The thought of an interview can be nerve-wracking, but the right preparation can make all the difference. Explore this comprehensive guide to Paystub Verification interview questions and gain the confidence you need to showcase your abilities and secure the role.

Questions Asked in Paystub Verification Interview

Q 1. What are the common methods used for paystub verification?

Paystub verification methods vary depending on the context, but generally fall into a few key categories. The most common include:

- Direct Employer Contact: This is the gold standard. We directly contact the employer’s payroll department (via phone or email) to confirm employment and income details. This allows for immediate clarification on any discrepancies.

- Online Verification Services: Many third-party services specialize in verifying employment and income data using secure online platforms. These services often provide immediate results and are a reliable alternative when direct contact isn’t feasible or efficient.

- Document Review: While not a verification method on its own, a thorough review of the paystub itself is crucial. We look for inconsistencies, formatting errors, and data anomalies that might signal fraud or inaccuracies. This involves checking details against known employer information if available.

- Third-Party Paystub Processors: Some employers use third-party payroll processors. In such cases, we might need to contact the processor directly for verification.

The best method depends on the level of verification needed, the resources available, and the urgency of the situation. Often a combination of methods is employed for robust verification.

Q 2. Explain the process of verifying a paystub’s authenticity.

Verifying a paystub’s authenticity is a multi-step process requiring attention to detail and a critical eye. It begins with a visual inspection, looking for professional formatting and company branding. Then, we move to data verification:

- Check for consistency: Do the dates, pay periods, and amounts match what’s expected based on other documents or information provided?

- Employer Information: Is the employer’s name, address, and contact information accurate and verifiable? We often use online resources to cross-check this.

- Employee Details: Verify that the employee’s name, address, social security number (or equivalent), and other identifying information match the provided documentation.

- Calculations: We check to ensure the gross pay, deductions (taxes, insurance, etc.), and net pay are all mathematically consistent. Errors here are a significant red flag.

- Signatures and Seals: Some paystubs include official signatures or company seals; these should be reviewed for authenticity. However, digital signatures and electronic paystubs are increasingly common and must be verified through the employer or relevant service.

Throughout the process, I maintain thorough documentation of all steps and findings. This meticulous approach ensures both accuracy and a clear audit trail.

Q 3. How do you identify potential red flags or inconsistencies in a paystub?

Identifying inconsistencies is key to detecting fraudulent or inaccurate paystubs. Several red flags should raise suspicion:

- Obvious Typos or Formatting Errors: Misspellings, inconsistent fonts, or unprofessional formatting can indicate a fake paystub.

- Unusual Pay Amounts: Significantly high or low pay relative to the claimed position or industry norms is a major warning sign.

- Inconsistent Data: Discrepancies between the gross pay, deductions, and net pay suggest a calculation error or intentional manipulation.

- Missing or Incomplete Information: A paystub missing crucial details, such as employer contact information or the employee’s social security number, is extremely suspicious.

- Unfamiliar Employer: If the employer is unknown or difficult to verify, it warrants extra scrutiny.

- Suspect Addresses or Contact Details: Mismatched or non-existent contact information is a key indicator of a potentially fraudulent paystub.

- Unusual Deductions: Unidentified or unusually high deductions could suggest attempts to manipulate the paystub’s appearance.

Experienced verification professionals can spot subtle inconsistencies that might go unnoticed by others. For example, a slight discrepancy in the formatting of a tax ID number might be insignificant to a lay person but reveal a fraudulent copy to a trained eye.

Q 4. What are the legal and regulatory considerations related to paystub verification?

Legal and regulatory considerations concerning paystub verification are significant and vary depending on jurisdiction and the specific purpose of the verification. Key aspects include:

- Data Privacy Regulations (GDPR, CCPA, etc.): We must strictly adhere to relevant data privacy laws when handling sensitive personal and financial information like that found on paystubs. This includes obtaining explicit consent where necessary and implementing robust security measures.

- Fair Credit Reporting Act (FCRA) Compliance (US): If paystub verification is part of a credit reporting process, strict adherence to the FCRA is mandatory. This involves ensuring accuracy, providing proper notices, and allowing individuals to dispute information.

- Employment Laws: Employers may have internal policies or legal obligations concerning the release of employee data. We must respect those policies and never attempt to obtain information illicitly.

- Data Security Regulations: Handling paystub data necessitates robust security measures to prevent unauthorized access and data breaches. This usually involves secure data storage, encryption, and access control protocols.

Non-compliance with these regulations can lead to significant legal and financial consequences. As such, it’s imperative to stay abreast of evolving legal requirements and best practices in data handling.

Q 5. How do you handle discrepancies or missing information on a paystub?

Discrepancies or missing information require a systematic approach:

- Identify the Discrepancy: Clearly define what information is missing or inconsistent.

- Attempt to Resolve Discrepancies Internally: If possible, try to resolve the issue by reviewing internal documentation or using any available online resources that might verify the employer or data.

- Contact the Employer (if possible): Directly contact the employer’s payroll department to clarify the discrepancies or request the missing information.

- Document All Attempts: Maintain detailed records of all attempts made to resolve the issue, including dates, methods of contact, and outcomes.

- Escalate (if Necessary): If all internal attempts are unsuccessful, escalate the issue to the appropriate authorities or stakeholders based on the circumstances of the verification.

Transparency and meticulous record-keeping are crucial in handling discrepancies. Proper documentation safeguards against potential disputes and demonstrates due diligence.

Q 6. Describe your experience with different paystub formats and systems.

My experience encompasses a wide range of paystub formats and systems, including:

- Paper Paystubs: I have extensive experience with manually reviewing and verifying traditional paper paystubs, assessing their authenticity based on visual cues and internal consistency checks.

- Electronic Paystubs (PDFs, Online Portals): I’m proficient in handling various electronic paystub formats, using secure methods to verify their authenticity and integrity. This includes understanding digital signatures and security protocols.

- Different Payroll Software: I’ve worked with paystubs generated by numerous payroll software systems, understanding their variations in formatting and data presentation. Examples include ADP, Paychex, and various custom solutions.

- International Paystubs: My experience extends to international paystubs, recognizing that regulations and formatting standards differ across countries. This involves careful consideration of local laws and standards.

This broad experience allows me to adapt quickly to different formats and systems, ensuring consistent accuracy and efficiency in the verification process. I also maintain a library of commonly used formats for quicker analysis.

Q 7. How do you ensure the confidentiality and security of paystub data?

Confidentiality and security are paramount when handling paystub data. My approach incorporates several key elements:

- Secure Data Storage: All paystub data is stored securely using encrypted databases and access control measures, restricting access to authorized personnel only.

- Data Encryption: Data transmission and storage are protected using robust encryption techniques, safeguarding against unauthorized access and interception.

- Access Control: Strict access control policies limit access to sensitive data based on the principle of least privilege. Only authorized personnel with a legitimate need to access the data are granted permission.

- Data Minimization: We only collect and retain the minimum necessary data to complete the verification process, reducing the risk of exposure.

- Compliance with Regulations: All handling of paystub data strictly adheres to relevant data privacy regulations (GDPR, CCPA, etc.), ensuring legal compliance and protecting individual rights.

- Regular Security Audits: Regular security audits and penetration testing are conducted to identify and address potential vulnerabilities in our systems and processes.

I treat every paystub with the utmost confidentiality, adhering to strict ethical and legal standards for data handling. Data breaches are taken extremely seriously, and preventative measures are continuously reviewed and updated.

Q 8. What are the potential risks associated with inaccurate paystub verification?

Inaccurate paystub verification carries significant risks, impacting both the individual and the organization. For individuals, it can lead to denied loans, rental applications, or employment opportunities. For organizations, inaccurate verification can result in hiring unsuitable candidates, financial losses due to fraudulent claims, and reputational damage. For example, if a loan application is rejected because of a wrongly interpreted paystub, the individual faces financial hardship, while the lender risks a missed opportunity.

- Financial Risk: Incorrect income information can lead to incorrect loan amounts, insurance premiums, or child support calculations.

- Legal Risk: Misrepresenting income can have legal ramifications, particularly in cases of fraud or tax evasion.

- Reputational Risk: For companies, inaccurate verification reflects poorly on their due diligence practices and can damage their credibility.

Q 9. How do you prioritize verification requests when faced with multiple deadlines?

Prioritizing verification requests with multiple deadlines requires a systematic approach. I utilize a prioritization matrix that considers urgency and importance. Urgency is determined by the deadline, while importance is assessed based on the potential impact of a delay. For instance, a verification needed for a time-sensitive job offer would be prioritized over one for a less urgent background check. I often use a Kanban board or similar project management tool to visualize the workflow and deadlines, ensuring efficient task management.

This ensures that critical verifications are completed first, minimizing potential disruptions and ensuring timely processing. Additionally, open communication with stakeholders about potential delays allows for better coordination and helps manage expectations.

Q 10. What is your experience with automated paystub verification tools or software?

I have extensive experience with automated paystub verification tools and software. I’ve worked with platforms that utilize optical character recognition (OCR) to extract data from paystubs, and I’m proficient in validating the extracted data against various payroll databases. These tools significantly increase efficiency and accuracy compared to manual verification. For example, a tool could automatically flag inconsistencies like discrepancies between reported income and tax withholdings, which a human might miss. I’m also familiar with platforms that allow for secure data exchange and compliance with data privacy regulations.

My experience extends to integrating these tools into existing workflows to streamline processes. I’ve participated in selecting, implementing, and training staff on the use of such software.

Q 11. How do you communicate verification results to stakeholders?

Communicating verification results requires clear, concise, and professional language, tailored to the specific stakeholder. For internal stakeholders, a summary report with key findings and data points would suffice. External stakeholders, like lenders or landlords, may need a formal verification letter adhering to their specific requirements. In either case, I ensure the communication is timely and contains all necessary information, including the verification status, any discrepancies noted, and contact information for any follow-up questions.

I always maintain professional and neutral language, avoiding any judgment or interpretation of the findings beyond the objective data.

Q 12. Describe your approach to resolving disputes related to paystub verification.

Resolving disputes requires a methodical and thorough approach. The first step involves carefully reviewing the disputed paystub and all supporting documentation. If the discrepancy is due to a simple error – for example, a typographical error – a correction is communicated immediately. If the issue involves a more complex discrepancy, I will contact the employer directly through official channels to clarify the information. This ensures that we gather data from the primary source and prevent misinterpretations.

Throughout the process, maintaining thorough documentation of every step is crucial. This transparency ensures accountability and helps in resolving the issue in a timely manner. If a resolution cannot be reached, escalation to a supervisor or legal counsel might be necessary.

Q 13. Explain the differences between gross pay, net pay, and other pay components.

Understanding the difference between gross pay, net pay, and other pay components is fundamental to paystub verification. Gross pay represents the total amount earned before any deductions. Net pay, also known as take-home pay, is the amount received after all deductions are made. These deductions include:

- Taxes: Federal, state, and local income taxes; Social Security and Medicare taxes.

- Insurance Premiums: Health, dental, vision, and life insurance.

- Retirement Contributions: 401(k) or other retirement plan contributions.

- Other Deductions: Garnishments, union dues, charitable contributions.

Understanding these components helps in verifying the accuracy and consistency of the data presented on the paystub.

Q 14. How do you verify the employment history of a candidate using paystubs?

Paystubs themselves don’t directly provide a comprehensive employment history. However, they serve as a crucial piece of evidence in verifying employment. To verify employment history using paystubs, I would corroborate the information on the paystubs with other supporting documents, such as:

- Employment verification letters: Directly contacting the employer and requesting an official verification letter confirming employment dates and positions.

- Tax returns: W-2 forms can provide independent verification of income and employment history reported to the IRS.

- Previous paystubs: Comparing multiple paystubs to see consistency in employment information like employer name, address, and employee ID.

By cross-referencing the data from multiple sources, a more complete and accurate picture of the candidate’s employment history can be assembled. Discrepancies between sources warrant further investigation.

Q 15. How do you handle situations where a candidate refuses to provide a paystub?

When a candidate refuses to provide a paystub, I begin by understanding their reason. Sometimes, there are legitimate concerns about privacy or the nature of their employment (e.g., contract work with inconsistent pay). I explain the importance of the verification in the context of the application process, emphasizing that it’s a standard procedure to verify income and employment history for risk mitigation and to ensure the candidate’s financial stability. I then explore alternative verification methods. This could include requesting bank statements (with redactions of sensitive information) or offering alternative proof of income like tax returns. If these alternatives are unsatisfactory or unavailable, I would explain to the candidate that their inability to provide sufficient verification will unfortunately preclude them from further consideration. This situation is always handled with sensitivity and professionalism, avoiding any judgmental language or actions.

For example, if a candidate explains they’re a freelancer, I might request a summary of income from their clients for the last three months instead of a traditional paystub.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. What are the ethical considerations involved in paystub verification?

Ethical considerations in paystub verification are paramount. The primary concern is protecting the candidate’s privacy. Only necessary information should be requested and viewed, following data protection regulations (like GDPR or CCPA). The information should be treated with strict confidentiality and handled securely, with appropriate access controls in place. Transparency is also key—candidates should be informed of why their income needs verification and how the information will be used. Finally, it’s crucial to avoid any discriminatory practices or bias based on the information provided. For instance, verifying income shouldn’t unfairly disadvantage candidates from specific employment sectors or with particular income patterns.

Imagine reviewing a paystub and accidentally noticing information unrelated to income, like a candidate’s medical condition. Ethical behavior dictates ignoring such information and focusing solely on the relevant financial data.

Q 17. How familiar are you with different types of income verification documents?

I’m familiar with a wide range of income verification documents, including traditional paystubs, bank statements, tax returns (W-2s, 1099s), offer letters, and employment verification letters from employers. I’m also aware of alternative documentation for self-employed individuals, such as invoices, contracts, and profit and loss statements. The acceptability of a document depends on the specifics of the role and the organization’s policies. For example, a recent paystub is generally preferred, but for self-employed individuals, a history of bank deposits or tax filings might be more relevant.

- Paystubs: Show gross and net pay, deductions, and pay period.

- Bank Statements: Demonstrate regular income deposits.

- Tax Returns: Provide an overview of annual income.

- Employment Verification Letters: Confirm employment details and income from the employer.

Q 18. Describe your experience with manual paystub verification procedures.

My experience with manual paystub verification involves meticulously reviewing each document for accuracy and consistency. This includes checking the candidate’s name, address, and employment details against the information provided in their application. I would then calculate the gross and net income, compare it to what they stated in their application, and note any discrepancies. During manual verification, I’d also look for any red flags, such as unusually high or low income fluctuations, or inconsistencies in the payment frequency. I’d maintain a detailed log of my findings, along with copies of the verified documents. However, I recognize the limitations of manual processes, particularly in terms of efficiency and scalability. That’s why I actively seek opportunities to leverage automated verification tools.

For example, I once spent a whole afternoon manually verifying the income of 10 candidates – a process that could have been far more efficient with a systematized approach or automated software.

Q 19. What are your strategies for improving efficiency in paystub verification?

To enhance efficiency, I advocate for a multi-pronged strategy. Firstly, implementing automated verification systems drastically cuts down on manual work. Many software solutions can electronically verify income data from various sources. Secondly, standardizing the required documents simplifies the verification process. Providing candidates with a clear list of acceptable documents upfront minimizes confusion and delays. Thirdly, streamlining internal processes by using standardized forms and checklists helps maintain consistency and reduce errors. Finally, training staff to efficiently identify discrepancies and red flags minimizes the time spent on reviewing documents. In addition to those, establishing clear escalation paths for difficult cases and fostering collaboration between different teams (e.g., HR and recruiting) also improves the overall efficiency.

Q 20. How do you manage the storage and retention of paystub verification records?

Secure storage and retention of paystub verification records are crucial. We utilize a secure, encrypted system that complies with all relevant data protection laws. Access to the system is restricted to authorized personnel only, using role-based access control. All documents are stored electronically, with appropriate version control to prevent accidental overwriting. Retention policies strictly adhere to legal requirements and company policies, ensuring documents are kept only for the necessary duration. Once the retention period expires, data is securely destroyed or archived according to best practices.

For instance, we might retain paystub verification documents for three years after the candidate’s employment is concluded, as per our company policy.

Q 21. What is your experience with different verification methods like phone calls, emails, or third-party services?

My experience spans various verification methods. Phone calls are useful for quick clarifications or to address discrepancies, allowing for direct interaction with the employer. Emails are suitable for formal requests or obtaining additional documentation. However, both methods are time-consuming and not always reliable. I have extensive experience with third-party verification services, which offer automated and secure solutions for verifying income and employment. These services often provide faster turnaround times and a higher degree of accuracy, but there is a cost associated with utilizing them. The choice of method depends on factors such as the urgency of the verification, the available resources, and the risk associated with the role. I weigh the costs and benefits of each approach to select the most efficient and reliable method for each scenario.

For example, for a high-level position requiring stringent background checks, using a third-party service is often more cost-effective in the long run despite initial costs.

Q 22. How do you maintain accuracy in recording and reporting paystub verification results?

Maintaining accuracy in paystub verification is paramount. It involves a multi-faceted approach, focusing on both process and technology. First, we employ a rigorous checklist and standardized procedures for reviewing each paystub. This ensures consistency and minimizes human error. This checklist typically includes verifying employee details (name, address, social security number), pay period dates, gross pay, net pay, deductions (taxes, insurance, 401k), and hours worked (if applicable). Discrepancies are immediately flagged and investigated. Second, we use robust data comparison tools and software to automatically check for inconsistencies, like mismatched numbers or illogical deductions. These tools are invaluable in identifying patterns of error that might otherwise be missed by the human eye. Finally, regular quality control checks are performed, both internally and potentially externally with audits, to ensure our processes are accurate and our reported findings reliable. Any identified shortcomings are addressed through improved training, refined procedures, or software updates.

Q 23. Describe a time when you faced a challenge during paystub verification. How did you overcome it?

During a large-scale paystub verification project for a new client, we encountered a significant challenge: the client’s payroll system generated paystubs with inconsistent formatting. Some paystubs used abbreviated names for deductions, while others used full names. Some used different date formats. This inconsistency directly impacted our automated data comparison tools, leading to numerous false positives and a significantly increased manual review workload. To overcome this, we developed a custom script that pre-processed the data, standardizing the formats to match our internal templates. We also collaborated closely with the client’s IT department to understand the root cause of the inconsistencies in their system. This collaborative approach not only resolved the immediate problem but also helped to prevent similar issues from recurring in the future. The project demonstrated the importance of adaptability and proactive problem-solving in paystub verification.

Q 24. How do you ensure compliance with data privacy regulations during paystub verification?

Data privacy is our highest priority. We strictly adhere to all relevant regulations, such as HIPAA and GDPR, depending on the geographical location of the data. This involves several key practices. First, access to sensitive data is strictly controlled using role-based access control (RBAC), ensuring only authorized personnel can view or process paystub information. Second, all paystub data is encrypted both in transit and at rest. Third, we maintain detailed audit trails tracking every access and modification to the data. These logs are essential for maintaining accountability and addressing any potential security breaches promptly. Fourth, we conduct regular security awareness training for all staff involved in paystub verification to reinforce responsible data handling practices. Finally, we dispose of sensitive data securely once it is no longer needed, adhering to strict data retention policies. This multi-layered approach guarantees data privacy and compliance with applicable regulations.

Q 25. What are the key performance indicators (KPIs) you use to measure the effectiveness of paystub verification processes?

We use several key performance indicators (KPIs) to measure the effectiveness of our paystub verification processes. These include:

- Accuracy rate: The percentage of paystubs correctly verified.

- Turnaround time: The average time taken to complete verification for each paystub.

- Error rate: The percentage of errors identified during the verification process.

- Client satisfaction: Measured through feedback surveys and ongoing communication.

- Cost per verification: A measure of efficiency and resource utilization.

Q 26. How would you explain the process of paystub verification to someone unfamiliar with it?

Imagine you need to verify someone’s employment and income. Paystub verification is simply the process of reviewing an employee’s paystub to confirm their employment details and income information. It involves examining details like the employee’s name, employer’s name, pay dates, gross pay, net pay, deductions, and any other relevant information printed on the paystub. This verification process is often used by lenders, landlords, or other entities requiring proof of income and employment before approving loans, leases, or other financial arrangements. Think of it as a crucial fact-checking step to ensure the information provided is accurate and reliable.

Q 27. What are some common errors to avoid during paystub verification?

Common errors to avoid include:

- Failing to verify all data points: A thorough review of all elements on the paystub is crucial.

- Ignoring inconsistencies: Discrepancies between the paystub and provided information should be investigated.

- Overlooking red flags: Suspicious information, such as unusually high or low income, requires closer scrutiny.

- Not properly securing data: Maintaining strict data privacy is non-negotiable.

- Lack of documentation: Every step of the process should be properly documented.

Q 28. How do you stay updated on the latest best practices and regulations in paystub verification?

Staying updated on best practices and regulations is an ongoing process. We actively participate in industry conferences and webinars to learn about emerging trends and new technologies. We subscribe to professional journals and newsletters focusing on payroll and compliance. We also closely monitor changes to relevant legislation and regulations, ensuring our procedures are always current and compliant. Furthermore, we maintain strong relationships with industry experts and regulatory bodies, enabling us to stay informed about the latest developments and challenges within the field.

Key Topics to Learn for Paystub Verification Interview

- Understanding Paystub Components: Learn to dissect a paystub, identifying gross pay, net pay, deductions (taxes, insurance, 401k), and other relevant components. Understand the terminology and their significance.

- Verification Methods and Processes: Explore different methods of verifying paystubs, including manual review, automated systems, and third-party verification services. Understand the advantages and disadvantages of each approach.

- Identifying Red Flags and Anomalies: Develop the ability to spot inconsistencies or irregularities in paystubs that might indicate fraud or inaccuracies. Practice identifying potential red flags and understanding their implications.

- Data Security and Compliance: Familiarize yourself with data privacy regulations (e.g., HIPAA) and best practices for handling sensitive employee information during the verification process. Understand the importance of confidentiality.

- Technological Aspects: Explore the use of software and technology in paystub verification. This may include understanding database management, data analysis, or specific verification platforms.

- Problem-Solving and Critical Thinking: Practice analyzing scenarios where paystub information is incomplete, contradictory, or requires further investigation. Develop your ability to make informed decisions based on available data.

- Communication and Collaboration: Understand the importance of clear communication with employees, employers, and other stakeholders during the verification process. Practice explaining complex information clearly and concisely.

Next Steps

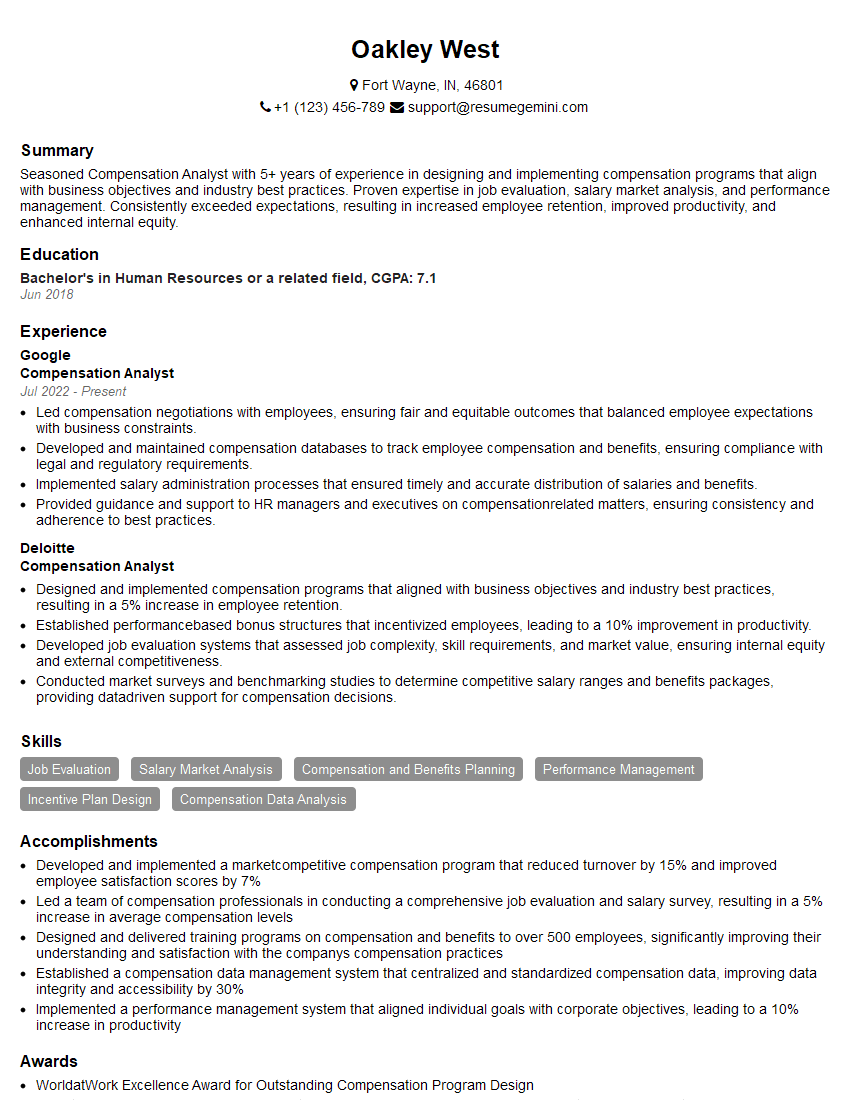

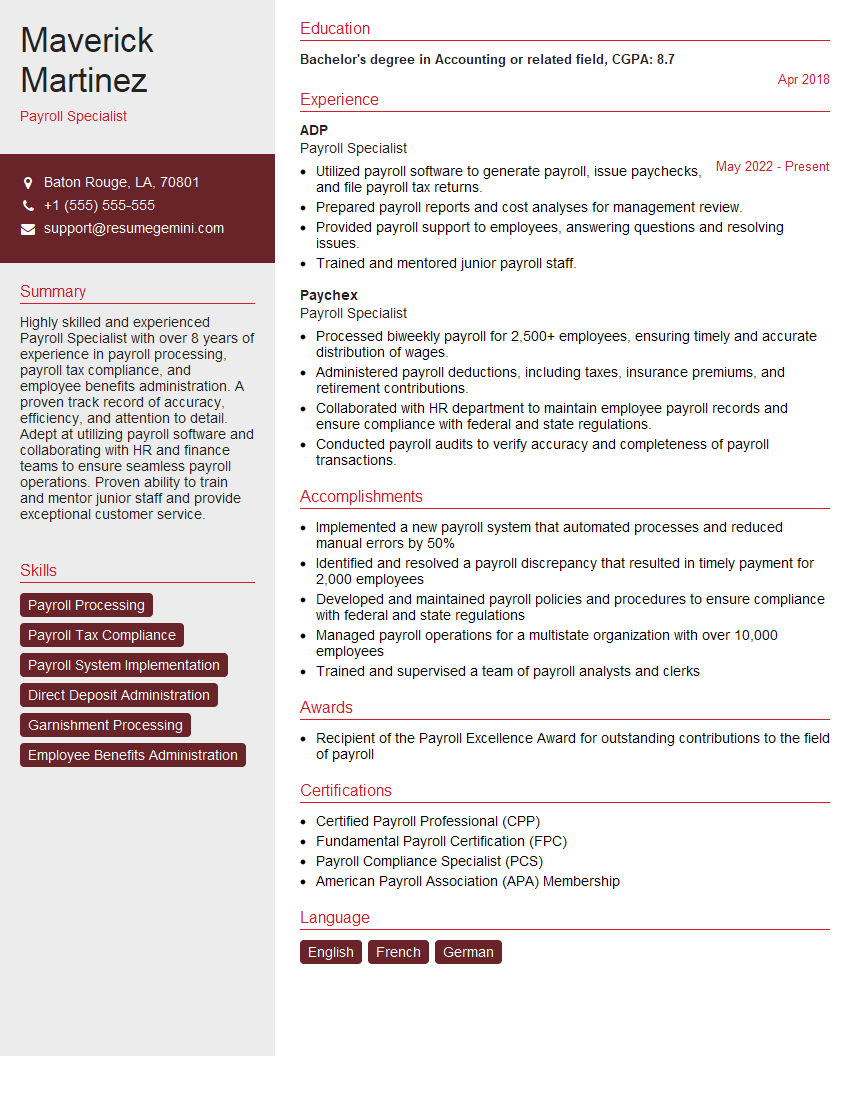

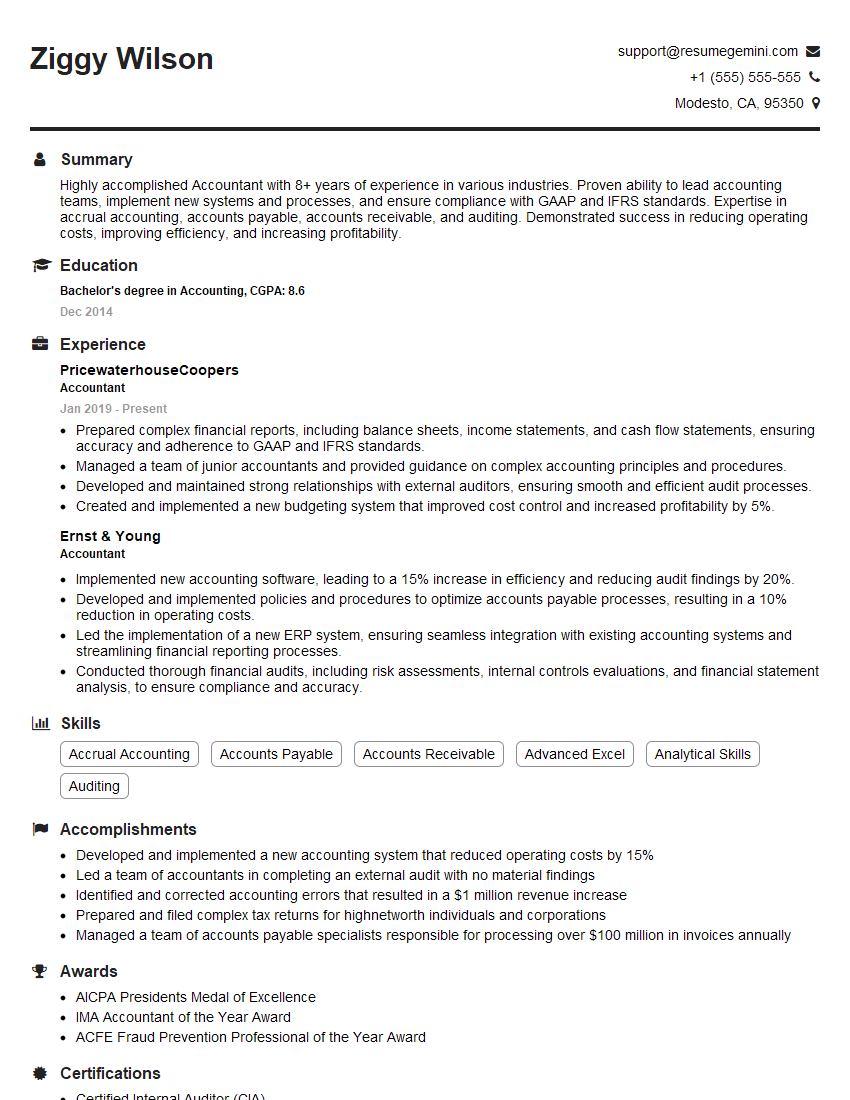

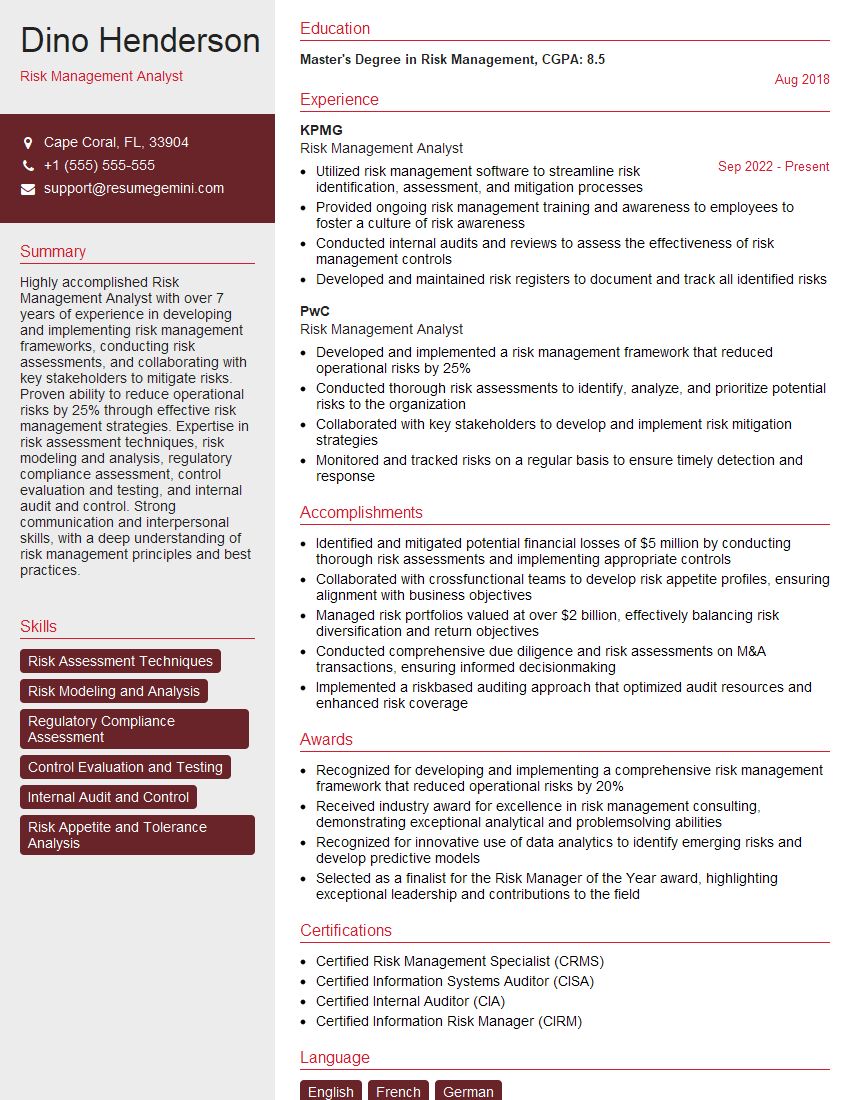

Mastering paystub verification skills opens doors to exciting opportunities in finance, accounting, and human resources. It demonstrates attention to detail, analytical skills, and a commitment to accuracy – highly valued attributes in today’s job market. To significantly boost your job prospects, create an ATS-friendly resume that highlights these skills effectively. We strongly encourage you to utilize ResumeGemini, a trusted resource for building professional resumes that get noticed. ResumeGemini offers examples of resumes tailored to Paystub Verification roles, providing a valuable template for crafting your own compelling application.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

I Redesigned Spongebob Squarepants and his main characters of my artwork.

https://www.deviantart.com/reimaginesponge/art/Redesigned-Spongebob-characters-1223583608

IT gave me an insight and words to use and be able to think of examples

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO