Feeling uncertain about what to expect in your upcoming interview? We’ve got you covered! This blog highlights the most important Performing due diligence and research on potential investments interview questions and provides actionable advice to help you stand out as the ideal candidate. Let’s pave the way for your success.

Questions Asked in Performing due diligence and research on potential investments Interview

Q 1. Explain your understanding of financial statement analysis.

Financial statement analysis is the process of reviewing a company’s financial statements—the balance sheet, income statement, and cash flow statement—to assess its financial health, performance, and prospects. It’s like giving a company a thorough physical exam to understand its strengths and weaknesses. We look for trends, anomalies, and relationships between different line items to gain a holistic picture.

For example, a consistently high debt-to-equity ratio might indicate high financial risk, while a growing gross profit margin suggests strong pricing power or efficient operations. We use various ratios and metrics—like liquidity ratios (current ratio, quick ratio), profitability ratios (gross profit margin, net profit margin, return on equity), and solvency ratios (debt-to-equity ratio, times interest earned)—to analyze the data and draw meaningful conclusions. We also compare the company’s performance to its industry peers and historical trends to gauge its relative strength.

In practice, I often use financial modeling software to automate calculations and scenario planning. This allows for a more efficient and comprehensive analysis, and also helps in presenting findings to stakeholders clearly and concisely.

Q 2. Describe your experience with discounted cash flow (DCF) analysis.

Discounted Cash Flow (DCF) analysis is a valuation method used to estimate the value of an investment based on its projected future cash flows. Think of it as predicting the future earnings of an asset and discounting them back to today’s value, considering the time value of money. The core principle is that a dollar today is worth more than a dollar tomorrow due to its potential earning capacity.

The process involves projecting free cash flows (FCF) for a specific period (usually 5-10 years), estimating a terminal value to represent cash flows beyond the projection period, and then discounting both the projected FCF and terminal value back to the present using a discount rate (usually the Weighted Average Cost of Capital or WACC). The sum of these discounted cash flows represents the estimated intrinsic value of the investment.

My experience includes building sophisticated DCF models in Excel and specialized financial software. I’ve used it to value various assets, from small businesses to large corporations, incorporating different assumptions and sensitivity analyses to assess the impact of uncertainty on the valuation. For instance, in one project, we tested the impact of different economic growth scenarios on a tech startup’s projected revenue and subsequently its valuation.

Q 3. How do you assess the creditworthiness of a potential investment?

Assessing creditworthiness involves evaluating a borrower’s ability and willingness to repay debt. We use several methods to determine the credit risk involved in lending to or investing in a company.

- Financial Ratio Analysis: Examining financial statements to assess leverage (debt levels), profitability, and liquidity. A high debt-to-equity ratio or low interest coverage ratio would signal higher credit risk.

- Credit Reports: Reviewing reports from credit rating agencies like Moody’s, S&P, and Fitch, which provide independent assessments of creditworthiness.

- Industry Benchmarking: Comparing the company’s financial performance to industry peers. This helps to gauge whether its creditworthiness is in line with competitors.

- Qualitative Factors: Considering non-financial factors such as management quality, industry trends, and regulatory environment. A company with strong management and a growing market would generally carry lower credit risk.

For example, if a company has consistently high debt levels and declining profitability, I would consider that a significant credit risk and would factor that into my investment decision, possibly demanding a higher rate of return or opting against the investment altogether.

Q 4. What are the key components of a comprehensive due diligence process?

A comprehensive due diligence process is a systematic investigation to verify information and identify potential risks associated with an investment. It’s like a detective’s work, leaving no stone unturned.

- Financial Due Diligence: Review of financial statements, including analysis of revenue, expenses, profitability, cash flow, and debt levels.

- Legal Due Diligence: Examination of legal documents, contracts, and compliance records to identify any legal risks or liabilities.

- Operational Due Diligence: Assessment of operational efficiency, management quality, and key business processes.

- Commercial Due Diligence: Analysis of market conditions, industry trends, competition, and the company’s competitive advantages.

- Environmental, Social, and Governance (ESG) Due Diligence: Assessing the company’s environmental impact, social responsibility, and corporate governance practices.

- Tax Due Diligence: Review of tax compliance and potential tax liabilities.

The specific components and depth of due diligence will depend on the nature of the investment and its complexity. For example, due diligence for a real estate investment will be different from due diligence for a technology startup.

Q 5. How do you identify and mitigate potential risks in an investment?

Identifying and mitigating potential risks is a crucial aspect of due diligence. We use a risk assessment framework to systematically identify, analyze, and mitigate potential risks.

Risk Identification: This involves brainstorming potential risks through various sources like financial statements, industry reports, management interviews, and regulatory filings. We often use a risk register to document all identified risks.

Risk Analysis: Evaluating the likelihood and potential impact of each risk. We assess the probability of occurrence and quantify the potential financial losses associated with each risk.

Risk Mitigation: Developing strategies to reduce the likelihood or impact of identified risks. This could involve negotiating contractual terms, implementing internal controls, diversification, or purchasing insurance.

For example, if a company is highly reliant on a single supplier, this represents a supply chain risk. A mitigation strategy could involve diversifying the supplier base or negotiating long-term contracts with favorable terms.

Q 6. Explain your experience with industry research and competitive analysis.

Industry research and competitive analysis are vital to understanding a potential investment’s market position and future prospects. It’s about understanding the playing field and the company’s place within it.

My approach involves studying industry reports, market research data, and competitor analysis. I use Porter’s Five Forces framework to analyze the competitive landscape, focusing on factors like industry growth, competitive intensity, supplier power, buyer power, and the threat of substitutes. I also analyze competitors’ strengths, weaknesses, strategies, and financial performance. This helps in understanding the target company’s competitive advantages, challenges, and market opportunities.

For instance, I recently evaluated a renewable energy company. My research involved analyzing market trends in renewable energy, studying the competitive landscape, and examining the company’s technology and its competitive advantages over other players in the same space.

Q 7. How do you evaluate the management team of a potential investment?

Evaluating the management team is critical because their competence and integrity are directly tied to the success of a business. I look beyond just resumes; I want to understand their experience, track record, and how they operate as a team.

- Experience and Expertise: Assessing the team’s relevant industry experience, their skills, and their track record of success in similar ventures.

- Leadership Style and Team Dynamics: Observing how the team interacts, communicates, and makes decisions. A strong leadership team is collaborative, decisive, and focused on achieving company goals.

- Integrity and Ethics: Examining the team’s reputation and adherence to ethical business practices.

- Financial Acumen: Assessing the team’s understanding of financial management and their ability to effectively manage the company’s finances.

I often conduct interviews with key members of the management team to assess their vision, strategic thinking, and operational capabilities. I also review references and check backgrounds to verify their credentials and reputation. A strong and experienced management team is a key indicator of a successful investment.

Q 8. Describe your experience using financial modeling software.

My experience with financial modeling software spans over eight years, encompassing various tools such as Excel, Bloomberg Terminal, and Argus Enterprise. I’m proficient in building complex models for discounted cash flow (DCF) analysis, leveraged buyout (LBO) modeling, and merger and acquisition (M&A) valuations. I’m also comfortable with scenario planning and sensitivity analysis, utilizing these models to assess investment risks and potential returns. For instance, in a recent project analyzing a potential acquisition, I built a three-statement model in Excel to project the target company’s financial performance over a five-year horizon, incorporating various assumptions about revenue growth, operating margins, and capital expenditures. This allowed us to determine a fair purchase price and assess the deal’s financial feasibility under different economic scenarios.

Furthermore, I’m adept at using Bloomberg Terminal for detailed financial data gathering, including comparable company analysis, industry benchmarking, and macroeconomic data integration into my models. My proficiency in Argus Enterprise has been particularly valuable in real estate investment analysis, allowing for intricate property-level modeling and cash flow projections. I regularly validate my models by back-testing them against historical data and ensuring consistency with underlying assumptions. I believe in transparency and readily share my models and methodology with my team for collaborative review and refinement.

Q 9. How do you interpret key financial ratios and metrics?

Interpreting key financial ratios and metrics involves understanding their context and interrelationships. It’s not just about the numbers themselves, but also about understanding the industry dynamics, the company’s business model, and the overall economic climate. For example, a high debt-to-equity ratio might be a red flag in one industry but perfectly acceptable in another, like real estate. I use a multi-faceted approach:

- Liquidity Ratios: (Current Ratio, Quick Ratio) – Assessing a company’s ability to meet its short-term obligations. A consistently low current ratio may signal liquidity problems.

- Profitability Ratios: (Gross Profit Margin, Net Profit Margin, Return on Equity (ROE)) – Examining the company’s ability to generate profits. A declining ROE over time could indicate operational inefficiencies or competitive pressure.

- Solvency Ratios: (Debt-to-Equity Ratio, Times Interest Earned) – Evaluating the company’s long-term financial health and ability to meet its debt obligations. High leverage can be risky, particularly in times of economic uncertainty.

- Efficiency Ratios: (Inventory Turnover, Asset Turnover) – Measuring how effectively the company manages its assets. Low inventory turnover could indicate obsolete inventory or poor sales.

I always compare these ratios to industry benchmarks and historical trends to identify any significant deviations. For instance, comparing a company’s ROE to that of its competitors can provide insights into its relative performance and competitive positioning. I also look for trends – consistent improvement or deterioration in key ratios over several years – to gauge the company’s overall financial health and sustainability.

Q 10. How do you handle conflicting information during due diligence?

Handling conflicting information during due diligence is a crucial skill. It requires a systematic approach, starting with identifying the source of the conflict. I typically follow these steps:

- Source Verification: I meticulously cross-reference information from multiple sources – financial statements, industry reports, news articles, regulatory filings, and interviews with management. The reliability of the source is paramount.

- Data Triangulation: I look for corroborating evidence. If several independent sources support a particular piece of information, it’s more likely to be accurate. Conversely, if there’s significant discrepancy, it warrants further investigation.

- Qualitative Assessment: Sometimes, conflicting information arises from differing interpretations or perspectives. I consider the qualitative aspects of the situation, such as management’s credibility, the overall market environment, and any potential biases.

- Sensitivity Analysis: For quantitative discrepancies, I perform a sensitivity analysis to assess the impact of different assumptions on the overall investment thesis. This helps determine the materiality of the conflicting information.

- Further Investigation: If the conflict remains unresolved, I may conduct additional research, interviews, or even engage external experts for a second opinion. Unresolved conflicts are carefully documented and their potential impact on the investment decision is explicitly stated.

For example, during a recent due diligence process, we discovered conflicting information about a target company’s revenue growth. By examining their financial statements, industry reports, and conducting interviews with key personnel, we discovered that the higher revenue figure was based on non-recurring items, whilst the lower revenue was representative of normalized performance. This allowed for a more accurate assessment and realistic projections in our financial model.

Q 11. Explain your experience with valuation methodologies.

My experience with valuation methodologies is extensive, covering a range of techniques tailored to different asset classes and circumstances. I’m proficient in:

- Discounted Cash Flow (DCF) Analysis: This is a fundamental method for valuing businesses by projecting future cash flows and discounting them back to their present value. I’m adept at making realistic assumptions about growth rates, discount rates (WACC), and terminal value, considering different sensitivity scenarios.

- Comparable Company Analysis (CCA): This method involves comparing the valuation multiples (such as P/E ratio, EV/EBITDA) of similar publicly traded companies to estimate the value of a private company. The key here is identifying truly comparable companies and adjusting for differences in size, growth rates, and profitability.

- Precedent Transactions Analysis: This involves analyzing the prices paid in similar acquisitions in the past to estimate the value of a target company. Careful consideration must be given to the specific circumstances of each transaction and the overall market conditions at the time.

- Asset-Based Valuation: This is particularly relevant for companies with significant tangible assets, such as real estate or manufacturing firms. It involves determining the fair market value of a company’s assets and subtracting its liabilities.

The choice of valuation method depends on the specific circumstances of the investment, the availability of data, and the nature of the asset being valued. For example, DCF is often preferred for stable, established businesses with predictable cash flows, while CCA is useful for companies with limited historical data. I typically employ multiple methodologies to arrive at a range of values, rather than relying on a single method.

Q 12. Describe your experience with legal and regulatory compliance in investments.

Legal and regulatory compliance is a non-negotiable aspect of my investment process. I’m familiar with relevant securities laws, including the Securities Act of 1933 and the Securities Exchange Act of 1934, as well as anti-money laundering (AML) regulations and know-your-customer (KYC) guidelines. My experience includes:

- Due Diligence on Legal and Regulatory Matters: I rigorously review legal documents, including incorporation papers, contracts, permits, licenses, and regulatory filings to ensure compliance and identify any potential legal risks.

- Understanding Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations: I am familiar with international AML and KYC standards and procedures, to ensure investments are conducted ethically and legally.

- Working with Legal Counsel: I collaborate closely with legal counsel to ensure compliance with all applicable laws and regulations and to address any legal complexities that arise during the investment process.

- Staying Updated on Legal and Regulatory Changes: The regulatory landscape is dynamic, so I make it a point to stay informed about any changes that could affect our investment activities.

A recent example involved reviewing the environmental compliance of a potential investment in a manufacturing company. Thorough due diligence revealed potential non-compliance issues which, if not addressed, could result in significant financial penalties and reputational damage. This led to careful negotiation of the acquisition terms to mitigate the risks and ensure compliance.

Q 13. How do you assess the market opportunity for a potential investment?

Assessing market opportunity involves a thorough analysis of the target market, the competitive landscape, and the potential for growth. My approach includes:

- Market Sizing: I determine the total addressable market (TAM), serviceable obtainable market (SOM), and serviceable available market (SAM) to quantify the potential market size. This provides a realistic estimate of the potential revenue generated.

- Competitive Analysis: I analyze the competitive landscape, identifying key competitors, their strengths and weaknesses, and their market share. This helps assess the competitive advantages and barriers to entry.

- Growth Potential: I evaluate the factors that could drive market growth, such as technological advancements, changing consumer preferences, and economic trends. This involves forecasting future market demand and identifying potential growth drivers.

- SWOT Analysis: I conduct a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) to understand the potential risks and challenges facing the investment opportunity. This involves identifying both internal and external factors that may affect the market opportunity.

- Regulatory Landscape: I consider the regulatory environment and potential changes in laws and regulations that may impact market growth or restrict market access. This ensures the compliance of operations with the applicable laws.

For example, when assessing the market opportunity for a new software-as-a-service (SaaS) product, I would analyze the size of the target market, the existing competitors, the rate of market growth, and the potential for disruption. This comprehensive analysis would help to determine the viability and potential profitability of the investment.

Q 14. What are your preferred sources of information for investment research?

My preferred sources of information for investment research are diverse and carefully vetted for reliability and accuracy. I utilize a multi-pronged approach:

- Financial Databases: Bloomberg Terminal, Refinitiv Eikon, S&P Capital IQ provide access to comprehensive financial data, including company financials, industry reports, and market data.

- Industry Reports and Publications: Reports from reputable research firms, trade publications, and government agencies provide valuable insights into market trends and competitive dynamics.

- Company Filings: SEC filings (10-K, 10-Q) and equivalent filings in other jurisdictions provide crucial information about a company’s financial performance, operations, and risk factors.

- News and Media Outlets: Reputable news sources, such as the Wall Street Journal, Financial Times, and Bloomberg provide up-to-date information on market events and company news.

- Direct Communication: I regularly interact with management teams, industry experts, and customers to gather first-hand insights and verify information obtained from other sources.

- Data Analytics Tools: Tools like Tableau and Power BI enable the visual exploration and analysis of large datasets to unearth hidden trends and patterns.

I always critically evaluate the information I gather, considering the source’s credibility, potential biases, and the overall context. Cross-referencing information from multiple sources is essential to ensure accuracy and reliability. For example, while I may rely on Bloomberg for financial data, I would cross-reference it with company filings to confirm the accuracy and consistency of the information.

Q 15. How do you prioritize tasks during a complex due diligence project?

Prioritizing tasks in a complex due diligence project requires a structured approach. I typically use a combination of methods, starting with a clear understanding of the project’s overall objectives and the investor’s priorities. Then, I employ a risk-based prioritization framework. This involves identifying potential risks associated with each task and assigning a risk score based on likelihood and impact. High-risk, high-impact tasks are tackled first. For example, verifying the target company’s financial statements is usually a high priority due to its significant impact on valuation. Next, I use a dependency mapping tool to visualize task relationships and identify critical paths. This ensures that tasks blocking subsequent activities are completed in a timely manner. Finally, I regularly review and adjust the priority list based on new information or changing circumstances. Think of it like a dynamic to-do list, constantly adapting to the evolving project needs.

Furthermore, I use project management software to track progress, assign responsibilities, and manage deadlines effectively. Regular team meetings ensure everyone stays informed and any roadblocks are addressed promptly. This ensures the most critical information is available when needed to make informed decisions.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Describe your experience with data analysis and interpretation.

My experience with data analysis and interpretation is extensive. I’m proficient in using various statistical software packages like SPSS, R, and Excel to analyze large datasets. My approach is always methodical and thorough. It begins with data cleansing and validation to ensure accuracy and consistency. I then employ descriptive statistics to understand the underlying patterns and trends in the data. This often involves creating visualizations like charts and graphs to help identify key findings. For example, I might analyze a company’s revenue growth over several years to assess its financial health. Beyond descriptive statistics, I also employ inferential statistics when appropriate, for instance using regression analysis to determine the relationship between different variables like marketing spend and sales revenue.

Beyond quantitative analysis, I am also adept at qualitative data analysis. This includes reviewing legal documents, contracts, and industry reports to gain a comprehensive understanding of the target company’s operations and market position. I always ensure that my interpretations are supported by robust evidence, presented clearly and concisely within the overall context of the due diligence process. I value transparency and can clearly articulate my analytical methodology and findings to both technical and non-technical audiences.

Q 17. How do you present your findings from a due diligence investigation?

Presenting due diligence findings requires careful consideration of the audience and the purpose of the report. My reports are typically structured in a clear and concise manner, starting with an executive summary that highlights the key findings and recommendations. The subsequent sections provide detailed analysis, including supporting data and evidence. I utilize visuals like charts, graphs, and tables to make complex information more accessible and digestible. For example, if we find inconsistencies in a company’s financial statements, I’ll clearly articulate the discrepancy along with supporting documentation, and then explain the potential implications of that finding.

I strive for objectivity and avoid using subjective language. I also ensure that my findings are well-supported by evidence and clearly explain any limitations or uncertainties. Furthermore, I always consider the legal implications of the report and ensure that it complies with all relevant regulations. The ultimate goal is to provide the client with a comprehensive and unbiased assessment that enables them to make informed investment decisions. Presentations are tailored to the audience – a detailed technical report for internal use might differ significantly from a concise summary for a board presentation.

Q 18. How do you handle uncertainty and incomplete information during due diligence?

Uncertainty and incomplete information are common challenges in due diligence. My strategy focuses on mitigating these risks through a multi-pronged approach. First, I develop a comprehensive data gathering plan which includes multiple data sources to validate information. For instance, relying on just one financial statement is risky; I prefer to cross-reference the data with tax returns, bank statements, and industry reports. Second, I use sensitivity analysis and scenario planning (discussed in detail later) to assess the impact of potential uncertainties on the investment decision. Third, I actively engage with management and other relevant stakeholders to obtain additional information and clarify outstanding issues. Fourth, I clearly articulate the limitations of the due diligence process and any remaining uncertainties in my report, making it transparent and preventing misleading conclusions. The key is to manage risk, not eliminate it entirely. A carefully crafted assessment of known unknowns is valuable in itself.

Imagine trying to value a tech startup with a rapidly evolving market. Some data points are inherently unpredictable. I would focus on understanding the key drivers of value (e.g., technology, market potential, management team) and assessing the potential range of outcomes under various scenarios, rather than searching for a definitive ‘correct’ answer.

Q 19. What are some common pitfalls to avoid during due diligence?

Several common pitfalls can derail a due diligence process. One major pitfall is insufficient time allocation. Rushing through the process compromises thoroughness and increases the likelihood of overlooking critical information. Another common error is scope creep: allowing the project to expand beyond its initial boundaries without adequate resource allocation. Overreliance on management-provided information without independent verification is another significant risk. Management might have incentives to present an overly optimistic view. Similarly, failing to consider legal and regulatory implications can lead to costly surprises down the line. Finally, insufficient communication among team members can lead to duplicated effort and inconsistencies in analysis.

To avoid these pitfalls, I recommend meticulous planning, setting clear deadlines, and establishing regular communication channels. A well-defined scope and clearly defined roles and responsibilities within the team are critical. Independent verification of information through multiple sources should be a standard procedure, along with rigorous documentation throughout the process.

Q 20. How do you determine the fair market value of an asset?

Determining the fair market value of an asset is a complex process that depends on the type of asset and the available information. There’s no single formula; rather, it’s an art and science. For publicly traded companies, the market capitalization (share price multiplied by the number of outstanding shares) often serves as a reasonable starting point, although it can be significantly impacted by short-term market fluctuations. For privately held companies or other assets (real estate, intellectual property etc.), multiple valuation methods are employed, usually in combination, to arrive at a range of values rather than a single definitive number.

Common approaches include discounted cash flow (DCF) analysis, which estimates the present value of future cash flows, comparable company analysis (comparing the target company to similar publicly traded companies), and precedent transaction analysis (examining previous transactions involving similar assets). The selection of the appropriate method depends on the specific circumstances. The final valuation is usually a professional judgment that takes into account all available data and considers market conditions. Each valuation method has its limitations and assumptions; therefore, a robust valuation report will clearly explain these. A critical aspect is understanding the context and employing the most suitable methodologies for the specific asset and market situation.

Q 21. Describe your experience with sensitivity analysis and scenario planning.

Sensitivity analysis and scenario planning are crucial tools in due diligence. Sensitivity analysis helps assess the impact of changes in key assumptions on the overall valuation or investment decision. For example, we might vary projected revenue growth rates to determine how this affects the DCF valuation. This reveals the robustness of the investment thesis to changes in these inputs. Results are typically presented in tables or charts showing how different input variations impact the final outcome.

Scenario planning goes further by considering a range of possible future outcomes, each based on different assumptions about market conditions, competitive dynamics, or other factors. This involves developing multiple scenarios (e.g., a best-case, base-case, and worst-case scenario), each with its own set of assumptions and projected outcomes. For example, in evaluating a renewable energy company, scenarios would explore different future regulatory environments and electricity price forecasts. By systematically considering different potential futures, we gain a more comprehensive understanding of the risks and opportunities associated with the investment. This process helps in making more informed decisions and crafting contingency plans to better navigate the uncertainty inherent in any investment.

Q 22. How do you measure the success of a due diligence process?

Measuring the success of a due diligence process goes beyond simply completing a checklist. It’s about evaluating whether the process effectively mitigated risks and provided the necessary information to make an informed investment decision. We measure success through several key indicators:

- Accuracy and Completeness of Information: Did we uncover all material facts and figures relevant to the investment? This includes financial statements, legal documentation, operational data, and market research.

- Identification and Assessment of Risks: Did the process effectively identify and assess key risks, such as financial, legal, operational, and reputational risks? This requires a thorough understanding of the target company’s business model and industry landscape. For example, identifying potential litigation risks or supply chain vulnerabilities is critical.

- Timeliness and Efficiency: Was the due diligence process completed within the allocated timeframe and budget? While thoroughness is paramount, efficiency is crucial, especially in competitive investment environments.

- Impact on Investment Decision: Did the due diligence findings significantly influence the investment decision, either positively or negatively? A successful process should lead to a well-justified investment thesis or a well-reasoned decision to pass on the opportunity.

- Post-Investment Performance: While not a direct measure of the due diligence process itself, the post-investment performance provides valuable feedback. Did the investment perform as expected based on our due diligence findings? This is crucial for continuous improvement and refining our processes.

Ultimately, a successful due diligence process is one that allows us to confidently invest in opportunities that align with our investment strategy and risk appetite, while minimizing potential downsides.

Q 23. How do you stay updated on industry trends and best practices?

Staying updated on industry trends and best practices is crucial in this fast-paced field. I employ a multi-pronged approach:

- Industry Publications and Journals: I regularly read publications like the Wall Street Journal, Financial Times, and industry-specific journals to keep abreast of market developments and emerging trends.

- Conferences and Webinars: Attending industry conferences and webinars allows me to network with peers, learn from experts, and stay informed about the latest methodologies and technologies.

- Professional Networks: I actively participate in professional organizations like the CFA Institute and maintain a strong network of contacts within the investment community. This provides access to invaluable insights and perspectives.

- Data and Analytics Platforms: I leverage various data and analytics platforms that provide real-time market data, industry reports, and competitive intelligence.

- Continuous Learning: I dedicate time to professional development through online courses, workshops, and certifications to enhance my skills and knowledge in areas such as financial modeling, valuation, and risk management.

This holistic approach ensures that my knowledge and skills remain current and relevant, allowing me to conduct more effective and insightful due diligence.

Q 24. Describe a time you had to make a difficult decision based on incomplete information.

During the due diligence process for a tech startup, we faced a situation where the management team’s financial projections were unusually optimistic, yet we lacked sufficient independent verification. While the team had a strong track record, concrete evidence to support their ambitious forecasts was limited.

The decision was whether to proceed with the investment despite the incomplete financial information or to walk away. This was challenging because the opportunity had significant potential, but substantial uncertainty existed. My approach was:

- Scenario Planning: We developed several scenarios based on different levels of achievement of the projections, from highly optimistic to very conservative.

- Sensitivity Analysis: We conducted a sensitivity analysis to understand how the valuation would change based on different assumptions about key variables like customer acquisition cost and revenue growth.

- Risk Mitigation Strategies: We explored possible risk mitigation strategies, such as structuring the investment with performance-based milestones and including protective covenants in the investment agreement.

Ultimately, we decided to proceed with a smaller investment than initially planned, taking a phased approach that allowed us to gather more data and verify the projections as the startup progressed. This measured approach allowed us to minimize our risk while capturing a portion of the potential upside. This experience highlighted the importance of building flexibility into investment decisions when faced with incomplete information.

Q 25. How do you collaborate effectively with other team members during due diligence?

Effective collaboration is crucial during due diligence. We utilize a structured approach:

- Clear Roles and Responsibilities: Each team member is assigned specific responsibilities based on their expertise, ensuring efficient task allocation and avoidance of duplication. For instance, one might focus on financial analysis, another on legal due diligence, and a third on operational review.

- Regular Communication and Meetings: We hold regular team meetings to share updates, discuss findings, and address any emerging issues. Utilizing project management software helps in tracking progress and sharing documents efficiently.

- Centralized Data Repository: All due diligence data and findings are stored in a centralized repository, accessible to all team members. This ensures everyone is working with the most up-to-date information.

- Open Communication and Feedback: A culture of open communication and constructive feedback is fostered, encouraging team members to voice concerns and share insights freely.

- Conflict Resolution Mechanisms: Procedures are in place to address any conflicts or disagreements that may arise during the due diligence process, focusing on objective analysis and data-driven decision-making.

This collaborative approach ensures that we leverage the collective expertise of the team, leading to a more thorough and insightful due diligence process.

Q 26. What is your experience with different types of investment structures?

My experience encompasses a wide range of investment structures, including:

- Equity Investments: This includes common stock, preferred stock, and convertible notes. I’m proficient in analyzing equity valuations, understanding capitalization tables, and assessing the rights and obligations of different classes of equity.

- Debt Investments: I’ve worked extensively with senior and subordinated debt, including term loans, revolving credit facilities, and mezzanine financing. This involves analyzing creditworthiness, covenants, and repayment terms.

- Private Equity and Venture Capital: I have experience in due diligence for investments in private companies, including understanding the complexities of valuation in illiquid markets and negotiating investment terms.

- Real Estate Investments: I’ve conducted due diligence on various real estate assets, including commercial properties and development projects, evaluating factors such as property value, market conditions, and lease agreements.

- Structured Products: This includes more complex investment structures that involve derivatives or other instruments. My expertise extends to understanding the risks and potential returns of these vehicles.

My experience with these diverse structures allows me to tailor my due diligence approach to the specific circumstances of each investment opportunity.

Q 27. Describe your experience with environmental, social, and governance (ESG) factors.

ESG factors are increasingly important in investment decisions. My experience includes:

- ESG Due Diligence: I incorporate ESG considerations into all due diligence processes. This involves assessing the environmental impact of the target company’s operations, evaluating its social responsibility initiatives, and examining its corporate governance structure. For example, this could involve reviewing a company’s carbon footprint, its labor practices, and its board diversity.

- ESG Data Collection and Analysis: I utilize various ESG data providers and databases to gather relevant information and analyze the company’s ESG performance against industry benchmarks and best practices.

- ESG Risk Assessment: I assess potential ESG-related risks, such as climate change risks, regulatory risks, and reputational risks. Identifying these risks allows us to factor them into investment valuation and mitigate potential downsides.

- ESG Reporting and Transparency: I review the target company’s ESG reporting and assess the quality and transparency of its disclosures. This ensures that the information gathered is reliable and credible.

- ESG Integration into Investment Strategy: I assist in integrating ESG factors into our firm’s investment strategy, helping to identify investment opportunities that align with our sustainability goals.

I believe that integrating ESG factors into due diligence leads to more robust and sustainable investment decisions.

Q 28. How do you manage your time effectively during a high-pressure due diligence process?

Time management during high-pressure due diligence is critical. I employ these strategies:

- Prioritization and Planning: I develop a detailed due diligence plan outlining key tasks, deadlines, and responsibilities. This provides a roadmap for efficient execution and helps in prioritizing tasks based on their importance and urgency. Using tools like Gantt charts can be highly effective here.

- Effective Delegation: I delegate tasks appropriately to team members based on their expertise and availability, maximizing efficiency and minimizing bottlenecks. Clear communication channels are crucial for delegation.

- Time Blocking: I allocate specific time blocks for focused work on particular tasks, minimizing interruptions and maximizing productivity. This helps avoid task switching, which can significantly reduce overall efficiency.

- Regular Progress Monitoring: I regularly track progress against the due diligence plan, identifying and addressing any potential delays proactively. This may involve daily check-ins with team members.

- Flexible Approach: I maintain a flexible approach, adapting to unexpected challenges and prioritizing tasks as needed. This requires adaptability and the ability to prioritize critical tasks swiftly.

By implementing these strategies, I ensure that the due diligence process is completed thoroughly and efficiently, even under tight deadlines and significant pressure.

Key Topics to Learn for Performing Due Diligence and Research on Potential Investments Interview

- Financial Statement Analysis: Understanding and interpreting balance sheets, income statements, and cash flow statements to assess a company’s financial health and performance. Practical application: Identifying key financial ratios and trends to predict future performance and risk.

- Valuation Methods: Mastering various valuation techniques like Discounted Cash Flow (DCF) analysis, comparable company analysis, and precedent transactions. Practical application: Applying different valuation methods to a specific investment opportunity and justifying your chosen approach.

- Industry and Competitive Analysis: Researching industry trends, competitive landscapes, and market dynamics to understand the investment’s potential and risks. Practical application: Developing a comprehensive competitive analysis report, identifying key competitors and their strengths/weaknesses.

- Risk Assessment and Mitigation: Identifying and assessing potential risks associated with an investment, including financial, operational, legal, and regulatory risks. Practical application: Developing a risk mitigation plan to address identified potential problems.

- Legal and Regulatory Compliance: Understanding relevant laws and regulations governing investments, including securities laws and anti-money laundering regulations. Practical application: Ensuring compliance with all relevant laws and regulations during the investment process.

- Qualitative Factors: Analyzing non-financial factors such as management team quality, corporate governance, and intellectual property. Practical application: Assessing the management team’s experience, track record, and strategic vision.

- Data Sources and Research Methods: Utilizing various sources of information, including financial databases, industry reports, and company filings, to gather relevant data. Practical application: Effectively using databases like Bloomberg Terminal or Capital IQ to gather crucial investment information.

Next Steps

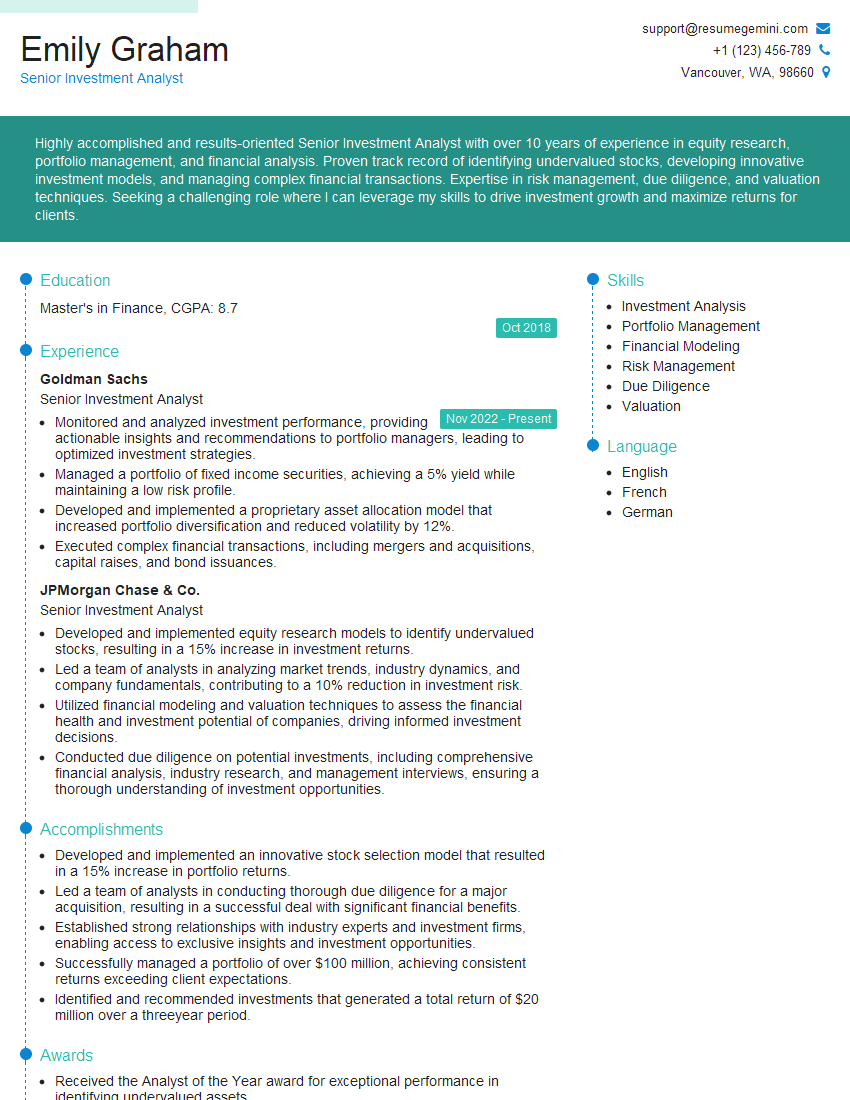

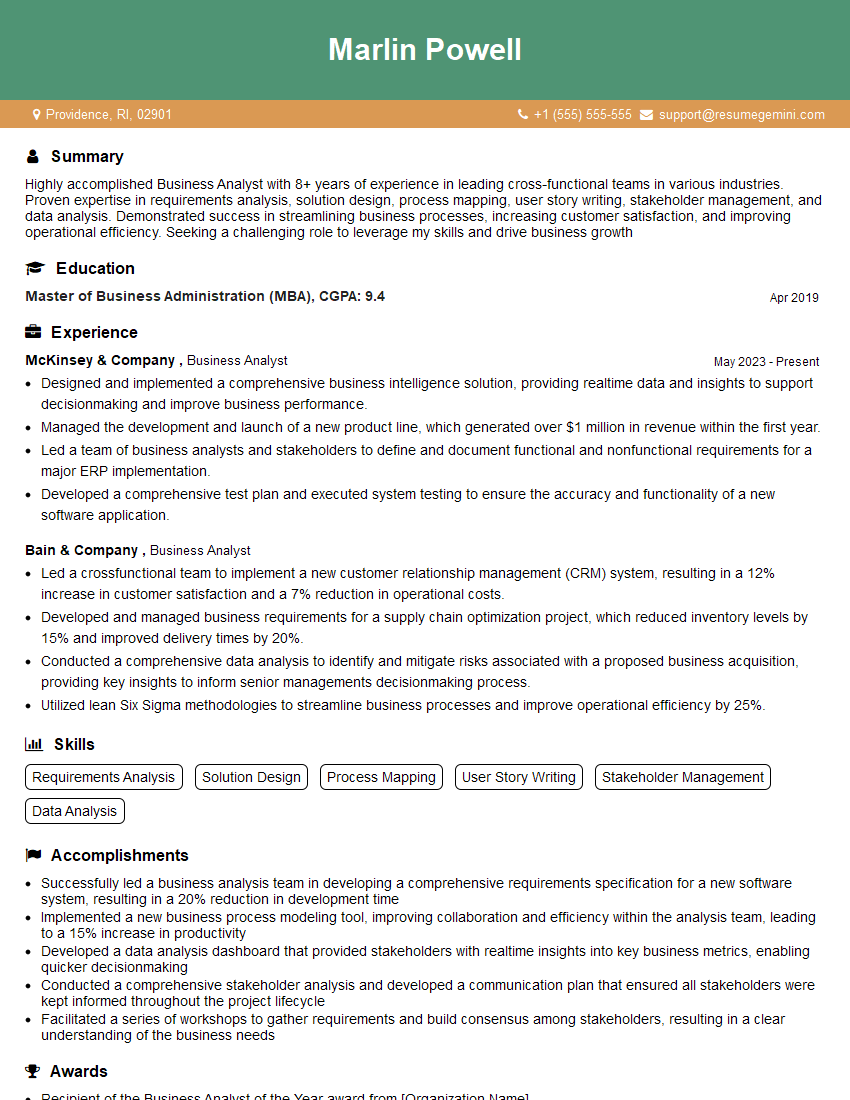

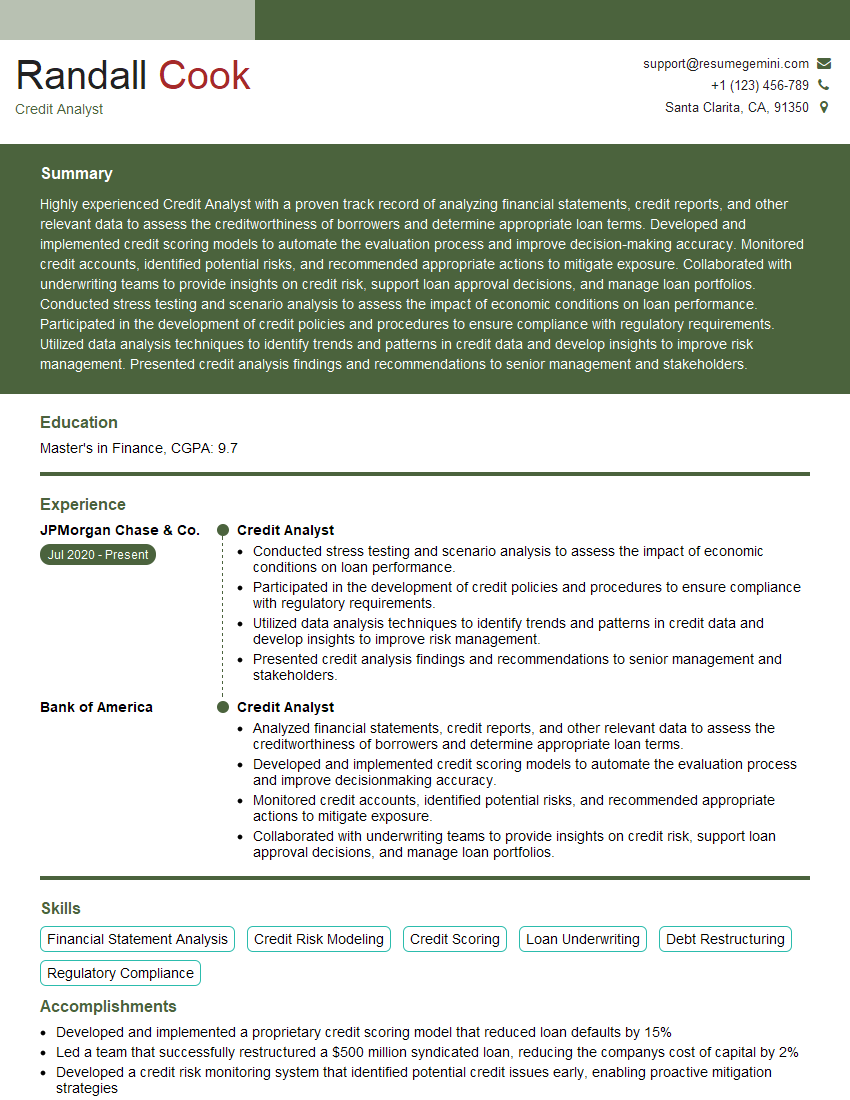

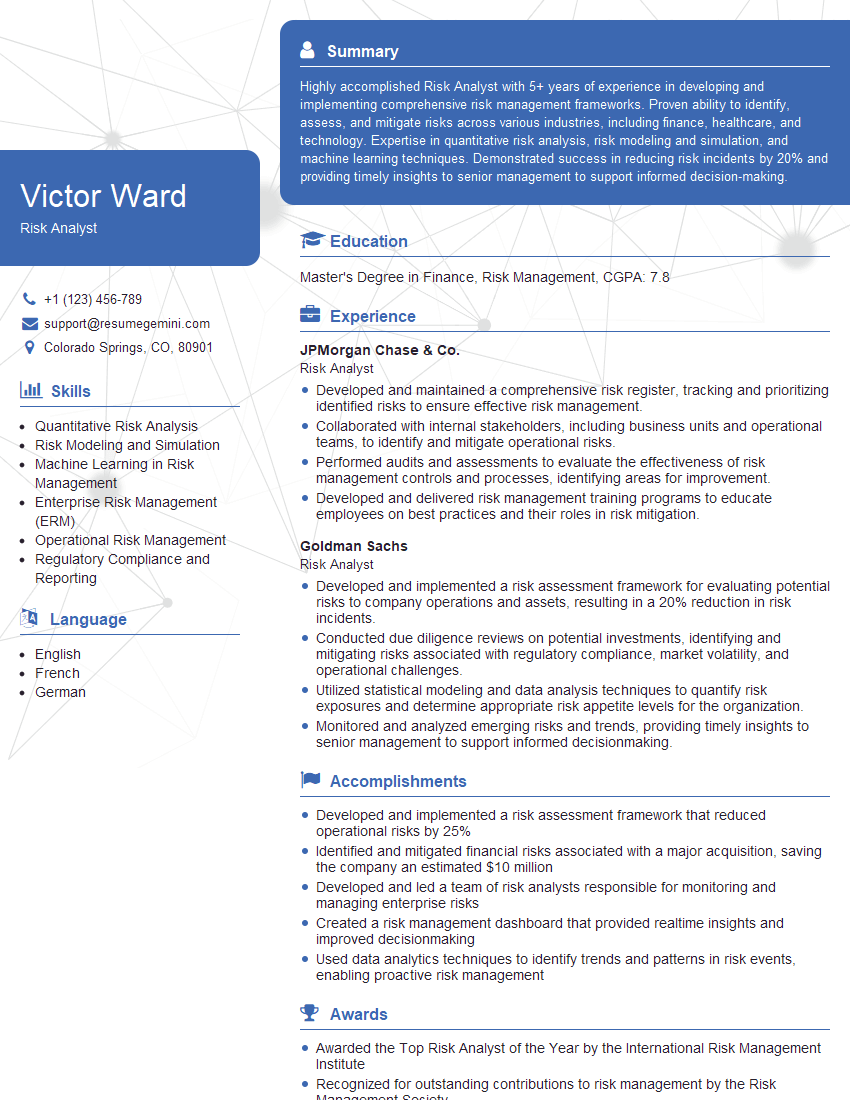

Mastering due diligence and research is crucial for a successful career in finance and investments. A strong understanding of these concepts will significantly enhance your interview performance and open doors to exciting opportunities. To increase your chances of landing your dream role, focus on building an ATS-friendly resume that highlights your skills and experience. ResumeGemini is a trusted resource that can help you craft a professional and impactful resume tailored to your specific skills and experience. Examples of resumes tailored to roles in Performing due diligence and research on potential investments are available to guide you.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO