The right preparation can turn an interview into an opportunity to showcase your expertise. This guide to Software Proficiency (e.g., budgeting software, financial modeling tools) interview questions is your ultimate resource, providing key insights and tips to help you ace your responses and stand out as a top candidate.

Questions Asked in Software Proficiency (e.g., budgeting software, financial modeling tools) Interview

Q 1. Describe your experience with budgeting software (e.g., Vena, Adaptive Insights).

My experience with budgeting software encompasses several leading platforms, including Vena and Adaptive Insights. I’ve used these tools extensively in various roles, from building complex financial models for large corporations to streamlining budgeting processes for smaller businesses. With Vena, for instance, I’ve leveraged its robust features for driver-based forecasting, effectively linking key performance indicators (KPIs) to financial projections. This allows for a more dynamic and responsive budgeting process. In Adaptive Insights, I’ve utilized its collaborative capabilities to manage multi-departmental budgets, ensuring consistent data and version control across teams. My proficiency extends beyond simple data entry; I’m adept at designing, implementing, and maintaining sophisticated models, including integrations with other enterprise systems like ERP and CRM solutions. I’m also comfortable with data manipulation, report generation, and user training, ensuring seamless adoption and utilization within organizations.

Q 2. Explain the difference between a static and dynamic financial model.

The key difference between static and dynamic financial models lies in their ability to respond to changes in input variables. A static model is a snapshot in time. It shows a single financial projection based on a fixed set of assumptions. Think of it like a photograph – it captures a moment but doesn’t reflect subsequent events. For example, a static model might show projected revenue based on a single sales growth rate assumption. Conversely, a dynamic model is interactive and responsive. It allows you to change input variables (e.g., sales growth, cost of goods sold) and instantly see the impact on the overall financial projections. This is more like a video, continuously updating based on new information. A dynamic model could simulate various scenarios, such as changes in market conditions or interest rates, illustrating their influence on profitability and cash flow. Dynamic models are invaluable for scenario planning and sensitivity analysis, offering a much more comprehensive understanding of the business’s financial health.

Q 3. How would you handle circular references in a financial model?

Circular references in financial models occur when a formula refers back to its own cell, either directly or indirectly, creating a loop. This prevents the model from calculating correctly and can lead to inaccurate or nonsensical results. Imagine it as trying to define a word using the same word in the definition – it’s a logical contradiction. The first step in handling circular references is to identify them. Most spreadsheet software will highlight circular dependencies. Once identified, you need to understand the underlying cause. Often, it’s due to incorrect formula construction or unintended dependencies between cells. Solutions include:

- Re-evaluating formulas: Carefully review the formulas involved in the circularity. Are they calculating correctly? Are there unnecessary loops? Perhaps a simpler formula or different approach is needed.

- Data organization: A poor spreadsheet design can contribute to circular references. A well-structured model, with clear data flow and logical cell relationships, can significantly reduce the risk.

- Iterative calculation (with caution): Some software allows for iterative calculations, where the model calculates multiple times to converge on a solution. However, this is often unstable and can lead to unexpected outcomes. It should be used only after careful consideration.

For example, if cell A1 contains the formula =A1+1, it creates a circular reference. The solution would be to redesign the formula to accurately reflect the intended calculation.

Q 4. What are the key assumptions you would consider when building a financial forecast?

Building a robust financial forecast requires careful consideration of several key assumptions. These assumptions form the foundation of the model and significantly impact the results. Some critical assumptions include:

- Revenue growth rate: This is a fundamental assumption based on market analysis, historical performance, and anticipated future trends. It’s crucial to justify this rate with supporting evidence.

- Cost of goods sold (COGS): Assumptions here need to account for fluctuations in raw material prices, manufacturing costs, and labor expenses.

- Operating expenses: This encompasses various costs like salaries, marketing, rent, and administrative expenses. Accurate forecasting depends on anticipated headcount changes, marketing campaigns, and other operational factors.

- Capital expenditures (CapEx): This involves investments in new equipment or infrastructure. Assumptions should account for planned acquisitions and upgrades.

- Financing assumptions: This covers debt levels, interest rates, and potential equity investments. These significantly impact the forecast’s financial health.

- Economic conditions: External factors like inflation, interest rates, and overall economic growth should be considered, along with their impact on revenue and costs.

It’s vital to document these assumptions clearly and transparently, so the forecast’s limitations and underlying logic are readily understood.

Q 5. Describe your experience with scenario planning and sensitivity analysis.

Scenario planning and sensitivity analysis are integral parts of robust financial modeling. Scenario planning involves creating multiple possible future outcomes based on different assumptions. For example, one scenario might assume optimistic market growth, while another considers a pessimistic downturn. This allows for a range of potential results to be explored. Sensitivity analysis investigates the impact of changes in individual input variables on the overall forecast. This helps to identify the most critical assumptions that drive the model’s results. For example, a sensitivity analysis might show that a small change in the sales growth rate has a large effect on profitability. My experience includes developing and implementing both types of analyses using spreadsheet software and dedicated financial modeling platforms. I’m comfortable using data tables, what-if analyses, and data visualization techniques to present findings effectively, helping stakeholders understand the range of potential outcomes and the relative importance of various assumptions.

Q 6. How do you ensure the accuracy and integrity of your financial data?

Ensuring the accuracy and integrity of financial data is paramount. My approach involves a multi-pronged strategy:

- Data validation: Employing data validation rules within spreadsheets to check for errors like incorrect data types, out-of-range values, and inconsistencies. For example, ensuring that revenue figures are positive and costs are formatted as currency.

- Source data verification: Always verify data from original sources, cross-checking information across multiple systems to identify discrepancies and improve data quality. Regular reconciliation of data sources is essential.

- Data governance procedures: Implementing clear processes for data entry, approval, and auditing to maintain data quality and traceability. Documenting all data sources and changes meticulously is vital.

- Regular audits: Conducting periodic internal audits to identify potential problems and ensure compliance with accounting standards and internal controls.

- Version control: Using version control systems to track changes in the financial model, allowing for easy rollback in case of errors or unintentional changes.

By using a combination of automated checks, manual reviews, and robust data governance processes, I help ensure that the financial models and data they rely on are accurate, reliable, and suitable for decision-making.

Q 7. What are some common errors in financial modeling, and how can they be avoided?

Common errors in financial modeling include:

- Incorrect formulas: Simple mistakes in formulas can lead to significant inaccuracies. Regularly reviewing formulas and using formula auditing tools can help catch errors early on.

- Inconsistent units: Mixing different units (e.g., thousands and millions) can lead to significant calculation errors. Maintaining consistency in units throughout the model is crucial.

- Hardcoded values: Using hardcoded values instead of cell references makes it difficult to update the model and increases the chance of errors. Using cell references promotes flexibility and reduces the risk of errors.

- Lack of documentation: Poor documentation makes it challenging to understand the model’s logic and assumptions, making it difficult to debug or update the model.

- Circular references (as discussed earlier): These lead to erroneous results. Identifying and resolving these early is essential.

Avoiding these errors requires careful planning, rigorous testing, and clear documentation. Using best practices, regularly reviewing and validating the model, and collaborating with others can also greatly reduce the risk of errors.

Q 8. How do you validate your financial models?

Validating a financial model is crucial to ensure its accuracy and reliability. It’s like testing a bridge before opening it to traffic – you wouldn’t want it to collapse! My validation process involves several key steps:

- Data Validation: I meticulously check the source and accuracy of all input data. This includes verifying numbers against original documents, reconciling data from different sources, and assessing the data’s completeness and consistency. For example, I’d compare revenue figures from a sales report to the general ledger.

- Formula Auditing: I systematically review all formulas and calculations within the model to ensure they are logically sound and correctly implemented. This might involve using Excel’s formula auditing tools or stepping through calculations manually to understand how the model derives its results. A simple error in a formula can cascade through the entire model.

- Sensitivity Analysis: I perform sensitivity analysis to understand how changes in key input variables (like interest rates or sales growth) affect the model’s output. This helps identify the most critical assumptions and quantify their impact on the model’s conclusions. For instance, I might vary the discount rate in a DCF model by +/- 1% to see its effect on the valuation.

- Scenario Planning: I develop multiple scenarios reflecting different potential outcomes (best-case, base-case, worst-case). This helps assess the robustness of the model under various conditions and identify potential vulnerabilities. Thinking about various economic climates is critical here.

- Peer Review: Whenever possible, I solicit feedback from other financial professionals to review the model’s methodology, assumptions, and results. A fresh pair of eyes can often catch errors or identify areas for improvement.

By combining these techniques, I build confidence in the model’s accuracy and reliability, ensuring that the financial insights it provides are trustworthy and actionable.

Q 9. Explain your experience with data visualization tools for financial data.

Data visualization is essential for communicating financial information effectively. It transforms raw data into easily understandable charts and graphs, making complex information accessible to a wider audience. My experience spans several tools:

- Tableau: I’ve used Tableau extensively to create interactive dashboards and visualizations for financial data. Its drag-and-drop interface makes it easy to build compelling reports, and its ability to connect to various data sources is invaluable. For example, I created a dashboard showing key performance indicators (KPIs) across different business units, allowing for easy comparison and trend analysis.

- Power BI: Similar to Tableau, Power BI provides a robust platform for creating insightful visualizations. I’ve leveraged its capabilities to generate interactive reports showcasing financial projections and variances against budget. Its integration with Microsoft Excel is particularly useful for financial analysts.

- Excel: While not solely a visualization tool, Excel’s charting capabilities are sufficient for simpler visualizations, especially during initial data exploration or for quickly creating charts for presentations. I often use it to create basic charts like bar graphs, line charts, and pie charts to illustrate key financial trends.

In each case, I focus on selecting the most appropriate chart type for the data and the intended audience, ensuring clarity and avoiding misleading visual representations.

Q 10. How familiar are you with different forecasting methods (e.g., regression, time series)?

Forecasting is a core skill for any financial analyst. Different methods are appropriate for different situations, and understanding their strengths and limitations is essential. My experience includes:

- Regression Analysis: I use regression to model the relationship between a dependent variable (e.g., sales) and one or more independent variables (e.g., marketing spend, economic indicators). This helps understand the drivers of sales and forecast future sales based on projected values of the independent variables. For instance, I might build a regression model to forecast next year’s revenue based on historical data and projected economic growth.

- Time Series Analysis: This involves analyzing historical data to identify trends and patterns, and then extrapolating these patterns to forecast future values. Techniques like ARIMA (Autoregressive Integrated Moving Average) modeling are useful here for forecasting time-dependent data, such as monthly sales or cash flows. This is particularly effective when predicting cyclical data.

- Qualitative Forecasting: I also incorporate qualitative methods like expert opinions and market research into my forecasts. These methods are crucial when dealing with uncertainties or emerging trends that are not easily captured by quantitative models.

The choice of forecasting method depends on the data available, the forecasting horizon, and the desired level of accuracy. Often, a combination of methods provides the most robust and reliable forecasts.

Q 11. Describe your experience using Excel for financial analysis (including advanced functions).

Excel is my primary tool for financial analysis. Beyond basic calculations, I’m proficient in advanced functions that significantly enhance my analytical capabilities:

VLOOKUPandINDEX-MATCH: These functions are essential for data retrieval and manipulation.VLOOKUPallows me to search for a value in a table and return a corresponding value from another column;INDEX-MATCHoffers greater flexibility and efficiency, especially when dealing with multiple lookup criteria.SUMIFS,COUNTIFS,AVERAGEIFS: These functions allow for conditional aggregation, making it easy to summarize data based on specific criteria. For example, I can quickly calculate the total revenue from a specific region or product line.- Pivot Tables: Pivot tables are invaluable for summarizing and analyzing large datasets. They allow for dynamic data aggregation and cross-tabulation, providing flexible insights into financial data.

- Data Tables (What-If Analysis): Data tables are used to understand the sensitivity of model outputs to changes in input variables. This helps assess the impact of uncertainty on financial projections.

- Macro Programming (VBA): I have experience using VBA to automate repetitive tasks, such as data cleaning, report generation, and model updates. This improves efficiency and reduces the risk of manual errors.

My Excel skills allow me to build sophisticated financial models, perform in-depth analyses, and create clear and concise reports.

Q 12. How would you interpret key financial ratios and metrics?

Interpreting financial ratios and metrics provides crucial insights into a company’s financial health and performance. Different ratios offer different perspectives:

- Liquidity Ratios (e.g., Current Ratio, Quick Ratio): These measure a company’s ability to meet its short-term obligations. A low ratio may indicate liquidity problems.

- Profitability Ratios (e.g., Gross Profit Margin, Net Profit Margin, Return on Equity): These assess a company’s ability to generate profits from its operations. High margins generally indicate efficient operations and strong pricing power.

- Solvency Ratios (e.g., Debt-to-Equity Ratio, Times Interest Earned): These gauge a company’s ability to meet its long-term obligations. High debt levels can pose significant risks.

- Efficiency Ratios (e.g., Inventory Turnover, Asset Turnover): These measure how efficiently a company utilizes its assets. High turnover suggests efficient management of inventory and assets.

I interpret these ratios in context, considering industry benchmarks, historical trends, and the company’s specific business model. A single ratio rarely tells the whole story; it’s the combination and trends that provide a comprehensive picture of financial performance. For example, a high debt-to-equity ratio might be acceptable for a capital-intensive industry, but concerning for a less capital-intensive one.

Q 13. Explain your experience with discounted cash flow (DCF) analysis.

Discounted Cash Flow (DCF) analysis is a valuation method used to estimate the value of an investment based on its projected future cash flows. It’s a cornerstone of financial modeling. My experience involves:

- Projecting Free Cash Flows: This is the most critical step. I build detailed financial projections, typically using a 5-10 year forecast horizon, to estimate the company’s future free cash flows. This involves careful consideration of revenue growth, operating expenses, capital expenditures, and working capital requirements.

- Determining the Discount Rate: The discount rate reflects the risk associated with the investment. It’s typically calculated using the Weighted Average Cost of Capital (WACC), which considers the company’s cost of equity and cost of debt.

- Calculating the Terminal Value: Beyond the explicit forecast period, a terminal value is calculated to capture the value of the cash flows beyond the forecast horizon. Common methods include the perpetuity growth model or exit multiple approach.

- Discounting Cash Flows: The projected free cash flows and the terminal value are discounted back to their present value using the discount rate. This reflects the time value of money – money today is worth more than money tomorrow.

- Summing Present Values: The sum of the present values of the projected free cash flows and the terminal value represents the estimated intrinsic value of the investment.

I understand the limitations of DCF analysis, such as its sensitivity to assumptions about future cash flows and the discount rate. I always conduct sensitivity analysis to assess the impact of these assumptions on the valuation.

Q 14. How would you identify and address potential risks in a financial model?

Identifying and addressing risks in a financial model is crucial to ensure its reliability and accuracy. My approach involves:

- Identifying Potential Risks: I systematically identify potential risks throughout the modeling process. This involves considering macroeconomic factors (e.g., inflation, interest rates), industry-specific risks (e.g., competition, regulatory changes), and company-specific risks (e.g., operational challenges, management changes). A thorough understanding of the business is key here.

- Assessing Risk Impact: Once risks are identified, I assess their potential impact on the model’s output. This could involve quantitative analysis (e.g., sensitivity analysis, scenario planning) or qualitative assessments (e.g., expert judgment). A risk register can be very helpful here.

- Developing Mitigation Strategies: For significant risks, I develop mitigation strategies to reduce their potential impact. This could involve adjusting assumptions, incorporating contingency plans, or implementing risk management controls.

- Incorporating Risk into the Model: Where possible, I incorporate risk into the model itself. This could involve using probabilistic distributions for uncertain input variables, employing Monte Carlo simulation to assess the range of possible outcomes, or incorporating risk-adjusted discount rates.

- Documenting Risks and Mitigation Strategies: I meticulously document all identified risks, their potential impact, and the mitigation strategies implemented. This ensures transparency and facilitates ongoing monitoring and adjustment.

By proactively identifying and addressing potential risks, I enhance the robustness and reliability of my financial models and increase the confidence in the conclusions they provide.

Q 15. What is your experience with database management systems and querying financial data?

My experience with database management systems (DBMS) and querying financial data is extensive. I’m proficient in SQL and have worked with various relational databases like PostgreSQL and MySQL, as well as NoSQL databases like MongoDB for handling unstructured financial data. For example, in my previous role, I used SQL to extract and analyze transaction data from a PostgreSQL database, identifying key performance indicators (KPIs) such as average transaction value and customer lifetime value. This involved writing complex queries using joins, subqueries, and aggregate functions to manipulate and filter large datasets efficiently. I’ve also utilized database tools to ensure data integrity and implement data governance best practices.

Beyond SQL, I have experience with data visualization tools that integrate directly with databases, such as Tableau and Power BI. This allows me to create interactive dashboards for presenting financial insights directly from the data source, providing a more dynamic and insightful analysis.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you handle large datasets for financial analysis?

Handling large datasets for financial analysis requires a strategic approach. Simply loading everything into memory isn’t feasible. My approach typically involves a multi-step process:

- Data Sampling and Subsetting: For initial exploratory analysis, I often work with a representative sample of the data. This allows for quicker iteration and testing of hypotheses. Later, I scale up the analysis to the full dataset when necessary.

- Data Aggregation and Summarization: Instead of analyzing every single row, I frequently aggregate data into meaningful summaries. For example, instead of looking at each individual transaction, I might group them by month, product, or customer segment to identify trends.

- Database Optimization and Indexing: Efficient database design and indexing are crucial for fast query execution. I’ve worked extensively with database administrators to ensure that queries are optimized, using appropriate indexes and query structures.

- Distributed Computing: For truly massive datasets, I leverage tools like Apache Spark or Hadoop to distribute the processing across multiple machines, significantly reducing processing time. This is particularly important for complex calculations like Monte Carlo simulations.

- Data Warehousing and ETL Processes: I have experience designing and implementing Extract, Transform, Load (ETL) processes to prepare data for analysis. This involves cleaning, transforming, and loading data into a data warehouse optimized for querying and reporting.

Q 17. Describe your experience with financial reporting and compliance.

My experience with financial reporting and compliance is grounded in a deep understanding of Generally Accepted Accounting Principles (GAAP) and relevant regulations. I’ve been involved in the preparation of various financial reports, including balance sheets, income statements, and cash flow statements, ensuring accuracy and adherence to regulatory requirements. I’m proficient in using accounting software such as QuickBooks and Xero. For example, I successfully implemented a new financial reporting system that automated many manual processes and reduced the time required to generate reports by over 50%. This also significantly reduced the risk of human error and improved overall compliance.

Beyond standard reporting, I have experience working with audit teams, providing documentation and support during audits to ensure compliance with relevant regulations. I understand the importance of maintaining a detailed audit trail and adhering to internal controls.

Q 18. Explain your experience with variance analysis and identifying cost drivers.

Variance analysis and identifying cost drivers are critical for effective financial management. Variance analysis involves comparing actual results to budgeted or planned results to understand deviations. I employ several techniques, including:

- Identifying Significant Variances: I use statistical methods to identify which variances are statistically significant and require further investigation.

- Root Cause Analysis: Once significant variances are identified, I conduct a thorough root cause analysis to determine the underlying reasons. This may involve interviewing stakeholders, reviewing internal controls, and analyzing supporting documentation.

- Cost Driver Analysis: This involves identifying factors that significantly impact costs. For example, in a manufacturing setting, this could involve analyzing the relationship between production volume and direct labor costs. I use regression analysis and other statistical techniques to quantify these relationships.

For example, in a previous role, I identified a significant unfavorable variance in marketing expenses. Through variance analysis, I discovered that a new advertising campaign was less effective than anticipated. This led to adjustments in the marketing strategy, improving efficiency and reducing future costs.

Q 19. What are your preferred methods for presenting financial information to non-technical audiences?

When presenting financial information to non-technical audiences, clarity and simplicity are paramount. I avoid jargon and use visual aids extensively. My preferred methods include:

- Data Visualization: Charts, graphs, and dashboards are essential for conveying complex data in an easily digestible format. I use tools like Tableau and Power BI to create interactive visualizations.

- Storytelling: I frame the data within a narrative, highlighting key findings and insights in a way that’s engaging and easy to understand. This helps to connect the numbers to the bigger picture.

- Analogies and Real-World Examples: I use relatable analogies and real-world examples to explain complex financial concepts in a way that resonates with the audience.

- Summary Reports: I provide concise summary reports that highlight the most important findings, avoiding overwhelming the audience with detail.

For instance, instead of presenting a complex financial model, I would summarize the key projections in a clear and concise executive summary, backed up by visually compelling charts demonstrating key forecasts.

Q 20. How do you stay up-to-date with changes in financial software and regulations?

Staying current in the rapidly evolving field of financial software and regulations is crucial. My strategies include:

- Professional Development: I actively participate in webinars, conferences, and online courses to learn about new software and regulations. I also pursue relevant certifications to enhance my expertise.

- Industry Publications and Journals: I regularly read industry publications and journals to stay informed about the latest trends and developments.

- Networking: I network with other professionals in the field to share knowledge and insights.

- Software Updates and Training: I proactively participate in software updates and training sessions to enhance my skills with existing tools and learn about new features.

- Regulatory Websites and Alerts: I monitor regulatory websites and subscribe to alerts to stay informed about changes in relevant legislation and compliance requirements.

Q 21. Describe your experience automating financial processes using software tools.

I have extensive experience automating financial processes using various software tools. This has significantly improved efficiency and reduced manual effort. For example, I’ve:

- Automated Report Generation: I’ve developed scripts and macros to automate the generation of recurring financial reports, reducing manual data entry and ensuring consistency.

- Integrated Software Systems: I’ve integrated different software systems to streamline workflows. For instance, I’ve connected accounting software with CRM systems to improve data flow and reporting accuracy.

- Developed Custom Financial Models: I’ve built custom financial models using programming languages such as Python and R, automating complex calculations and analysis.

- Implemented Robotic Process Automation (RPA): I’ve used RPA tools to automate repetitive tasks such as data entry, reconciliation, and invoice processing.

In one instance, I automated the monthly reconciliation process, which previously took a team of two several days to complete. By implementing an automated solution, this process now takes less than an hour, freeing up valuable time for more strategic initiatives.

Q 22. How familiar are you with different accounting standards (e.g., GAAP, IFRS)?

I possess a strong understanding of both Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). GAAP is primarily used in the United States, focusing on providing reliable and consistent financial information to investors. IFRS, on the other hand, is an internationally recognized set of accounting standards, aiming for comparability across different countries. I understand the key differences between them, such as the treatment of inventory (LIFO vs. FIFO), revenue recognition, and the level of detail required in financial statements. This knowledge is crucial for developing accurate and compliant financial models, ensuring that the resulting data is meaningful and applicable within the relevant regulatory framework. For example, a model built for a US-based company would need to adhere strictly to GAAP, whereas a multinational corporation might use IFRS for consolidated financial reporting. My experience encompasses working with both sets of standards and adapting my approach accordingly.

Q 23. What software packages are you proficient in for financial modeling and analysis?

My proficiency in financial modeling and analysis software is extensive. I’m highly skilled in Microsoft Excel, including advanced functionalities like VBA macros for automation and data manipulation. I also have considerable experience with dedicated financial modeling software, such as Bloomberg Terminal and FactSet, leveraging their powerful data analysis and forecasting tools. Furthermore, I’m familiar with specialized software like Argus Enterprise for real estate financial modeling and Alteryx for data cleaning and preparation before model creation. This diverse toolkit allows me to select the best tool for the task at hand, ensuring efficiency and accuracy in my work. For instance, using VBA macros in Excel can automate repetitive tasks, significantly speeding up the model building process, while platforms like Bloomberg give access to real-time market data for more dynamic models.

Q 24. Describe a time you had to debug a complex financial model.

In a previous role, I was tasked with building a discounted cash flow (DCF) model for a large infrastructure project. The model unexpectedly produced unrealistic results, with a negative net present value (NPV) despite positive projections. My debugging process involved a methodical approach: first, I meticulously reviewed the input assumptions, checking for errors in the discount rate, growth rates, and cash flow projections. I then systematically examined each formula in the model, tracing the calculations to identify the source of the discrepancy. It turned out there was a subtle error in the formula calculating depreciation, causing an underestimation of the net cash flow in the early years. Once identified, correcting this simple error rectified the NPV. This experience taught me the value of meticulous attention to detail and the importance of regularly testing and validating model outputs against reasonable expectations. It emphasized that even seemingly small errors can have significant consequences.

Q 25. How do you prioritize tasks when managing multiple financial projects?

When managing multiple financial projects, I use a prioritization framework that considers urgency and importance. I utilize a system that combines a task list with a matrix classifying tasks as Urgent/Important, Important/Not Urgent, Urgent/Not Important, and Not Urgent/Not Important. Urgent and Important tasks are tackled immediately, Important/Not Urgent tasks are scheduled strategically, and I often delegate or eliminate less important tasks. This allows me to focus on the most impactful projects first, maintaining a clear and achievable workflow. For example, preparing a critical board presentation would be classified as Urgent and Important, while updating a secondary financial report might be Important/Not Urgent, allowing for flexible scheduling.

Q 26. How do you handle conflicting requirements or deadlines in a financial project?

Handling conflicting requirements or deadlines requires proactive communication and negotiation. I begin by clearly identifying the conflict, documenting the competing requirements and their respective timelines. Then, I discuss the situation with all stakeholders involved, seeking a collaborative solution that balances competing needs. This might involve re-prioritizing tasks, renegotiating deadlines, or even proposing alternative solutions that meet the essential requirements. If necessary, I present a trade-off analysis to stakeholders, clearly outlining the potential impacts of choosing one option over another. Open and honest communication ensures that everyone understands the challenges and participates in finding the best path forward. In a situation where unavoidable delays are anticipated, transparent communication is key to maintaining trust and managing expectations.

Q 27. Describe your experience with collaborative financial software platforms.

I have extensive experience with collaborative financial software platforms, such as Google Sheets, Microsoft Teams, and dedicated project management software like Asana. These platforms facilitate efficient collaboration on financial projects through real-time data sharing, version control, and streamlined communication. For instance, using Google Sheets, multiple team members can work simultaneously on a financial model, while the version history tracks all changes, ensuring transparency and accountability. The use of dedicated project management tools allows for the centralized tracking of deadlines, the assignment of tasks, and the monitoring of progress, making collaboration more efficient and less prone to errors caused by miscommunication or lost information.

Q 28. How would you approach building a financial model for a new business venture?

Building a financial model for a new business venture requires a phased approach. First, I’d conduct thorough market research to understand the industry, target market, and competitive landscape. This would inform the revenue projections and assumptions used in the model. Next, I’d develop detailed operating expense projections, encompassing all costs associated with running the business. This includes direct costs like materials and labor, as well as indirect costs like rent, utilities, and marketing. Then, I would develop a funding plan, outlining the sources of capital and their associated costs. The model would then integrate these projections to determine key metrics like break-even point, profitability, and return on investment. Regular sensitivity analysis would be performed to test the model’s robustness under various scenarios, including optimistic, pessimistic, and base-case projections. Finally, the model would be presented with clear visualizations and detailed explanations, ensuring that all assumptions and key findings are clearly communicated to stakeholders.

Key Topics to Learn for Software Proficiency (e.g., budgeting software, financial modeling tools) Interview

- Data Input and Validation: Understanding how to accurately input and verify data within budgeting and financial modeling software. This includes recognizing and addressing potential errors.

- Formula Creation and Manipulation: Mastering the creation and modification of formulas to perform calculations, including understanding cell referencing and function usage (e.g., SUM, IF, VLOOKUP).

- Report Generation and Analysis: Learning to generate clear and insightful reports from your data, including the ability to interpret and explain key findings and trends.

- Scenario Planning and What-If Analysis: Understanding how to use the software to model different scenarios and assess their potential impact on financial outcomes.

- Data Visualization: Creating effective charts and graphs to present financial data in a visually compelling and easily understandable manner.

- Software-Specific Features: Familiarizing yourself with the specific features and functionalities of the budgeting and financial modeling tools mentioned in the job description. This might include shortcuts, advanced functions, or specific reporting capabilities.

- Data Integrity and Security: Understanding best practices for maintaining data integrity and ensuring the security of sensitive financial information.

- Problem-Solving and Troubleshooting: Developing the ability to identify and resolve common issues encountered while using budgeting and financial modeling software.

Next Steps

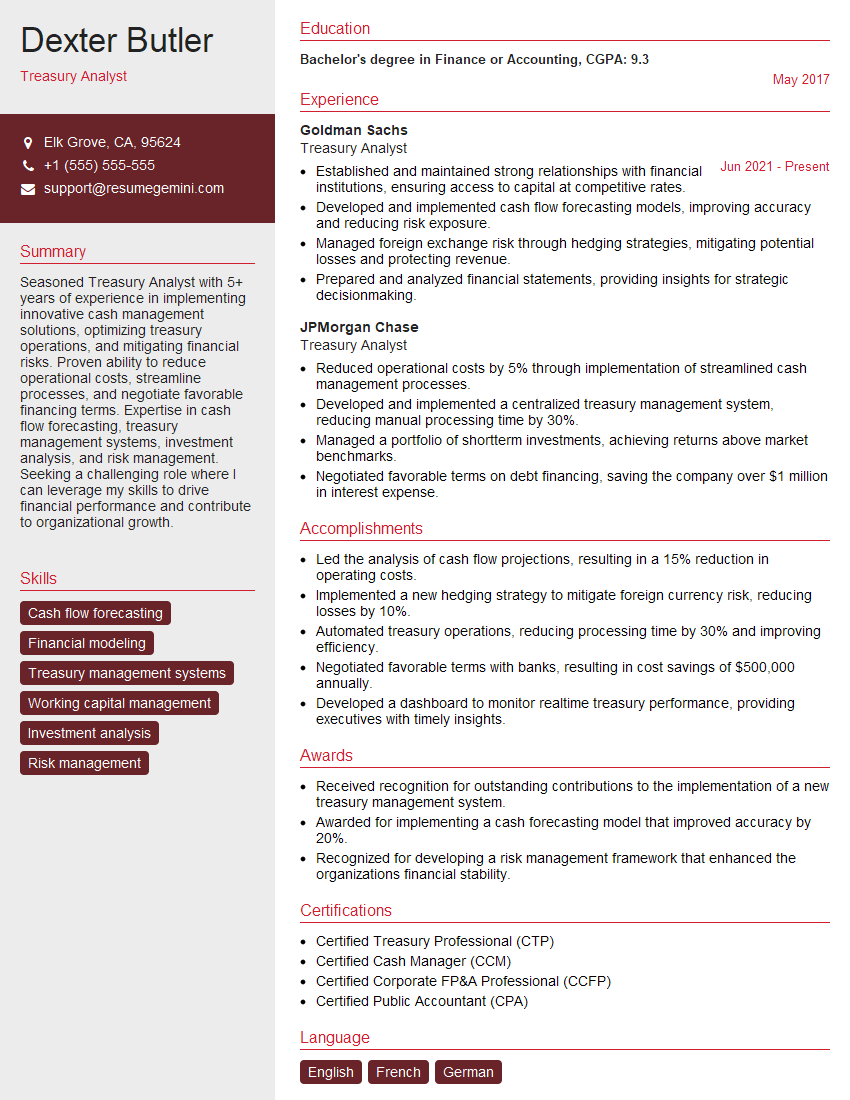

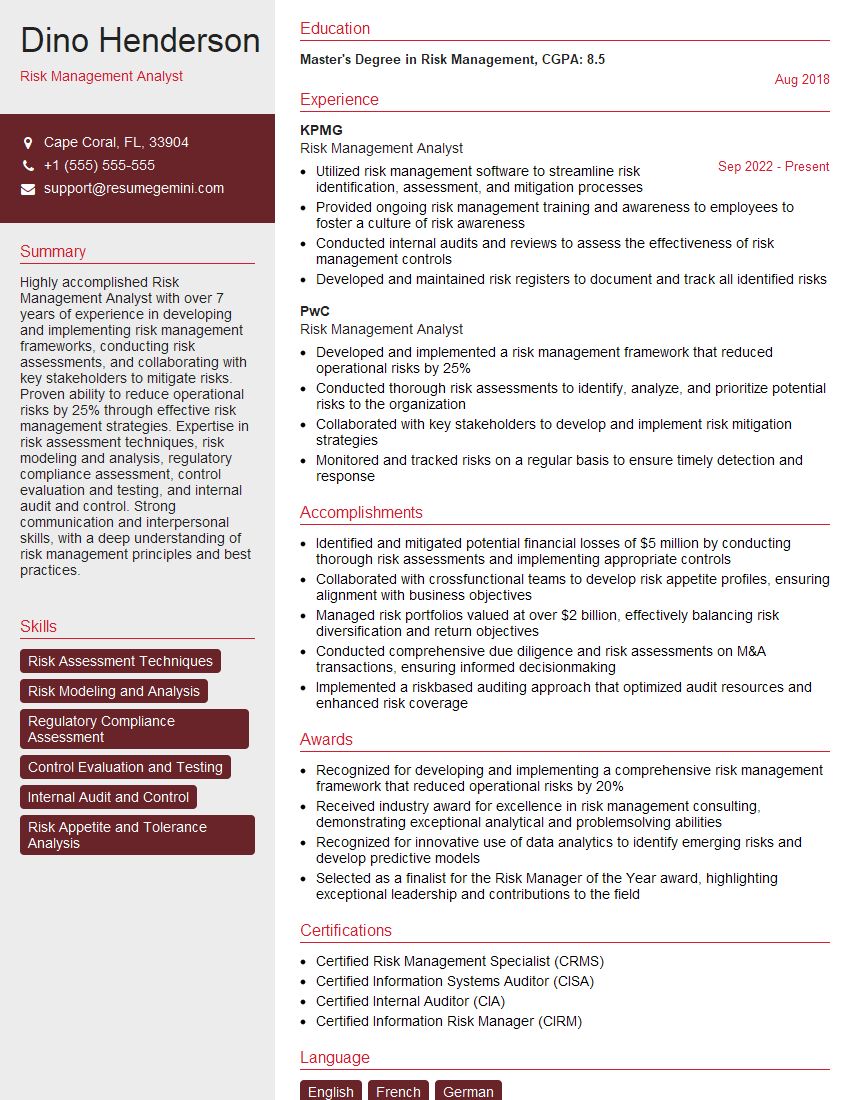

Mastering budgeting software and financial modeling tools is crucial for career advancement in finance and related fields. These skills demonstrate a high level of proficiency and attention to detail, making you a valuable asset to any organization. To significantly increase your chances of landing your dream role, it’s vital to present your skills effectively. Creating an ATS-friendly resume is key to getting past initial screening processes. ResumeGemini can help you build a professional and impactful resume that highlights your software proficiency. We provide examples of resumes tailored to showcase expertise in budgeting software and financial modeling tools, ensuring your application stands out.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO