Feeling uncertain about what to expect in your upcoming interview? We’ve got you covered! This blog highlights the most important Property Transfer Procedures interview questions and provides actionable advice to help you stand out as the ideal candidate. Let’s pave the way for your success.

Questions Asked in Property Transfer Procedures Interview

Q 1. Explain the process of transferring property ownership.

Transferring property ownership is a multifaceted process involving legal and financial steps to ensure a smooth transition of title from the seller to the buyer. Think of it like a carefully choreographed dance, where each step needs to be executed perfectly.

The process typically begins with a purchase agreement, outlining the terms of sale. Then comes due diligence, where the buyer verifies the property’s condition and legal standing. Next is financing (if applicable), securing a mortgage or other funding. Simultaneously, the buyer and seller work with lawyers and title companies to prepare and file necessary documents. This includes preparing the deed, transferring ownership, and finally registering the new ownership with the relevant authorities. Once all paperwork is completed and funds are exchanged, the property officially changes hands.

- Purchase Agreement: The initial contract outlining the terms of the sale.

- Due Diligence: Buyer’s investigation of the property’s title, condition, and any encumbrances.

- Financing: Securing a mortgage or other financing for the purchase.

- Document Preparation: Deeds, affidavits, and other legal documents.

- Closing: The final exchange of funds and signing of documents. This is where the ownership officially transfers.

- Registration: Recording the transfer with the relevant government agency to make it official and legally binding.

Q 2. What are the key documents involved in a property transfer?

Several key documents are crucial for a successful property transfer. These documents act as the legal foundation for the transaction, ensuring a clear and legally sound transfer of ownership. Missing even one crucial document can significantly delay or even derail the entire process.

- Deed: The formal legal document that transfers ownership of the property. Different types of deeds exist, each with its own implications (e.g., Warranty Deed, Quitclaim Deed).

- Title Insurance Policy: Protects the buyer against potential title defects or claims against the property.

- Survey: A detailed map showing the property’s boundaries.

- Purchase Agreement: The contract outlining the terms of the sale.

- Mortgage Documents (if applicable): Loan documents and related paperwork.

- Closing Disclosure: A detailed breakdown of all costs involved in the transaction.

- Affidavits: Sworn statements confirming certain facts, often used to clarify ownership history or address title issues.

Q 3. Describe your experience with title insurance and its role in property transfers.

Title insurance is an essential part of any property transfer. It’s like an insurance policy for the ownership of your property, protecting you against financial losses caused by unforeseen title defects. My experience shows that it’s not just a formality; it offers critical protection. For example, I’ve handled cases where hidden liens or disputed boundaries were uncovered after closing. Title insurance stepped in and protected my clients from significant financial losses, providing compensation to rectify the issue.

Title insurance comes in two main forms: lender’s title insurance (protecting the lender’s investment) and owner’s title insurance (protecting the buyer’s investment). Both are crucial in mitigating risks associated with potential title issues such as:

- Forged deeds or wills

- Unpaid taxes or liens

- Boundary disputes

- Errors in public records

A comprehensive title search conducted by the title insurance company helps identify these potential issues *before* closing, minimizing the buyer’s risk.

Q 4. How do you handle discrepancies in property records during a transfer?

Discrepancies in property records are a common challenge. These can range from minor inconsistencies to major title defects. My approach involves a systematic investigation. First, I thoroughly review all available documentation, comparing it against the official records. This includes deeds, surveys, tax assessments, and any other relevant documents. Then, I contact the relevant authorities (county recorder’s office, land surveyors) to clarify the discrepancies. If necessary, I might engage a title attorney or a land surveyor to conduct further investigation or provide expert opinions. The goal is to resolve the discrepancies before closing, ensuring a clear and marketable title for the buyer.

For instance, I once encountered a case where the recorded legal description of a property didn’t exactly match the actual boundaries. Through careful investigation and working with a surveyor, we resolved the issue by accurately defining and correcting the legal description, avoiding any future disputes.

Q 5. What are the common challenges faced during property transfers, and how do you address them?

Property transfers often face various challenges. These can include:

- Title defects: Liens, encumbrances, or other issues affecting the clear ownership of the property.

- Financing issues: Delays or difficulties in securing mortgage approval.

- Survey discrepancies: Inconsistent information between the property’s recorded boundaries and the actual boundaries.

- Disputes between parties: Conflicts concerning the terms of the sale or the condition of the property.

- Delays in processing documents: Slowdowns from government agencies.

I address these challenges by proactive communication, careful documentation, thorough due diligence, and engaging relevant experts when necessary. For example, if a financing issue arises, I work closely with the lender and the buyer to find a solution. If there are title defects, I engage a title attorney to assist in resolving them. Open and honest communication among all parties involved is key to overcoming these hurdles successfully.

Q 6. Explain the importance of due diligence in property transfers.

Due diligence is the cornerstone of a successful property transfer. It’s the investigative process where potential buyers thoroughly examine all aspects of a property before committing to a purchase. Imagine buying a car without a test drive – that’s how risky a property purchase is without due diligence. It’s like a thorough health check for the property.

Due diligence includes verifying the property’s title, examining the condition of the property, reviewing relevant legal documents, and ensuring the property meets the buyer’s needs and expectations. It helps uncover potential problems early on, allowing the buyer to negotiate terms, request repairs, or walk away from a problematic deal. This safeguards the buyer’s financial investment and protects them from future legal disputes.

Q 7. Describe your experience with different types of property deeds.

I have extensive experience with various types of property deeds. Each deed carries different implications for the buyer and seller regarding warranties and liabilities. Understanding these differences is crucial for a successful transfer. Here are a few common types:

- Warranty Deed: Offers the strongest protection to the buyer, as the seller guarantees clear title and protects against future claims.

- Quitclaim Deed: Transfers whatever interest the grantor (seller) has in the property, without any guarantees of clear title. This is often used to resolve title issues or transfer property within families.

- Special Warranty Deed: The grantor warrants clear title only during their ownership period, not necessarily before.

- Grant Deed: A common deed used in some states, offering implied warranties of title.

The choice of deed depends on the circumstances of the transfer, the risk tolerance of the parties involved, and the specific legal requirements of the jurisdiction.

Q 8. How do you ensure compliance with relevant regulations and laws during property transfers?

Ensuring compliance in property transfers is paramount. It involves meticulous adherence to all applicable federal, state, and local laws and regulations. This includes, but isn’t limited to, fair housing laws, environmental regulations, zoning ordinances, and tax implications. My approach is multifaceted:

- Thorough Due Diligence: Before any transfer begins, I conduct extensive title searches to uncover any liens, encumbrances, or other issues that could impact the transaction. I also verify the zoning and building codes compliance of the property.

- Regulatory Research: I stay updated on all relevant laws and regulations through professional development, legal updates, and collaboration with legal professionals. This guarantees that the transaction conforms to the current legal landscape.

- Documentation and Disclosure: All necessary documents are meticulously prepared and reviewed, ensuring full transparency and disclosure to all parties involved. This includes all contracts, deeds, and any relevant disclosures about the property’s condition or history.

- Expert Consultation: When dealing with complex regulatory issues, I don’t hesitate to consult with specialists, such as environmental lawyers or tax advisors, to ensure complete compliance.

For example, in one recent transaction, we identified a potential environmental concern on the property during the due diligence phase. Consulting an environmental attorney allowed us to mitigate the issue proactively, preventing potential delays and legal complications.

Q 9. What is your experience with handling complex property transfers involving multiple parties?

I have extensive experience in managing complex property transfers involving multiple parties, including those with intricate ownership structures, multiple buyers or sellers, and numerous stakeholders. My approach focuses on clear communication, organization, and a collaborative spirit.

- Clearly Defined Roles and Responsibilities: I establish clear roles and responsibilities for each party from the outset. This avoids confusion and ensures everyone understands their part in the process.

- Comprehensive Communication Plan: Regular communication, through emails, meetings, and updates, keeps all parties informed and minimizes misunderstandings.

- Structured Documentation: I create and maintain detailed records of all agreements, communication, and transactions, providing a transparent and easily accessible audit trail for all participants.

- Negotiation and Conflict Resolution: I am adept at mediating disagreements between parties, ensuring that everyone’s interests are addressed fairly and efficiently.

For instance, I recently managed a property transfer involving five different heirs, each with differing opinions on the best course of action. Through open communication, careful negotiation, and clear legal guidance, I successfully guided them towards a mutually agreeable solution and facilitated a smooth transfer.

Q 10. How do you manage the timelines and deadlines associated with property transfers?

Managing timelines and deadlines in property transfers requires meticulous planning and proactive management. My approach involves:

- Detailed Project Schedule: I create a detailed project schedule with clearly defined milestones and deadlines for each stage of the transfer process. This includes title searches, inspections, contract negotiations, financing arrangements, and closing.

- Regular Monitoring and Reporting: I regularly monitor progress against the schedule, identifying potential delays early on. I then provide timely reports to all parties involved.

- Contingency Planning: I develop contingency plans to address potential delays or unforeseen circumstances that may arise during the process. This minimizes disruption and keeps the transaction on track.

- Proactive Communication: Open and proactive communication with all parties is crucial in ensuring everyone is aware of the timeline and any potential challenges.

Think of it like orchestrating a complex symphony; each instrument (task) must play its part at the right time to achieve a harmonious result (successful closing).

Q 11. Explain your understanding of escrow accounts and their management.

Escrow accounts are crucial in property transfers, providing a neutral third-party holding of funds until all conditions of the sale are met. I have extensive experience in managing escrow accounts, ensuring the safe and efficient handling of significant sums of money.

- Selection of Reputable Escrow Agent: I select reputable and licensed escrow agents, ensuring they meet the highest standards of professionalism and security.

- Clear Instructions and Documentation: I provide clear and concise instructions to the escrow agent, outlining all conditions for the release of funds.

- Regular Monitoring: I regularly monitor the escrow account to ensure funds are handled appropriately and in accordance with the terms of the agreement.

- Compliance with Regulations: I ensure strict adherence to all relevant state and federal regulations regarding escrow accounts.

A well-managed escrow account minimizes risk and ensures that funds are disbursed only after all conditions are met, providing security and peace of mind for all parties.

Q 12. How do you handle disputes or conflicts that may arise during a property transfer?

Disputes can arise during property transfers. My approach emphasizes proactive conflict resolution:

- Early Identification and Prevention: I actively look for potential conflicts during the initial stages of the transaction and address them proactively to prevent escalation.

- Mediation and Negotiation: I facilitate communication and negotiation between the parties involved, seeking mutually agreeable solutions.

- Legal Counsel: If mediation fails, I assist parties in obtaining legal counsel to resolve the dispute through formal legal channels.

- Documentation of all Communication: Maintaining a comprehensive record of all communications and agreements helps to support any claims or counterclaims.

For example, in one case, a disagreement arose regarding the condition of the property. By facilitating open communication and utilizing professional home inspectors’ reports, we were able to reach a compromise acceptable to both buyer and seller, preventing litigation.

Q 13. Describe your proficiency in using relevant software and technology for property transfers.

Proficiency in relevant software and technology is essential in today’s real estate market. I am skilled in using various software and platforms for:

- Title and Escrow Management Systems: I utilize specialized software for managing title searches, escrow accounts, and document processing.

- Contract Management Software: I use software to create, manage, and track contracts, ensuring efficient and accurate documentation.

- Real Estate Databases and CRMs: Access to and use of real estate databases and CRMs enhances my ability to analyze market data and track client information effectively.

- E-signature platforms: I utilize e-signature platforms to expedite the signing process and improve efficiency.

These technologies streamline the property transfer process, improving accuracy, reducing errors, and saving time.

Q 14. How do you prioritize tasks and manage multiple property transfers simultaneously?

Managing multiple property transfers concurrently requires a systematic and organized approach.

- Prioritization Matrix: I use a prioritization matrix to rank tasks based on urgency and importance, ensuring that critical deadlines are met.

- Time Management Techniques: I employ time management techniques such as time blocking and task delegation to optimize my workflow.

- Regular Review and Adjustment: I regularly review my workload, making adjustments to the schedule as needed.

- Teamwork and Delegation: When necessary, I delegate tasks to capable team members, ensuring efficient task completion.

It’s like managing a portfolio of investments; each transaction requires individual attention, but the overall strategy (efficient task management) ensures a balanced and successful outcome.

Q 15. Explain your experience with preparing and reviewing closing statements.

Preparing and reviewing closing statements is a critical part of ensuring a smooth property transfer. A closing statement is a detailed financial document that summarizes all the monetary transactions involved in a real estate closing. It outlines the buyer’s and seller’s debits and credits, ultimately showing the exact amount each party needs to pay or receive at closing.

My experience encompasses meticulously reviewing every line item, verifying calculations, and ensuring the accuracy of all figures. This includes reconciling the purchase price, down payment, mortgage amount, closing costs, prepaid taxes, and any adjustments related to property taxes or utilities. I’ve handled hundreds of closing statements, ranging from straightforward residential transactions to complex commercial deals involving multiple parties and intricate financing arrangements. For example, in one instance, I identified a discrepancy of several thousand dollars in a commercial closing statement related to the proration of property taxes, preventing a significant financial loss for my client. I utilize specialized software to streamline this process and enhance accuracy, cross-referencing figures against various supporting documents.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you ensure accuracy and completeness in all property transfer documentation?

Accuracy and completeness in property transfer documentation are paramount to avoid costly disputes and legal complications. My approach involves a multi-layered system of checks and balances. First, I thoroughly review all documentation provided by the parties involved, ensuring all forms are properly completed and all necessary signatures are present. This includes deeds, title reports, surveys, disclosures, and financing documents. I then perform meticulous cross-checking of data points across different documents, looking for any inconsistencies or omissions.

Secondly, I utilize various technology tools like title search platforms to verify ownership history and identify any potential liens or encumbrances. Finally, I prepare comprehensive checklists and utilize a structured workflow to ensure no step is missed in the process. Think of it like assembling a complex puzzle—each piece needs to fit perfectly. Any missing piece or incorrectly placed one can jeopardize the entire transaction. I have developed my own internal quality control procedures to enhance this process.

Q 17. Describe your experience with different types of property, such as residential, commercial, or industrial.

My experience spans various property types, including residential, commercial, and industrial properties. While the fundamental principles of property transfer remain the same, the complexities vary significantly. Residential transactions often involve simpler financing and fewer stakeholders compared to commercial or industrial properties. Commercial properties, for example, may involve lease agreements, complex financing structures, and multiple parties. Industrial properties often have unique considerations related to environmental regulations and zoning laws.

I’ve worked on the sale of luxury waterfront homes, large-scale retail complexes, and even industrial warehouses. Each type of property demands a unique understanding of its specific market nuances and legal requirements. This experience has equipped me with the ability to adapt my approach and expertise to the specific challenges of different property classes. My understanding extends to the different due diligence processes required for each, including environmental site assessments and building inspections.

Q 18. How do you handle situations involving liens or encumbrances on the property?

Liens and encumbrances are claims or rights against a property that can affect its transfer. Handling these situations requires careful attention to detail and a thorough understanding of legal principles. My process begins with identifying the nature of the lien or encumbrance through title searches and reviewing the property’s history. This may include mortgage liens, tax liens, mechanic’s liens, or judgments. Once identified, I determine the best course of action to resolve the issue before closing.

This may involve negotiating with lienholders to satisfy the claim, obtaining a release of the lien, or implementing escrow procedures to ensure the claim is settled during the closing. For instance, in a recent transaction, a mechanic’s lien was discovered against the property. We were able to work with the contractor and the seller to resolve the matter swiftly and prevent delays in closing. Communication and coordination with all parties involved is crucial for effective lien resolution.

Q 19. What is your understanding of property taxes and their role in property transfers?

Property taxes are a significant consideration in property transfers. They represent a recurring cost associated with owning property and are levied by local government authorities. In a property transfer, the buyer and seller typically prorate the property taxes, meaning they divide the responsibility for the current tax year based on the number of days each party owns the property. This proration ensures a fair and equitable distribution of tax liability.

My understanding of property taxes extends to the various methods used to calculate prorations, taking into account tax rates, assessment values, and payment schedules. I’m proficient in working with tax statements and ensuring accurate calculation and allocation of tax payments between the buyer and seller at closing. Errors in this area can lead to disputes and financial losses. I utilize specialized software to automate the tax proration calculation, ensuring accuracy and efficiency.

Q 20. How do you communicate effectively with clients, legal representatives, and other stakeholders?

Effective communication is the cornerstone of successful property transfers. I prioritize clear and concise communication with all stakeholders, including clients, legal representatives, lenders, and title companies. I maintain regular contact, providing timely updates and addressing any concerns promptly. I strive to explain complex concepts in a simple, understandable manner, ensuring everyone is well-informed throughout the process.

For example, I utilize various communication channels, including email, phone calls, and video conferencing, to suit the preferences of each individual. I also maintain detailed records of all communication to ensure transparency and accountability. I believe in proactive communication, anticipating potential problems and proactively addressing them before they escalate into larger issues. Building trust through transparent and honest communication is essential for building strong client relationships.

Q 21. Explain your experience with property transfer processes in different jurisdictions.

My experience encompasses property transfer processes across multiple jurisdictions. While the fundamental principles are consistent, the specific regulations, legal requirements, and documentation vary significantly. For example, the requirements for recording deeds, the types of required disclosures, and the tax implications can differ greatly between states or even counties. I have a strong understanding of these jurisdictional differences and adapt my approach accordingly.

This knowledge allows me to navigate the complexities of each jurisdiction smoothly and efficiently. I actively stay updated on changes in relevant laws and regulations to ensure I’m providing accurate and compliant services. This ongoing professional development is critical to staying ahead of the curve and offering the best service to my clients. A detailed understanding of each jurisdiction’s specific requirements allows me to minimize potential delays and complications in the transfer process.

Q 22. Describe your experience with handling post-closing matters.

Post-closing matters are crucial for ensuring a smooth and legally sound property transfer. My experience encompasses a wide range of activities, from coordinating the final walkthrough and disbursement of funds to handling title insurance policy issuance and recording the deed with the relevant authorities. This also includes addressing any outstanding issues that may arise after the closing, such as correcting minor discrepancies in the closing documents or resolving disputes related to the property’s condition. For example, I once assisted a client in resolving a dispute over a previously undisclosed repair needed to a property’s septic system. We used the contract’s contingency clauses to negotiate a fair resolution between the buyer and seller, ultimately averting costly litigation.

Furthermore, post-closing, I diligently monitor for any potential issues and work proactively to mitigate any risks to my clients’ interests. This includes staying in communication to address any unforeseen problems promptly and efficiently.

Q 23. How do you stay updated on changes in property transfer laws and regulations?

Staying current on ever-changing property transfer laws and regulations is paramount. I accomplish this through a multi-pronged approach. First, I actively subscribe to and regularly review publications from reputable sources like the American Bar Association’s Real Property, Probate and Trust Law Section and state-specific bar associations. These publications offer detailed analysis of recent legislative changes and case law impacting property transfers. Secondly, I participate in continuing legal education (CLE) courses specifically focused on real estate law updates. These courses provide invaluable insights from leading experts in the field and offer opportunities for networking with other professionals. Finally, I maintain professional relationships with other legal professionals and title insurance representatives, ensuring a constant flow of information and best practices. This continuous learning guarantees I am always prepared to offer my clients the most up-to-date and effective legal counsel.

Q 24. How do you identify and mitigate potential risks during property transfers?

Identifying and mitigating potential risks is a proactive, multi-step process that begins with a thorough due diligence review. This includes a comprehensive title search to uncover any encumbrances, liens, or other issues that could affect the transfer. We verify the seller’s ownership, check for outstanding mortgages or taxes, and examine zoning regulations to ensure the property’s intended use is permissible. Furthermore, we carefully review the contract of sale, identifying and addressing any potential ambiguities or loopholes.

- Risk Mitigation Strategies: We use escrow accounts to protect funds, obtain necessary insurance policies (like title insurance), and carefully review survey reports to avoid boundary disputes. In addition, thorough communication between all parties involved is vital in identifying and addressing potential problems early on.

For example, during a recent transaction, a title search revealed an unrecorded easement that could have significantly impacted the property’s use. By promptly addressing this issue with the seller and relevant parties, we were able to negotiate a satisfactory resolution before the closing, ensuring a smooth transfer without surprises.

Q 25. Describe a situation where you had to resolve a complex issue during a property transfer.

I once encountered a complex situation involving a property transfer where the seller’s heirs were geographically dispersed and had conflicting interests in the sale. One heir challenged the validity of the will, creating uncertainty about the seller’s authority to transfer the property. This presented a significant obstacle to the timely completion of the transaction.

To resolve this, I engaged in extensive communication with all the heirs, carefully explaining the legal implications of their actions and the potential ramifications of protracted legal challenges. I worked collaboratively with their legal representatives to facilitate a compromise that ensured a fair distribution of proceeds while adhering to legal requirements and preserving the interests of all parties. Ultimately, we structured a settlement that satisfied all heirs while allowing the sale to proceed smoothly. The case highlighted the need for patience, clear communication, and a collaborative approach to navigate complex family dynamics in real estate transactions.

Q 26. How do you ensure the confidentiality and security of sensitive client information?

Client confidentiality and data security are of utmost importance. I adhere to strict protocols to ensure sensitive information remains protected. This includes using secure electronic communication platforms, password-protected files, and encrypted storage for all client documents. We also comply with all relevant data privacy regulations like HIPAA and GDPR where applicable. Access to client files is strictly controlled, limited to authorized personnel only. Furthermore, our firm conducts regular security audits to identify and mitigate potential vulnerabilities. Finally, all employees undergo regular training on data security best practices and ethical handling of client information. We treat client confidentiality with the utmost seriousness, understanding that trust is fundamental to our professional relationships.

Q 27. What is your approach to continuous professional development in the field of property transfers?

Continuous professional development is a cornerstone of my approach to legal practice. I believe staying at the forefront of the field requires a dedicated commitment to ongoing learning. I actively participate in professional development programs, such as CLE courses and webinars, to stay abreast of the latest legal updates, changes in technology, and emerging trends in the property transfer sector. I also actively seek mentorship opportunities from experienced professionals and actively engage with professional organizations to learn from peers and share best practices. This commitment to ongoing learning ensures I can consistently provide the highest level of service and expertise to my clients.

Q 28. What are your salary expectations?

My salary expectations are commensurate with my experience, expertise, and the market rate for professionals with similar qualifications in this specialized field. I am open to discussing a competitive compensation package that reflects my contributions and aligns with the firm’s overall compensation structure.

Key Topics to Learn for Property Transfer Procedures Interview

- Legal Frameworks Governing Property Transfers: Understanding relevant laws, regulations, and statutes at local, state, and potentially federal levels. This includes deed restrictions, zoning regulations, and environmental considerations.

- Due Diligence Processes: Practical application of research methods to verify property ownership, title history, outstanding liens, and encumbrances. This includes interpreting title reports and identifying potential risks.

- Contract Negotiation and Drafting: Understanding the key clauses in purchase agreements, including contingencies, closing dates, and allocation of responsibilities. Practical application includes identifying potential pitfalls and negotiating favorable terms.

- Closing Procedures and Documentation: Knowledge of the steps involved in a successful closing, including the preparation and execution of documents, disbursement of funds, and recording of the deed. This includes understanding escrow procedures and the role of various parties involved.

- Property Tax and Assessment Implications: Understanding how property taxes are assessed and transferred during a sale, including implications for buyers and sellers. This also includes navigating property tax appeals processes.

- Ethical Considerations and Best Practices: Adherence to professional standards and ethical guidelines in handling sensitive client information and navigating potential conflicts of interest.

- Problem-Solving in Property Transfer Scenarios: Developing the ability to identify and resolve common issues that arise during property transfers, such as title disputes, financing problems, or contract breaches. This includes proactive identification and mitigation of risks.

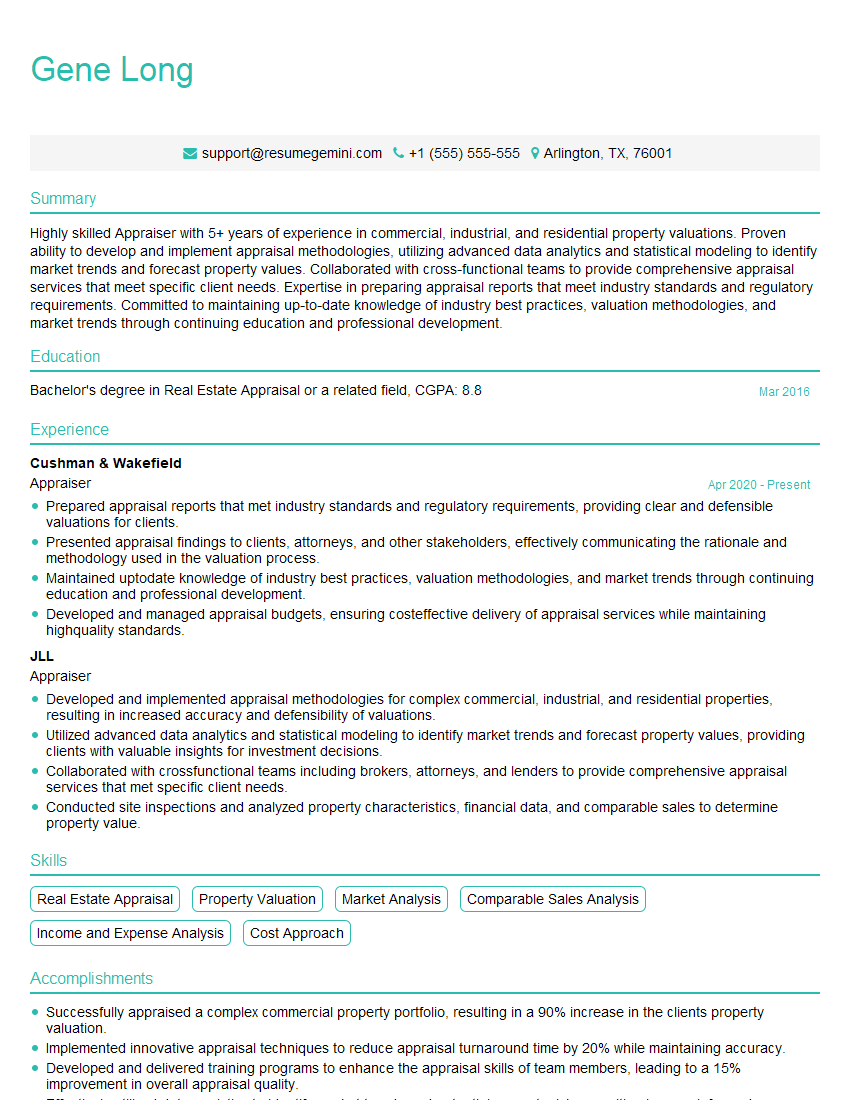

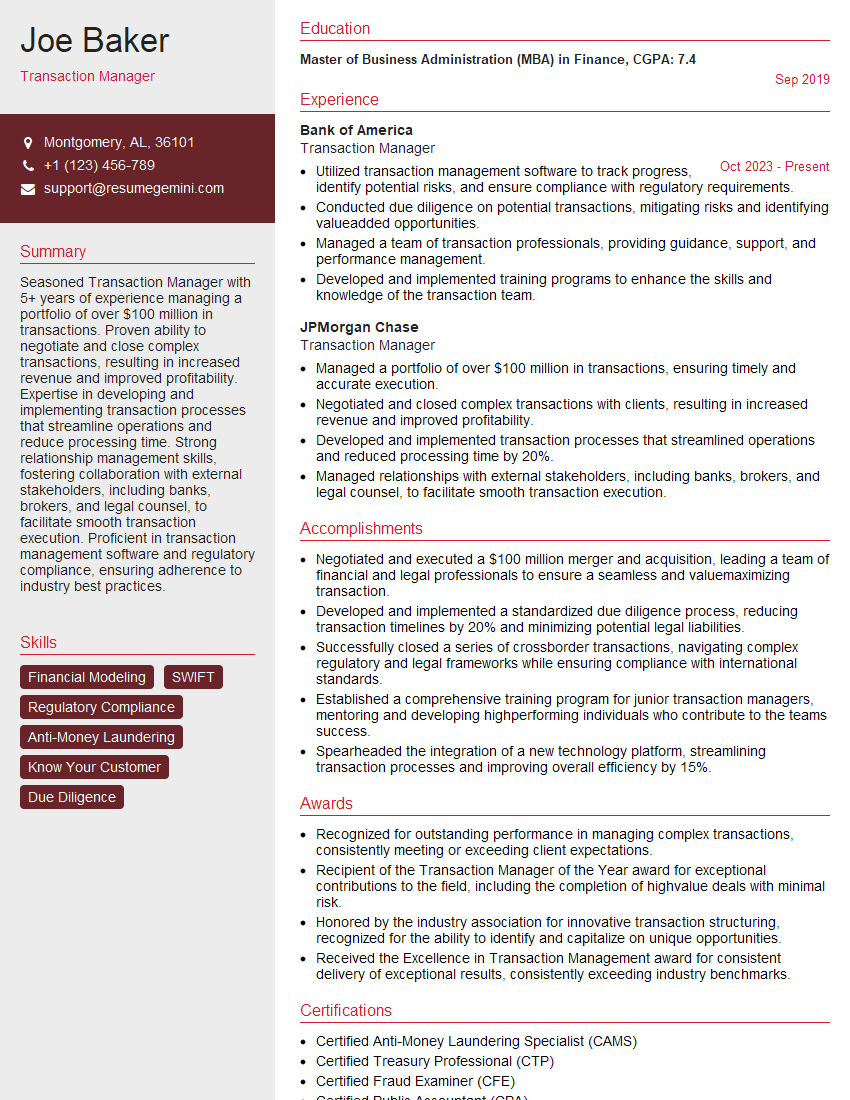

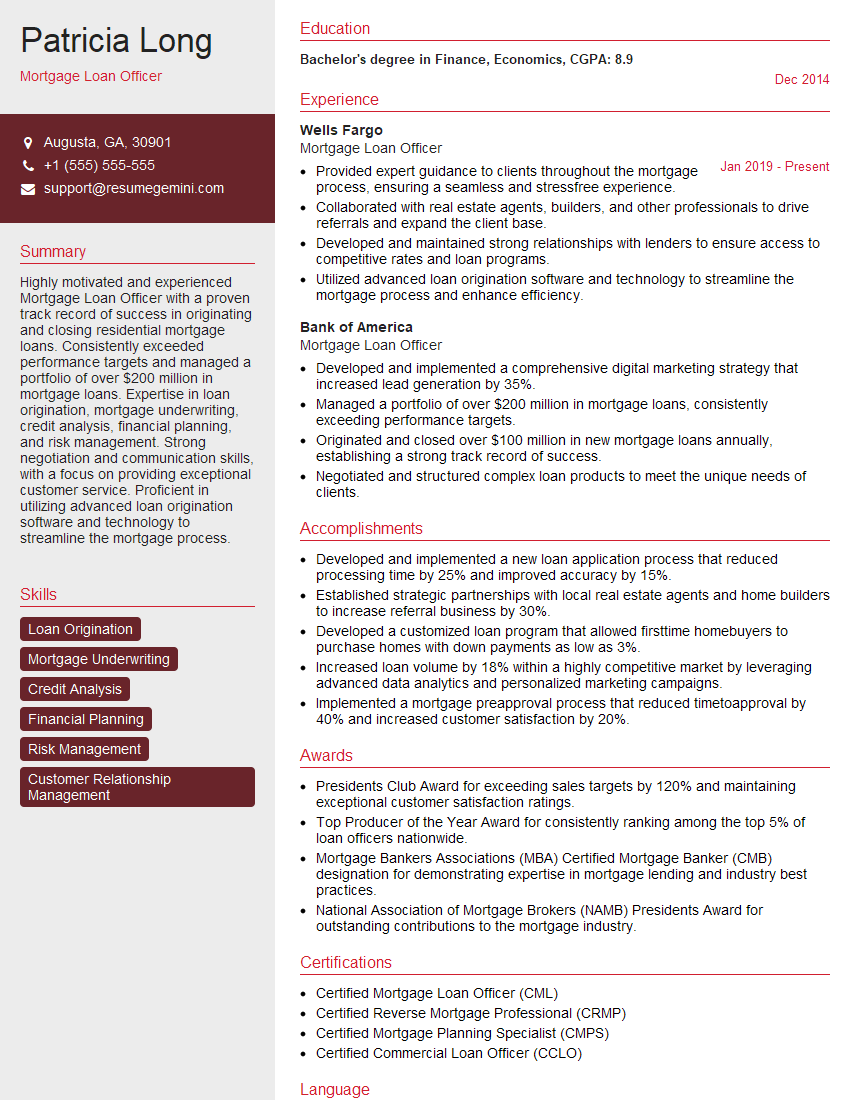

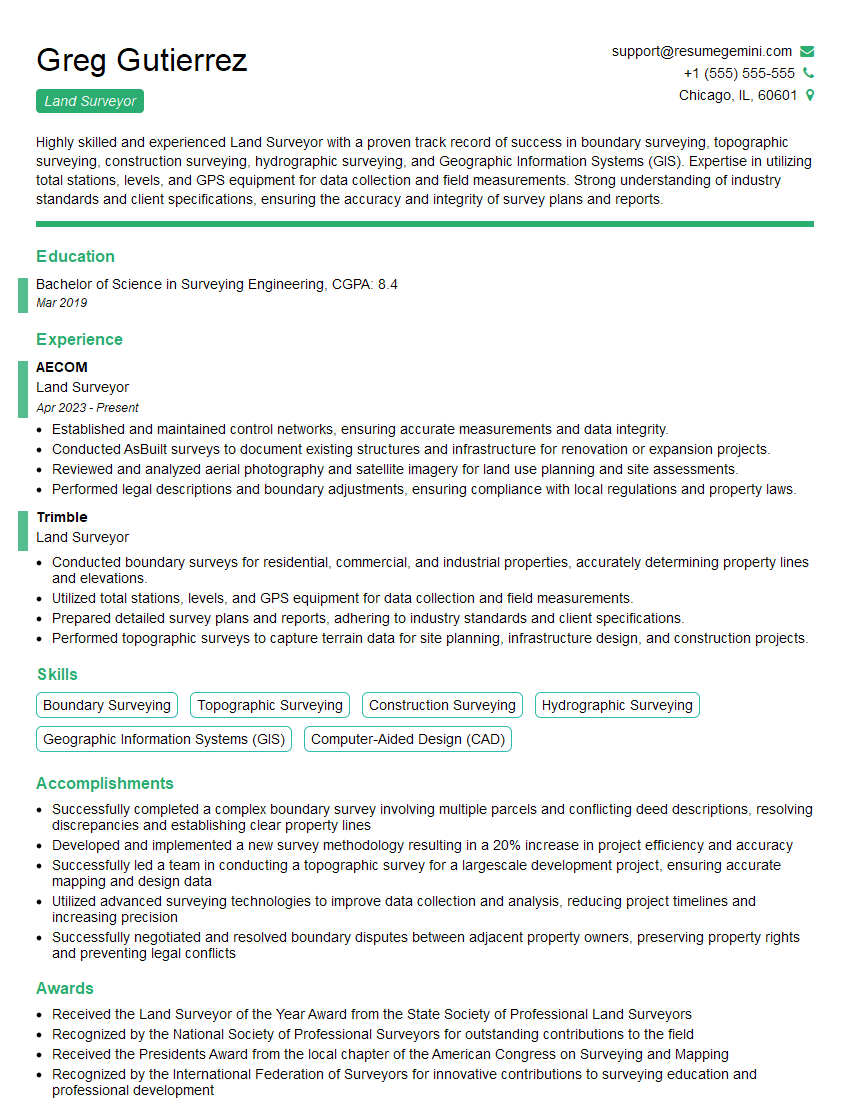

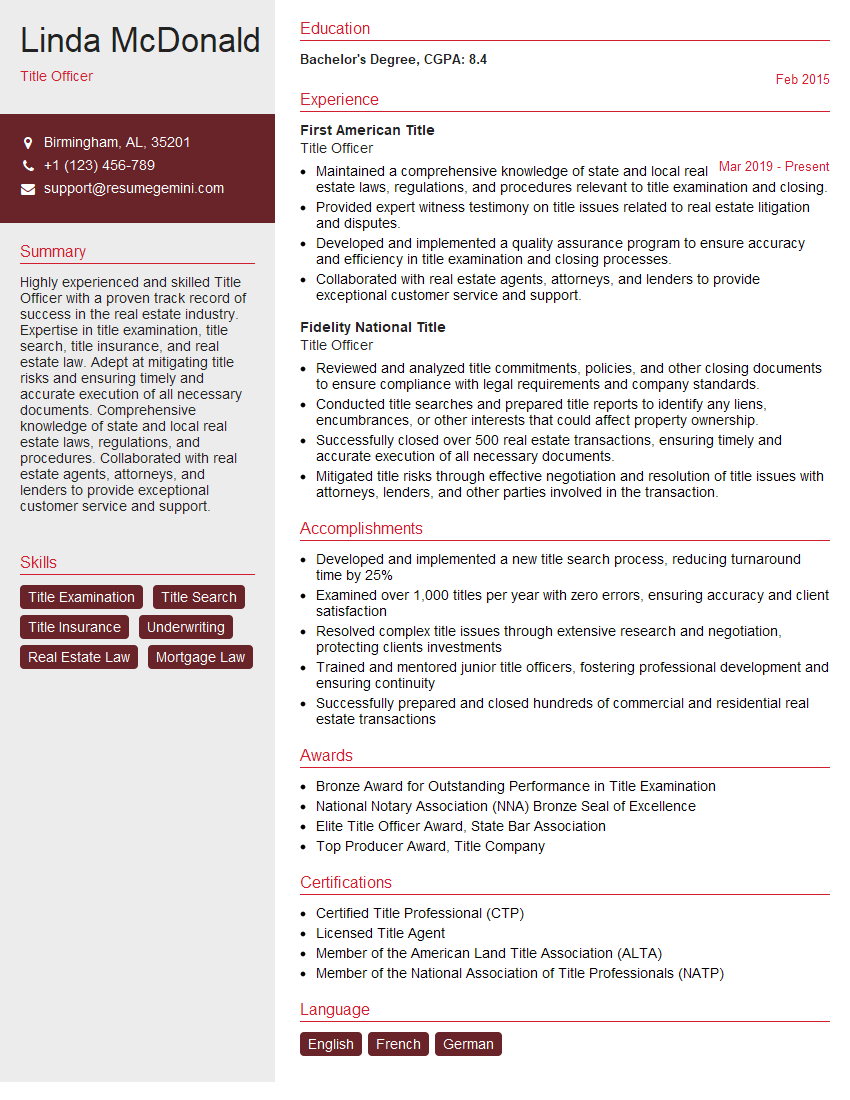

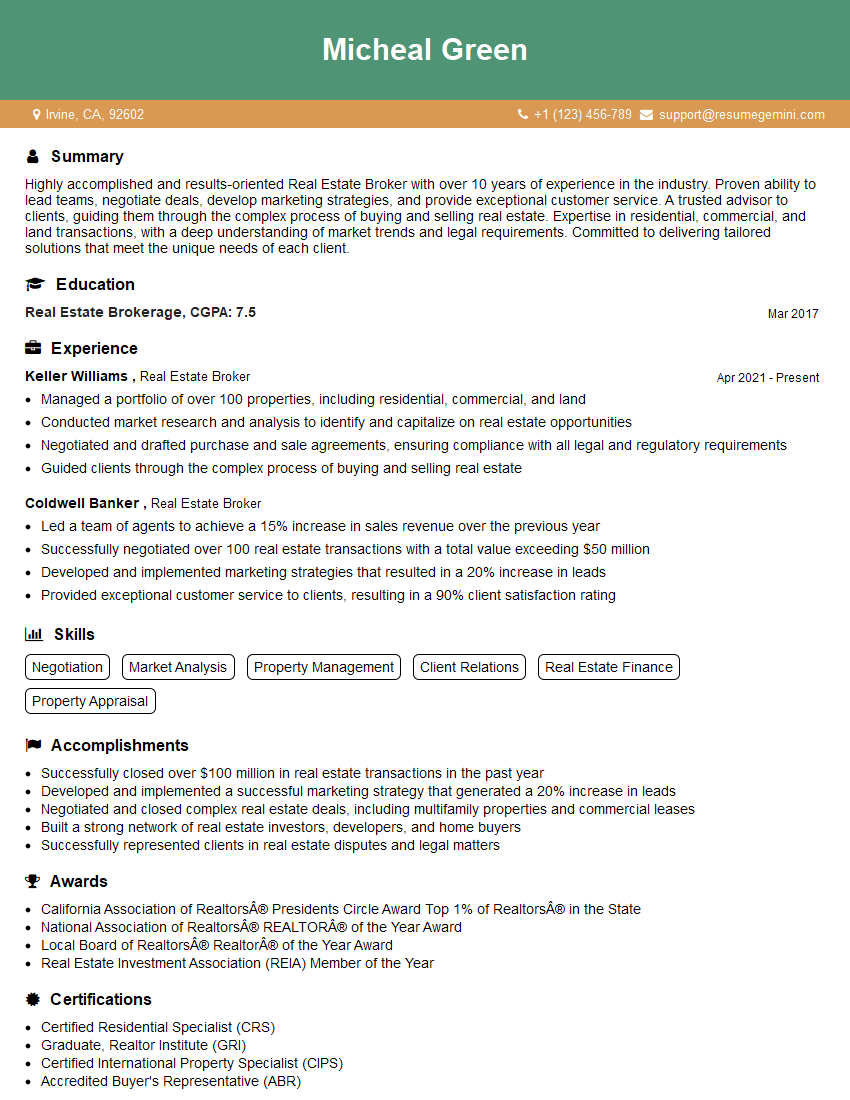

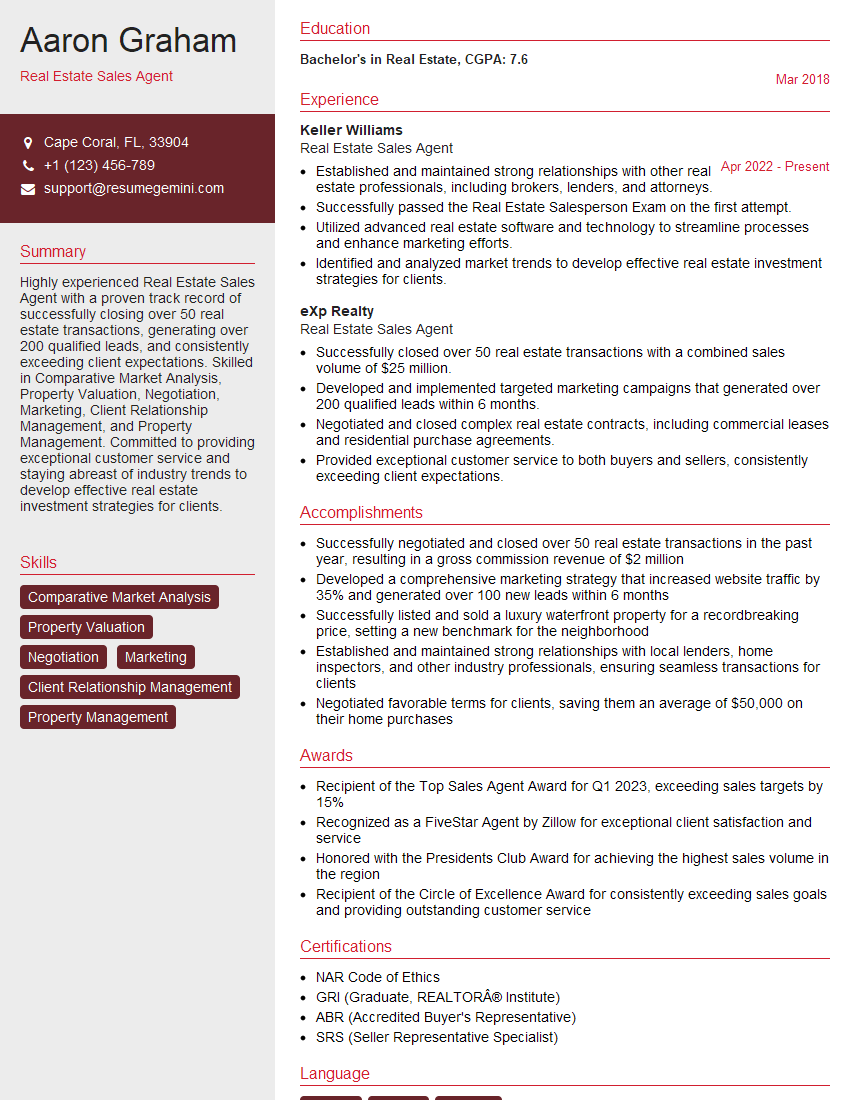

Next Steps

Mastering Property Transfer Procedures is crucial for career advancement in real estate, legal, and financial sectors. A strong understanding of these procedures demonstrates professionalism and competence, opening doors to higher-paying positions and leadership roles. To maximize your job prospects, crafting an ATS-friendly resume is essential. ResumeGemini is a trusted resource to help you build a compelling and effective resume that highlights your skills and experience. Examples of resumes tailored specifically to Property Transfer Procedures are available to guide you.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

I Redesigned Spongebob Squarepants and his main characters of my artwork.

https://www.deviantart.com/reimaginesponge/art/Redesigned-Spongebob-characters-1223583608

IT gave me an insight and words to use and be able to think of examples

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO