Unlock your full potential by mastering the most common Rental Application Processing interview questions. This blog offers a deep dive into the critical topics, ensuring you’re not only prepared to answer but to excel. With these insights, you’ll approach your interview with clarity and confidence.

Questions Asked in Rental Application Processing Interview

Q 1. Explain your experience with tenant screening processes.

Tenant screening is a crucial process to mitigate risk for landlords. It involves a systematic review of potential tenants to assess their suitability for a rental property. My experience encompasses the entire process, from initial application review to final approval or rejection. This includes verifying information provided on the application, conducting background checks (criminal and eviction history), and evaluating credit reports.

For instance, I recently screened an applicant whose application initially looked promising. However, a deeper dive into their background revealed a history of late rent payments and several evictions. This information, readily available through reputable screening services, allowed me to make an informed decision to decline the application, thus protecting the property owner’s interests.

- Background checks: Reviewing criminal records and eviction histories to identify potential risks.

- Credit report analysis: Assessing credit scores and payment history to gauge financial responsibility.

- Reference checks: Contacting previous landlords to verify rental history and behavior.

- Verification of employment and income: Confirming the applicant’s ability to afford rent.

Q 2. Describe your proficiency in verifying income and employment history.

Verifying income and employment history is a critical component of tenant screening. I employ a multi-pronged approach to ensure accuracy and reliability. This includes contacting employers directly to verify employment status, salary, and length of tenure. I also review pay stubs, bank statements, and tax returns (with the applicant’s consent, of course) to corroborate their claimed income.

In one case, an applicant provided a seemingly legitimate pay stub. However, when I called their employer, I discovered the information was fabricated. This highlights the importance of directly contacting employers and verifying information from multiple sources. I meticulously document all verification efforts, including contact dates, individuals spoken to, and the information obtained.

Q 3. How do you handle incomplete or inaccurate rental applications?

Incomplete or inaccurate rental applications present a challenge, but I have a systematic process for handling them. My first step is to politely contact the applicant, explaining what information is missing and requesting the necessary documentation. I allow a reasonable timeframe for them to respond. If the applicant fails to provide the missing information, or if the information provided is still insufficient or inconsistent, I may need to reject the application. It’s essential to maintain clear communication throughout the process and document all attempts to obtain complete and accurate information.

For example, if an applicant omits their previous landlord’s contact information, I’ll reach out to the applicant to request this information. If they fail to provide it, I have to weigh the risk – the missing information is a significant gap in the tenant screening process, and it may be necessary to decline the application in order to avoid potential future problems.

Q 4. What is your experience with Fair Housing Act compliance in rental applications?

Compliance with the Fair Housing Act is paramount. I am thoroughly familiar with the Act’s provisions, ensuring that all screening practices are fair and non-discriminatory. This means avoiding inquiries or decisions based on protected characteristics such as race, color, national origin, religion, sex, familial status, or disability. All applicants are held to the same standards, and any decisions to approve or deny applications are based solely on objective criteria relevant to tenancy.

For instance, I would never ask about a prospective tenant’s marital status or inquire about the presence of children with a disability. Instead, I focus on verifiable factors like rental history, creditworthiness, and income.

Q 5. How do you assess a tenant’s creditworthiness?

Assessing a tenant’s creditworthiness involves a careful review of their credit report. I look for several key indicators: credit score, payment history, debt-to-income ratio, and any bankruptcies or judgments. A higher credit score generally indicates better financial responsibility. A consistent history of on-time payments is also very positive. A high debt-to-income ratio, however, could raise concerns about their ability to consistently afford rent.

However, I understand that credit reports aren’t the only indicator of financial responsibility. I also consider other factors like employment history and income verification. A low credit score doesn’t automatically disqualify an applicant, especially if they can provide evidence of improved financial stability.

Q 6. What are the key factors you consider when evaluating a rental application?

Evaluating a rental application involves a holistic assessment of several key factors. These include:

- Creditworthiness: As discussed earlier, this includes credit score, payment history, and debt-to-income ratio.

- Income verification: Ensuring the applicant has a stable income sufficient to cover rent and other expenses.

- Rental history: Reviewing previous landlord references to assess their payment history and overall tenancy behavior.

- Background check: Identifying any criminal history or evictions.

- References: Personal references can offer additional insights into the applicant’s character and reliability.

- Application completeness and accuracy: Ensuring all required information is provided and is accurate.

It’s important to weight these factors appropriately, and the relative importance may vary depending on the specific property and local market conditions.

Q 7. Describe your process for identifying and red-flagging potentially risky applicants.

Identifying risky applicants requires a keen eye for detail and a thorough understanding of potential red flags. These might include:

- Inconsistent information: Discrepancies between the application and other provided documents.

- Negative rental history: Multiple evictions or a history of late rent payments.

- Criminal history: Particularly those involving violence or property damage.

- Low credit score: Combined with other red flags, this can indicate financial instability.

- Unverifiable information: Inability to confirm employment history or income.

- Lack of references: Difficulty obtaining references or a pattern of unstable housing.

When I identify a potential red flag, I document it meticulously and carefully weigh the risks involved. I may conduct further investigation or seek additional information before making a decision. The goal is to balance risk mitigation with fair and non-discriminatory practices.

Q 8. How familiar are you with different types of rental agreements and lease terms?

Rental agreements come in various forms, each with specific lease terms. Understanding these nuances is crucial for effective rental application processing. Common types include:

- Fixed-Term Lease: This is the most common type, specifying a set lease period (e.g., 12 months). The rent and terms remain constant for the duration. For example, a tenant signs a one-year lease starting July 1st, 2024, and ending June 30th, 2025.

- Month-to-Month Lease (Tenancy at Will): This type of agreement doesn’t have a fixed end date. The tenant is required to give a specified notice (usually 30 days) before vacating, and the landlord can also terminate the tenancy with similar notice. This offers flexibility but less stability for both parties.

- Lease with Option to Purchase: This agreement combines renting with the option to buy the property at a pre-determined price within a specified timeframe. This is a good option for a tenant planning on buying the property in the future.

- Commercial Lease: These agreements are significantly more complex than residential leases, often involving detailed clauses regarding usage, alterations, and responsibilities. For example, a commercial lease might stipulate specific hours of operation or limitations on types of business permitted.

Lease terms cover aspects like rent amount, payment due dates, pet policies, responsibilities for repairs and maintenance, and late payment penalties. Thorough review and clear communication are key to avoiding misunderstandings.

Q 9. How do you prioritize applications when dealing with high volume?

Prioritizing applications with high volume requires a systematic approach. I use a multi-step process:

- Initial Screening: I quickly review applications for completeness and obvious disqualifiers (e.g., insufficient income, eviction history). This allows me to eliminate unsuitable candidates promptly.

- Credit and Background Checks: I leverage tenant screening software to automate this process. I prioritize applications with strong credit scores and clean background checks. I have pre-set criteria that help streamline this.

- Verification of Employment and Income: This step verifies the information provided by applicants, ensuring their financial stability. I might follow up with employers or request additional documentation.

- Reference Checks: Contacting previous landlords provides valuable insight into the applicant’s tenancy history, including their payment habits and respect for property.

- Ranking and Selection: Based on the results of the above steps, I rank applicants and make a selection. This might involve comparing multiple candidates based on my predefined scoring system.

This process ensures fairness and efficiency, allowing me to quickly identify qualified tenants without compromising thoroughness. I also document every step in the process to maintain a transparent and auditable record.

Q 10. Describe your experience using tenant screening software/databases.

I’m proficient in using several tenant screening software and databases, including [Name Software 1], [Name Software 2], and [Name Software 3]. These tools streamline the application process by automating background checks, credit reports, and criminal history searches. My experience includes:

- Data Entry and Management: Efficiently inputting applicant data and managing the information within the software.

- Report Generation and Analysis: Interpreting the results of tenant screenings to identify potential risks and make informed decisions.

- Compliance with Fair Housing Laws: Understanding and applying the guidelines of these laws to ensure fair and unbiased screening practices. I am meticulous to avoid any discrimination and ensure equal opportunity to all applicants.

- Integration with Property Management Systems: Seamlessly integrating tenant screening data into our property management software to maintain comprehensive records.

These software tools are indispensable for efficiently handling high volumes of applications while ensuring compliance and minimizing risks.

Q 11. How do you handle disputes or disagreements concerning application decisions?

Disputes regarding application decisions are handled with professionalism and transparency. My approach involves:

- Review of the Decision: I re-examine the application and the screening reports to ensure accuracy and fairness. I look for any bias or inconsistencies in my decision-making process.

- Communication with the Applicant: I clearly and respectfully communicate the reasons for the decision, providing specific details without divulging sensitive information about other applicants. I explain the criteria used and how the applicant didn’t meet them.

- Documentation: All communication and the reasoning behind the decision are meticulously documented to maintain a clear record.

- Mediation (If Necessary): In some cases, mediation may be helpful to resolve concerns and reach a mutually acceptable solution. This is particularly helpful in cases with minor discrepancies.

- Escalation (If Necessary): In situations where the dispute cannot be resolved through direct communication or mediation, I’ll escalate it to my supervisor or management team.

My goal is to resolve disputes fairly and promptly, maintaining positive relationships with applicants even when a negative decision is made. I understand that this is a delicate process and always strive for professionalism and respect.

Q 12. What is your understanding of eviction processes?

Eviction is a legal process that should only be undertaken as a last resort and in strict accordance with state and local laws. My understanding of the process includes:

- Notice to Vacate: The landlord must provide the tenant with formal written notice, specifying the reasons for eviction and the timeframe for vacating the property (this timeframe varies by jurisdiction).

- Filing an Eviction Lawsuit: If the tenant fails to vacate after receiving the notice, the landlord must file an eviction lawsuit in court.

- Court Hearing: Both the landlord and tenant present their cases before a judge. The judge will make a decision based on the evidence presented.

- Writ of Possession: If the court rules in favor of the landlord, a writ of possession is issued, authorizing law enforcement to remove the tenant from the property.

I understand that evictions can be complex and time-consuming. I’m familiar with the specific laws and procedures in [State/Region], and I would always work with legal counsel to ensure the process is handled correctly and ethically. Avoiding evictions through proactive communication and management is always preferred.

Q 13. How do you maintain confidentiality and protect sensitive tenant data?

Maintaining confidentiality and protecting sensitive tenant data is paramount. I adhere to strict privacy policies and best practices, including:

- Secure Data Storage: All tenant data is stored securely using encrypted databases and password-protected systems. Access is restricted to authorized personnel only.

- Data Minimization: I only collect and retain the minimum necessary data for screening purposes. Any unnecessary information is discarded.

- Compliance with Regulations: I strictly adhere to relevant federal and state regulations regarding data privacy, such as the Fair Credit Reporting Act (FCRA) and other applicable laws.

- Employee Training: All staff members are thoroughly trained on data privacy policies and procedures. Regular refresher training keeps everyone informed on best practices.

- Data Breach Procedures: I’m familiar with our company’s protocols for handling data breaches, ensuring swift action to mitigate any potential harm.

Data security and confidentiality are top priorities, and I’m committed to upholding the highest ethical standards in protecting tenant information.

Q 14. How do you ensure compliance with all relevant state and local regulations?

Compliance with state and local regulations is non-negotiable. My approach to ensuring compliance involves:

- Staying Updated: I regularly review and stay abreast of all relevant federal, state, and local laws and regulations impacting rental housing, including fair housing laws, landlord-tenant laws, and data privacy regulations.

- Legal Counsel: I consult with legal counsel to ensure our application process, lease agreements, and eviction procedures are fully compliant. They offer guidance on the evolving legal landscape.

- Regular Audits: Participating in and supporting regular internal audits of our processes ensures we are consistently adhering to all regulations.

- Training and Education: I am proactive in seeking continuing education and training to stay current on any changes in legislation.

- Documentation: I maintain meticulous records of all compliance-related activities, ensuring transparency and accountability.

Maintaining compliance is not just a legal obligation, but it’s also about ensuring fair and ethical treatment of tenants. It fosters trust and maintains a positive reputation for the property and management company.

Q 15. What is your experience with background checks and criminal history reports?

Background checks and criminal history reports are crucial in tenant screening to ensure the safety and security of the property and other tenants. My experience involves utilizing various services, such as those offered by TransUnion SmartMove or Experian, to obtain comprehensive reports. These reports typically include criminal history checks, covering felonies and misdemeanors, and sometimes even eviction records. I’m proficient in interpreting these reports, understanding the nuances of different jurisdictions and their reporting standards. For example, I know that a misdemeanor charge from 10 years ago might not hold the same weight as a recent felony conviction. I always adhere to Fair Housing laws and avoid discriminatory practices when reviewing these reports. I focus on identifying patterns of behavior that might suggest a risk, rather than simply relying on individual data points. If a report raises concerns, I carefully weigh its relevance to the tenancy while ensuring fairness and compliance.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Describe your experience with reviewing and interpreting credit reports.

Reviewing and interpreting credit reports is another essential part of the screening process. I have extensive experience working with credit reports from the three major credit bureaus – Equifax, Experian, and TransUnion. My expertise extends beyond simply looking at the credit score; I analyze the entire report, paying close attention to factors like payment history, debt-to-income ratio, and types of credit accounts. A low credit score isn’t an automatic disqualifier; I consider the reasons behind a lower score. For instance, a recent medical emergency leading to missed payments might be viewed differently than a consistent history of late payments. I look for a pattern of responsible financial behavior. I understand how to distinguish between a poor credit history versus a temporary financial setback. To illustrate, I once had an applicant with a low score due to identity theft; after verification, we were able to work with them and understand the true picture of their financial stability.

Q 17. How do you communicate application status updates to applicants?

Keeping applicants informed is paramount. I use a multi-pronged approach to communicate application status updates. This usually starts with an automated email acknowledgment upon application submission, confirming receipt and outlining the next steps. Subsequent updates are delivered via email, frequently including specific details about the processing stage. For instance, ‘Background check is complete,’ or ‘Credit report is being reviewed.’ For applications requiring additional information, I will send a personalized email requesting the documents and explaining the necessity. If an application is approved or denied, I send a formal letter outlining the decision, along with reasons for denial if applicable and ensuring all communications comply with fair housing regulations. This transparency and clear communication helps manage expectations and builds trust.

Q 18. How do you handle inquiries from applicants about their application status?

I handle inquiries from applicants promptly and professionally. I typically respond to emails within 24-48 hours and phone calls as soon as possible. I understand that waiting for updates can be stressful, so I strive for clear, concise communication. I don’t provide vague answers; if I don’t have an answer immediately, I provide a timeframe for when I can follow up. For instance, I might say, ‘I’m still awaiting the results of the background check; I expect to have an update for you by the end of the day tomorrow.’ This approach creates a sense of responsibility and commitment. I always maintain a professional and courteous tone, regardless of the outcome of the application. Even if the application is denied, I provide a clear explanation and, when possible, guidance on improving their chances in the future.

Q 19. What is your experience with managing a high volume of paperwork and electronic documents?

I’m highly proficient in managing large volumes of paperwork and electronic documents. My experience includes using various property management software, such as Buildium or AppFolio, to streamline the process. These platforms allow for secure storage, efficient organization, and easy retrieval of application documents, from rental applications themselves to supporting documentation like pay stubs and IDs. I’m adept at implementing robust filing systems, both physical and digital, to ensure efficient retrieval of information and compliance with record-keeping regulations. This includes regular archiving of inactive files, ensuring easy access to information for audits or future references. My organizational skills enable me to handle peak application periods effectively, maintain data integrity, and meet all deadlines without compromising accuracy or security. For example, during peak seasons, I implemented a color-coded system for physical files that simplified sorting and reduced processing time.

Q 20. How familiar are you with different types of rental properties (apartments, houses, etc.)?

I’m familiar with various types of rental properties, including single-family homes, apartments (both in high-rise and low-rise buildings), townhouses, condos, and duplexes. My understanding extends to the specific nuances associated with each property type. For example, I know the differences in lease agreements for single-family homes versus multi-unit dwellings. I also understand the common concerns associated with each property type: maintenance needs of larger homes, rules and regulations in apartment complexes, or the shared responsibilities in a townhouse complex. This broad knowledge allows me to adapt my approach to different scenarios, preparing appropriate documentation and addressing specific concerns relevant to each property type.

Q 21. Describe your experience with lease preparation and execution.

Lease preparation and execution are critical aspects of my role. I’m experienced in drafting leases that are compliant with all relevant state and local laws. This includes carefully reviewing and incorporating clauses related to security deposits, rent payments, late fees, lease terms, pet policies, and other relevant conditions. I ensure that the lease is clear, concise, and easily understandable by both the landlord and tenant. Before execution, I thoroughly review the lease with the tenant, answering all questions and ensuring complete understanding. I’m proficient in electronic lease signing processes using platforms that guarantee legal validity and electronic signatures. I maintain a record of all executed leases, ensuring proper storage and accessibility for future reference, fulfilling all legal requirements for archiving and access. In short, I treat lease preparation not just as a formality but as a critical legal document that protects both parties’ interests.

Q 22. How do you identify and prevent fraud in rental applications?

Fraud prevention in rental applications is crucial. We employ a multi-layered approach, starting with verifying applicant information. This includes checking credit reports for inconsistencies, verifying employment history through direct contact with employers (not just relying on applicant-provided information), and confirming income through pay stubs or bank statements. We also use specialized software that cross-references applicant data against various databases to flag potential red flags, such as known fraudulent addresses or social security numbers. Furthermore, we carefully examine application details for inconsistencies or unrealistic claims. For example, an applicant claiming significantly higher income than their reported employment would warrant further investigation. Finally, we are careful to avoid bias in our verification process, ensuring that we apply the same rigorous standards to all applicants.

For example, we once identified a fraudulent application where the applicant provided a forged pay stub. Our verification process flagged inconsistencies in the document, leading us to contact the purported employer, who confirmed the pay stub was fake. This prevented us from renting to a potentially problematic tenant.

Q 23. How do you maintain organized and efficient filing systems for rental applications?

Maintaining organized rental application files is vital for efficiency and compliance. We use a combination of digital and physical filing systems. Each application is assigned a unique identifier, and all related documents (application, verification documents, lease agreement, etc.) are digitally stored in a secure, cloud-based system with robust access controls. This allows for quick retrieval and efficient collaboration among team members. We utilize a robust folder structure within the system, categorizing applications by property, status (pending, approved, denied), and applicant name. This allows us to easily search and filter applications based on any criteria. For physical files, we maintain a similar structured filing system with secure, off-site storage of archival documents.

We regularly purge obsolete files and ensure our system is compliant with data privacy regulations. This structured approach prevents confusion, streamlines the application processing, and guarantees easy access to information when needed. Imagine trying to find a specific document in a disorganized pile – it’s a nightmare! Our system is designed to prevent that.

Q 24. What software or tools do you use to process rental applications?

We leverage a suite of tools to streamline rental application processing. Our primary software is a property management system (PMS) that integrates with tenant screening services, allowing us to automate many tasks. This PMS manages the entire process from application intake to lease signing and rent collection. We also use applicant screening services which provide credit reports, background checks, and eviction history reports. These are critical components in our risk assessment process. Additionally, we utilize electronic signature platforms to expedite lease signing and digital document management tools to ensure secure and efficient storage. These integrated systems minimize manual data entry, reduce errors, and provide a comprehensive view of each application.

For instance, our PMS automatically sends email notifications to applicants at each stage of the process, improving transparency and communication. The integration with screening services instantly flags potential issues, saving us significant time and effort.

Q 25. Describe a time you had to resolve a difficult situation involving a rental application.

One challenging situation involved an applicant with a bankruptcy on their credit report but who presented strong evidence of financial recovery. While the bankruptcy initially flagged them as a high-risk tenant, their subsequent consistent employment history, substantial savings, and positive references painted a different picture. The situation required careful consideration. We decided to conduct a more thorough interview and gather additional supporting documentation to fully understand their circumstances. After a detailed review of all the information, we were comfortable moving forward and they became a responsible, long-term tenant. This demonstrated the importance of not solely relying on automated screening tools but applying critical thinking and judgment to each individual case. It highlights the value of a holistic approach to risk assessment.

Q 26. What are your salary expectations for this position?

My salary expectations are in the range of $X to $Y per year, commensurate with my experience and skills, and competitive within the current market. This range reflects my expertise in rental application processing, my proven ability to maintain efficient systems, and my commitment to minimizing risk. I am open to discussing this further based on the specifics of the role and benefits package offered.

Q 27. What are your strengths and weaknesses related to this role?

My strengths include meticulous attention to detail, excellent organizational skills, and a proven ability to manage high volumes of applications efficiently. I am proficient in utilizing property management software and tenant screening services, and I possess strong problem-solving skills and the ability to adapt quickly to changing situations. I excel at building rapport with applicants, making the process transparent and less stressful for them. One area I am actively working to improve is my delegation skills. While I am efficient independently, I recognize the benefits of empowering team members to share responsibilities more effectively. I am actively seeking opportunities to further hone my skills in team leadership and effective delegation.

Q 28. Why are you interested in this specific rental application processing position?

I am particularly interested in this position because of [Company Name]’s reputation for fair and efficient tenant screening practices, as well as its commitment to providing excellent customer service. I believe my experience and skill set align perfectly with your requirements. I am eager to contribute my expertise to a company that values thoroughness, accuracy, and a positive applicant experience. I also appreciate the company’s focus on [mention a specific company value or initiative, if known from research, to show you’ve done your homework], which resonates strongly with my personal values.

Key Topics to Learn for Rental Application Processing Interview

- Understanding Lease Agreements: Thoroughly grasp the key clauses, legal implications, and common variations in lease agreements. This includes understanding tenant rights and responsibilities.

- Application Screening & Verification: Learn effective techniques for reviewing applications, verifying income, employment history, and rental history. Practice identifying potential red flags and assessing risk.

- Credit & Background Checks: Understand the legal and ethical considerations surrounding background and credit checks. Learn how to interpret reports and make informed decisions based on the findings.

- Fair Housing Laws & Compliance: Develop a strong understanding of federal, state, and local fair housing laws to ensure compliant application processing and avoid discrimination.

- Data Management & Organization: Explore efficient methods for managing applicant data, maintaining organized records, and utilizing property management software (if applicable).

- Communication & Customer Service: Practice effective communication strategies for interacting with applicants, landlords, and other stakeholders. Develop skills in handling difficult conversations and managing expectations.

- Problem-Solving & Decision-Making: Prepare examples demonstrating your ability to analyze complex situations, resolve conflicts, and make sound judgments regarding applicant suitability.

Next Steps

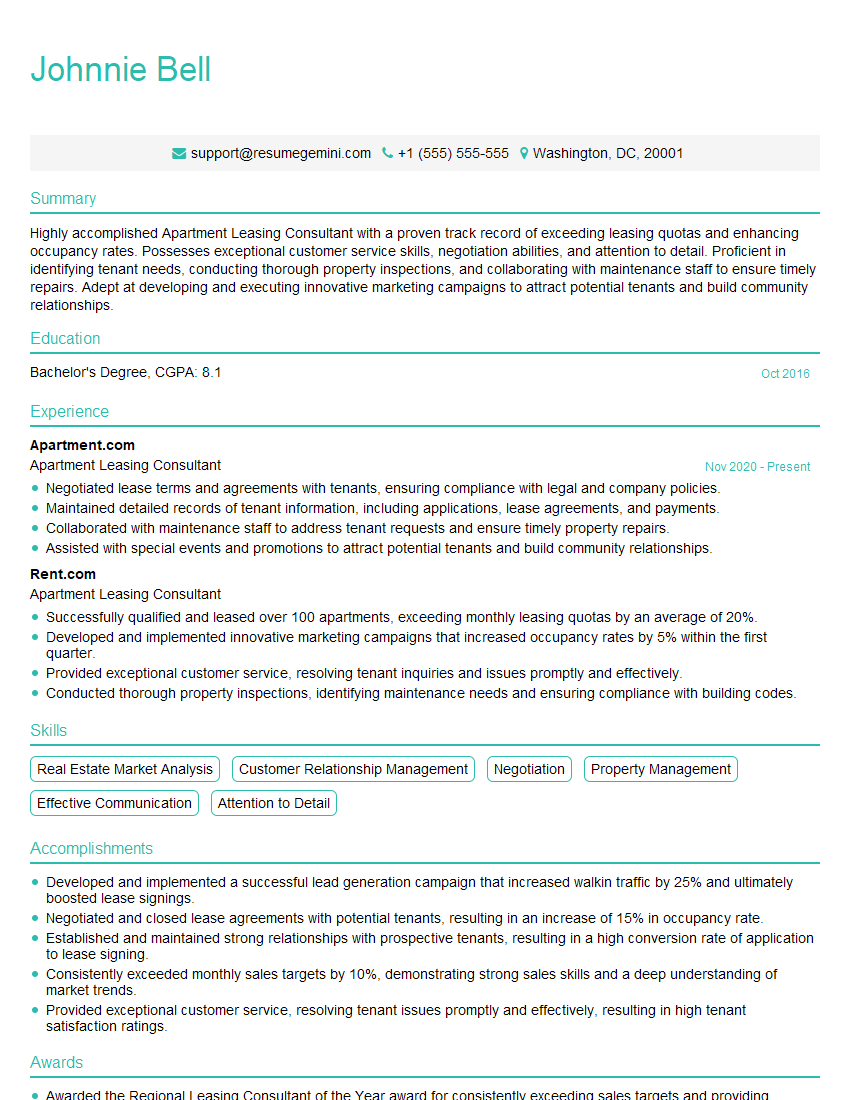

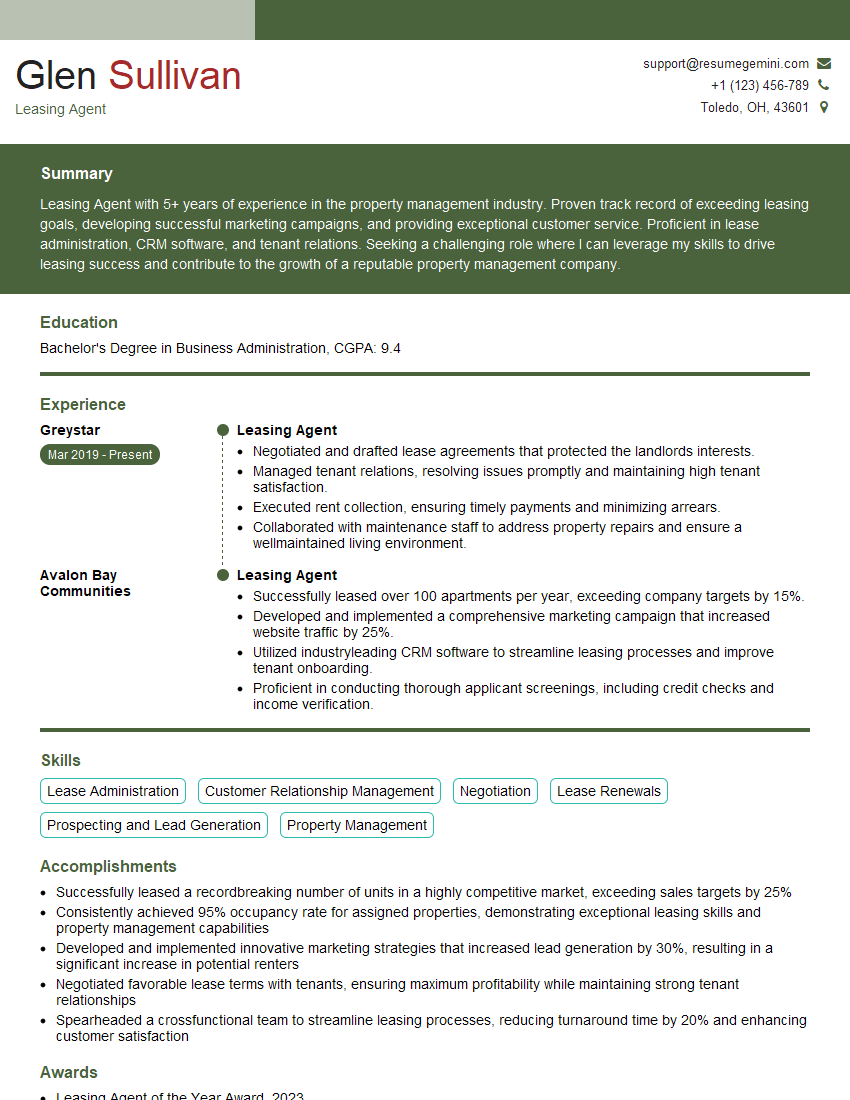

Mastering rental application processing opens doors to exciting career opportunities in property management and real estate. A strong understanding of this crucial process demonstrates efficiency, attention to detail, and compliance expertise—highly valued skills in today’s competitive market. To maximize your job prospects, create an ATS-friendly resume that highlights your relevant skills and experience. ResumeGemini is a trusted resource to help you build a professional and impactful resume. We provide examples of resumes tailored to Rental Application Processing to guide you in creating a document that showcases your qualifications effectively.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO