Interviews are opportunities to demonstrate your expertise, and this guide is here to help you shine. Explore the essential Real Estate Contracts interview questions that employers frequently ask, paired with strategies for crafting responses that set you apart from the competition.

Questions Asked in Real Estate Contracts Interview

Q 1. Explain the difference between a ‘time is of the essence’ clause and a ‘reasonable time’ clause in a real estate contract.

The difference between a ‘time is of the essence’ clause and a ‘reasonable time’ clause lies in the strictness of deadlines. A ‘time is of the essence’ clause means that all deadlines and timelines specified in the contract must be met precisely. Failure to meet even a minor deadline can be considered a breach of contract. Think of it like a high-stakes deadline for a crucial project: any delay, even a slight one, has significant consequences.

Conversely, a ‘reasonable time’ clause provides more flexibility. Deadlines are not strictly defined; instead, they are interpreted based on what’s considered reasonable under the circumstances. This allows for some leeway in case of unforeseen delays or extenuating circumstances. Imagine a construction project where a delay of a few days due to unexpected weather isn’t necessarily a breach, as long as it remains within a reasonable timeframe.

For example, imagine a contract with a closing date of July 1st. With a ‘time is of the essence’ clause, failure to close on July 1st could lead to the contract being voided, even if the delay is just a few hours. However, with a ‘reasonable time’ clause, a slight delay might be acceptable, depending on the specific context and the reasons for the delay. The courts would look at whether the delay was truly unreasonable given the circumstances.

Q 2. What are the essential elements of a legally binding real estate contract?

A legally binding real estate contract requires several key elements. First, there must be an offer and an acceptance. This means a clear offer from the buyer, and an unequivocal acceptance from the seller, creating a ‘meeting of the minds’. Next, there must be a clear description of the property, including the address, legal description, and any included items. Both parties must have legal capacity; they must be of legal age and sound mind to enter into a contract. The contract needs to specify a purchase price and the method of payment. Lastly, the contract should clearly define the terms and conditions of the sale, including closing date, contingencies, and responsibilities of each party. Think of it as a comprehensive agreement that leaves nothing to ambiguity.

Let’s say a buyer makes an offer for $500,000 on a specific house (offer & acceptance). The contract then states the address, property boundaries (description of property). Both the buyer and seller are adults (legal capacity), agreeing on the $500,000 price and a mortgage payment schedule. All other conditions, such as inspection deadlines and closing dates are clearly listed (terms and conditions). Only then does the agreement become legally watertight.

Q 3. Describe the process of due diligence in a real estate transaction.

Due diligence in real estate is the investigative process a buyer undertakes to verify all aspects of the property before finalizing the purchase. It’s like a thorough background check for a house. It involves several steps, including:

- Property inspection: A professional inspector examines the property’s structure, systems (plumbing, electrical, HVAC), and identifies any potential problems.

- Title search: This verifies the seller’s ownership and identifies any liens, encumbrances, or other issues affecting the title. It ensures you’re buying a property free of any hidden legal challenges.

- Environmental review: This assesses environmental hazards such as asbestos, lead paint, or radon. It protects you from future environmental remediation costs.

- Zoning and permitting review: Verifies the property’s compliance with local zoning regulations and building codes.

- Review of disclosures: The seller is legally obligated to disclose known material defects; this review ensures they’ve fully complied.

A thorough due diligence process helps buyers make informed decisions and avoid costly surprises after closing. For example, discovering significant structural damage during the inspection could allow the buyer to negotiate a lower price or even back out of the contract.

Q 4. How do you handle contingencies in a real estate contract?

Contingencies are conditions that must be met before a real estate contract is legally binding. They act as safety nets for buyers and sellers. These are typically handled by including specific clauses in the contract. For example, a financing contingency allows the buyer to back out of the contract if they can’t secure financing within a specified timeframe. An inspection contingency lets the buyer terminate the contract if the property inspection reveals significant defects. Appraisal contingencies protect buyers from overpaying if the property’s appraised value is lower than the purchase price.

Handling contingencies involves clearly defining the conditions, deadlines, and remedies in the contract. For instance, the contract might state that if the buyer cannot secure financing within 30 days, the contract is null and void. This gives clarity to both parties. The key is to set realistic deadlines and clearly define the actions to be taken if a contingency is not met. Good communication is essential to navigate contingencies successfully. It allows both parties to address issues proactively and potentially reach mutually agreeable solutions.

Q 5. What are the common types of real estate contracts?

Several types of real estate contracts exist, each serving a unique purpose. Common ones include:

- Purchase and Sale Agreement: This is the most common type, outlining the terms of the sale between a buyer and a seller.

- Option Contract: This gives a buyer the right, but not the obligation, to purchase a property within a specified timeframe.

- Lease Agreement: This establishes the terms of a rental agreement between a landlord and a tenant.

- Land Contract (or Installment Contract): The seller finances the sale for the buyer, retaining ownership until the buyer makes final payment.

- Exchange Agreement (1031 Exchange): This allows investors to defer capital gains taxes by exchanging one investment property for another.

The choice of contract depends heavily on the specific transaction. A purchase and sale agreement is the standard for a typical home purchase, while a lease is used for rentals. Understanding the nuances of each contract type is crucial for a successful real estate transaction.

Q 6. Explain the concept of earnest money and its role in a real estate transaction.

Earnest money is a deposit made by a buyer to show their good faith and commitment to purchasing a property. It’s like a down payment but more symbolic, demonstrating serious intent. It’s typically held in escrow by a third party, such as a real estate agent or title company, until closing. If the transaction closes successfully, the earnest money is applied towards the purchase price. If the buyer breaches the contract without a valid reason (e.g., failing to secure financing when a financing contingency wasn’t included), they may forfeit the earnest money to the seller as compensation for lost time and potential other opportunities.

For example, a buyer might deposit $10,000 as earnest money when making an offer. If the deal closes successfully, that $10,000 will be used towards the total purchase price. If the buyer breaches the contract without a valid reason (and the contract allows for it), the seller can retain the $10,000. This incentivizes buyers to complete the transaction as agreed. The amount of earnest money is typically negotiated between the buyer and seller, and is usually a small percentage of the purchase price.

Q 7. What are the implications of a breach of contract in a real estate transaction?

A breach of contract in a real estate transaction occurs when one party fails to fulfill its obligations as outlined in the agreement. The implications can be significant. The non-breaching party may be entitled to legal remedies, such as:

- Specific performance: A court order requiring the breaching party to fulfill the contract’s terms (e.g., forcing a seller to complete the sale).

- Monetary damages: Compensation for financial losses incurred due to the breach (e.g., lost profits or expenses).

- Rescission: Cancellation of the contract, returning both parties to their pre-contractual positions.

- Liquidated damages: Damages agreed upon in the contract in advance (often the earnest money).

For instance, if a seller breaches the contract by refusing to sell the property after accepting an offer, the buyer could sue for specific performance to force the sale or seek monetary damages for lost profits and expenses associated with the failed transaction. The specific remedy will depend on the nature of the breach, the terms of the contract, and the applicable laws.

Q 8. How do you identify and mitigate risks associated with real estate contracts?

Identifying and mitigating risks in real estate contracts is crucial for a successful transaction. It involves a thorough due diligence process, starting with a careful review of the contract itself and extending to investigations into the property and the parties involved.

- Property Due Diligence: This includes title searches to uncover any liens, encumbrances, or other claims against the property; surveys to verify property boundaries; inspections to identify any structural or other defects; and environmental reviews to check for hazardous materials. For example, a hidden underground fuel tank could significantly impact the value and liability of a property.

- Contractual Risk Assessment: Closely examine every clause, paying close attention to contingencies (e.g., financing, appraisal), deadlines, representations and warranties (statements of fact made by the parties), and remedies for breach of contract. A poorly drafted financing contingency, for example, could leave a buyer vulnerable if their financing falls through.

- Party Due Diligence: Verify the identity and legal capacity of all parties involved. Ensure the seller has the legal authority to sell the property. For example, if the property is owned by a corporation, ensure the contract is signed by authorized representatives.

- Risk Mitigation Strategies: Use of escrow accounts to protect funds; securing appropriate insurance (e.g., title insurance); including strong representations and warranties in the contract; negotiating favorable terms and contingencies; and seeking legal counsel throughout the process are all essential risk mitigation strategies.

By proactively identifying and addressing potential risks, you can significantly reduce the chances of disputes, delays, and financial losses in real estate transactions.

Q 9. What are the key legal considerations for real estate contracts in your state/region?

Key legal considerations for real estate contracts vary by jurisdiction. However, some common elements include:

- Statute of Frauds: Most jurisdictions require real estate contracts to be in writing to be enforceable. This prevents disputes arising from verbal agreements.

- Specific Performance: This legal remedy allows a buyer or seller to force the other party to complete the transaction if a breach of contract occurs. The court can compel the breaching party to proceed with the sale.

- Deed Restrictions and Covenants: These restrictions, usually found in community documents, affect how the property can be used. Contracts must address compliance with these regulations. For instance, certain covenants might limit the exterior paint colors.

- Disclosure Requirements: Sellers often have a legal duty to disclose material defects known to them, that significantly affect property value and are not readily observable. Failure to disclose can lead to lawsuits.

- Real Estate Licensing Laws: Real estate agents must be properly licensed, and their actions must comply with the law. Contracts must involve parties acting within the scope of their licenses.

- Property Taxes and Assessments: The contract must clarify the responsibility for property taxes and special assessments.

It’s crucial to consult with a real estate attorney in your specific state/region to ensure full compliance with all applicable laws.

Q 10. Describe the process of closing a real estate transaction.

Closing a real estate transaction is the final step, where ownership of the property is transferred from the seller to the buyer. It’s a complex process involving multiple parties and documents.

- Final Walkthrough: The buyer conducts a final inspection to ensure the property is in the agreed-upon condition.

- Loan Closing (if applicable): If the buyer is financing the purchase, the lender disburses the funds.

- Document Preparation and Review: All parties review and sign the final closing documents, including the deed, mortgage (if applicable), and other related paperwork. This includes the closing disclosure which provides a final summary of the costs of the transaction.

- Funding: The buyer’s funds (down payment and/or loan proceeds) are transferred to the seller, typically through an escrow agent.

- Deed Recording: The deed is recorded with the appropriate county office, officially transferring ownership to the buyer. Recording provides public notice of the transfer of ownership.

- Funds Distribution: The escrow agent distributes the funds to the appropriate parties, including the seller, the lender (if applicable), and various other parties involved in the transaction such as title companies or real estate agents.

The entire process typically involves legal counsel, real estate agents, lenders, title companies, and escrow agents, all working together to ensure a smooth and legally sound transfer of ownership.

Q 11. Explain the difference between a purchase agreement and a sales contract.

While often used interchangeably, a purchase agreement and a sales contract are distinct, though related, documents. A purchase agreement is a legally binding contract outlining the terms and conditions under which a buyer agrees to purchase a property from a seller. It’s a preliminary agreement, often subject to contingencies (e.g., financing, inspection).

A sales contract is typically a more formal document that solidifies the agreement and often includes details that weren’t fully specified in the purchase agreement, such as a detailed closing schedule, proration of property taxes and other closing costs, and other final details to effectuate the transfer.

Think of the purchase agreement as the engagement, and the sales contract as the marriage certificate. The purchase agreement is the initial offer and acceptance of the terms, while the sales contract incorporates all the terms and closes the deal.

Q 12. How do you interpret and apply legal clauses in real estate contracts?

Interpreting legal clauses requires careful attention to detail and an understanding of legal principles. The process involves:

- Careful Reading and Analysis: Each clause should be read thoroughly, considering its context within the entire contract.

- Legal Definition and Interpretation: Understanding legal terms and principles is crucial, and undefined terms should be clarified.

- Consideration of Context: The interpretation of a clause should consider its relationship to other clauses and the overall intent of the contract. You should also consider any relevant extrinsic evidence which might clarify the parties’ intentions.

- Application to Facts: After interpreting the clause, its implications should be applied to the specific facts of the situation.

- Use of Precedents: Referring to case law or prior rulings can help clarify the meaning and interpretation of clauses.

For example, a clause stating that the “property is sold as is” needs careful interpretation. It doesn’t necessarily exclude all liability, especially if the seller has made material misrepresentations about the property’s condition. It also needs to be understood in context with local laws.

Q 13. How do you ensure compliance with relevant regulations and laws in real estate contracts?

Ensuring compliance with relevant regulations and laws is paramount in real estate. This involves:

- Thorough Due Diligence: Conducting comprehensive research to identify all applicable federal, state, and local laws and regulations.

- Professional Advice: Seeking advice from real estate attorneys and other relevant professionals throughout the contract negotiation and closing process.

- Contract Drafting: Drafting contracts that explicitly address compliance requirements, including disclosure obligations and restrictions.

- Monitoring Compliance: Regularly checking for any changes in legislation affecting real estate transactions, such as updates to disclosure requirements or zoning regulations.

- Record Keeping: Maintaining meticulous records of all aspects of the transaction, including the contract, addenda, amendments, and all supporting documentation.

Failure to comply with relevant regulations can result in serious consequences, including financial penalties, contract voidability, and legal action.

Q 14. What is the significance of a title insurance policy in a real estate transaction?

A title insurance policy protects the buyer and lender against financial losses from defects in the title to the property. It insures against risks such as:

- Encroachments: Structures built on neighboring property.

- Liens: Unpaid debts or judgments against the property.

- Forgeries: Fraudulent documents affecting title.

- Errors in public records: Mistakes in land records.

- Undisclosed heirs: Claims from individuals with an ownership interest not reflected in the title.

Title insurance provides peace of mind, protecting the buyer’s investment from potentially devastating financial losses that could arise from undiscovered title defects. It is a critical component of a secure real estate transaction. Both the buyer and lender usually purchase a title insurance policy.

Q 15. Explain the process of negotiating contract terms.

Negotiating contract terms is a delicate dance requiring strong communication, strategic thinking, and a deep understanding of real estate law. It’s about finding mutually beneficial compromises that protect both the buyer and the seller. The process typically begins with reviewing the initial contract, identifying areas for negotiation, and then engaging in a back-and-forth discussion to reach an agreement.

- Identifying Key Areas: Common points of negotiation include price, closing date, contingencies (financing, appraisal, inspection), and inclusions (fixtures, appliances). For example, a buyer might negotiate a lower price based on a less-than-perfect home inspection report or request an extension to the closing date due to unforeseen circumstances.

- Presenting Counteroffers: Negotiations usually involve submitting counteroffers. A counteroffer is a response to an offer, changing at least one of the terms. It’s crucial to clearly articulate the changes and justify them with reasoned arguments. For instance, if the seller’s asking price is too high, the buyer might counter with a lower offer supported by comparable property sales data.

- Compromise and Collaboration: Successful negotiations often involve compromise. Both parties may need to concede on certain points to reach a final agreement. Think of it as a win-win scenario where both sides feel they’ve achieved a satisfactory outcome. It’s a process of give and take.

- Documentation is Key: Every agreed-upon change should be documented in writing and incorporated into the final contract. This ensures clarity and prevents misunderstandings later on.

For example, I recently helped a client negotiate a significant reduction in price on a commercial property by presenting a detailed market analysis demonstrating that the initial asking price was significantly inflated compared to comparable properties in the area. This involved meticulous research and strategic presentation of data to support the client’s position.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you handle contract disputes?

Handling contract disputes requires a methodical approach, prioritizing negotiation and mediation before resorting to litigation. Early intervention is critical to minimizing potential costs and preserving relationships.

- Negotiation: Attempting to resolve the dispute through direct communication between the parties is the first and often most effective step. A collaborative approach, focusing on finding common ground, can lead to a mutually acceptable solution.

- Mediation: If direct negotiation fails, mediation offers a structured environment where a neutral third party facilitates communication and helps the parties reach an agreement. Mediators don’t decide the outcome; they help parties find common ground.

- Arbitration: If mediation proves unsuccessful, arbitration involves presenting the case to a neutral arbitrator who will make a binding decision. This is less formal and less expensive than litigation.

- Litigation: As a last resort, litigation involves filing a lawsuit in court. This is the most time-consuming and expensive option, and should be considered only after exhausting all other avenues.

In my experience, most real estate contract disputes arise from misunderstandings or unmet expectations. Thoroughly reviewed contracts and clear communication can significantly reduce the likelihood of disputes. For instance, I once helped resolve a dispute involving a delayed closing by facilitating a mediation session between the buyer and seller, ultimately resulting in an agreement that satisfied both parties.

Q 17. Describe your experience with reviewing and analyzing real estate contracts.

My experience in reviewing and analyzing real estate contracts is extensive, encompassing years of handling various types of agreements, including residential, commercial, and land acquisition contracts. My process involves a systematic approach to identify potential risks and ensure the contract protects my client’s interests.

- Thorough Review: I meticulously examine each clause, paying close attention to definitions, exclusions, contingencies, and timelines. I look for ambiguities and areas of potential conflict.

- Risk Assessment: I identify potential risks to my clients, such as unforeseen costs, liabilities, or contractual obligations that may be detrimental to their position.

- Comparative Analysis: Where appropriate, I compare the contract terms to market standards and best practices to determine if they’re favorable to my client.

- Legal Compliance: I ensure that the contract complies with all applicable federal, state, and local laws and regulations.

For example, I recently reviewed a contract for a large commercial property purchase and identified a clause that could have exposed my client to significant liability in the event of environmental contamination. By negotiating changes to this clause, I successfully protected my client from potential financial losses.

Q 18. What is your experience with managing and tracking multiple real estate contracts?

Managing multiple real estate contracts simultaneously requires exceptional organizational skills and the ability to prioritize tasks effectively. I utilize a robust system that involves detailed tracking and regular communication with all parties involved.

- Centralized Database: I maintain a centralized database of all active contracts, including key dates, deadlines, and relevant documentation. This database allows me to easily monitor the progress of each contract and identify any potential issues.

- Calendar Management: I use a detailed calendar system to track important deadlines, such as inspections, appraisals, and closing dates. This helps prevent missed deadlines and ensures timely execution.

- Regular Communication: I maintain consistent communication with all parties involved in each contract, including clients, agents, lenders, and other relevant stakeholders. This proactive approach helps prevent misunderstandings and ensures everyone is on the same page.

- Automated Reminders: I use automated reminder systems to ensure that deadlines are met promptly. This helps mitigate potential risks associated with missed deadlines.

For instance, during a particularly busy period where I managed over 15 contracts concurrently, my organized system and proactive communication prevented any major issues, allowing all transactions to close smoothly and efficiently.

Q 19. How do you stay updated on changes in real estate laws and regulations?

Staying current with real estate laws and regulations is critical for any real estate professional. I employ a multi-pronged approach to ensure my knowledge remains up-to-date.

- Professional Development: I regularly attend industry conferences, seminars, and workshops to learn about the latest changes in real estate law and best practices. This ensures I’m aware of any new regulations or case law that might affect my practice.

- Legal Subscriptions: I subscribe to legal publications and online resources that provide updates on relevant case law and legislative changes. This allows me to stay informed about any developments in the field.

- Networking: I maintain strong professional networks with other real estate professionals, attorneys, and industry experts. This provides opportunities to discuss current issues and share insights.

- Continuing Education: I complete continuing education courses required by my licensing body. This helps me stay abreast of new legal and regulatory requirements.

For example, when recent changes were made to fair housing laws in my area, I immediately updated my procedures and client communication to ensure complete compliance. This proactive approach demonstrates my commitment to ethical and legal practice.

Q 20. Explain the process of amending a real estate contract.

Amending a real estate contract is a formal process that requires careful attention to detail and adherence to legal requirements. It’s important to ensure that any changes are clearly documented and agreed upon by all parties.

- Mutual Agreement: All parties to the contract must agree to any amendments. This agreement should be documented in writing.

- Written Amendment: Amendments must be made in writing and clearly identify the specific clauses being modified. Vague or ambiguous language should be avoided.

- Signatures: All parties must sign and date the amendment. This demonstrates their consent to the changes.

- Integration: The amendment should be incorporated into the original contract to avoid confusion. Often a separate amendment document is attached and signed as an addendum to the existing contract.

- Legal Counsel: If the changes are significant, it’s advisable to seek legal counsel to ensure that the amended contract remains legally sound and protects the interests of all parties.

For example, I recently helped amend a contract to extend the closing date due to delays in securing financing for the buyer. The amendment clearly outlined the new closing date and was signed by both the buyer and the seller, ensuring a legally binding agreement.

Q 21. What is your experience with different types of property (residential, commercial)?

My experience encompasses a wide range of property types, including residential, commercial, and land development projects. I’ve worked with various property sizes and complexities. While the underlying principles of real estate contracts remain consistent, the specific clauses and considerations vary depending on the type of property.

- Residential Properties: I have extensive experience handling residential transactions, from single-family homes to condominiums and townhouses. This includes negotiating purchase agreements, handling contingencies, and managing closings. Common considerations include inspections, financing, and disclosures.

- Commercial Properties: I have experience in commercial real estate, working on transactions involving office buildings, retail spaces, and industrial properties. These transactions often involve more complex legal and financial considerations, including lease agreements, zoning regulations, and due diligence.

- Land Development: My experience extends to land development projects, including negotiating land purchase agreements and managing the legal aspects of development projects, including environmental concerns and zoning approvals. These transactions often involve significant due diligence and often require specialized expertise.

This diverse experience allows me to approach each contract with a nuanced understanding of the specific issues and challenges involved, ensuring that my clients receive the best possible legal and strategic guidance, regardless of the property type.

Q 22. Describe a situation where you had to resolve a complex contractual issue.

One particularly challenging case involved a contract dispute over a commercial property’s environmental assessment. The buyer claimed the seller had not disclosed significant environmental contamination discovered during due diligence. The contract contained a clause addressing environmental issues, but its interpretation was ambiguous. Resolving this required a deep dive into the contract’s specific wording, relevant environmental regulations, and prior case law concerning similar situations. My strategy involved:

- Thorough contract review: I meticulously analyzed the contract’s language related to environmental disclosures, focusing on specific definitions and exceptions.

- Environmental assessment review: I independently reviewed the environmental reports and compared them to the seller’s disclosures, identifying discrepancies and areas of ambiguity.

- Legal research: I conducted extensive legal research to understand applicable environmental laws and case precedents dealing with similar contract disputes, seeking to establish a legally sound argument for both sides.

- Negotiation and mediation: Instead of immediate litigation, I facilitated negotiations between the buyer and seller, aiming for a mutually agreeable resolution that took into account the legal interpretations and the financial implications.

Ultimately, we negotiated a settlement where the seller agreed to a partial price reduction and remediation of a portion of the contamination, avoiding costly and lengthy litigation for both parties. The case highlighted the importance of precise language and clear disclosure in real estate contracts, especially regarding environmental matters.

Q 23. What software or tools do you use to manage real estate contracts?

For managing real estate contracts, I leverage a combination of software and tools to ensure efficiency and accuracy. These include:

- Contract management software: I use a cloud-based platform that allows for secure storage, version control, and streamlined collaboration on contracts. This ensures everyone involved has access to the most up-to-date version.

- Document automation software: To create standardized and consistent contracts, I utilize document automation software. This minimizes manual input and significantly reduces the risk of errors by populating templates with client-specific data.

- E-signature platforms: Secure electronic signature platforms are integral for efficient contract execution, reducing the time and expense associated with physical document signing and mailing.

- Project management tools: I use project management tools to track deadlines, assign tasks, and maintain transparency regarding the contract lifecycle, from initiation to closing. This helps keep the process organized and on schedule.

The choice of specific software varies depending on client needs and project complexity, but the overarching goal is to maintain a centralized, organized, and efficient system for managing contractual documents.

Q 24. How do you ensure the accuracy and completeness of contract documentation?

Ensuring accuracy and completeness in contract documentation is paramount. My approach involves a multi-layered system of checks and balances:

- Template usage: I utilize pre-approved contract templates that are regularly updated to reflect current legal standards and best practices. This provides a strong foundation for accuracy.

- Data validation: I implement robust data validation procedures to verify the accuracy of information entered into the contract, particularly numerical data (price, acreage, etc.) and property details.

- Review process: A thorough review process is crucial. This involves multiple layers of review, including a self-review, a peer review by another experienced professional, and potentially a legal review depending on complexity.

- Due diligence: Rigorous due diligence ensures all necessary information is gathered and incorporated into the contract, minimizing omissions or inaccuracies. This involves title searches, property inspections, and review of relevant documents.

- Version control: Utilizing version control within our contract management software allows us to track changes, ensuring we always have access to the most current and accurate version of the document.

This multi-faceted approach helps minimize errors and ensures the contract accurately and completely reflects the agreement between the parties.

Q 25. What is your understanding of the Statute of Frauds as it relates to real estate?

The Statute of Frauds is a legal principle requiring certain contracts to be in writing to be enforceable. In real estate, this is incredibly important. Essentially, it prevents disputes based on conflicting oral agreements. For real estate contracts, the Statute of Frauds typically mandates that contracts for the sale of land or an interest in land must be in writing and signed by the party against whom enforcement is sought. This writing doesn’t need to be overly formal but must contain essential terms, including:

- Identification of parties: Clearly named buyer and seller.

- Property description: Accurate legal description of the property being sold.

- Purchase price: The agreed-upon price.

- Payment terms: How and when the payment will be made.

A contract lacking these essential elements in writing is likely unenforceable under the Statute of Frauds. Exceptions may exist, such as partial performance, but these are rare and require specific circumstances to be proven.

Q 26. How would you explain the concept of ‘specific performance’ in a real estate contract?

Specific performance, in the context of real estate, is a legal remedy that compels a breaching party to fulfill their contractual obligations. Unlike monetary damages, which compensate for losses, specific performance orders the breaching party to perform the specific action promised in the contract – in this case, typically conveying the property to the buyer or fulfilling other contractual promises.

For example, if a seller signs a contract to sell a property but then backs out, the buyer might seek specific performance. The court could order the seller to transfer the property’s title to the buyer as agreed upon, as long as the buyer is able to perform their contractual obligations (making payment, etc.).

This remedy is particularly relevant in real estate because land is considered unique; monetary damages may not adequately compensate for the loss of a specific property.

Q 27. Explain the differences between a bilateral and unilateral contract in a real estate context.

In real estate, the distinction between bilateral and unilateral contracts is crucial:

- Bilateral Contract: This is the most common type of real estate contract. It involves a mutual exchange of promises between two parties. The buyer promises to pay the purchase price, and the seller promises to deliver the property. Both parties have obligations to perform.

- Unilateral Contract: This is less common in real estate but can arise in certain circumstances. It involves a promise by one party in exchange for a performance by the other party. A classic (though not strictly real estate) example is a reward poster: “$100 reward for finding my lost dog.” The offeror (poster) promises a reward only upon performance (finding the dog) by the offeree.

In real estate, a unilateral contract might occur in situations such as an option agreement, where the seller promises to keep an offer open for a specific period if the potential buyer pays a fee. The buyer is only obligated to purchase the property if they exercise the option. Understanding this distinction helps determine the rights and obligations of each party within the agreement.

Q 28. What are your strategies for identifying potential legal issues in real estate contracts?

Identifying potential legal issues in real estate contracts requires a proactive and systematic approach. My strategy involves:

- Careful review of all clauses: I meticulously examine every clause of the contract, including seemingly minor details. This helps avoid overlooking potential problems or ambiguities.

- Understanding the context: I consider the broader context of the transaction, including the property’s characteristics, local market conditions, and the parties’ individual circumstances. This provides a more complete picture and helps identify potential conflicts of interest.

- Due diligence review: A thorough due diligence process is vital. This includes title searches to uncover any liens, encumbrances, or other title defects; environmental assessments to detect potential contamination; and property inspections to identify physical defects or structural issues.

- Compliance with regulations: I ensure the contract complies with all relevant federal, state, and local regulations, such as fair housing laws, environmental regulations, and zoning laws.

- Legal counsel: For complex or high-value transactions, I consult with legal counsel to gain an expert opinion and ensure compliance with all legal requirements. This is especially crucial when dealing with unfamiliar jurisdictions or unusual contractual terms.

Proactive issue identification minimizes disputes and protects the interests of all parties involved.

Key Topics to Learn for Your Real Estate Contracts Interview

- Contract Formation: Understand the essential elements of a valid real estate contract, including offer, acceptance, consideration, and capacity. Practice analyzing hypothetical scenarios to determine if a contract is legally binding.

- Types of Contracts: Familiarize yourself with different contract types commonly used in real estate transactions (e.g., purchase agreements, listing agreements, lease agreements). Be prepared to discuss their key differences and implications.

- Disclosures and Disclaimers: Master the importance of proper disclosures and disclaimers in protecting both buyers and sellers. Understand the legal ramifications of failing to disclose material facts.

- Due Diligence and Contingencies: Explore the role of due diligence in the contract process and the various contingencies that protect the parties involved (e.g., financing contingency, appraisal contingency, inspection contingency). Be ready to discuss how these clauses impact the transaction.

- Closing and Settlement: Understand the procedures involved in closing a real estate transaction, including the distribution of funds, recording of documents, and transfer of title. Prepare to discuss potential issues that may arise during closing.

- Breach of Contract and Remedies: Learn about the legal consequences of breaching a real estate contract and the various remedies available to the non-breaching party (e.g., specific performance, damages). Practice analyzing scenarios involving contract breaches.

- Ethical Considerations: Discuss the ethical obligations of real estate professionals in handling contracts and ensuring fair and transparent transactions. This demonstrates your understanding of the professional responsibilities involved.

Next Steps: Unlock Your Real Estate Career

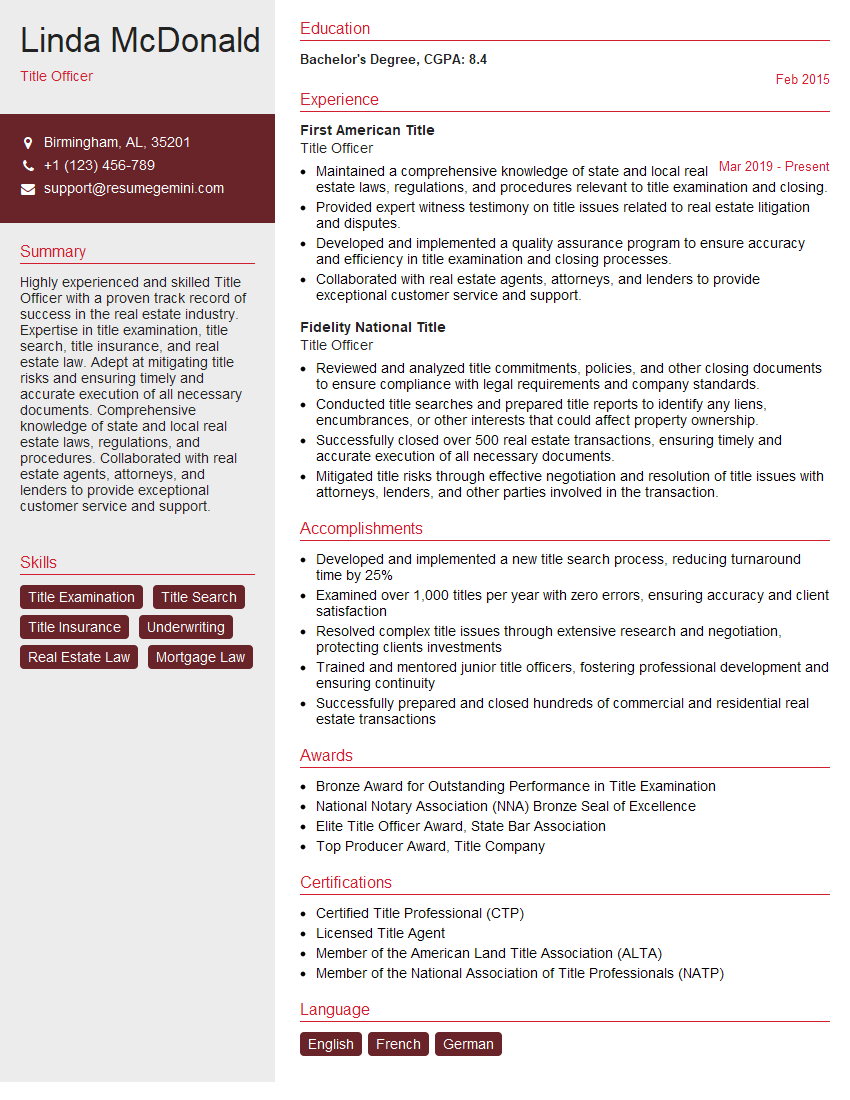

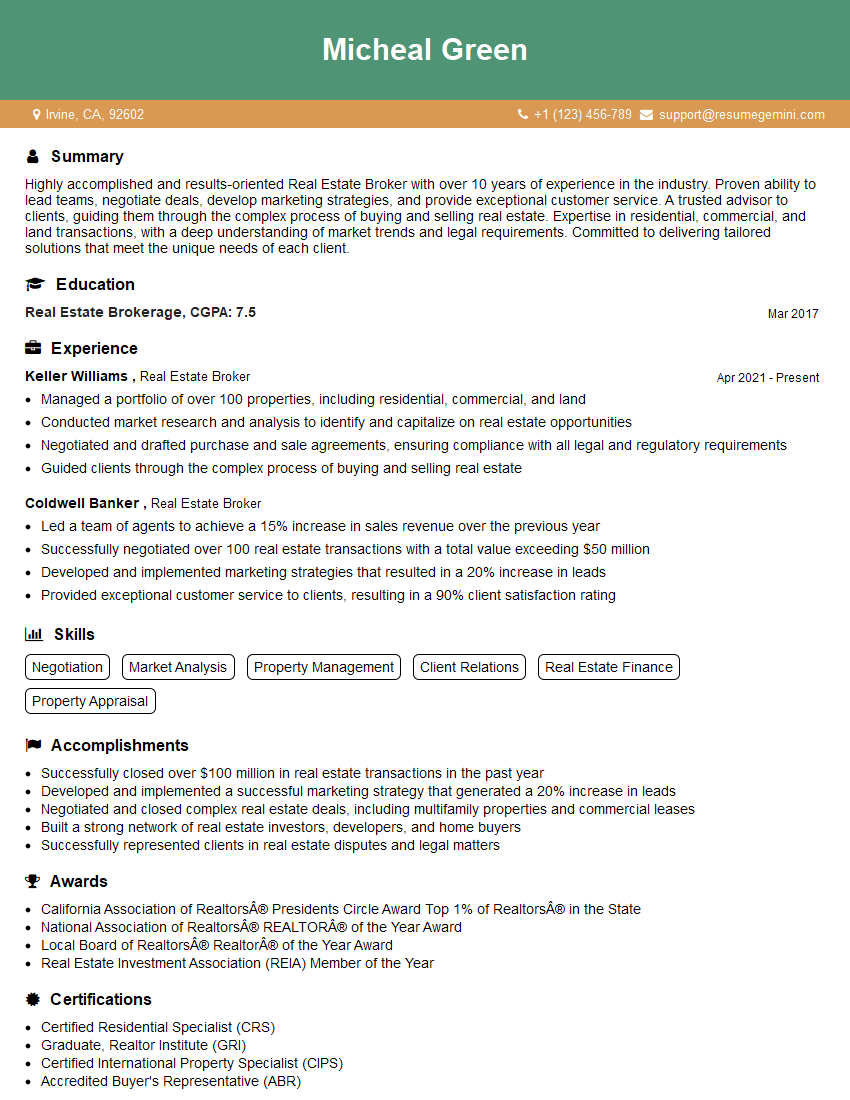

Mastering real estate contracts is crucial for a successful career in this dynamic field. A strong understanding of contract law opens doors to higher-level positions and demonstrates your expertise to potential employers. To maximize your job prospects, create an ATS-friendly resume that highlights your skills and experience effectively. ResumeGemini is a trusted resource that can help you build a professional and impactful resume tailored to the real estate industry. We offer examples of resumes specifically designed for candidates with expertise in Real Estate Contracts to guide you in creating your own compelling application.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

I Redesigned Spongebob Squarepants and his main characters of my artwork.

https://www.deviantart.com/reimaginesponge/art/Redesigned-Spongebob-characters-1223583608

IT gave me an insight and words to use and be able to think of examples

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO