Unlock your full potential by mastering the most common Real Estate Terminology and Concepts interview questions. This blog offers a deep dive into the critical topics, ensuring you’re not only prepared to answer but to excel. With these insights, you’ll approach your interview with clarity and confidence.

Questions Asked in Real Estate Terminology and Concepts Interview

Q 1. Define ‘escrow’ in the context of a real estate transaction.

In a real estate transaction, escrow is a neutral third-party account where funds and documents related to the sale are held until all conditions of the sale are met. Think of it as a safekeeping service ensuring that both the buyer and seller are protected.

For example, the buyer’s down payment, loan proceeds, and closing costs are deposited into escrow. The seller’s proceeds from the sale are also held there. The escrow agent, typically a title company or escrow officer, disburses these funds only after all contingencies, such as inspections, appraisals, and loan approvals, are satisfied. This ensures that the buyer only pays once they’re sure the property is as agreed upon and the seller only receives payment once the buyer has completed their obligations. It’s a crucial part of safeguarding both parties’ interests throughout the transaction.

Q 2. Explain the difference between a ‘fee simple’ and a ‘life estate’.

The key difference between a fee simple and a life estate lies in the ownership duration. Fee simple represents the most complete form of ownership, granting the owner full rights to the property, including the right to sell, lease, or bequeath it. It’s essentially outright ownership with no limitations on duration.

A life estate, on the other hand, grants ownership only for the lifetime of a specific individual (the life tenant). Upon the death of the life tenant, ownership automatically transfers to another designated party, called the remainderman. Imagine leaving your house to your child, but allowing your aging parent to live there until they pass. Your parent holds a life estate, and the child will receive the fee simple afterward.

For instance, you could leave your property to your spouse as a life estate, ensuring their accommodation for their life, and then to your children after their death. The critical difference is the limited duration of a life estate versus the perpetual nature of fee simple ownership.

Q 3. What is a ‘comparative market analysis’ (CMA) and how is it used?

A Comparative Market Analysis (CMA) is an estimate of a property’s market value based on a comparison of recently sold properties (comparables or ‘comps’) with similar characteristics in the same area. Real estate agents use CMAs to help sellers determine a listing price and buyers understand the value of a property they are considering. It’s not an official appraisal but a useful tool for price negotiation.

To conduct a CMA, an agent identifies comparable properties that have sold recently, considering factors like size, location, age, features, and condition. They then adjust the prices of the comparables to reflect differences between them and the subject property. For example, if a comparable has a pool and the subject property doesn’t, the agent may subtract the value of the pool from the comparable’s sale price. This process helps arrive at an estimated market value range for the subject property. This helps buyers and sellers make informed decisions on offers and pricing strategies respectively.

Q 4. Describe the process of a real estate closing.

A real estate closing is the final step in a real estate transaction where ownership of the property is transferred from the seller to the buyer. It’s a complex process involving several steps:

- Final Walkthrough: The buyer inspects the property to ensure everything is in order as agreed upon.

- Document Review: All parties review and sign the final closing documents, including the deed, mortgage (if applicable), and other related paperwork.

- Funding: The buyer’s funds are disbursed from escrow, and the seller receives their proceeds.

- Recording: The deed is recorded with the county recorder’s office, making the transfer of ownership official.

- Closing Costs: Both the buyer and seller pay their respective closing costs, including taxes, fees, and other expenses.

Think of closing as the culmination of all the hard work in the purchase process. It’s when everything comes together and titles are officially transferred. The actual closing might take place at a title company’s office or another neutral location. A smooth closing hinges on careful preparation and attention to detail.

Q 5. What are the key components of a purchase agreement?

A purchase agreement, also known as a contract of sale, is a legally binding document outlining the terms and conditions of a real estate transaction between a buyer and a seller. Key components typically include:

- Property Description: A detailed description of the property being sold, including the address and legal description.

- Purchase Price: The agreed-upon price the buyer will pay for the property.

- Earnest Money Deposit: A deposit made by the buyer to show good faith and commitment to the purchase.

- Financing Contingencies: Conditions specifying that the purchase is contingent on the buyer securing financing.

- Inspection Contingency: A condition allowing the buyer to conduct a home inspection and potentially withdraw from the purchase if significant issues are found.

- Closing Date: The date the transaction is scheduled to close.

- Closing Costs: An allocation of closing costs between buyer and seller.

The purchase agreement serves as a roadmap for the entire transaction and protects the interests of both parties. It’s essential to thoroughly review and understand each clause before signing.

Q 6. Explain the difference between a ‘mortgage’ and a ‘deed of trust’.

Both mortgages and deeds of trust are financing instruments used to secure a loan for real estate, but they differ in their legal structure. A mortgage is a direct loan between a borrower (the mortgagor) and a lender (the mortgagee), creating a lien on the property as collateral. In case of default, the lender can foreclose on the property to recover the loan.

A deed of trust involves three parties: the borrower (trustor), the lender (beneficiary), and a neutral third party (trustee). The borrower conveys legal title to the trustee, who holds it on behalf of the lender. If the borrower defaults, the trustee can initiate foreclosure proceedings on behalf of the lender. Deeds of trust are generally used more often than mortgages in many states.

The key difference is that with a mortgage, the lender directly holds the lien, while with a deed of trust, the trustee holds the title for the benefit of the lender. While both secure loans, the legal process for foreclosure differs.

Q 7. What are ‘property taxes’ and how are they assessed?

Property taxes are taxes levied by local governments on real estate owners. These taxes fund essential public services such as schools, roads, and police and fire departments. The amount of property tax owed is assessed based on the property’s assessed value, which is an estimate of the property’s market value determined by the local tax assessor’s office.

The assessment process involves several steps: the tax assessor reviews property characteristics and comparable sales to estimate market value; the property’s assessed value is then multiplied by the local tax rate (a millage rate or percentage set by the local government) to determine the annual property tax liability. Tax rates vary from location to location. For example, a property with an assessed value of $200,000 in a jurisdiction with a tax rate of 1% would have an annual property tax liability of $2,000. Property taxes are typically paid annually or in installments, and non-payment can lead to penalties and even foreclosure.

Q 8. Define ’eminent domain’ and its implications.

Eminent domain is the power of the government to take private property for public use, even if the owner doesn’t want to sell it. This is a crucial concept rooted in the Fifth Amendment of the US Constitution, which mandates ‘just compensation’ to the property owner. The key here is that the taking must be for a legitimate public use, such as building a road, school, or utility infrastructure. However, the definition of ‘public use’ has been debated and broadened over time.

The implications of eminent domain can be significant. While it allows for essential public works projects, it also raises concerns about fairness and potential abuse. The government’s appraisal of the property’s value might be contested, leading to lengthy legal battles. For example, a homeowner might receive less compensation than their property’s market value, causing financial hardship. Determining what constitutes ‘just compensation’ is often a complex and contentious process.

A classic example involves the construction of a highway that requires acquisition of land owned by a small business. The government has the right to take the property, but must offer fair market value to the business owner. However, the owner may argue that the forced sale disrupts their operations and leads to unforeseen losses, demanding more than just the land’s assessed value.

Q 9. What are the different types of real estate ownership?

Real estate ownership can be categorized in several ways, depending on the number of owners and the nature of their interests. Here are some common types:

- Fee Simple Ownership: This represents the most complete form of ownership. The owner has absolute rights to the property, including the right to possess, use, enjoy, and dispose of it as they see fit, subject to zoning laws and other regulations. Think of this as outright ownership.

- Joint Tenancy: In this arrangement, two or more people own the property equally. The key feature is the ‘right of survivorship,’ meaning that when one owner dies, their share automatically transfers to the surviving owner(s), bypassing probate.

- Tenancy in Common: Similar to joint tenancy, but without the right of survivorship. When an owner dies, their share passes to their heirs as specified in their will, not automatically to the other owners. Each owner can sell or transfer their share independently.

- Community Property: This applies in specific states and reflects ownership of assets acquired during a marriage equally by both spouses. Upon divorce or death, the property is typically divided equally.

- Timeshares: This involves the ownership of the right to use a property for a specific period each year. It’s not full ownership, but rather fractional ownership of usage rights.

Understanding the nuances of each ownership type is crucial for property transactions and estate planning.

Q 10. What is a ‘title search’ and why is it important?

A title search is a thorough examination of public records to determine the ownership history of a piece of real estate. It’s a critical step in any property transaction, ensuring that the seller has a clear and marketable title—meaning they have the legal right to sell the property free from any encumbrances (claims or liens).

Why is it important? A title search identifies any potential problems with the title, such as:

- Liens: Unpaid taxes, mortgages, or judgments against the property.

- Encroachments: Structures or improvements that extend onto neighboring property.

- Easements: Rights granted to others to use part of the property (e.g., a utility easement).

- Forgeries or Fraudulent Transfers: Instances where the ownership history shows irregularities.

A clean title search is crucial for a buyer to avoid inheriting problems with the property. A flawed title can lead to costly legal disputes and delays, potentially jeopardizing the entire transaction. Think of it like a car’s history report – you wouldn’t buy a car without checking its history, and similarly, you shouldn’t buy a property without a clear title search.

Q 11. Explain the concept of ‘depreciation’ in real estate.

Depreciation, in real estate, refers to the decrease in the value of an income-producing property over time due to wear and tear, obsolescence, or other factors. It’s an important concept for tax purposes, allowing investors to deduct a portion of the property’s value from their taxable income each year.

Unlike physical depreciation (actual wear and tear), real estate depreciation is mostly for accounting purposes. It’s a way to spread the cost of the property over its useful life. For instance, a building might be depreciated over 27.5 years (residential) or 39 years (commercial) according to IRS guidelines. This allows for tax deductions, reducing the taxable income earned through rental or other property income, providing financial relief to property owners.

For example, if an investor buys a building for $1 million (excluding land, which is not depreciable), they can deduct a portion of that $1 million annually as depreciation. This deduction does not directly reflect the actual market value, but rather a systematic accounting practice allowed by tax law.

Q 12. What are ‘capital gains’ in real estate investment?

Capital gains in real estate refer to the profit realized when an investment property is sold for more than its adjusted basis. The adjusted basis is the original cost of the property plus any capital improvements made, less any depreciation taken. The profit is subject to capital gains taxes, the rates of which depend on the length of time the property was held and the investor’s overall income.

For example, if you bought a property for $200,000, added $50,000 in improvements, and claimed $25,000 in depreciation, your adjusted basis is $225,000 ($200,000 + $50,000 – $25,000). If you sell the property for $300,000, your capital gain is $75,000 ($300,000 – $225,000), which will be taxable according to applicable capital gains tax rates.

Understanding capital gains is essential for real estate investors, as they can significantly impact overall returns. Careful planning, such as utilizing tax-advantaged strategies, can help minimize tax liability.

Q 13. What is a ‘1031 exchange’ and how does it work?

A 1031 exchange, also known as a like-kind exchange, is a tax-deferred exchange that allows investors to defer capital gains taxes when selling investment real estate and reinvesting the proceeds into a similar property. This means you won’t pay capital gains taxes on the sale of the old property, but you also won’t realize any profit until you eventually sell the new property.

How it works: The investor sells their property and places the proceeds into a qualified intermediary account. Within a specific timeframe, they must identify potential replacement properties and complete the purchase of a similar property of equal or greater value. The key is the ‘like-kind’ nature of the properties—meaning they must be used for investment or business purposes. There are strict rules and timelines to follow, and using a qualified intermediary is vital for a successful exchange.

Example: An investor sells an apartment building for $1 million and identifies a new apartment building (or other suitable like-kind property) for $1.2 million. The profit from the sale of the first property isn’t immediately taxed. The investor then utilizes the $1 million (plus any additional capital if necessary) to purchase the new building, deferring the capital gains taxes until the sale of the new property.

Q 14. Explain the difference between ‘gross rent multiplier’ and ‘net operating income’.

Both the Gross Rent Multiplier (GRM) and Net Operating Income (NOI) are crucial metrics in real estate investment analysis, but they serve different purposes.

Gross Rent Multiplier (GRM): This is a quick valuation tool that estimates the value of an income-producing property by comparing its gross annual rental income to its price. It’s calculated by dividing the property’s purchase price or market value by its annual gross rental income. GRM = Property Price / Gross Annual Rental Income. A higher GRM indicates that the property may be more expensive relative to its rental income.

Net Operating Income (NOI): This is a more comprehensive measure of a property’s profitability, representing the income generated by a property after deducting operating expenses (excluding debt service). NOI = Revenue - Operating Expenses. It offers a clearer picture of cash flow than GRM. Operating expenses include property taxes, insurance, maintenance, and management fees. NOI is used in several other real estate investment calculations like capitalization rate (Cap Rate).

The difference is that GRM is a simple, quick estimate, whereas NOI provides a more detailed picture of a property’s profitability and is used for more sophisticated analysis and valuation. GRM is a good starting point for a quick assessment of relative value, but NOI is essential for a comprehensive understanding of potential returns.

Q 15. What are the key indicators of a healthy real estate market?

A healthy real estate market is characterized by a balance between supply and demand, reflected in stable or modestly rising prices, consistent sales volume, and low inventory levels. Several key indicators help paint this picture.

- Price Appreciation: Steady, moderate price increases signify a healthy market. Rapid increases can indicate a bubble, while sharp declines suggest a downturn.

- Sales Volume: A consistent number of properties changing hands demonstrates market activity and confidence. A significant drop could signal economic weakness.

- Inventory Levels: Low inventory (fewer properties for sale) often indicates a strong seller’s market, while high inventory suggests a buyer’s market. A balanced market has a moderate inventory level.

- Days on Market (DOM): This metric tracks how long properties remain listed before selling. Lower DOM suggests a strong market with high demand.

- Absorption Rate: This measures how quickly homes are selling relative to the available inventory. A healthy market usually has an absorption rate between 4-6 months.

- Interest Rates: Lower interest rates generally stimulate buyer activity, while higher rates can cool the market.

- Local Economic Conditions: A strong local economy with job growth and population increase typically supports a robust real estate market.

For example, a market with steady price growth of 3-5% annually, low inventory, and a healthy absorption rate is generally considered healthy. Conversely, a market with rapidly escalating prices and very low inventory might be overheating, indicating potential risk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you analyze a property’s financial viability?

Analyzing a property’s financial viability involves a thorough assessment of its potential income and expenses to determine its profitability. Key metrics are crucial.

- Purchase Price: The initial investment cost is the foundation of any analysis.

- Repairs and Renovations (CapEx): Estimate costs to bring the property to desirable condition.

- Operating Expenses (OpEx): Include property taxes, insurance, utilities, maintenance, and management fees.

- Rental Income (Gross Rent Multiplier): Project potential rental income based on comparable properties in the area. The Gross Rent Multiplier (GRM) – the ratio of the property’s price to its annual rental income – provides a quick market comparison tool.

- Net Operating Income (NOI): Calculated by subtracting OpEx from Gross Operating Income (GOI – rental income plus other income streams).

- Cash Flow: The difference between NOI and debt service (mortgage payments).

- Return on Investment (ROI): Measures the profitability of an investment. It’s calculated by dividing the net profit by the initial investment.

- Cap Rate: NOI divided by the purchase price, indicating the potential return on investment relative to the property’s value.

Imagine analyzing a property with a purchase price of $200,000, estimated annual rental income of $24,000, and annual expenses of $6,000. The NOI would be $18,000, and the cap rate would be 9% ($18,000/$200,000). This provides a baseline for evaluating its financial potential. Further analysis would involve considering financing costs and potential appreciation to create a complete picture.

Q 17. Explain the concept of ‘leverage’ in real estate investment.

Leverage in real estate refers to using borrowed capital (debt) to finance the purchase of an asset, thereby amplifying the potential return on investment. Think of it as using other people’s money to increase your own investment power.

For instance, if you have $50,000 in savings and take out a $150,000 mortgage to buy a $200,000 property, you’re using a 3:1 leverage ratio. A small increase in the property value will result in a larger percentage gain on your original $50,000 investment. Conversely, a price decrease will magnify your losses.

Example: Suppose the property increases in value by 10%, or $20,000. Your percentage return on your $50,000 investment is 40% ($20,000/$50,000). Without leverage, your return would have only been 10%.

However, leverage is a double-edged sword. It magnifies both gains and losses. Careful assessment of risk tolerance and market conditions is essential before leveraging significant debt.

Q 18. What are the risks associated with real estate investment?

Real estate investment carries several inherent risks. Understanding these is crucial for mitigating potential losses.

- Market Risk: Fluctuations in market conditions, interest rates, and economic downturns can significantly impact property values and rental income.

- Interest Rate Risk: Rising interest rates can increase borrowing costs and reduce affordability, affecting both buyers and sellers.

- Liquidity Risk: Real estate is not a highly liquid asset. Selling a property quickly may require price concessions, potentially resulting in a loss.

- Vacancy Risk: Periods of vacancy can reduce rental income and impact cash flow, especially in challenging market conditions.

- Property Management Risk: Challenges in finding and managing reliable tenants can lead to financial and operational difficulties.

- Legal and Regulatory Risk: Changes in zoning laws, building codes, or environmental regulations can significantly affect property value and use.

- Financial Risk: Unexpected repair costs, property damage, and unforeseen expenses can strain finances.

For example, an unexpected economic downturn could reduce rental demand, leading to vacancy and diminished cash flow. Thorough due diligence and risk management strategies are necessary to address these potential issues.

Q 19. How do you identify and mitigate risks in real estate transactions?

Identifying and mitigating risks in real estate transactions involves a multi-step process encompassing comprehensive due diligence and proactive risk management.

- Thorough Due Diligence: This includes property inspections, title searches, environmental assessments, and appraisal reviews to identify potential issues before committing to a purchase.

- Market Research: Analyze market trends, comparable sales data, and rental rates to make informed decisions regarding purchase price and rental income projections.

- Financial Planning: Create a detailed budget considering all potential costs, including repairs, maintenance, and financing.

- Diversification: Spread investments across different properties and geographic locations to reduce the impact of localized market downturns.

- Professional Advice: Consult with real estate attorneys, appraisers, and property managers to gain expert insights and guidance.

- Insurance: Secure adequate insurance coverage, including property insurance, liability insurance, and landlord insurance.

- Contingency Planning: Develop a plan to address potential challenges, such as unforeseen repairs, tenant issues, or market fluctuations.

For instance, a thorough property inspection might reveal hidden structural damage, allowing for negotiation on the purchase price or withdrawal from the deal. Similarly, obtaining landlord insurance protects against financial losses from tenant-related issues.

Q 20. What are the legal aspects of real estate contracts?

Real estate contracts are legally binding agreements governing the sale, purchase, or lease of property. Several key legal aspects need careful consideration.

- Offer and Acceptance: A valid contract requires a clear offer and an unconditional acceptance.

- Consideration: Each party must provide something of value (e.g., money for the buyer, property for the seller).

- Capacity: Parties involved must be legally competent to enter into a contract.

- Legality: The contract’s purpose must be legal and not violate any laws or regulations.

- Writing Requirement: Most real estate contracts must be in writing to be enforceable under the Statute of Frauds.

- Disclaimers and Contingencies: Clauses outlining conditions that must be met for the contract to be valid (e.g., financing contingency, appraisal contingency).

- Representations and Warranties: Statements made by the seller regarding the property’s condition and characteristics.

- Closing Process: Details outlining how and when the property will transfer ownership, including payment and deed transfer.

Ignoring any of these aspects can lead to disputes or invalidate the contract. Legal counsel is often crucial to ensure the contract protects the interests of both buyer and seller.

Q 21. Explain the difference between ‘zoning’ and ‘building codes’.

Zoning and building codes are both regulatory frameworks governing land use and construction, but they serve different purposes.

- Zoning: Regulates the permissible use of land within a specific area (residential, commercial, industrial, etc.). It determines what types of structures can be built, building density, lot sizes, and setbacks from property lines. Zoning ordinances are implemented by local governments.

- Building Codes: Establish minimum standards for the design, construction, and safety of buildings. They cover structural integrity, fire safety, plumbing, electrical systems, and accessibility requirements. Building codes are designed to protect public health and safety.

Example: A zoning ordinance might designate a particular area as residential, allowing only single-family homes to be built. Building codes would then dictate specific requirements for the construction of those homes, such as minimum structural requirements, electrical standards, and fire safety measures.

A developer ignoring zoning regulations might find their project stalled or even face legal action. Disregarding building codes can lead to safety hazards and structural problems, potentially resulting in costly repairs or even legal liabilities.

Q 22. What is a ‘restrictive covenant’ and how does it impact property rights?

A restrictive covenant is a legally binding promise in a deed that restricts the use or development of a property. Think of it as a clause in a property’s title that limits what future owners can do with it. These covenants are often put in place by developers or homeowner associations (HOAs) to maintain a certain standard or character within a neighborhood.

These covenants can impact property rights by limiting the owner’s ability to make alterations, build certain structures, or engage in specific activities. For example, a covenant might restrict the size of a home, prohibit certain types of businesses, or mandate specific architectural styles. This limits the owner’s freedom to use their property as they see fit.

Impact on Property Rights: Restrictive covenants essentially create ‘negative easements’ – rights that restrict the use of a property rather than grant access. If a covenant is violated, the homeowner association or another affected party can take legal action, possibly leading to fines or court orders to comply.

Example: Imagine a neighborhood with a covenant requiring all homes to be painted a certain range of colors. A homeowner who decides to paint their house bright purple could face legal repercussions because they violated the covenant.

Q 23. How do you handle objections from buyers or sellers?

Handling objections from buyers or sellers requires a calm, professional, and empathetic approach. Active listening is key – truly understanding their concerns before attempting to address them. It’s less about winning an argument and more about finding a mutually beneficial solution.

My approach involves:

- Empathetic Listening: I start by letting the buyer or seller fully express their concerns without interruption. I paraphrase their points to ensure I understand.

- Identifying the Root Cause: Is the objection based on price, property condition, financing, or something else entirely? Pinpointing the root problem is crucial.

- Offering Solutions: Based on the root cause, I brainstorm solutions. This might involve renegotiating terms, providing additional information, or connecting them with relevant professionals (e.g., inspectors, lenders).

- Managing Expectations: It’s vital to be realistic. Not every objection can be resolved to everyone’s complete satisfaction, but I strive to find compromise.

- Documenting Everything: All communication, offers, and counter-offers are meticulously documented to maintain transparency and protect all parties.

Example: If a buyer objects to the price, I might present comparable market analyses demonstrating the property’s fair market value. Or, if a seller objects to a buyer’s financing contingencies, we could explore options to make the offer more attractive to the seller.

Q 24. What is your experience with different types of real estate financing?

My experience with real estate financing is extensive, encompassing various loan types and financial institutions. I’m familiar with conventional loans (backed by Fannie Mae and Freddie Mac), FHA loans (insured by the Federal Housing Administration), VA loans (for eligible veterans), USDA loans (for rural properties), and jumbo loans (for larger loan amounts exceeding conforming loan limits).

I understand the nuances of each type, including qualification requirements, interest rates, closing costs, and the implications for both buyers and sellers. I’m comfortable working with lenders, reviewing loan applications, and guiding clients through the financing process.

Beyond traditional loans, I also have experience with creative financing options, such as seller financing, lease-options, and lease-purchase agreements. This knowledge allows me to explore a broader range of solutions for clients with diverse financial situations.

Practical Application: I regularly advise clients on which loan type best fits their needs, considering credit scores, down payments, and financial goals. I help them prequalify for a loan to avoid wasted time viewing properties beyond their financial reach.

Q 25. Describe your experience using real estate software and technology.

I’m proficient in using a variety of real estate software and technology to enhance efficiency and provide superior client service. My experience includes using Customer Relationship Management (CRM) systems to manage leads, track client interactions, and maintain organized records. I utilize Multiple Listing Service (MLS) systems for property searches, data analysis, and listing management.

I’m also comfortable using digital marketing tools to reach potential buyers and sellers online. This includes utilizing social media platforms, search engine optimization (SEO) techniques, and email marketing campaigns. I use virtual tour software to showcase properties effectively and conduct virtual showings when needed.

Examples: I use [CRM software name] for contact management, [MLS software name] for listing information, and [Digital marketing platform name] for online advertising.

Technology has transformed the industry, and I embrace these tools to optimize my workflow and provide a superior experience for my clients.

Q 26. Explain your understanding of Fair Housing Laws.

Fair Housing Laws are federal and state regulations designed to prevent discrimination in housing based on race, color, national origin, religion, sex, familial status (families with children), or disability. These laws prohibit discriminatory practices in all aspects of housing, including advertising, lending, and property sales.

Understanding of the Laws: I understand that it’s illegal to refuse to sell, rent, or finance a property to someone because of their protected characteristics. It’s also illegal to steer individuals towards or away from specific neighborhoods based on those characteristics. Advertising must be inclusive and avoid language that could be interpreted as discriminatory.

Practical Application: I meticulously avoid any discriminatory practices in my dealings with clients. I am careful in my advertising to ensure it’s inclusive and compliant with Fair Housing Laws. If I encounter a situation that raises concerns about potential discrimination, I immediately seek guidance from legal professionals to ensure compliance.

Example: An advertisement that specifies ‘no children allowed’ is a clear violation of Fair Housing Law’s protection of familial status.

Q 27. How do you stay current with changes in real estate laws and regulations?

Staying current with changes in real estate laws and regulations is crucial for maintaining ethical and legal compliance. I accomplish this through several methods:

- Continuing Education: I regularly attend seminars, workshops, and online courses offered by professional organizations and legal experts specializing in real estate.

- Professional Affiliations: My membership in professional organizations like the National Association of Realtors (NAR) provides access to up-to-date information, legal updates, and industry best practices.

- Legal and Regulatory Resources: I monitor updates from government agencies such as the Department of Housing and Urban Development (HUD) and relevant state regulatory bodies.

- Legal Counsel: I consult with legal counsel when needed to address complex legal questions or navigate ambiguous situations.

- Industry Publications: I subscribe to industry publications and journals to stay informed about legal changes and current market trends.

Staying abreast of these developments is vital to protecting my clients’ interests and ensuring my own professional practice remains compliant.

Q 28. Describe your approach to negotiating real estate deals.

My approach to negotiating real estate deals is collaborative and results-oriented. I view negotiation not as a battle, but as an opportunity to find common ground that benefits all parties involved.

Key elements of my approach include:

- Preparation: Before any negotiation, I thoroughly research the market, analyze comparable properties, and understand my client’s goals and priorities.

- Open Communication: I foster open and honest communication with all parties involved. I clearly articulate my client’s position while actively listening to the other side.

- Strategic Problem Solving: I approach obstacles creatively, identifying alternative solutions to overcome roadblocks and ensure a mutually acceptable outcome.

- Professionalism: I maintain a professional demeanor throughout the process, even when faced with challenging situations. My focus is always on fostering trust and respect.

- Win-Win Outcome: My goal is always to achieve a win-win outcome that satisfies both the buyer and seller. I believe successful negotiation requires compromise and mutual understanding.

Example: If a seller is hesitant to accept an offer due to a low appraisal, we might negotiate a price adjustment or explore options for bridging the gap between the offer price and the appraised value.

Key Topics to Learn for Real Estate Terminology and Concepts Interview

- Property Types: Understand the differences between residential, commercial, industrial, and multifamily properties. Consider the nuances of each and their respective market trends.

- Real Estate Contracts and Agreements: Familiarize yourself with common contract clauses, including contingencies, earnest money deposits, and closing costs. Practice analyzing hypothetical scenarios involving contract disputes.

- Financing and Mortgages: Grasp the fundamentals of mortgage loans, including interest rates, loan-to-value ratios (LTV), and different types of mortgages (e.g., fixed-rate, adjustable-rate). Be prepared to discuss the impact of various financial factors on buyer affordability.

- Appraisals and Valuations: Learn about the different appraisal methods and their applications. Understand factors influencing property value and how to interpret appraisal reports.

- Market Analysis and Trends: Develop the ability to analyze market data, including supply and demand, price fluctuations, and absorption rates. Practice interpreting market reports and predicting future trends.

- Real Estate Laws and Regulations: Understand relevant fair housing laws, disclosure requirements, and agency relationships. Be familiar with common legal issues in real estate transactions.

- Property Taxes and Assessments: Understand how property taxes are calculated and the implications of property assessments on market value and investment decisions.

- Investment Strategies: Familiarize yourself with different real estate investment strategies, such as buy-and-hold, flipping, and REITs. Be prepared to discuss the risks and rewards associated with each.

- Real Estate Technology and Software: Demonstrate familiarity with commonly used real estate software and platforms for property management, CRM, and market analysis.

Next Steps

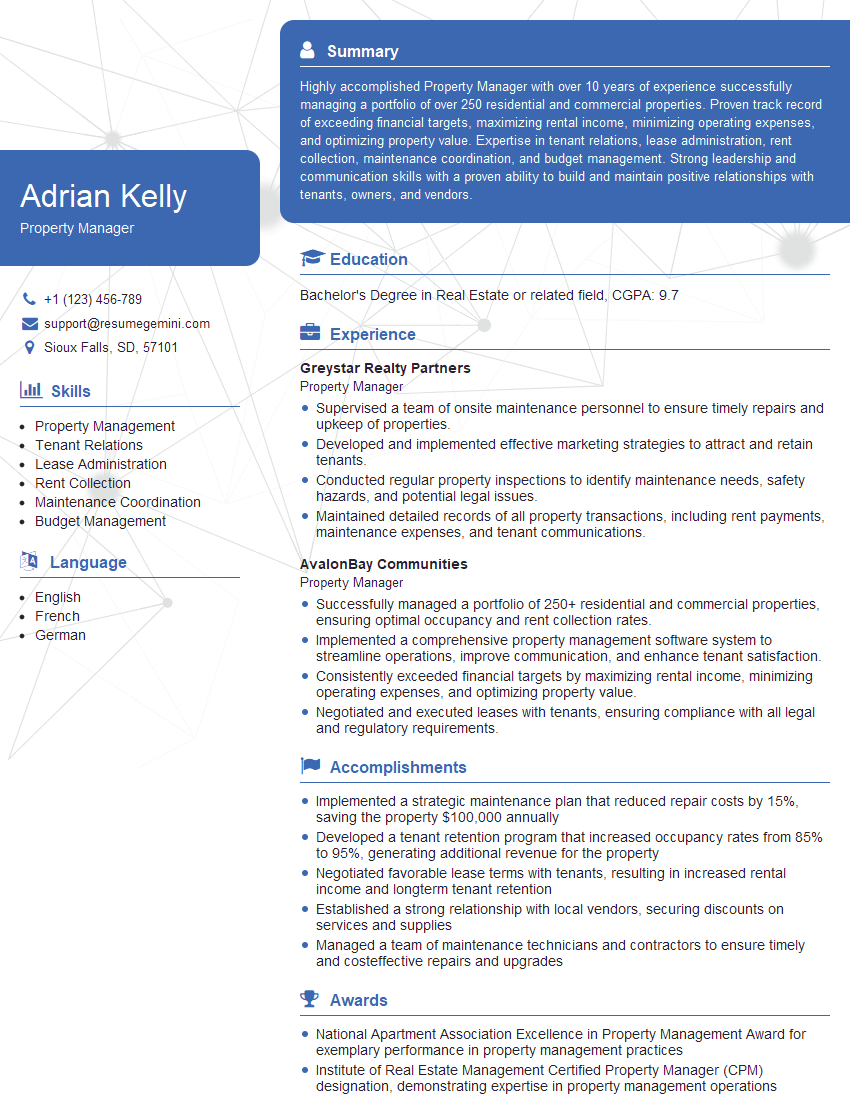

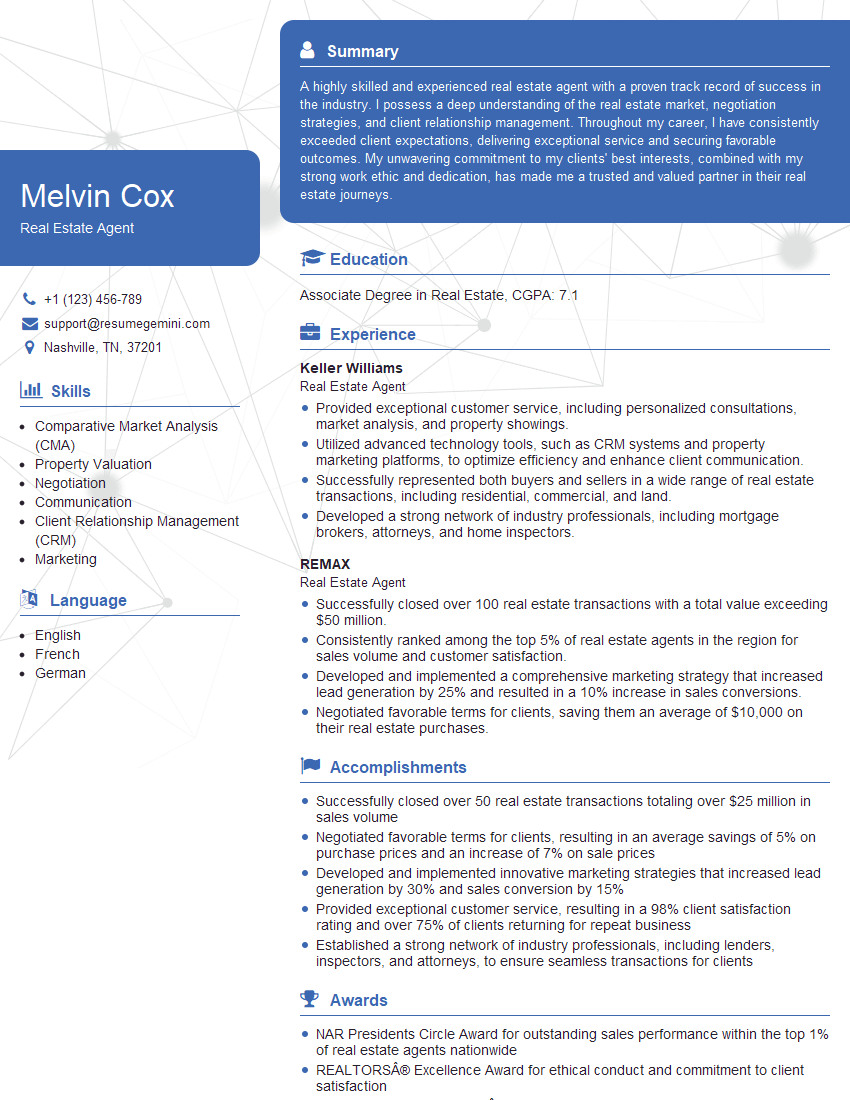

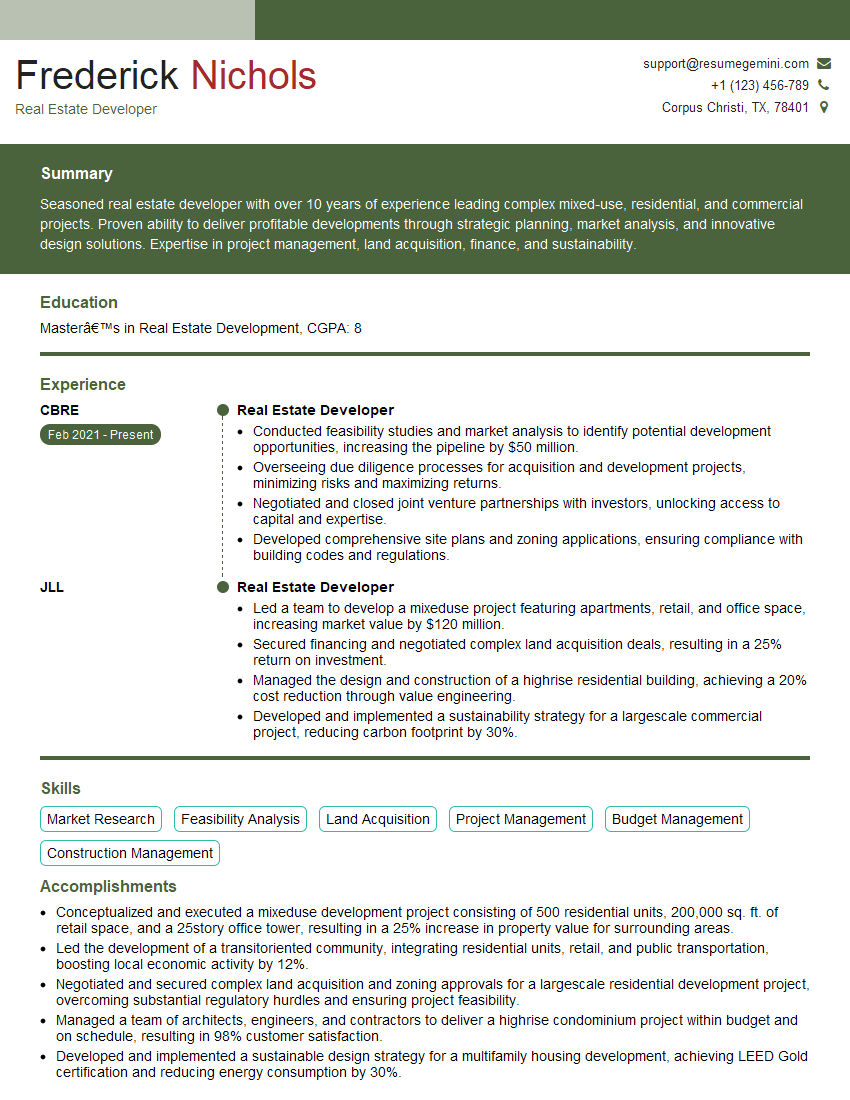

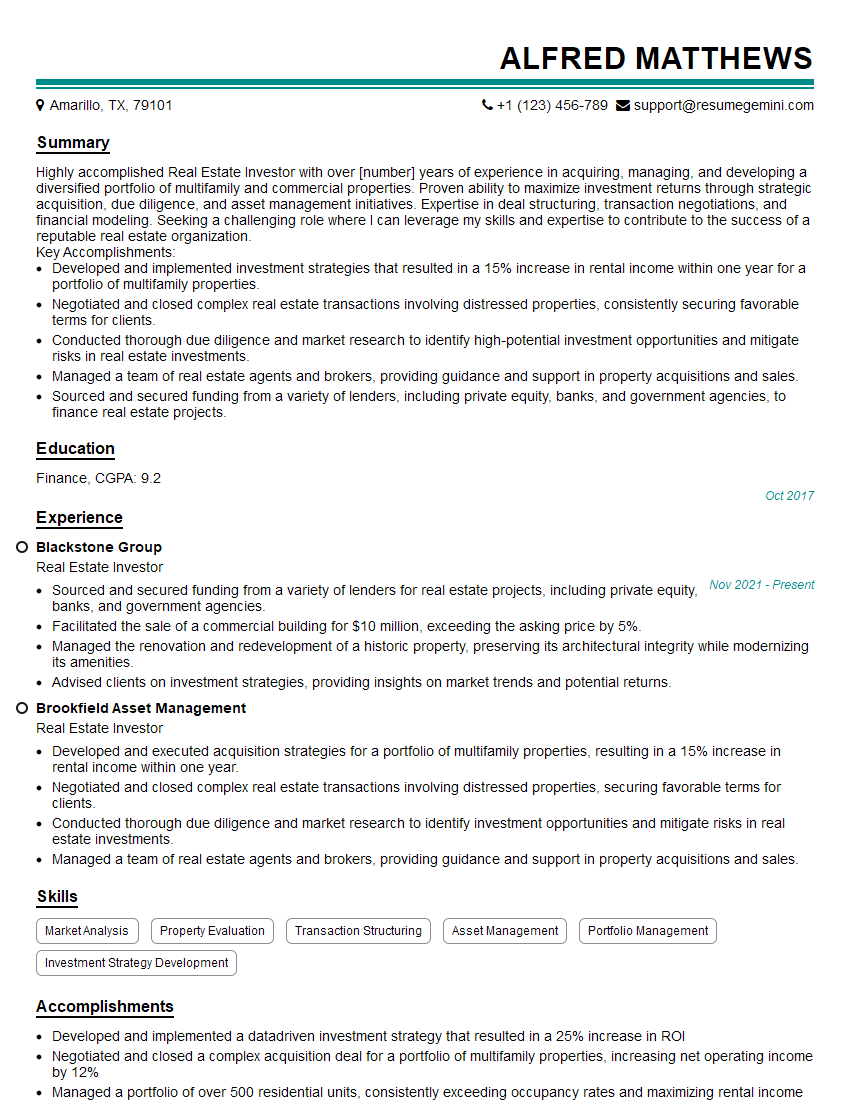

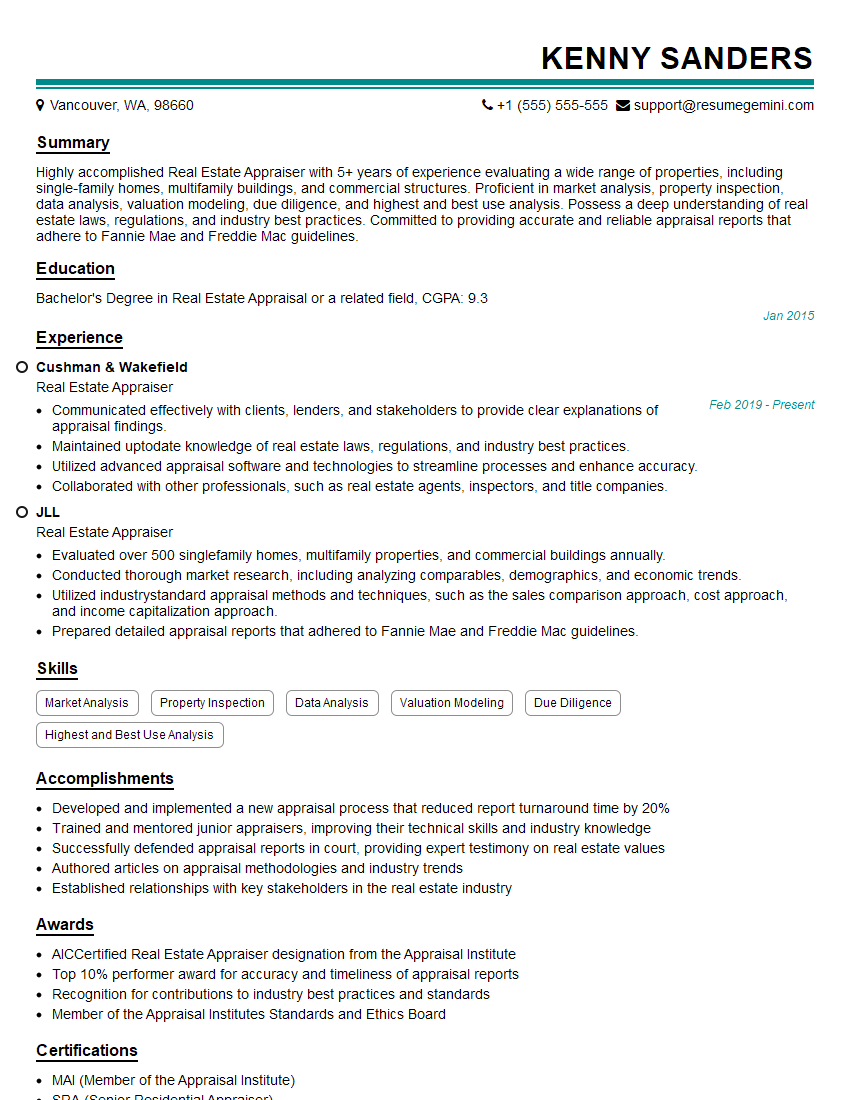

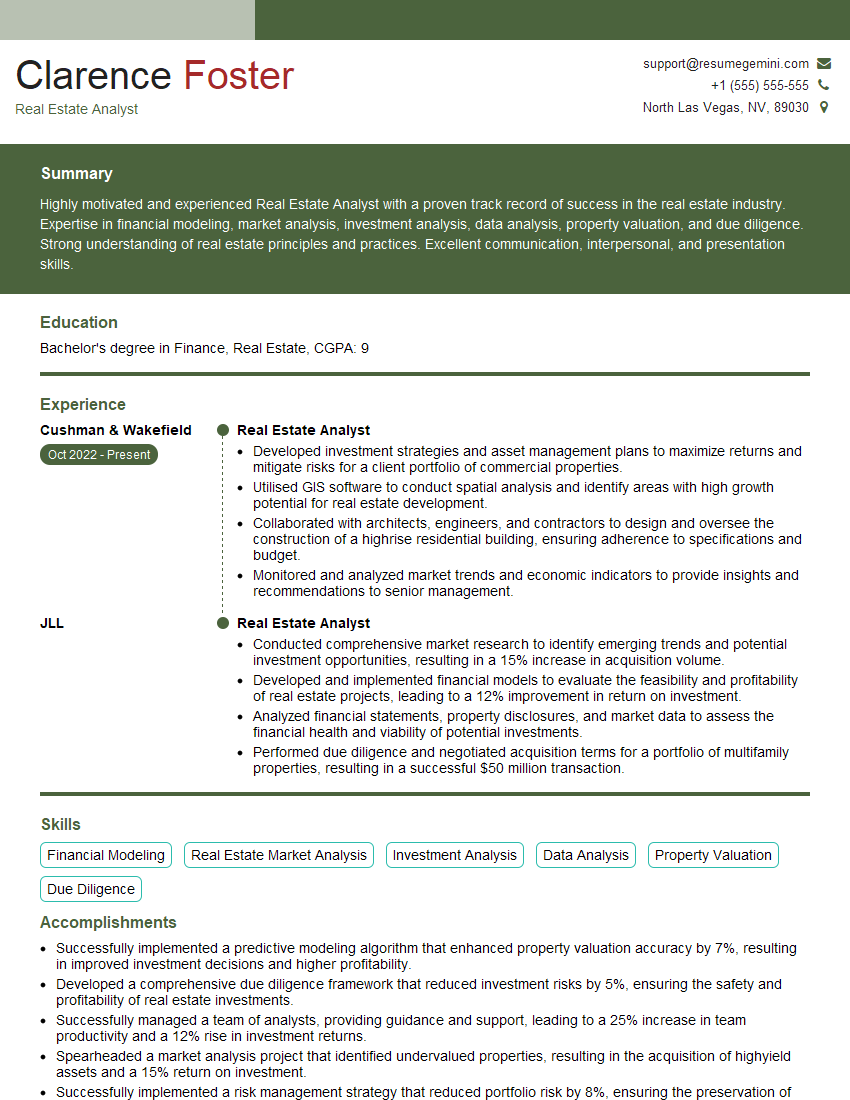

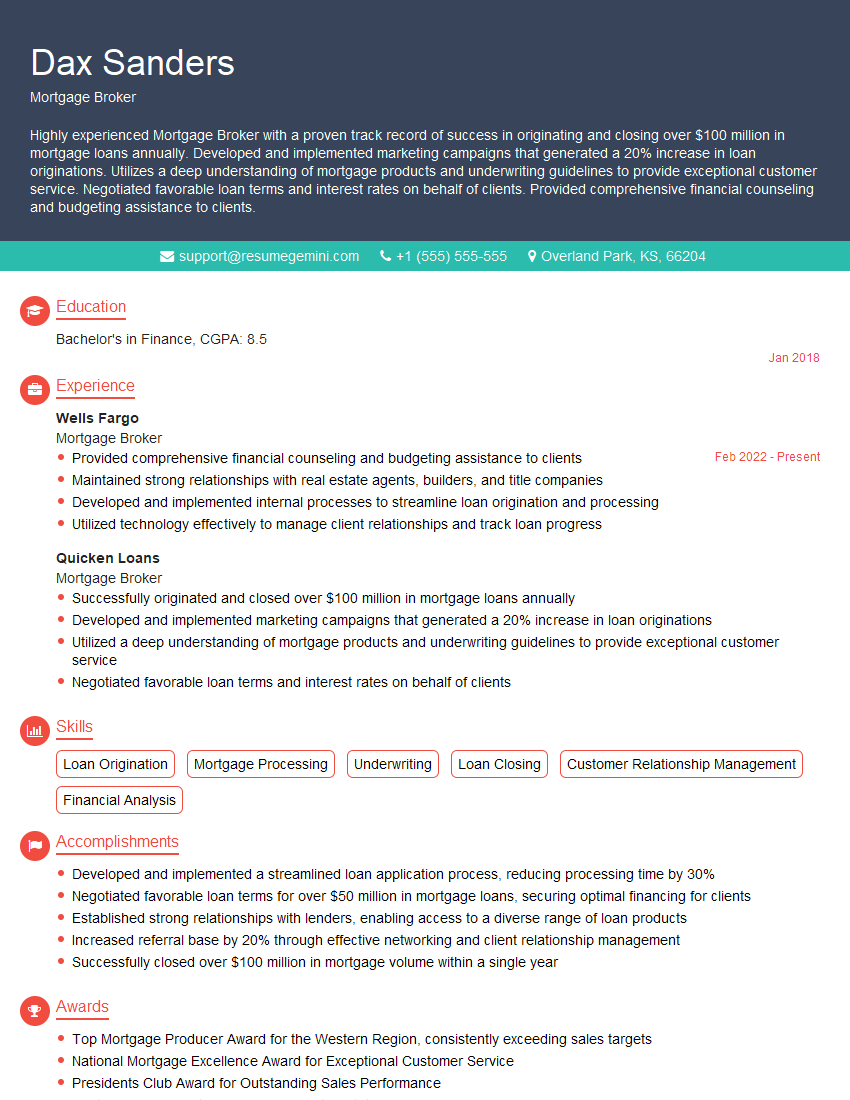

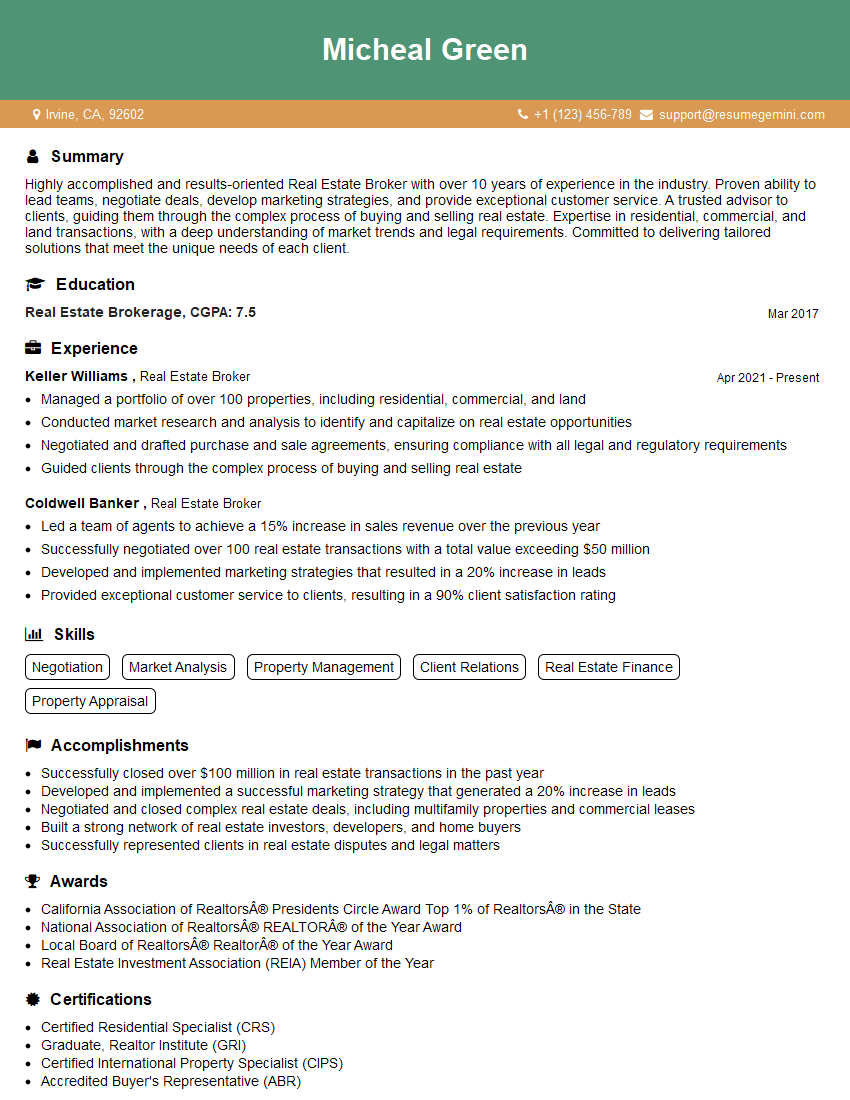

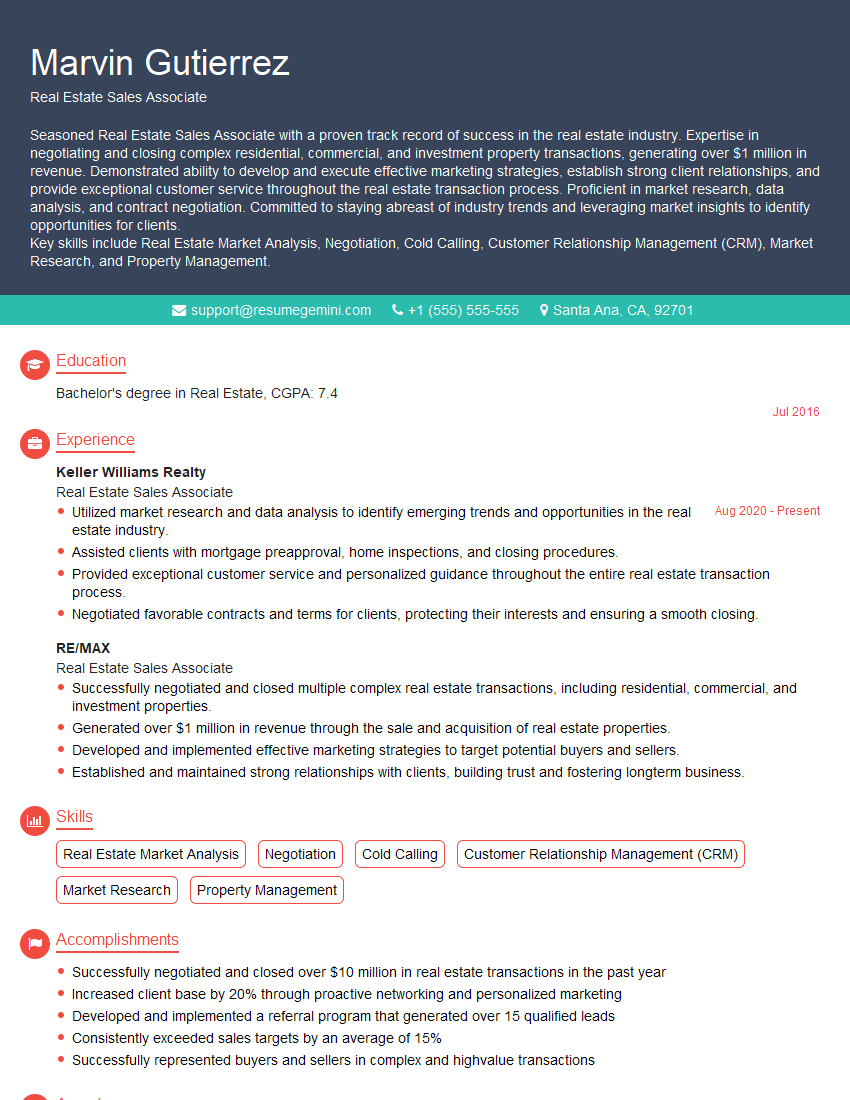

Mastering Real Estate Terminology and Concepts is crucial for a successful career in this dynamic field. A strong understanding of these concepts will differentiate you from other candidates and demonstrate your commitment to excellence. To significantly improve your job prospects, focus on creating an ATS-friendly resume that highlights your skills and experience effectively. ResumeGemini is a trusted resource that can help you build a professional and impactful resume. Take advantage of their expertise and access examples of resumes tailored to Real Estate Terminology and Concepts to showcase your knowledge and impress potential employers.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

I Redesigned Spongebob Squarepants and his main characters of my artwork.

https://www.deviantart.com/reimaginesponge/art/Redesigned-Spongebob-characters-1223583608

IT gave me an insight and words to use and be able to think of examples

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO