Unlock your full potential by mastering the most common Understanding and using financial leverage interview questions. This blog offers a deep dive into the critical topics, ensuring you’re not only prepared to answer but to excel. With these insights, you’ll approach your interview with clarity and confidence.

Questions Asked in Understanding and using financial leverage Interview

Q 1. Define financial leverage and explain its impact on profitability.

Financial leverage is the use of debt to finance a company’s assets. Think of it like using a lever to lift a heavy object – a small amount of effort (debt) can move a much larger weight (assets). Its impact on profitability is twofold. Increased leverage can amplify profits when times are good because the return on assets is magnified. The company is earning a higher return on the assets they own, with part of that financed by cheaper debt. However, it also magnifies losses during bad times, as the fixed costs associated with that debt still need to be paid regardless of revenue generated.

For example, imagine two companies, A and B, both aiming to purchase a $1 million asset. Company A uses all equity financing, while Company B uses $500,000 in debt and $500,000 in equity. If both companies earn a 15% return on assets, Company B will have a higher return on equity (ROE) due to the leverage. However, if the return on assets drops to 5%, Company B’s ROE will be significantly lower than Company A’s because they need to cover the debt’s interest payments. This highlights the double-edged sword of leverage.

Q 2. Explain the difference between operating leverage and financial leverage.

Operating leverage and financial leverage are distinct but related concepts, both impacting a company’s profitability and risk profile. Operating leverage refers to the degree to which a firm uses fixed operating costs (like rent, salaries, and manufacturing overhead) versus variable operating costs (like raw materials and direct labor). A high degree of operating leverage means a larger proportion of fixed costs; therefore, a small change in sales revenue can lead to a significant change in operating income. Think of a manufacturing plant with high fixed costs – a small increase in production volume can drastically increase profitability, but a drop in sales can severely impact profitability.

Financial leverage, on the other hand, focuses on the degree to which a company uses debt financing. It’s the proportion of debt relative to equity in the company’s capital structure. A high degree of financial leverage amplifies both profits and losses, as interest payments on debt represent a fixed cost that must be paid regardless of the company’s performance.

The key difference is that operating leverage affects operating income, while financial leverage impacts the company’s overall profitability (net income) by impacting the cost of debt and influencing the return on equity.

Q 3. What are the advantages and disadvantages of using financial leverage?

Advantages of Financial Leverage:

- Amplified Returns: As explained earlier, leverage boosts returns when profitability is high. It allows a company to achieve greater returns on equity with a smaller amount of invested capital.

- Tax benefits: Interest paid on debt is usually tax-deductible, reducing the overall tax burden. This lowers the effective cost of debt.

- Increased Investment Capacity: Leverage permits investments in growth opportunities that would otherwise be unaffordable using only equity financing.

Disadvantages of Financial Leverage:

- Increased Financial Risk: The most significant disadvantage is the increased risk of financial distress or bankruptcy. If revenue falls short of expectations, the fixed interest payments become a major burden.

- Higher Cost of Debt: The interest rate on borrowed funds is always higher than the return a company could achieve on its equity investment. This cost of debt can significantly reduce profitability when profitability is low. Companies with poor credit ratings face even higher interest rates.

- Agency Conflicts: Increased debt can create agency conflicts between debt holders and equity holders, leading to disagreements over investment decisions and the distribution of earnings.

Q 4. How is the degree of financial leverage (DFL) calculated and interpreted?

The Degree of Financial Leverage (DFL) measures the sensitivity of a company’s earnings per share (EPS) to changes in its earnings before interest and taxes (EBIT). It’s calculated as:

DFL = % Change in EPS / % Change in EBITAlternatively, it can be calculated using this formula:

DFL = EBIT / (EBIT - Interest Expense)A higher DFL indicates a greater sensitivity of EPS to changes in EBIT, implying a higher degree of financial risk. For example, a DFL of 2 means a 10% increase in EBIT will result in a 20% increase in EPS; conversely, a 10% decrease in EBIT will lead to a 20% decrease in EPS. Interpreting DFL requires considering the company’s industry, risk tolerance, and overall financial health. A high DFL might be acceptable for a high-growth company with consistent profits, but it’s extremely risky for a company operating in an unpredictable market.

Q 5. How does financial leverage affect a company’s risk profile?

Financial leverage significantly affects a company’s risk profile by increasing both its business risk and financial risk. Business risk is inherent in the nature of a company’s operations, stemming from factors like competition, industry cycles, and technological changes. Financial leverage doesn’t directly increase this risk, but it does magnify its impact on profitability. A leveraged company faces greater variability in its earnings because of the fixed costs associated with debt.

Financial risk, on the other hand, is directly linked to the level of debt financing. High financial leverage increases the probability of financial distress or bankruptcy because of the fixed payment obligations (interest and principal repayments). This is exacerbated by an already high business risk. A company with high business and financial risk might find it difficult to secure additional funding when required.

In essence, increased financial leverage acts as an amplifier of both positive and negative outcomes. While it can boost returns during favorable economic conditions, it substantially increases the downside during economic downturns, thereby increasing overall risk.

Q 6. Explain the concept of break-even analysis and its relationship to leverage.

Break-even analysis determines the point at which a company’s revenues equal its total costs (both fixed and variable). It’s crucial for understanding the relationship between sales volume and profitability. The break-even point is affected by both operating leverage and financial leverage.

High operating leverage implies high fixed operating costs; therefore, the company needs to sell more units to reach its break-even point. A company with high fixed costs associated with high operating leverage will struggle to cover those costs in periods of low sales, which increases financial risk and sensitivity of earnings. Conversely, a company with high financial leverage will have higher fixed financial costs (interest payments), pushing the break-even point higher and increasing the pressure to maintain sales volume and earnings.

Understanding the break-even point, considering both types of leverage, is critical for financial planning, forecasting profitability, and setting sales targets. The break-even calculation helps management determine the sales revenue or volume required to cover all costs and start generating profit. A sensitivity analysis can be used to assess how changes in sales price, variable costs, or fixed costs impact the break-even point.

Q 7. Describe the impact of financial leverage on a company’s return on equity (ROE).

Financial leverage has a significant impact on Return on Equity (ROE). ROE is a measure of how efficiently a company uses its shareholders’ equity to generate profits. Leverage can either improve or worsen ROE, depending on the company’s profitability and the cost of debt.

When a company uses debt financing, it increases its assets without requiring additional equity. If the return on assets (ROA) exceeds the cost of debt, the ROE will increase because the company is generating more profit than it is paying in interest. The increased assets financed by debt amplify the earnings available to equity holders.

However, if the ROA is lower than the cost of debt, the ROE will be lower than if the company had not used any leverage. The interest expense reduces the company’s net income and reduces the return to equity holders. In short, leveraging magnifies both profits and losses. Companies with low profitability should use leverage very cautiously.

Q 8. How does financial leverage influence a company’s credit rating?

A company’s credit rating is significantly influenced by its financial leverage. Credit rating agencies assess the risk of default, and high leverage, meaning a substantial reliance on debt financing, generally signals higher risk. Think of it like this: if a company has borrowed heavily, its ability to meet its debt obligations becomes more sensitive to economic downturns or unexpected events. A higher debt-to-equity ratio, a key indicator of leverage, will likely lead to a lower credit rating, making it more expensive for the company to borrow money in the future.

For example, a company with a high debt load and weak cash flow might receive a lower rating like BB+ or even fall into the junk bond category (below Baa3/BBB-), whereas a company with conservative debt levels and strong cash flow will likely have a higher rating like A or AAA. The rating agencies carefully analyze the company’s financial statements, including profitability, cash flow, and the proportion of debt to equity, to determine the appropriate credit rating.

Q 9. What are some common financial ratios used to assess a company’s leverage?

Several financial ratios are used to assess a company’s leverage. These ratios help investors and creditors understand the extent to which a company relies on borrowed funds. Key ratios include:

- Debt-to-Equity Ratio: This ratio measures the proportion of a company’s financing that comes from debt relative to equity.

Debt-to-Equity Ratio = Total Debt / Total EquityA higher ratio indicates higher leverage and greater financial risk. - Debt Ratio: This ratio shows the proportion of a company’s assets financed by debt.

Debt Ratio = Total Debt / Total AssetsA higher ratio signifies greater reliance on debt. - Times Interest Earned Ratio: This ratio indicates a company’s ability to meet its interest payments.

Times Interest Earned Ratio = Earnings Before Interest and Taxes (EBIT) / Interest ExpenseA lower ratio suggests a higher risk of default. - Debt Service Coverage Ratio: This ratio assesses the company’s ability to cover its debt obligations, including principal and interest payments. It considers both interest and principal repayments. A lower ratio signals higher risk.

Analyzing these ratios together provides a comprehensive picture of a company’s leverage position and its ability to manage its debt obligations. Remember, each ratio should be considered in context with industry benchmarks and the company’s specific business model.

Q 10. Discuss the impact of interest rates on companies with high financial leverage.

Interest rates have a significant impact on highly leveraged companies. Since these companies rely heavily on debt, changes in interest rates directly affect their interest expense. A rise in interest rates increases the cost of servicing debt, potentially squeezing profitability and cash flow. This can lead to a reduced ability to repay debt and even financial distress. Conversely, a decrease in interest rates can reduce interest expense, freeing up cash flow and improving profitability. Imagine a highly leveraged company with significant floating-rate debt: a sudden increase in interest rates can significantly increase their financial burden, while a decrease might provide a significant boost.

For example, a company with $1 billion in debt at a 5% interest rate would pay $50 million in annual interest. If interest rates rise to 7%, the annual interest expense jumps to $70 million, impacting profitability and potentially putting stress on the company’s cash flows.

Q 11. Explain how changes in sales volume affect a highly leveraged company.

Changes in sales volume significantly impact highly leveraged companies due to the impact on operating leverage. Operating leverage refers to the proportion of fixed costs to variable costs in a company’s cost structure. Highly leveraged companies often have a high proportion of fixed costs (e.g., debt service, rent, salaries). When sales increase, the increase in profits is amplified because fixed costs remain constant. However, a decline in sales volume has a magnified negative effect on profitability because the fixed costs still need to be covered despite the reduced revenue. This phenomenon is known as operating leverage.

For example, a small increase in sales for a highly leveraged company might result in a larger percentage increase in profit due to the fixed cost structure. However, a drop in sales can rapidly erode profitability and can potentially lead to difficulty in meeting debt obligations.

Q 12. How can financial leverage be used strategically to maximize shareholder value?

Financial leverage can be used strategically to maximize shareholder value, but it requires careful management. The key is to use borrowed funds to invest in projects with returns that exceed the cost of borrowing. This amplifies the return on equity, benefiting shareholders. This is often referred to as ‘leveraging’ returns. For example, if a company can borrow at 5% interest and invest in projects with an expected return of 10%, the difference (5%) adds to the returns for shareholders.

However, it’s crucial to remember that this strategy works only if the investments are successful. If the projects fail to generate sufficient returns, the high leverage can exacerbate losses and harm shareholder value. Proper due diligence, risk assessment, and a clear understanding of the company’s financial capacity are essential. It is advisable to strike a balance between debt and equity funding.

Q 13. Describe a scenario where excessive financial leverage could lead to financial distress.

Excessive financial leverage can lead to financial distress, even bankruptcy. Imagine a small manufacturing company that borrows heavily to expand its operations during a period of economic boom. The expansion may initially be successful, generating good returns. However, an unexpected economic downturn or a decline in market demand could severely impact the company’s sales. The company may then struggle to meet its debt obligations due to the already high debt burden. Even if the business is fundamentally sound, inability to meet debt obligations will result in financial distress. This will lead to lender actions like demanding immediate repayment or initiating default proceedings which may ultimately lead to bankruptcy.

The company might face difficulties obtaining further financing to navigate the downturn, leading to a vicious cycle of declining sales and increasing financial pressure. This highlights the importance of maintaining a healthy balance sheet and considering the potential risks before taking on excessive debt.

Q 14. What are some red flags indicating excessive reliance on debt financing?

Several red flags indicate excessive reliance on debt financing, which can signal potential financial problems. These include:

- Consistently high debt-to-equity ratios: A significantly higher ratio compared to industry averages is a warning sign.

- Declining times interest earned ratio: A decreasing ability to cover interest expense suggests increasing financial strain.

- Difficulty in obtaining new financing: Lenders may be hesitant to provide additional funds to already highly leveraged companies.

- Frequent refinancing of debt: This suggests the company is struggling to repay existing debt.

- Decreasing cash flow coverage of debt: A shrinking cushion to handle unexpected situations indicates increased risk.

- Using short-term debt to finance long-term assets: This is a risky strategy that can expose the company to refinancing risk.

The presence of multiple red flags warrants a closer examination of the company’s financial health and its ability to manage its debt burden.

Q 15. How does the capital structure of a company affect its financial leverage?

A company’s capital structure, the mix of debt and equity financing it uses, directly influences its financial leverage. Leverage refers to the extent to which a company uses debt to finance its assets. A higher proportion of debt in the capital structure leads to higher financial leverage, while a greater reliance on equity results in lower leverage.

Think of it like a seesaw: equity is one side, and debt is the other. A company with high leverage has a heavy debt side on the seesaw – a small change in earnings can significantly impact its financial stability. Conversely, a company with low leverage has a more balanced seesaw; it’s less vulnerable to earnings fluctuations.

For example, Company A uses 80% debt and 20% equity, while Company B uses 20% debt and 80% equity. Company A has significantly higher financial leverage and is therefore riskier. A slight downturn in revenue could make it difficult to service its debt, while Company B is more resilient.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Explain the concept of debt covenants and their relevance to leverage management.

Debt covenants are restrictions placed on a borrower by a lender as a condition of providing a loan. These covenants are designed to protect the lender’s interests by ensuring the borrower maintains a certain level of financial health. They often relate directly to leverage ratios and are crucial to leverage management.

Common covenants might limit the borrower’s total debt-to-equity ratio, restrict the amount of additional debt it can take on, or impose minimum liquidity requirements. If a company violates a debt covenant, it may be in breach of contract, potentially triggering immediate repayment of the loan or other penalties.

Effective leverage management involves carefully monitoring and adhering to these covenants. Failing to do so can lead to severe financial consequences, including bankruptcy.

For instance, a covenant might state that a company’s debt-to-equity ratio cannot exceed 1.5. If the company’s ratio rises above this threshold, it is in breach of its covenant, potentially leading to penalties or even loan default.

Q 17. Describe the relationship between financial leverage and agency costs.

Financial leverage and agency costs are intertwined. Agency costs arise from conflicts of interest between a company’s managers (agents) and its shareholders (principals). High leverage can exacerbate these conflicts.

With high leverage, managers might be tempted to take on excessive risk to pursue high returns, hoping to boost their own compensation even if it jeopardizes the company’s long-term stability. This is because high leverage amplifies the impact of both successes and failures. Shareholders, on the other hand, are naturally more risk-averse and prefer more stable growth.

Furthermore, high leverage can increase monitoring costs for shareholders to oversee management’s actions. They might need to hire consultants or employ more rigorous oversight measures to ensure managers are acting in their best interests.

Consider a scenario where a highly leveraged company invests in a risky project. If successful, managers receive high bonuses. However, failure could lead to bankruptcy, wiping out shareholder value. This illustrates the agency cost stemming from a potential conflict of interest amplified by high financial leverage.

Q 18. How does the choice of financing affect a company’s tax burden?

The choice of financing significantly impacts a company’s tax burden primarily due to the tax deductibility of interest payments on debt. Interest expenses are usually tax-deductible, reducing a company’s taxable income and, therefore, its overall tax liability.

Conversely, dividends paid to equity holders are typically not tax-deductible. This creates a tax advantage for debt financing. The magnitude of this advantage depends on the company’s tax rate. A company with a high tax rate will benefit more from the tax shield provided by interest deductions on debt.

For example, if a company has a 30% tax rate and pays $100,000 in interest, it can deduct this amount from its taxable income, effectively saving $30,000 in taxes (30% of $100,000). This is a direct benefit of utilizing debt financing.

However, it’s crucial to note that excessive debt can lead to financial distress and potential bankruptcy, which can negate the tax benefits of debt.

Q 19. What is the role of the WACC (weighted average cost of capital) in assessing leverage?

The Weighted Average Cost of Capital (WACC) is a crucial metric for assessing the overall cost of a company’s capital, considering the proportion of debt and equity financing. It plays a key role in evaluating the optimal level of leverage.

A lower WACC is generally preferred, as it indicates a lower cost of capital for the company. The relationship between leverage and WACC is not linear. Initially, increasing leverage (using more debt) can reduce the WACC due to the tax shield benefit of debt. However, beyond a certain point, the increased financial risk associated with higher debt levels will raise the cost of both debt and equity, ultimately increasing the WACC.

Companies aim to find the optimal capital structure that minimizes their WACC. This involves balancing the tax advantages of debt with the increased risk of financial distress. The optimal capital structure will vary depending on factors such as industry, risk tolerance, and access to capital.

In practice, financial managers use WACC calculations to evaluate different financing options and determine the optimal leverage level for their companies.

Q 20. Explain how to analyze a company’s leverage using its balance sheet.

A company’s balance sheet provides essential data for analyzing its leverage. Several key ratios can be calculated to assess its financial leverage:

- Debt-to-Equity Ratio: This ratio shows the proportion of a company’s financing from debt relative to equity. A higher ratio indicates higher leverage.

Debt-to-Equity Ratio = Total Debt / Total Equity - Debt-to-Asset Ratio: This ratio measures the proportion of a company’s assets financed by debt. A higher ratio indicates greater reliance on debt financing.

Debt-to-Asset Ratio = Total Debt / Total Assets - Times Interest Earned Ratio: This ratio indicates a company’s ability to meet its interest obligations. It’s a measure of financial risk.

Times Interest Earned Ratio = Earnings Before Interest and Taxes (EBIT) / Interest Expense

By analyzing these ratios over time and comparing them to industry benchmarks, analysts can gain insights into a company’s leverage position, its financial risk, and its ability to service its debt.

Q 21. Describe how financial leverage impacts a company’s ability to weather economic downturns.

Financial leverage significantly impacts a company’s ability to withstand economic downturns. Highly leveraged companies are particularly vulnerable during recessions or economic slowdowns.

During economic downturns, revenue often declines, making it harder for highly leveraged companies to meet their debt obligations. Fixed interest payments on debt continue regardless of sales performance, increasing the risk of default and even bankruptcy. The higher the leverage, the more significant this risk becomes.

Conversely, companies with lower leverage are better positioned to weather economic storms. Their lower debt burden allows them more flexibility to adjust to reduced revenue without immediately facing a crisis. They can also more easily access additional financing if needed.

The 2008 financial crisis provided a stark example. Many highly leveraged financial institutions faced severe challenges and even failures due to their inability to handle the sharp decline in asset values and revenue. Companies with lower leverage fared considerably better.

Q 22. What are some alternative financing strategies to minimize reliance on debt?

Minimizing reliance on debt requires exploring alternative financing strategies that offer less financial risk. Instead of borrowing, companies can focus on internal financing or attracting equity investments.

- Retained Earnings: Profit reinvestment is a powerful tool. By retaining a portion of profits instead of distributing them as dividends, companies organically fund growth and reduce their dependence on external debt. Think of it like saving for a rainy day – building a financial cushion for future expansion or unexpected expenses.

- Equity Financing: Issuing new shares of stock dilutes existing shareholders but injects capital without incurring debt. This is especially useful for startups or companies undergoing rapid expansion. For example, a tech firm developing a groundbreaking product might secure funding through a venture capital round rather than taking out a large loan.

- Asset Sales: Selling non-core assets, such as underutilized equipment or real estate, generates immediate cash flow. This can significantly lessen the need for debt financing, providing a cleaner balance sheet and greater financial flexibility. Imagine a manufacturing company selling off an old factory to finance a new, more efficient facility.

- Leasing: Instead of purchasing capital equipment outright with a loan, leasing allows companies to access the assets they need while spreading the cost over time without directly increasing debt. This is a popular strategy for businesses requiring frequent technological upgrades.

- Trade Credit: Negotiating favorable payment terms with suppliers extends the payment period, providing short-term financing without the need for loans. Effectively, this is an interest-free loan from your suppliers, a useful tool for managing cash flow.

Q 23. How do you assess the sustainability of a company’s leverage level?

Assessing the sustainability of a company’s leverage level involves a multi-faceted approach that looks beyond simple debt-to-equity ratios. We need to consider the company’s ability to service its debt and its overall financial health.

- Debt Service Coverage Ratio (DSCR): This crucial metric measures a company’s ability to pay its debt obligations using its operating cash flow. A higher DSCR indicates a greater capacity to handle debt payments.

DSCR = (Net Operating Income + Depreciation & Amortization) / Total Debt Service - Interest Coverage Ratio: Similar to DSCR, but focuses specifically on interest payments. A low ratio signals potential difficulty meeting interest payments.

Interest Coverage Ratio = Earnings Before Interest and Taxes (EBIT) / Interest Expense - Debt-to-Equity Ratio: A classic indicator of leverage, comparing total debt to shareholder equity. A high ratio suggests higher risk. However, we must interpret this in context of the industry.

- Cash Flow Analysis: Examining the company’s free cash flow is vital. Does the company generate enough cash to meet its debt obligations, capital expenditures, and operational needs? Consistent positive free cash flow is a strong indicator of sustainable leverage.

- Industry Benchmarks: Comparing the company’s leverage ratios to industry averages provides context. Some industries naturally operate with higher leverage than others. For example, utilities might have higher leverage than tech firms due to their capital-intensive nature.

A holistic assessment combines these metrics with qualitative factors like management’s experience in handling debt, the company’s competitive landscape, and the overall economic environment.

Q 24. Explain the concept of leveraged buyouts (LBOs) and their use of leverage.

Leveraged buyouts (LBOs) are transactions where a company’s acquisition is financed predominantly through debt. The acquiring entity uses a significant amount of borrowed funds to purchase the target company, with the target’s assets often used as collateral. This creates substantial financial leverage for the buyer.

The use of leverage magnifies returns (if the investment is successful) and magnifies losses (if it fails). A successful LBO can result in high returns for the investors because a small equity investment controls a larger asset base. However, the high debt levels increase financial risk. The acquired company’s cash flow is critical for paying off the debt.

For example, imagine a private equity firm wants to acquire a manufacturing company. Instead of paying the full purchase price with cash, they might borrow a large sum (80-90%) at a favorable interest rate, using the manufacturing company’s assets as collateral. This maximizes their return on the smaller equity investment. However, if the acquired company’s performance falters, the debt burden could cripple it.

Q 25. Describe the implications of using financial leverage for a company’s liquidity.

Financial leverage significantly impacts a company’s liquidity. While it can boost profitability, it simultaneously increases the risk of liquidity problems. High levels of debt increase the company’s fixed financial obligations – interest payments, principal repayments – which reduce its available cash.

Imagine a scenario where a company has taken on considerable debt to expand its operations. If sales unexpectedly decline or economic conditions worsen, the company might struggle to generate enough cash flow to meet its debt obligations. This could lead to liquidity issues, impacting its ability to pay its suppliers, employees, and even meet its short-term financial commitments. This emphasizes the importance of strong cash flow management when using financial leverage.

In contrast, a company with low leverage has more financial flexibility. It can more easily weather economic downturns or unexpected expenses because it has less debt to service. This resilience adds a significant buffer against liquidity crises.

Q 26. How does the industry context impact the optimal level of financial leverage?

The optimal level of financial leverage varies significantly across industries. Capital-intensive industries, such as utilities or telecommunications, often have higher debt-to-equity ratios compared to less capital-intensive industries like software or consulting. This is because these capital-intensive businesses require substantial investments in infrastructure and equipment that are often financed through debt.

For example, a utility company might utilize high leverage to finance its extensive power grid, while a software company might rely more on equity financing due to lower capital requirements. Therefore, comparing a company’s leverage to industry averages provides a much more meaningful assessment than looking at it in isolation.

Furthermore, industry-specific factors such as regulatory environments, competitive pressures, and the cyclical nature of demand also influence the appropriate level of leverage. A company operating in a volatile industry might prefer lower leverage to mitigate risk, while a company in a stable industry might be comfortable with higher leverage.

Q 27. Explain the difference between debt and equity financing in the context of leverage.

Debt and equity financing are the two primary sources of capital, both influencing a company’s leverage. They differ fundamentally in their claim on the company’s assets and their impact on ownership.

- Debt Financing: Involves borrowing money, creating a liability for the company. Creditors (lenders) have a fixed claim on the company’s assets and income, and they receive interest payments. Debt increases financial leverage, magnifying both returns and risks.

- Equity Financing: Involves issuing shares of stock, giving investors an ownership stake in the company. Shareholders have a residual claim on the company’s assets and income after all debts have been paid. Equity increases the company’s capital base without creating a fixed financial obligation.

The choice between debt and equity financing is crucial for managing leverage. Debt increases leverage, amplifying potential returns but also increasing financial risk. Equity financing dilutes ownership but reduces the risk of financial distress.

Q 28. Discuss the importance of considering a company’s cash flow when using financial leverage.

A company’s cash flow is paramount when using financial leverage. The ability to consistently generate sufficient cash flow to meet debt obligations – interest and principal repayments – is crucial for maintaining financial health and avoiding distress.

Strong, predictable cash flow provides a safety net, enabling the company to comfortably service its debt even during economic downturns. Conversely, weak or erratic cash flow exposes the company to significant financial risk, potentially leading to default and bankruptcy if debt obligations cannot be met. Before taking on any significant debt, a thorough analysis of projected cash flows is essential. A company should ensure its cash flow projections comfortably cover debt service, even under various adverse scenarios. This emphasizes the need for realistic financial planning and stress testing.

For example, a company with a stable and growing cash flow from its operations is much better positioned to take on additional debt than a company with inconsistent cash flows. This ability to comfortably cover debt obligations underscores the importance of aligning leverage strategy with the realities of the business’s cash generation capabilities.

Key Topics to Learn for Understanding and Using Financial Leverage Interviews

- Defining Financial Leverage: Understand the concept of leverage, its benefits (amplified returns), and its risks (amplified losses). Distinguish between operating and financial leverage.

- Leverage Ratios: Master the calculation and interpretation of key leverage ratios such as Debt-to-Equity Ratio, Debt-to-Asset Ratio, Times Interest Earned, and Equity Multiplier. Know how these ratios reflect a company’s financial health and risk profile.

- Impact on Profitability: Analyze how different levels of financial leverage affect a company’s profitability (e.g., Return on Equity, Return on Assets). Be prepared to discuss the trade-offs between risk and return.

- Capital Structure Decisions: Understand the factors influencing a company’s capital structure choices (debt vs. equity financing). Discuss the implications of different capital structures on a company’s financial performance and risk.

- Practical Application: Case Studies: Be ready to discuss real-world examples of companies using financial leverage effectively (or ineffectively). Analyze the consequences of their decisions.

- Cost of Capital: Understand how leverage affects a company’s weighted average cost of capital (WACC) and its implications for investment decisions.

- Financial Distress and Bankruptcy: Discuss the risks associated with high levels of leverage, including the potential for financial distress and bankruptcy. Understand the warning signs and preventative measures.

- Scenario Analysis: Be prepared to analyze the impact of changes in sales, interest rates, or other economic factors on a company’s leverage and profitability using scenario analysis or sensitivity analysis.

Next Steps

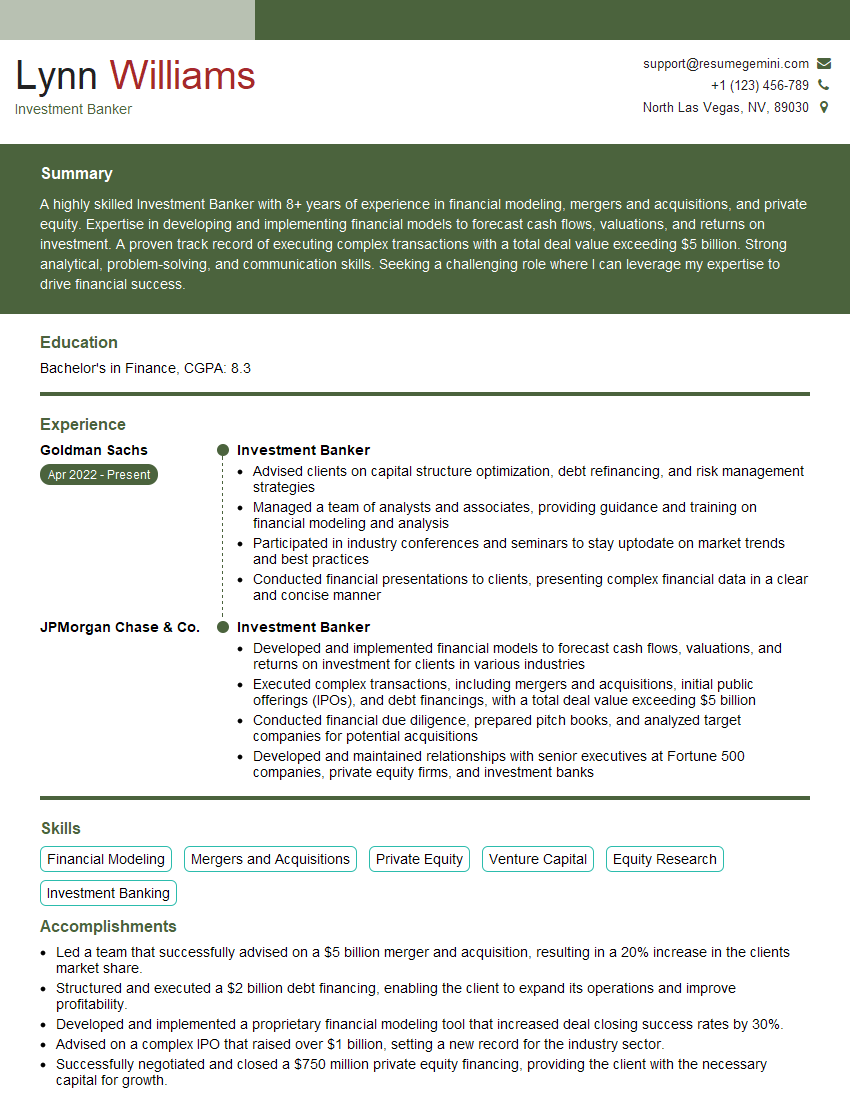

Mastering financial leverage is crucial for career advancement in finance, accounting, and related fields. A strong understanding of these concepts demonstrates analytical skills and financial acumen – highly sought-after qualities by employers. To significantly improve your job prospects, create an ATS-friendly resume that effectively highlights your skills and experience. ResumeGemini is a trusted resource to help you build a professional and impactful resume. Examples of resumes tailored to showcasing expertise in understanding and using financial leverage are available to guide you.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I’m Jay, we have a few potential clients that are interested in your services, thought you might be a good fit. I’d love to talk about the details, when do you have time to talk?

Best,

Jay

Founder | CEO