Interviews are opportunities to demonstrate your expertise, and this guide is here to help you shine. Explore the essential Repossessions interview questions that employers frequently ask, paired with strategies for crafting responses that set you apart from the competition.

Questions Asked in Repossessions Interview

Q 1. Describe your experience in repossessing various types of collateral.

My experience encompasses repossessing a wide range of collateral, from automobiles and RVs to heavy machinery and commercial equipment. I’ve handled situations involving both secured and unsecured debt, understanding the nuances of each type of collateral and the legal procedures involved in its recovery. For example, repossessing a car requires a different approach than repossessing a piece of farm equipment. Cars are typically repossessed during off-hours, minimizing disruption, while farm equipment may require more advanced planning due to its size and location.

- Automobiles: I have extensive experience in recovering passenger vehicles, trucks, and motorcycles. This often involves careful consideration of location and time to avoid confrontation.

- Heavy Machinery: Recovering heavy equipment, like tractors or construction vehicles, necessitates more coordination and often involves specialized towing services.

- Residential Property: While less frequent, I have experience with the complex procedures involved in repossessing real estate, which involves strict adherence to foreclosure laws.

In each case, the process begins with verifying ownership, locating the collateral, and then executing the repossession in accordance with all applicable laws and regulations. Safety is always the top priority.

Q 2. Explain your understanding of the legal requirements and procedures involved in repossessions.

Understanding the legal framework governing repossessions is critical. It varies by state and involves aspects of contract law, property law, and consumer protection laws. Key legal aspects include:

- State Laws: Each state has its own specific statutes regarding repossession, including the methods allowed (self-help vs. judicial process), notice requirements, and restrictions on the time and place of repossession.

- Uniform Commercial Code (UCC): The UCC governs secured transactions and provides a framework for repossessing collateral secured by a security agreement. Article 9 of the UCC details the procedures for repossession, including the right to peacefully repossess without breaching the peace.

- Breach of the Peace: This is a crucial legal consideration. Repossession must be conducted peacefully, without violence, threats, or causing a disturbance. This means avoiding confrontations with the debtor or their family.

- Notice Requirements: Many states require some form of notice to the debtor before repossession, although the specific requirements vary. Failure to provide proper notice can lead to legal challenges.

I’m meticulously trained in navigating these legal complexities to ensure compliance. Each case involves reviewing the relevant legal documents and verifying the specific requirements applicable to that particular jurisdiction and situation.

Q 3. How do you handle situations where the debtor is unwilling to cooperate?

When a debtor is uncooperative, a measured and professional approach is vital. First, I try to de-escalate the situation through calm and respectful communication. I explain the process clearly and emphasize the legal basis for the repossession. I attempt to obtain their cooperation in a safe and orderly handover of the collateral. However, if cooperation remains impossible, I must proceed according to established legal procedures.

- Documentation: Thorough documentation is key. All attempts at communication and any refusal to cooperate are meticulously documented, including dates, times, and details of any interactions.

- Legal Counsel: If cooperation remains impossible and the situation becomes volatile, legal counsel is sought to ensure compliance and to avoid legal repercussions. This might involve obtaining a court order to facilitate the repossession.

- Law Enforcement: In extreme cases, law enforcement may be involved to ensure a safe and lawful repossession, especially if there’s a risk of violence or obstruction.

The goal is always to complete the repossession safely and legally, while minimizing disruption and potential conflict.

Q 4. Describe your experience with skip tracing.

Skip tracing is a crucial skill in repossession. It’s the process of locating debtors who have absconded. My experience includes using various techniques and resources to track down individuals and locate the collateral. These techniques include:

- Public Records: Accessing county records, court documents, and other public databases to identify addresses, phone numbers, and other relevant information.

- Commercial Databases: Utilizing skip tracing services and databases that offer access to more comprehensive information about individuals, often including past addresses and known associates.

- Social Media: Using social media platforms cautiously and ethically to find clues about the debtor’s location or associates.

- Network and Collaboration: Working with other industry professionals and leveraging collective knowledge to locate individuals.

Ethical considerations are paramount in skip tracing. I always ensure compliance with all privacy laws and regulations. Accuracy is critical, as incorrect information can lead to wasted time and resources.

Q 5. How do you prioritize repossession cases based on urgency and risk?

Prioritization of repossession cases depends on a combination of urgency and risk. Cases are assessed based on several factors:

- Debt Amount: Larger debt amounts often take priority, given the higher financial risk to the creditor.

- Age of the Debt: Older debts may carry greater risk of deterioration of collateral or increased difficulty in recovery.

- Debtor’s Behavior: A debtor known to be evasive or potentially violent will be prioritized differently from a cooperative debtor.

- Collateral Condition and Location: The risk of the collateral being damaged or destroyed is a major consideration, pushing certain cases to the top of the list.

- Legal Deadlines: Approaching deadlines for legal action, such as the statute of limitations, will influence prioritization.

A well-defined system is used to manage cases, often involving case management software, to ensure efficient allocation of resources and optimized recovery.

Q 6. Explain your understanding of Fair Debt Collection Practices Act (FDCPA).

The Fair Debt Collection Practices Act (FDCPA) is a crucial piece of legislation governing debt collection. It dictates how debt collectors, including repossession agents, can communicate with and interact with debtors. Key aspects of the FDCPA include:

- Prohibition of Harassment: The FDCPA strictly prohibits harassing or abusive behavior, such as repeated calls at inconvenient times, using profane or threatening language, or falsely representing oneself.

- Truthful Representation: Debt collectors must accurately represent themselves and the nature of the debt. Misleading or false statements are strictly prohibited.

- Time and Place of Contact: There are restrictions on when and where debt collectors can contact debtors, typically avoiding early morning or late-night calls, or contacting debtors at their place of employment without permission.

- Validation of Debt: Upon request, the debt collector must provide verification of the debt to the debtor.

- Communication with Third Parties: The FDCPA regulates communication with third parties, including family members and friends.

Strict adherence to the FDCPA is critical to avoid legal liability and maintain ethical standards in the repossession process. Any violation of FDCPA can result in significant fines and legal repercussions.

Q 7. What is your experience with repossessing vehicles in different locations and under varying conditions?

My experience encompasses repossessions in diverse geographical locations and under varying conditions. This includes urban, suburban, and rural areas, as well as different weather conditions. Adaptability is essential to this role.

- Urban Environments: Recovering collateral in densely populated urban areas often requires navigating traffic, parking restrictions, and potentially higher security measures.

- Rural Environments: Rural repossessions may involve traveling longer distances on varied terrain, requiring specialized vehicles or equipment.

- Weather Conditions: Repossessions must still be executed in inclement weather such as rain, snow, or extreme temperatures, always prioritizing safety.

- Security Concerns: Recovering collateral in high-crime areas or properties with security systems requires heightened awareness and careful planning.

In all circumstances, safety remains the top priority. Appropriate safety measures are taken to ensure the security of both myself and the collateral. Each situation requires careful assessment and a tailored approach to ensure a safe and efficient repossession.

Q 8. How do you maintain accurate records and documentation throughout the repossession process?

Maintaining accurate records is paramount in repossessions. It’s not just about protecting myself and my company; it’s about ensuring legal compliance and providing irrefutable evidence in case of disputes. My process starts with meticulously documenting every step, from the initial default notice to the final disposition of the collateral.

- Detailed Initial Documentation: I carefully record the loan agreement details, the borrower’s contact information, the vehicle identification number (VIN), and any relevant legal documentation. This forms the foundation of my records.

- Step-by-Step Repossession Process: Every attempt to contact the borrower is logged, including dates, times, and methods of contact (phone calls, emails, certified mail). Each step of the repossession itself is documented: the location, time, condition of the collateral, any witnesses present, and photographic or video evidence.

- Secure Storage & Handling: Once repossessed, the collateral’s location is meticulously recorded. Regular inventories are conducted, and condition reports are updated to account for any damage that may occur while the asset is in storage. All documentation is stored securely, both physically and digitally, adhering to all relevant data privacy regulations.

- Digital Management: I utilize a sophisticated digital record-keeping system to ensure easy access, searchability, and data integrity. This system integrates with my GPS tracking device on the vehicle, automatically generating location data.

Imagine a scenario where a borrower claims the vehicle was damaged during repossession. My detailed photographic and written documentation, corroborated by time-stamped GPS data, would provide irrefutable evidence to support my actions.

Q 9. Describe your experience handling customer complaints or disputes.

Handling customer complaints and disputes requires a calm, professional, and empathetic approach. My goal is always to resolve the issue fairly and efficiently, while upholding the legal rights of all parties involved. I start by actively listening to the customer’s concerns, ensuring they feel heard and understood.

- Thorough Review of Documentation: I begin by meticulously reviewing all relevant documentation, ensuring all procedures were followed accurately and that the repossession was carried out legally. This might involve verifying the terms of the loan agreement, reviewing communication logs, and confirming the legitimacy of the repossession order.

- Open and Honest Communication: I explain the process clearly and concisely, ensuring the customer understands the legal framework and the steps taken. I avoid jargon and focus on clarity.

- Mediation and Negotiation: Where possible, I attempt to mediate a solution that benefits both parties. This could involve exploring options for reinstatement of the loan or exploring alternative arrangements.

- Escalation to Legal Counsel: If the dispute cannot be resolved amicably, I escalate the matter to legal counsel for further guidance and action. This might involve preparing for potential litigation.

For example, I once had a borrower dispute a repossession claim, arguing that they had made a payment. After a thorough review, we discovered a processing error on our end, leading to a delayed payment application. We rectified the situation, refunded the late fees, and worked to reinstate the loan, thereby maintaining a positive relationship with the customer.

Q 10. Explain your understanding of different repossession methods (e.g., self-help repossession, judicial repossession).

Repossession methods vary depending on state laws and the terms of the loan agreement. Two prominent methods are self-help repossession and judicial repossession.

- Self-Help Repossession: This method allows the creditor to repossess collateral without court intervention. However, it’s crucial to adhere strictly to state laws governing this process. Breaching these laws can lead to legal repercussions. Key considerations include ensuring the repossession is conducted peacefully, without breach of the peace, and that the collateral is not taken from a place where the borrower has a reasonable expectation of privacy (e.g., their home, unless a specific court order permits it).

- Judicial Repossession: This involves obtaining a court order authorizing the repossession. This method offers a more secure and less risky approach, eliminating concerns about potential legal challenges from the borrower. It requires filing a lawsuit, serving the debtor with the court documents, and obtaining a court-ordered judgment.

The choice of method depends on various factors, including the borrower’s cooperation, the risk of violence, and the specific legal environment. While self-help repossession is often faster and less expensive, judicial repossession offers greater legal protection.

Q 11. How do you assess the risk involved in each repossession assignment?

Risk assessment is critical before undertaking any repossession. I use a structured approach that considers several key factors:

- Borrower’s History: Reviewing past interactions with the borrower is critical. Previous instances of aggression or threats raise the risk level significantly.

- Location Assessment: The location where the collateral is situated plays a major role. Repossessions in high-crime areas or locations known for violent incidents present increased risk.

- Collateral Type and Value: The value of the collateral influences the risk. Higher-value items might attract more criminal activity. The type of collateral (e.g., a car versus a piece of equipment) also influences the complexity and potential risks involved.

- Legal Environment: Understanding local laws and regulations is crucial. Some jurisdictions have stricter regulations regarding repossession than others.

- Presence of Other Individuals: The presence of other individuals near the collateral increases the risk of confrontations or interference.

For high-risk situations, I may request backup from colleagues or local law enforcement, or opt for judicial repossession instead.

Q 12. How do you ensure the safety and security of both yourself and the collateral during repossession?

Safety and security are my top priorities. My procedures are designed to minimize risks to both myself and the collateral.

- Partnering with Law Enforcement: For high-risk situations, I always collaborate with local law enforcement. Their presence can deter violence and ensure the safety of all parties involved.

- Proper Training and Equipment: I undergo regular training in safe repossession techniques. This includes de-escalation strategies, defensive tactics, and awareness of potential threats. I use GPS tracking devices, two-way radios, and personal protection equipment (PPE) as needed.

- Careful Planning and Execution: Before each repossession, I carefully plan the operation, considering the location, time of day, and potential challenges. I choose the least disruptive method possible and always prioritize non-confrontational approaches.

- Secure Transport and Storage: Once the collateral is repossessed, I transport it securely to a designated storage facility. I ensure the asset is adequately protected against theft, damage, and vandalism during transit and storage.

Think of it like this: we’re not just retrieving assets; we’re managing a potential conflict-resolution situation. My approach is always calm and professional, aiming for de-escalation rather than confrontation.

Q 13. What is your experience working with law enforcement or legal counsel during repossessions?

Collaboration with law enforcement and legal counsel is crucial for complex repossessions.

- Law Enforcement: I work closely with law enforcement when dealing with potentially volatile situations, ensuring their involvement reduces the risk of violence or injury. A strong working relationship with local police departments speeds up the process and ensures adherence to the law.

- Legal Counsel: Legal counsel is essential for navigating intricate legal matters. They advise on compliance with state laws, review contracts, and help resolve disputes. This collaboration ensures our actions are legally sound and protects the company from potential liability.

For example, I once worked with local police when repossessing a vehicle from a known gang member’s property. Their presence significantly reduced the risks, and the repossession was executed peacefully and safely.

Q 14. How do you manage your time effectively to handle a high volume of repossession cases?

Managing a high volume of repossession cases demands effective time management. My approach uses a combination of planning, prioritization, and technology.

- Prioritization: I prioritize cases based on factors like risk level, urgency, and legal deadlines. High-risk cases receive immediate attention.

- Scheduling and Routing: I use sophisticated scheduling software and GPS technology to optimize my routes, reducing travel time and maximizing efficiency.

- Teamwork and Delegation: For larger operations, I coordinate with my team, delegating tasks effectively to streamline the process.

- Regular Reporting and Follow-up: I maintain detailed records and reports, tracking the progress of each case and following up with borrowers, clients, and legal counsel as needed.

- Technology Integration: I utilize GPS tracking, digital documentation, and communication software to ensure smooth workflow and minimize paperwork.

Imagine having 20 cases to handle in a week. Without effective time management, this could quickly become overwhelming. My strategies allow me to tackle each case methodically and efficiently, ensuring that deadlines are met and legal requirements are fulfilled.

Q 15. Describe a challenging repossession situation and how you resolved it.

One of the most challenging repossessions involved a debtor who had barricaded themselves in their home with the collateral, a late-model SUV, parked in the driveway. This created a significant safety concern and required a delicate approach. We couldn’t just forcibly enter the property; that would’ve risked injury and legal repercussions.

My solution involved first contacting the local law enforcement to inform them of the situation and request their presence for safety and legal compliance. Simultaneously, I initiated contact with the debtor again, emphasizing the legal process and the potential consequences of further defiance. We offered several options, including a payment plan or voluntary surrender of the vehicle. After several hours of negotiation, supported by the police presence, the debtor agreed to surrender the vehicle peacefully, avoiding any confrontation or potential harm.

This situation highlighted the importance of de-escalation techniques and collaborative problem-solving when dealing with emotionally charged scenarios. It also underscored the need for close cooperation with law enforcement to ensure safety and compliance.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. What is your proficiency with GPS tracking and other technological tools used in repossessions?

I’m highly proficient in using GPS tracking technology, specifically in locating and recovering repossessed collateral. I’m familiar with various GPS tracking devices and software, including those that provide real-time location updates and historical tracking data. This allows us to effectively monitor the location of collateral and optimize the repossession process, minimizing time and resources.

Beyond GPS, I utilize other technological tools such as mobile data access for quick communication, digital record-keeping for documentation and compliance, and specialized repossession software for scheduling and managing repossession assignments. I am constantly learning new technologies in the ever-evolving landscape of the repossession industry.

Q 17. How do you ensure compliance with state and local regulations related to repossessions?

Compliance with state and local regulations is paramount in the repossession industry. I meticulously study and adhere to all relevant laws concerning notice requirements, permissible repossession methods, and debtor’s rights. This includes understanding the specific regulations regarding the timing and method of notice to the debtor, permissible hours for repossession, and any restrictions on where repossessions can take place (e.g., on private property).

Our company maintains updated records of all applicable regulations, and we conduct regular training to ensure all team members are fully aware of and comply with these regulations. Any deviation from these regulations can lead to serious legal consequences, including hefty fines and legal action. We prioritize proactive compliance over reactive solutions.

Q 18. Describe your experience with repossession logistics, including transportation and storage of collateral.

My experience with repossession logistics encompasses the entire process, from the initial retrieval to secure storage. This includes coordinating transportation via company vehicles or contracted services, ensuring safe and secure transportation of the collateral. Careful documentation at every step, including chain-of-custody records, is crucial.

We use secure storage facilities, complying with all relevant security protocols, to safeguard the repossessed items until they are returned to the creditor. Inventory management and condition reports are carefully maintained for each item, to prevent damage, loss, or disputes. Proper insurance coverage also plays a key role in protecting the collateral and the company from potential liability.

Q 19. How do you communicate effectively with debtors, creditors, and other stakeholders?

Effective communication is critical for success in repossessions. With debtors, I maintain a professional yet empathetic approach. I clearly explain the legal process, the debtor’s options, and the consequences of non-compliance, while also attempting to build a rapport to avoid confrontation. I always maintain respectful and courteous communication.

With creditors, I provide regular updates on the status of repossessions, ensuring transparency and accountability. I promptly report any challenges or complications encountered. Communication with other stakeholders, such as law enforcement and storage facilities, is equally crucial for seamless operation and compliance.

Q 20. What is your experience with different types of collateral (e.g., vehicles, equipment, etc.)?

I have extensive experience with various types of collateral, including vehicles (cars, trucks, motorcycles, RVs), heavy equipment (construction machinery, farm equipment), and other personal property such as boats and recreational vehicles. Each type presents unique challenges in terms of retrieval, transportation, and storage.

For instance, repossessing a large piece of construction equipment requires specialized transportation and securing methods compared to retrieving a car. My expertise extends to understanding the specifics of handling different types of collateral in order to mitigate any risks of damage or injury. This includes knowing the best techniques for securing and transporting each type of item safely and legally.

Q 21. How do you handle repossessions in high-risk areas or situations?

Repossessions in high-risk areas or situations require a heightened level of awareness and preparedness. Safety is the top priority. Before engaging in such a repossession, we carefully assess the potential risks, including the debtor’s known behavior, the surrounding environment, and potential security threats.

We often coordinate with law enforcement for additional support in these cases. Teamwork, clear communication within the team, and a strict adherence to established safety protocols are vital for minimizing risk to personnel and ensuring a successful, safe repossession. Using technology such as GPS tracking and real-time communication tools allows for coordinated responses and efficient collaboration.

Q 22. What are your strategies for minimizing potential damage to the collateral during repossession?

Minimizing damage to collateral during repossession is paramount. It’s not just about legally retrieving the asset; it’s about protecting its value for both the creditor and the debtor (to the extent possible, given the circumstances). My strategy involves a multi-pronged approach:

- Thorough Pre-Repossession Planning: This includes reviewing all relevant documentation to understand the location and condition of the asset. Knowing whether it’s parked in a garage, on a busy street, or in a secure compound drastically alters the approach. For instance, a vehicle in a crowded area might necessitate a less conspicuous approach, perhaps late at night.

- Trained Personnel: I exclusively work with trained and licensed repossession agents who understand proper handling procedures for different types of collateral. This includes knowing how to safely tow a vehicle, operate specialized equipment for larger assets, and even understanding the nuances of safely removing delicate items from a residence.

- Documentation and Photography: Before, during, and after repossession, comprehensive documentation, including photos and video, is crucial. This not only protects against accusations of damage but also provides a complete record of the asset’s condition. For example, if there was pre-existing damage, it’s documented to prevent unfair claims.

- Methodical Procedures: We adhere to strict protocols for each repossession. This often involves using appropriate equipment to avoid scratches, dents, or other damage. For example, soft straps are preferred over chains when towing vehicles. In cases involving homes or other structures, we prioritize preventing damage through coordination with property management or legal channels.

Ultimately, minimizing damage saves time, money, and potential legal complications. A damaged asset leads to disputes, legal battles, and diminished recovery for the creditor.

Q 23. How do you ensure the confidentiality and security of sensitive information related to debtors and creditors?

Confidentiality and security are cornerstones of our operations. We understand the sensitive nature of the information we handle, encompassing personal details of debtors and the financial arrangements with creditors. Our commitment to data protection rests on several pillars:

- Secure Data Storage: All client data, including debtor information, is stored in encrypted databases that are only accessible to authorized personnel. Access is controlled with strict password policies and multi-factor authentication.

- Data Minimization: We collect only the necessary information for repossession and avoid unnecessarily storing excessive details. We comply fully with relevant data privacy regulations.

- Employee Training: Our team undergoes regular training on data privacy best practices and legal requirements, including compliance with regulations such as GDPR and CCPA. We stress the importance of protecting sensitive information at all times.

- Secure Communication: All communication regarding repossessions employs encrypted channels to prevent unauthorized access. Any communication that is not fully secure is avoided.

- Incident Response Plan: In the event of a data breach, we have a comprehensive incident response plan to mitigate risks and notify affected individuals as required by law.

We take these measures very seriously. A breach of confidentiality could not only damage our reputation but also lead to significant legal and financial repercussions.

Q 24. Describe your experience with the repossession of high-value assets.

My experience with high-value asset repossessions includes a wide range of items from luxury vehicles and yachts to expensive equipment and fine art. These repossessions require a higher level of planning, security, and expertise. For instance:

- Specialized Expertise: We collaborate with specialists who understand the specific handling requirements of each asset type. For example, transporting a classic car involves different precautions than relocating heavy machinery.

- Enhanced Security Measures: The potential for theft and damage is higher, so we utilize increased security measures, potentially including armed guards, GPS tracking, and discreet transport methods.

- Insurance Considerations: High-value assets necessitate robust insurance coverage during transport and storage to protect the value and avoid potential losses in case of unforeseen circumstances.

- Legal and Regulatory Compliance: These repossessions often involve more complex legal and regulatory considerations, requiring close collaboration with legal counsel to ensure compliance and minimize risks.

I recall one instance involving a repossession of a classic car collection worth millions of dollars. The operation required detailed planning, a specialized transporter, and constant monitoring to prevent any damage or theft. The successful execution hinged on meticulous attention to detail and adherence to established protocols.

Q 25. How do you adhere to ethical standards and best practices in the repossession industry?

Ethical standards and best practices are the bedrock of my work. We adhere to a strict code of conduct encompassing:

- Legal Compliance: We strictly comply with all federal, state, and local laws and regulations related to repossession. This is non-negotiable.

- Respectful Interactions: We treat debtors with respect and dignity, even in challenging situations. We understand that repossession can be a stressful experience, and we strive to minimize any unnecessary hardship.

- Transparency and Communication: We maintain open communication with debtors and creditors throughout the process, providing timely updates and clear explanations.

- Professionalism and Integrity: We uphold the highest standards of professionalism and integrity, maintaining a reputation for fairness and ethical behavior within the industry.

- Avoiding Unnecessary Force: We never resort to violence or intimidation. Our focus is on a peaceful and efficient repossession.

Our commitment to ethical practices fosters trust and minimizes potential conflicts. It’s a core element of building long-term relationships with creditors and minimizing the emotional distress for debtors.

Q 26. How do you identify and mitigate potential risks associated with repossessions?

Risk mitigation in repossession is crucial. It’s about identifying and proactively addressing potential problems before they arise. This includes:

- Debtor Behavior Assessment: We assess the potential for resistance or aggression by reviewing past interactions and the debtor’s history. This helps in determining the appropriate response and security measures.

- Location Risk Assessment: We carefully evaluate the location where the asset is situated. A high-crime area requires different safety measures than a quiet residential street.

- Asset Condition Assessment: Understanding the asset’s condition is critical to selecting the appropriate handling and transport methods.

- Legal Compliance Checks: We verify all legal documents are valid before proceeding. Any discrepancies or issues must be resolved before the repossession.

- Insurance and Liability Coverage: Comprehensive insurance protects against potential losses and liabilities associated with the repossession process.

- Contingency Planning: Having backup plans for various scenarios (e.g., unforeseen obstacles, debtor resistance) is critical for a smooth operation.

For example, if we suspect potential resistance during a vehicle repossession, we might coordinate with law enforcement for backup. A thorough risk assessment is vital for a successful and safe operation.

Q 27. What are your skills in conflict resolution and de-escalation techniques?

Conflict resolution and de-escalation are essential skills in repossession. A significant portion of my training focused on these areas. My approach involves:

- Calm and Respectful Communication: Even in tense situations, maintaining calm, respectful communication is crucial. I actively listen to the debtor’s concerns and try to understand their perspective.

- Empathy and Understanding: Recognizing the emotional impact of repossession on the debtor is crucial. Showing empathy can significantly de-escalate tension.

- Clear and Concise Communication: I communicate clearly and concisely, explaining the legal process and avoiding jargon. I provide information in a way that is easy to understand.

- Setting Boundaries: While showing empathy, it’s crucial to set clear boundaries and firmly but respectfully enforce the legal process.

- Seeking Mediation When Necessary: In situations where conflict cannot be resolved directly, we may explore mediation or other conflict-resolution options.

For example, I’ve had situations where a debtor was upset and emotionally charged. By calmly explaining the process, listening to their concerns, and showing empathy, I managed to de-escalate the situation and complete the repossession peacefully.

Q 28. Describe your experience with repossession software and reporting systems.

My experience with repossession software and reporting systems is extensive. I’m proficient in using various software platforms designed for managing the entire repossession process, from initial client intake to final reporting. This includes:

- Client Relationship Management (CRM) Systems: I use CRM systems to track client information, manage communication, and document all stages of the repossession process.

- GPS Tracking and Monitoring: I utilize GPS technology to locate assets efficiently and ensure their safe transportation.

- Reporting and Analytics: I’m skilled in generating reports on repossession activities, providing insights on performance, cost-effectiveness, and other key metrics.

- Legal and Compliance Management Systems: Many software platforms offer tools to help ensure compliance with all relevant regulations and laws.

My proficiency in these systems enables efficient management of cases, improved communication, and timely reporting to clients, ensuring transparency and accountability throughout the entire repossession lifecycle. I am always adapting to the latest technologies to improve our operational efficiency and maintain the highest standards in the industry.

Key Topics to Learn for Repossessions Interview

- Legal Aspects of Repossession: Understanding state and federal laws governing repossession procedures, including due process rights and legal limitations.

- Repossession Strategies and Techniques: Learning various methods for repossessing collateral, from voluntary surrender to skip tracing and field recovery, and understanding the ethical considerations involved.

- Risk Management in Repossessions: Identifying and mitigating potential risks, including safety concerns for field agents, legal challenges, and damage to repossessed assets.

- Documentation and Compliance: Mastering the accurate and complete documentation of all repossession activities, ensuring compliance with company policies and legal requirements.

- Communication and Customer Interaction: Developing effective communication skills to handle interactions with borrowers, balancing professionalism with empathy during a stressful situation.

- Technology in Repossessions: Familiarity with GPS tracking, skip tracing software, and other technological tools used in modern repossession practices.

- Ethical Considerations and Best Practices: Understanding and adhering to ethical guidelines, prioritizing safety and minimizing negative impacts on borrowers.

- Financial Aspects of Repossession: Understanding the financial implications of repossession for both the lender and the borrower, including costs and potential losses.

Next Steps

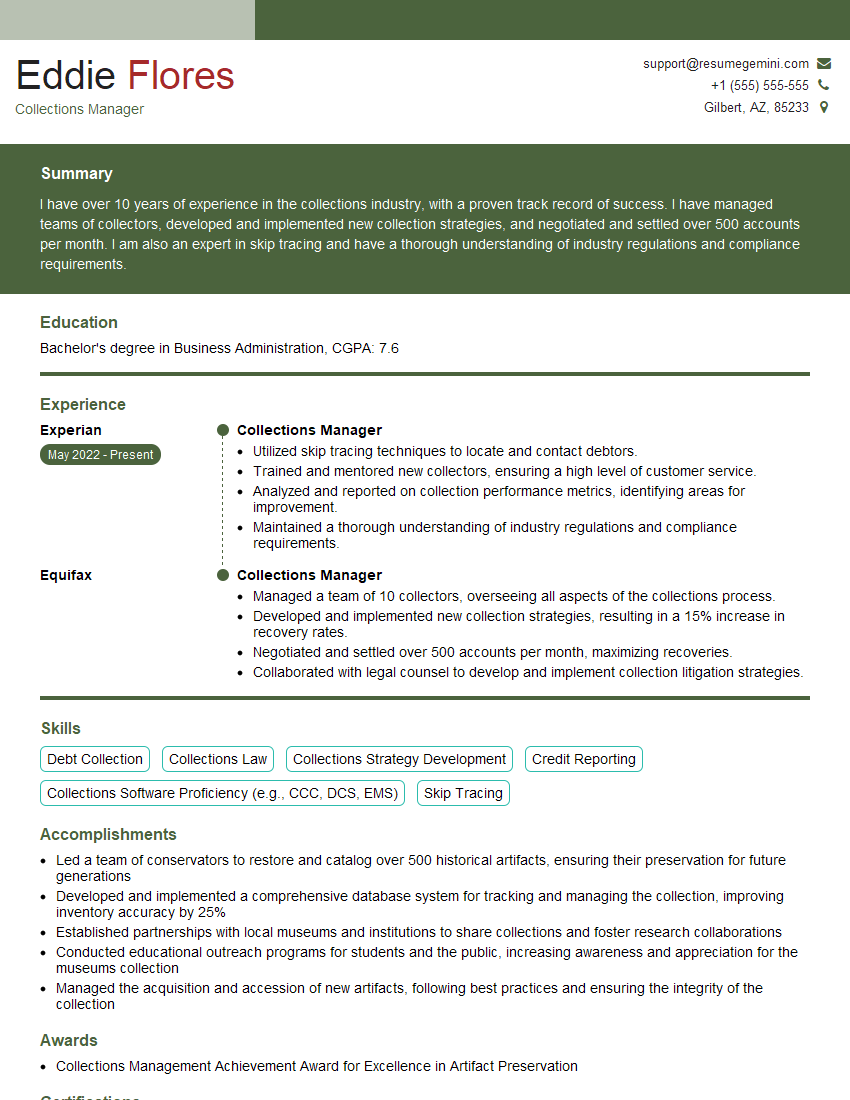

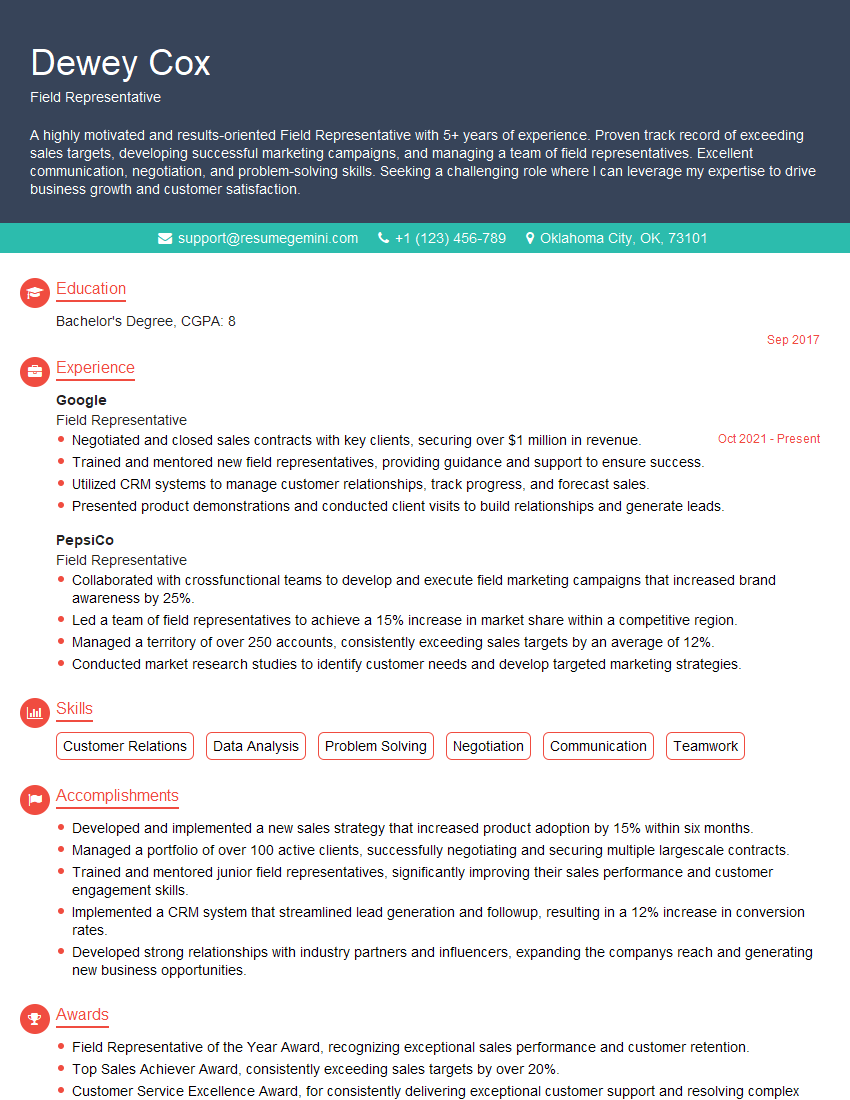

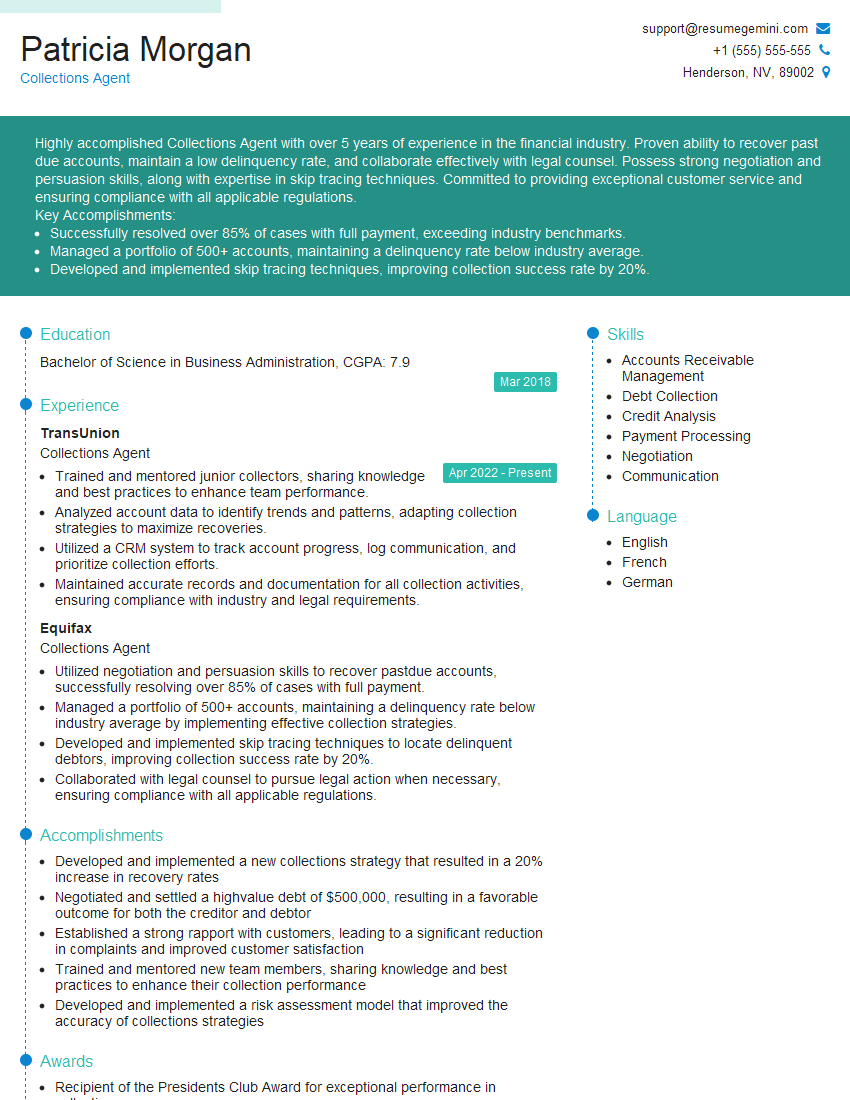

Mastering the intricacies of repossessions opens doors to rewarding careers in the finance and asset recovery sectors. A strong understanding of legal frameworks, ethical practices, and efficient operational strategies is highly valued by employers. To significantly boost your job prospects, it’s crucial to create an ATS-friendly resume that highlights your skills and experience effectively. ResumeGemini is a trusted resource to help you build a professional and impactful resume that gets noticed. We provide examples of resumes tailored to the Repossessions field to guide you in crafting a compelling application.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

I Redesigned Spongebob Squarepants and his main characters of my artwork.

https://www.deviantart.com/reimaginesponge/art/Redesigned-Spongebob-characters-1223583608

IT gave me an insight and words to use and be able to think of examples

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO