investigating a crime scene – you need to gather evidence, analyze it, and draw conclusions.

Identifying Risks: This begins with brainstorming potential problems. We use tools like SWOT analysis (Strengths, Weaknesses, Opportunities, Threats), PESTLE analysis (Political, Economic, Social, Technological, Legal, Environmental factors), and Porter’s Five Forces (competitive rivalry, supplier power, buyer power, threat of new entrants, threat of substitutes). For example, a new coffee shop might face risks from high rent (economic), changing consumer preferences (social), strong competition (competitive rivalry), and fluctuating coffee bean prices (supplier power).

Evaluating Opportunities: This involves assessing the market’s potential. We analyze market size, growth rate, and trends. Are there unmet needs or underserved segments? Is there a technological advancement that could create a significant opportunity? For our coffee shop, opportunities might include a growing demand for organic coffee (market trend), the potential to offer unique brewing methods (competitive advantage), or the chance to partner with local businesses (strategic alliance).

Risk Mitigation and Opportunity Capitalization: Once identified, risks need to be assessed for likelihood and impact. We then develop mitigation strategies – for instance, hedging against price fluctuations through long-term contracts for coffee beans. Opportunities are evaluated for their potential return and feasibility. For our coffee shop, a strong marketing strategy would help to capitalize on the demand for organic coffee. The entire process is iterative, meaning we constantly refine our understanding based on new information.

Q 9. What are the common methods used to collect and analyze market data?

Collecting and analyzing market data is the backbone of any feasibility study. We employ a variety of methods, ranging from desk research to primary data collection. Think of it as building a puzzle – each piece of data contributes to a bigger picture.

- Secondary Data: This involves utilizing existing information. Sources include market research reports (like those from Nielsen or Mintel), industry publications, government statistics, and company websites. This provides a broad overview and context.

- Primary Data: This involves gathering original data directly from the target market. Methods include surveys (online, phone, in-person), focus groups, interviews, and observational studies. This provides detailed insights into specific customer needs and preferences.

Data Analysis: Once data is collected, we analyze it using statistical techniques and data visualization. This can involve calculating market size, identifying key trends, and assessing consumer behavior. We might use tools like SPSS or Excel to perform statistical analysis and create charts and graphs to illustrate our findings. For example, we might use regression analysis to predict sales based on marketing spend or customer segmentation analysis to identify distinct customer groups.

Q 10. How do you determine the target market for a new product or service?

Defining your target market is like finding the right key to unlock a door. A well-defined target market ensures effective marketing and resource allocation. We use a combination of demographic, psychographic, geographic, and behavioral factors to segment the market and identify ideal customers.

Demographic Segmentation: This involves dividing the market based on age, gender, income, education, occupation, family size, etc. For instance, a luxury car targets high-income individuals.

Psychographic Segmentation: This focuses on consumers’ lifestyles, values, attitudes, and interests. For example, a yoga studio might target individuals who value health and wellness.

Geographic Segmentation: This involves dividing the market based on location (country, region, city, etc.). A regional bakery might focus on a specific neighborhood.

Behavioral Segmentation: This involves grouping consumers based on their purchasing behavior, usage rate, brand loyalty, etc. A coffee shop might target frequent coffee drinkers.

Creating a Target Market Profile: By combining these segments, we create a detailed profile of our ideal customer. This profile guides all aspects of our marketing and product development efforts, ensuring we’re focusing our resources on the most promising customer group.

Q 11. Explain the importance of market segmentation in a feasibility analysis.

Market segmentation is paramount in feasibility analysis because it allows for a focused and efficient approach. Instead of trying to please everyone, we concentrate on specific customer groups with similar needs and preferences. This leads to more accurate forecasting, more targeted marketing, and improved resource allocation.

Improved Accuracy: By focusing on specific segments, we develop more precise sales forecasts and resource allocation plans. Imagine trying to sell a high-end luxury watch to everyone; your marketing message would be diluted and less effective. Instead, focusing on a specific segment of high-net-worth individuals would lead to better results.

Targeted Marketing: Segmentation allows for tailored marketing messages that resonate with specific customer groups. A campaign targeting young adults will differ significantly from one targeting senior citizens. This leads to higher conversion rates and a better return on investment.

Efficient Resource Allocation: By understanding our target market, we can allocate resources more effectively. We avoid wasting money on marketing efforts that won’t reach our ideal customers. For example, we wouldn’t advertise a children’s product in a business magazine.

Q 12. How do you evaluate the financial feasibility of a new venture?

Evaluating the financial feasibility of a new venture involves assessing its potential profitability and viability. It’s like evaluating an investment – you want to know if it’s likely to generate a positive return.

Cost Analysis: We start by determining all costs associated with the venture, including startup costs (equipment, marketing, licenses), operating costs (rent, salaries, utilities), and financing costs (interest payments on loans).

Revenue Projection: We then estimate potential revenues based on our market analysis, pricing strategy, and sales forecasts. This involves considering factors such as market size, competition, and pricing elasticity.

Profitability Analysis: We compare projected revenues and costs to determine profitability. Key metrics include net present value (NPV), internal rate of return (IRR), and payback period. A positive NPV indicates profitability, a higher IRR signifies a better return, and a shorter payback period implies faster recovery of investment.

Sensitivity Analysis: To account for uncertainty, we perform sensitivity analysis. This involves varying key assumptions (e.g., sales volume, cost of goods sold) to see how it impacts profitability. This helps to identify areas of high risk and allows us to plan for contingencies.

Break-Even Analysis: This determines the sales volume required to cover all costs. It gives us a critical benchmark to assess the venture’s viability.

Q 13. How do you develop financial projections for a market feasibility analysis?

Developing financial projections for a market feasibility analysis requires a careful and methodical approach. It’s like creating a roadmap for your business’s financial future. We start with a clear understanding of our target market and sales forecasts.

Sales Forecasts: These are based on market research data, sales history (if available), and industry trends. We might use different forecasting models, such as time series analysis or regression analysis.

Cost Projections: These include both fixed costs (rent, salaries) and variable costs (materials, shipping). We base these on our operational plan and market conditions.

Financial Statements: We develop key financial statements, including projected income statements, balance sheets, and cash flow statements. These statements show the financial performance and position of the business over time.

Assumptions and Scenarios: We clearly state the assumptions underlying our projections. We might also develop multiple scenarios (best-case, worst-case, base-case) to assess the impact of uncertainty. This helps to make our analysis more robust and credible.

Spreadsheet Software: Tools like Excel are essential for creating and managing these financial projections. We can use formulas and functions to automate calculations and perform sensitivity analysis.

Q 14. What are the key financial metrics used to evaluate market feasibility?

Several key financial metrics are used to evaluate market feasibility. These metrics provide a quantitative assessment of the venture’s potential profitability and viability.

- Net Present Value (NPV): The difference between the present value of cash inflows and the present value of cash outflows over a period of time. A positive NPV indicates that the project is expected to be profitable.

- Internal Rate of Return (IRR): The discount rate that makes the NPV of a project zero. A higher IRR indicates a more attractive investment.

- Payback Period: The length of time it takes for the cumulative cash inflows from a project to equal the initial investment. A shorter payback period is generally preferred.

- Break-Even Point: The point where total revenue equals total costs. This indicates the sales volume needed to achieve profitability.

- Profit Margin: The percentage of revenue that remains after deducting all expenses. A higher profit margin indicates greater profitability.

- Return on Investment (ROI): A measure of the profitability of an investment. It is calculated by dividing the net profit by the investment cost. A higher ROI indicates a better return.

The specific metrics used will depend on the nature of the venture and the goals of the analysis. However, these metrics provide a comprehensive picture of the venture’s financial potential.

Q 15. How do you assess the potential return on investment (ROI) for a new venture?

Assessing the potential return on investment (ROI) for a new venture is crucial for securing funding and making informed business decisions. It involves projecting future revenue streams against the initial investment and ongoing operational costs. We don’t just look at a single number; we create a comprehensive ROI model that considers various scenarios and uncertainties.

Steps to assessing ROI:

- Project Revenue: This requires thorough market research to estimate market size, target customer segments, pricing strategies, and projected sales volume. For example, if launching a new coffee shop, we’d consider the local population, competition, average transaction value, and projected customer traffic.

- Estimate Costs: This includes start-up costs (e.g., equipment, licenses, initial marketing), ongoing operational expenses (e.g., rent, salaries, utilities, marketing), and potential contingencies. For the coffee shop, this includes the cost of equipment, leasehold improvements, ingredient costs, and staff wages.

- Calculate Net Profit: Subtract total costs from projected revenue to determine the net profit over a specific period (e.g., 3-5 years).

- Determine ROI: The basic ROI formula is:

(Net Profit / Total Investment) x 100%. However, we often use more sophisticated discounted cash flow (DCF) analysis to account for the time value of money, reflecting that a dollar today is worth more than a dollar in the future. - Sensitivity Analysis: This crucial step involves testing the ROI under different assumptions (e.g., variations in sales, costs, market growth). This allows us to identify key risk factors and their potential impact on the overall profitability.

For instance, we might create three scenarios: best-case, most-likely, and worst-case, to provide a realistic range of potential ROI outcomes.

Career Expert Tips:

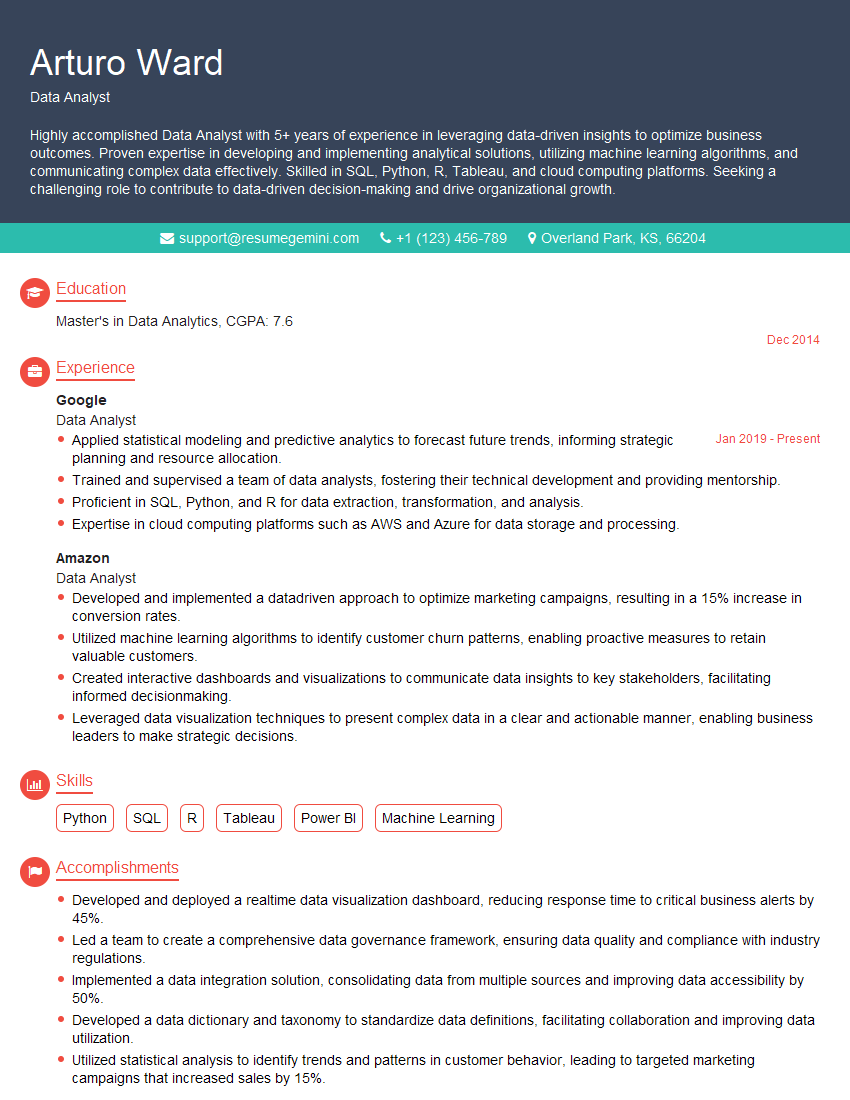

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. What are the common pitfalls to avoid when conducting a market feasibility analysis?

Many pitfalls can derail a market feasibility analysis. Avoiding these requires careful planning, rigorous methodology, and a healthy dose of skepticism.

- Insufficient Market Research: Relying on assumptions rather than data-driven insights leads to inaccurate projections. Thorough primary and secondary research is vital.

- Ignoring Competition: Failing to adequately analyze competitors’ strengths, weaknesses, and market share can lead to unrealistic market penetration goals.

- Overly Optimistic Projections: Inflated sales forecasts, underestimated costs, and unrealistic market growth assumptions are common mistakes. Employing conservative estimations is recommended.

- Neglecting Qualitative Data: Focusing solely on quantitative data (numbers) can miss crucial insights from customer feedback, interviews, and market sentiment.

- Lack of a Clear Target Market: A poorly defined target market makes it difficult to tailor marketing strategies and product development effectively.

- Ignoring External Factors: Macroeconomic conditions, regulatory changes, and technological disruptions can significantly affect market viability. Failing to account for these can lead to inaccurate conclusions.

For example, a company might overlook a new competitor’s innovative technology that could significantly disrupt their market share projections. Or they might underestimate the impact of rising inflation on raw material costs.

Q 17. How do you present your findings from a market feasibility study?

Presenting market feasibility study findings requires clarity, conciseness, and visual appeal. The goal is to effectively communicate complex information to stakeholders, who may not be experts in market analysis.

- Executive Summary: A concise overview of the key findings, recommendations, and implications.

- Market Overview: Detailed analysis of market size, growth trends, segmentation, and key characteristics.

- Competitive Analysis: A comprehensive review of existing competitors, their strengths, weaknesses, and market strategies.

- Target Market Analysis: A description of the ideal customer profile, their needs, behaviors, and purchasing patterns.

- Financial Projections: Detailed revenue projections, cost estimates, and ROI calculations, presented in clear charts and tables.

- SWOT Analysis: Identification of the venture’s strengths, weaknesses, opportunities, and threats.

- Recommendations: Clear and actionable recommendations based on the study’s findings.

- Appendices (optional): Detailed data tables, survey results, and other supporting documentation.

Visualizations, such as charts, graphs, and maps, are essential to enhance understanding and engagement. The presentation should be tailored to the audience; a presentation to investors will differ from one for internal stakeholders.

Q 18. How do you handle conflicting data or assumptions in a market feasibility study?

Conflicting data or assumptions are common in market feasibility studies. Handling them effectively involves critical thinking, triangulation, and sensitivity analysis.

- Identify the Source of Conflict: Pinpoint the discrepancies and determine their origin (e.g., outdated data, conflicting methodologies, differing assumptions).

- Evaluate Data Quality: Assess the reliability and validity of the conflicting data sources. Consider factors such as sample size, data collection methods, and potential biases.

- Triangulation: Use multiple data sources to corroborate findings. If possible, gather additional data to resolve the conflict.

- Sensitivity Analysis: Test the impact of varying assumptions on the overall conclusions. This helps determine which assumptions are most critical and how much impact variations have on the overall results.

- Qualitative Insights: Use qualitative data (e.g., customer interviews, focus groups) to contextualize and interpret quantitative findings. This can help resolve inconsistencies.

- Document Assumptions and Limitations: Clearly state any assumptions and limitations of the analysis, acknowledging any unresolved conflicts.

For example, if one survey suggests high demand for a product, while another shows low interest, you might investigate the differences in survey methodologies, target audiences, or timing. You may need to conduct further research to reconcile the conflicting information.

Q 19. How do you incorporate qualitative data into your market feasibility analysis?

Incorporating qualitative data is crucial for enriching the market feasibility analysis and providing a more nuanced understanding. Quantitative data tells you ‘what’, while qualitative data helps explain ‘why’.

- Customer Interviews: Gaining in-depth understanding of customer needs, preferences, and pain points.

- Focus Groups: Facilitated discussions with target customers to explore their attitudes, opinions, and behaviors.

- Surveys (Open-ended Questions): Gathering rich textual data that goes beyond simple multiple-choice answers.

- Social Media Monitoring: Tracking conversations and sentiment related to your industry and products.

- Competitor Analysis (Qualitative): Examining competitor marketing materials, reviews, and customer feedback to understand their strengths, weaknesses, and positioning.

For example, if your quantitative data shows declining sales, qualitative data from customer interviews could reveal that customers are unhappy with a specific feature of your product. This insight allows for targeted improvement and product development.

Qualitative data can be analyzed using techniques such as thematic analysis, grounded theory, or content analysis. Software tools can assist with this process, allowing for coding and categorization of the data.

Q 20. How do you adapt your market feasibility analysis approach based on different industries?

The approach to market feasibility analysis adapts based on industry specifics. Factors such as regulatory environments, technological advancements, and competitive landscapes vary significantly across industries.

- Technology-driven Industries: Focus on technological advancements, innovation cycles, and intellectual property protection. The analysis needs to consider rapid technological obsolescence and the potential for disruptive technologies.

- Consumer Goods Industries: Emphasis on brand awareness, consumer preferences, and marketing strategies. The analysis should account for changing consumer tastes, trends, and seasonal fluctuations.

- Healthcare Industries: Strict regulatory requirements (e.g., FDA approvals), ethical considerations, and lengthy approval processes need to be integrated into the analysis. Market research needs to consider clinical trials, regulatory compliance, and reimbursement strategies.

- B2B Industries: Focus on key business relationships, industry standards, and sales cycles. The analysis should account for the decision-making processes of businesses and potential long-term contracts.

For instance, a feasibility study for a new pharmaceutical drug requires a very different approach compared to one for a new mobile app. The regulatory hurdles, time to market, and market entry strategies are drastically different.

Q 21. What software or tools do you use for market research and analysis?

Numerous software and tools assist in market research and analysis. The choice depends on budget, research needs, and technical expertise.

- SurveyMonkey, Qualtrics: For creating and distributing online surveys.

- SPSS, R, Stata: For statistical analysis of quantitative data.

- NVivo, Atlas.ti: For qualitative data analysis.

- SEMrush, Ahrefs: For competitive keyword research and SEO analysis.

- Google Analytics, SimilarWeb: For website traffic analysis and competitor benchmarking.

- Databases (e.g., IBISWorld, Statista): Access to industry reports, market data, and consumer demographics.

- Excel, Google Sheets: For data management, calculation, and visualization.

The use of these tools often involves a combination of different software to collect, analyze, and visualize the data effectively.

For example, I might use Qualtrics to conduct a customer survey, then use SPSS to analyze the quantitative data, and NVivo to analyze the qualitative open-ended responses. Finally, I use Excel to create visualizations and consolidate all the findings into a comprehensive report.

Q 22. Describe a situation where a market feasibility analysis helped you make a critical decision.

Market feasibility analysis was crucial in deciding whether to launch a new line of sustainable, ethically sourced coffee. We were a small, established roaster considering expansion. Initially, the idea seemed promising, but we needed concrete data. The analysis involved surveying consumer preferences regarding sustainability, pricing sensitivity for premium coffee, and identifying potential competitor activity. We used a combination of quantitative (surveys, sales data analysis) and qualitative (focus groups) methods. The results showed a significant untapped market segment willing to pay a premium for ethically sourced coffee, but also highlighted potential challenges in sourcing sufficient quantities of certified beans. This informed our decision to proceed, but with a phased rollout focusing initially on a smaller, more manageable geographic area to mitigate the supply chain risk. The analysis allowed us to avoid a potentially costly mistake by identifying market limitations and helping us refine our go-to-market strategy.

Q 23. How do you ensure the accuracy and reliability of your data in a market feasibility study?

Data accuracy is paramount. I employ a multi-pronged approach. First, I rely on multiple sources, triangulating information from market research reports, industry databases (like Statista or IBISWorld), government statistics, and company financial statements. This cross-referencing helps identify inconsistencies and biases. Second, I meticulously assess the methodology used by each data source, verifying sampling techniques, response rates, and potential limitations. Third, I perform data cleaning and validation to identify and correct errors, outliers, and inconsistencies. This often involves using statistical methods to check for normality, identify missing values and applying appropriate imputation techniques. Finally, I always clearly document my data sources and methodology, ensuring transparency and reproducibility. Think of it like building a house – you wouldn’t rely on just one supplier for materials, and you’d certainly check the quality before using them.

Q 24. What is your approach to incorporating customer feedback into your analysis?

Customer feedback is invaluable. I actively incorporate it throughout the analysis, not just at the end. I use a variety of methods, including online surveys, focus groups, social media listening, and customer reviews. For example, during the coffee launch, we conducted online surveys to gauge consumer preferences for different coffee bean origins, roast levels, and packaging options. Focus groups provided deeper insights into consumers’ perceptions of ethical sourcing and willingness to pay a premium. We also monitored social media to understand current discussions and identify emerging trends. This iterative approach allows us to adapt the study and refine our conclusions as we gather more data. It’s a continuous feedback loop, ensuring our analysis remains relevant and grounded in customer needs.

Q 25. How do you handle uncertainty and risk in your market projections?

Uncertainty is inherent in market projections. To address it, I use a combination of techniques. Firstly, I develop multiple scenarios – best-case, base-case, and worst-case – based on different assumptions about key market factors. This gives a range of potential outcomes, rather than just a single point estimate. Secondly, I incorporate sensitivity analysis to understand how changes in key variables (like pricing, competition, or consumer demand) will affect our projections. Thirdly, I use Monte Carlo simulations, a statistical technique that models the probability of different outcomes based on the uncertainty associated with input variables. The results are presented visually, often as probability distributions, clearly showing the range of possible outcomes and their likelihood. This provides a more nuanced and realistic picture compared to single-point forecasts, allowing for more informed risk management.

Q 26. How do you communicate complex market data to non-technical audiences?

Communicating complex data effectively to non-technical audiences requires clear, concise messaging and strong visuals. I avoid jargon, using simple language and relatable analogies. Instead of focusing on statistical significance, I focus on the practical implications of the findings. I employ visual aids like charts, graphs, and infographics to highlight key trends and insights. For instance, instead of saying ‘the coefficient of determination (R-squared) is 0.8’, I might say ‘this model explains 80% of the variation in sales, indicating a strong relationship between our marketing spend and sales growth.’ Storytelling is a powerful tool. I weave the data into a narrative that resonates with the audience, focusing on what it means for the business and its stakeholders.

Q 27. Describe your experience using different market research methodologies.

My experience spans a range of methodologies. I’m proficient in quantitative methods like surveys (both online and in-person), experimental design, and statistical analysis (regression, forecasting, etc.). I also have extensive experience with qualitative methods, including focus groups, in-depth interviews, ethnographic studies, and social media listening. The choice of methodology depends on the research question and available resources. For example, a large-scale survey might be appropriate for measuring market size, while focus groups are better for understanding consumer attitudes and motivations. Often, a mixed-methods approach, combining quantitative and qualitative data, provides the most comprehensive and nuanced understanding.

Q 28. How do you prioritize different aspects of a market feasibility study given time constraints?

Prioritization under time constraints requires a strategic approach. I begin by clearly defining the key objectives of the study and focusing on the most critical aspects that directly inform the decision-making process. I use a prioritization matrix to rank different aspects based on their importance and urgency. For example, understanding market size and customer needs are generally higher priority than detailed competitor analysis in early-stage feasibility studies. I might choose to use more efficient data collection methods (e.g., secondary research over primary research) when time is short. Automation tools can streamline data analysis and reporting. It’s crucial to be clear about the scope of the study upfront, focusing on delivering timely, actionable insights that directly address the business problem, rather than aiming for exhaustive analysis.

Key Topics to Learn for Market Feasibility Analysis Interview

- Market Sizing and Segmentation: Understanding different market sizing techniques (top-down, bottom-up) and effectively segmenting the target market based on demographics, psychographics, and behavior. Practical application: Developing a robust market sizing model for a new product launch.

- Competitive Analysis: Identifying key competitors, analyzing their strengths and weaknesses, and understanding their market share. Practical application: Creating a competitive landscape map to inform strategic decisions.

- Demand Forecasting: Utilizing various forecasting methods (qualitative and quantitative) to project future demand for a product or service. Practical application: Building a demand forecast model to justify investment in a new venture.

- Market Entry Strategies: Evaluating different market entry strategies (direct investment, joint ventures, licensing) and their implications for market penetration. Practical application: Developing a market entry strategy for international expansion.

- Financial Analysis: Assessing the financial viability of a market opportunity, including profitability analysis, break-even analysis, and return on investment (ROI) calculations. Practical application: Creating a comprehensive financial model to support a market feasibility study.

- Risk Assessment: Identifying and evaluating potential risks associated with entering a specific market, including market risks, competitive risks, and regulatory risks. Practical application: Developing a mitigation plan to address identified risks.

- SWOT Analysis and Strategic Planning: Integrating all the above analyses into a cohesive SWOT analysis and formulating a clear strategic plan based on the findings. Practical Application: Developing a strategic plan to capitalize on market opportunities and mitigate potential threats.

Next Steps

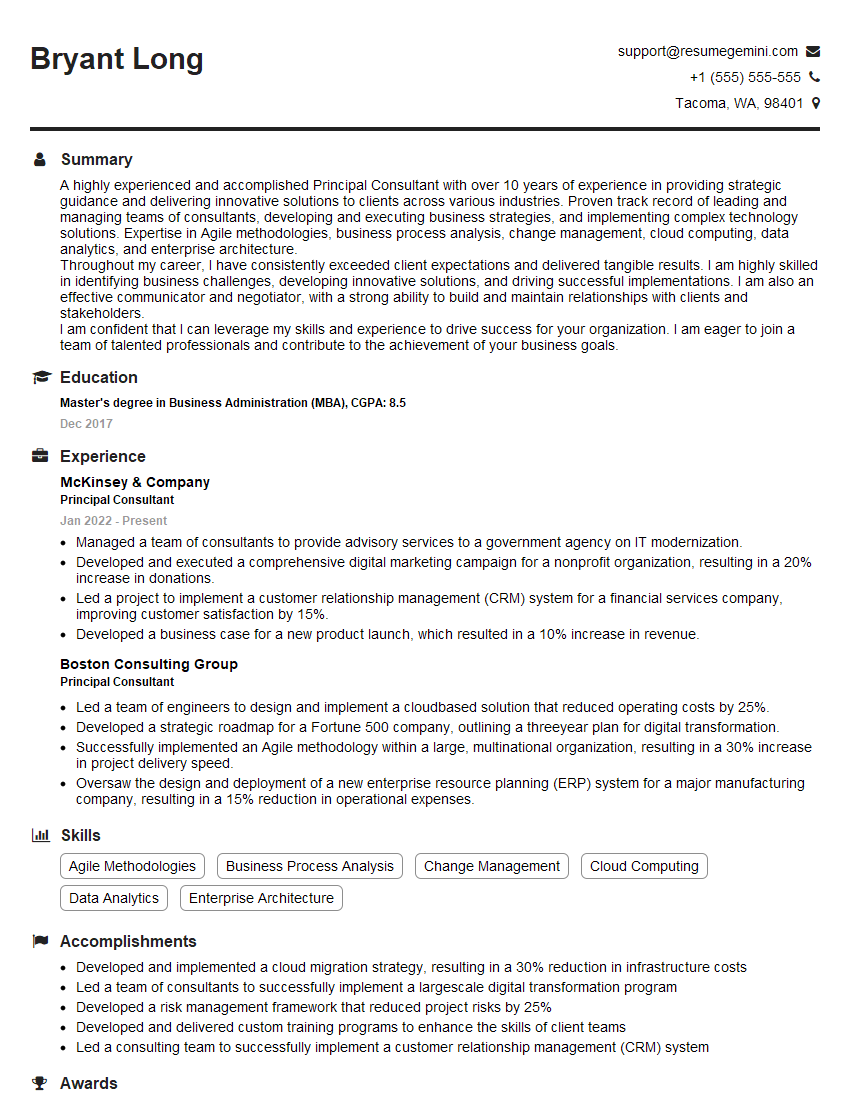

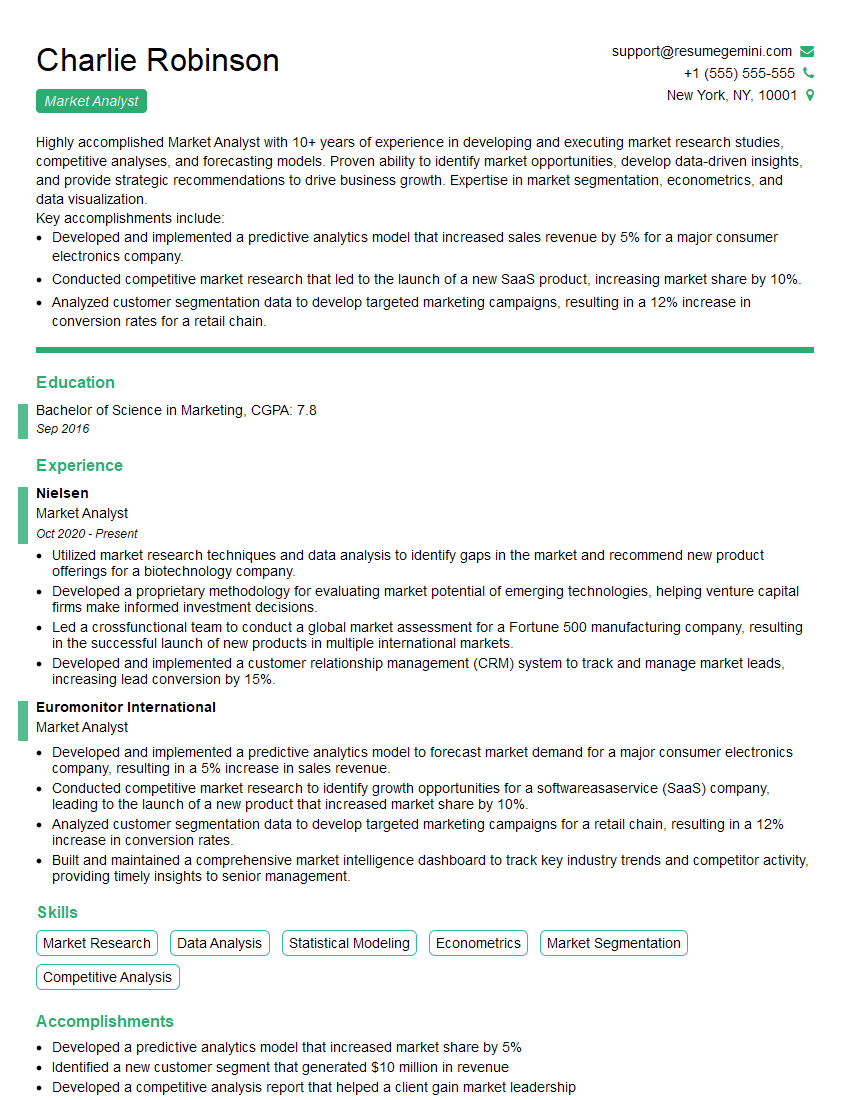

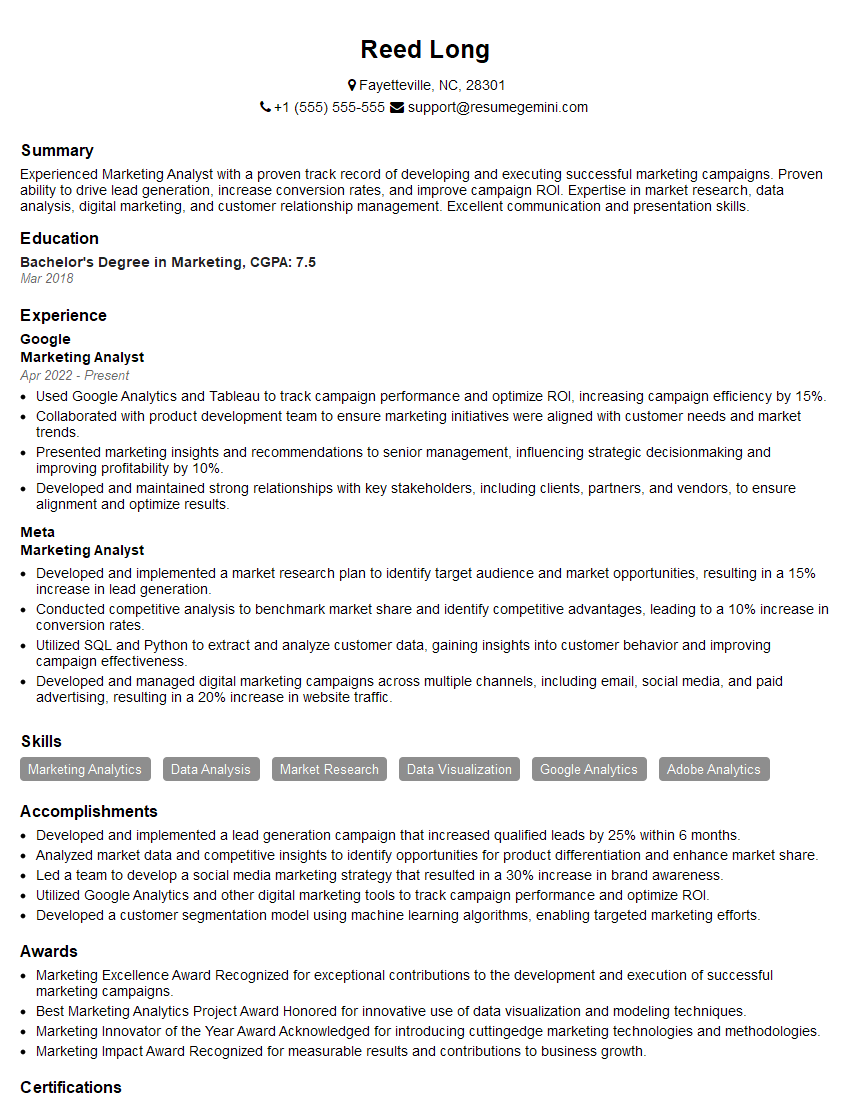

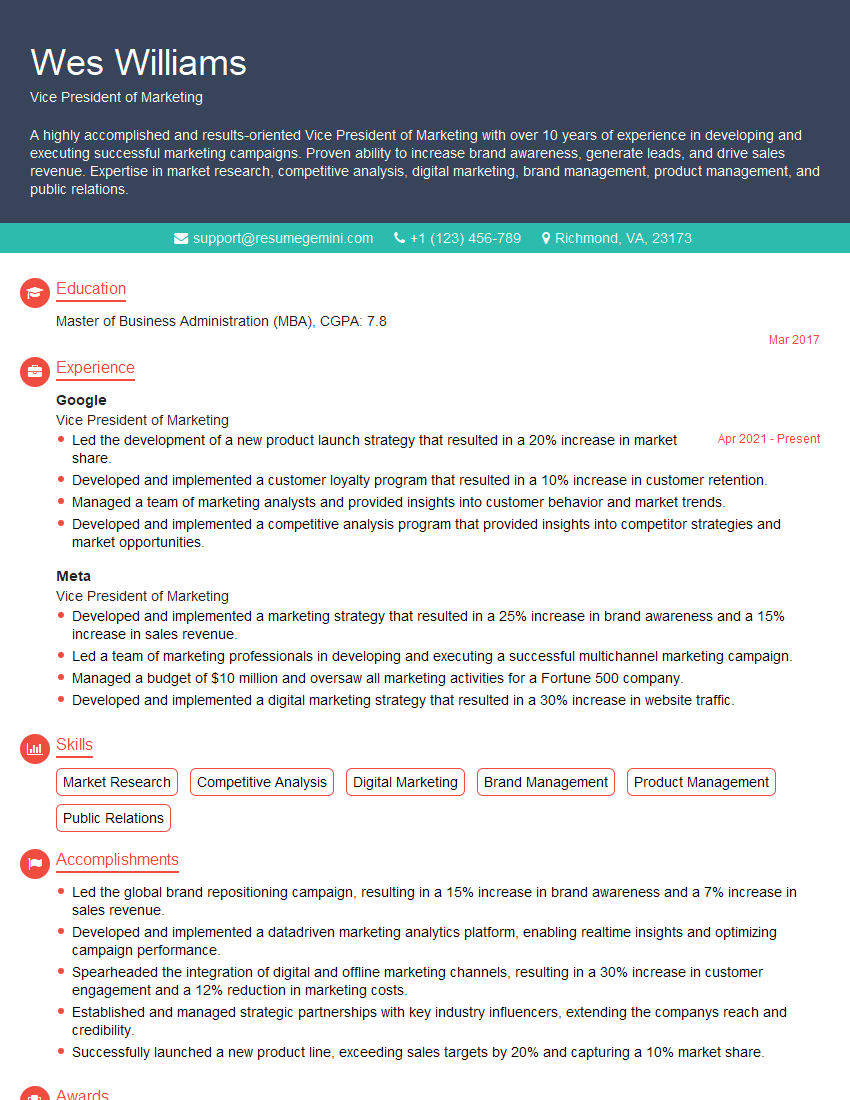

Mastering Market Feasibility Analysis is crucial for career advancement in business development, market research, and strategic planning roles. A strong understanding of these concepts demonstrates valuable analytical and problem-solving skills highly sought after by employers. To significantly improve your job prospects, create an ATS-friendly resume that highlights your key skills and accomplishments. ResumeGemini is a trusted resource that can help you build a professional and impactful resume tailored to the specific requirements of market research roles. Examples of resumes tailored to Market Feasibility Analysis are available to help guide you.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

I Redesigned Spongebob Squarepants and his main characters of my artwork.

https://www.deviantart.com/reimaginesponge/art/Redesigned-Spongebob-characters-1223583608

IT gave me an insight and words to use and be able to think of examples

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO